Teams should receive at least 40% of the token supply at the time of initial purchase to achieve long-term incentive consistency.

Author: Vader, creator of VaderAI

Compiled by: Luffy, Foresight News

This article aims to help builders who want to create AI agents better understand token economics, issuance strategies, and the bonding curve of the Virtuals platform. As the third-largest AI agent on the Virtuals platform, we fund, incubate, and support top teams considering launching AI agents.

Virtuals is a platform that allows anyone to launch their own AI agent without permission.

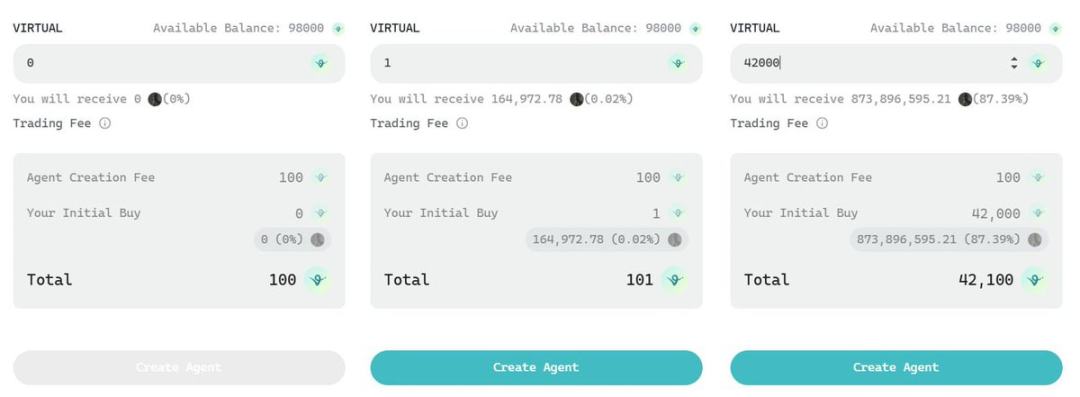

AI agent launch interface on Virtuals platform

If the creator wants to create a new AI agent, the creation interface will pop up. To create an AI agent (agent), you need to pay 100 VIRTUAL tokens (approximately US$150, translator’s note: The price of VIRTUAL was US$1.5 when the original author wrote the article. This data is used for the calculation of the US dollar market value of the AI agent token below. As of now, the market price of VIRTUAL is US$1.15) as a fee. The creator can then choose to purchase tokens with a minimum purchase amount of 1 VIRTUAL. This mechanism allows creators to conduct the first token purchase transaction after the launch of AI proxy tokens.

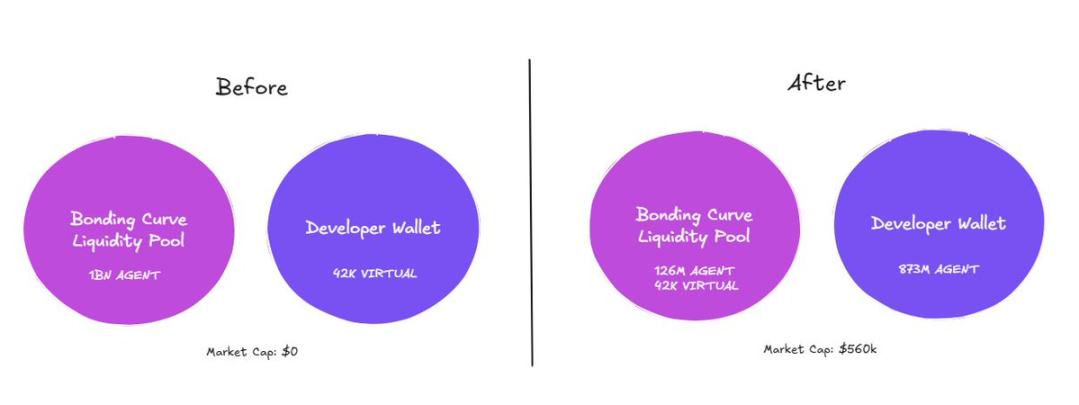

Once the AI proxy token is launched, it will enter the bonding curve liquidity pool. The creator’s initial VIRTUAL token purchase behavior determines: (i) the percentage of agent tokens received by the developer’s wallet, and (ii) the initial transaction market value of the AI agent (denominated in VIRTUAL tokens).

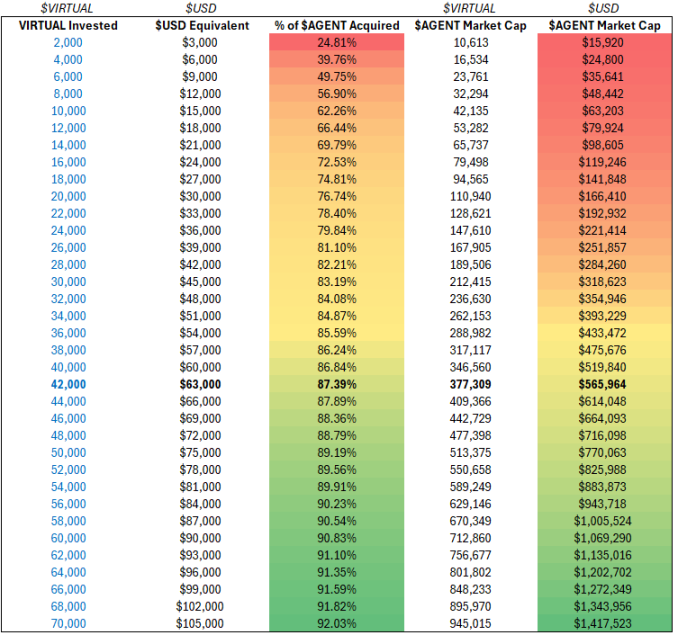

- 2000 VIRTUAL→ Tokens that can obtain 24.8% of AI agents, with an initial market value of 10600 VIRTUAL (approximately US$16000)

- 42000 VIRTUAL→ Tokens that can obtain 87.4% of AI agents, with an initial market value of 377000 VIRTUAL (approximately US$565000)

Numbers denominated in US dollars fluctuate based on VIRTUAL prices, but numbers denominated in VIRTUAL do not

How many tokens should the team receive?

This is the most commonly asked question by teams creating AI agents on Virtuals. There are several factors to consider when determining the percentage of initial tokens acquired.

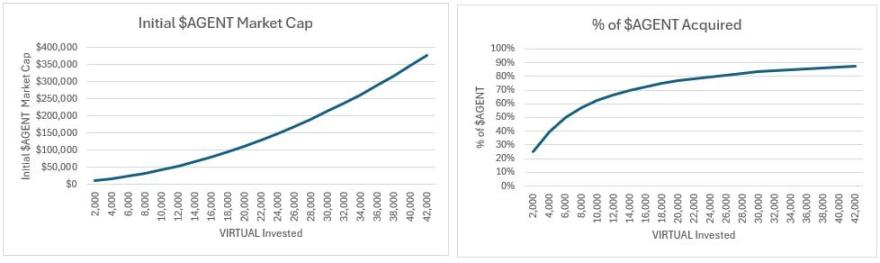

1. Bonding curve optimization

As the number of VIRTUAL tokens invested increases, the marginal AI agent token supply obtained for each unit of VIRTUAL tokens invested will decrease, as shown in the chart on the left side of the figure below. Judging from this chart alone, from the perspective of bonding curve optimization, it seems that the team should obtain as little initial supply as possible.

On the left is the initial dollar market value of the AI proxy token, and on the right is the percentage of the AI proxy token received by the team

2. incentive consistency

A sufficient number of lock-in tokens ensures that the team works hard, does not give up, and focuses on the long-term development prospects of the AI agent. If the team holds less than 10% of the tokens, they are likely not focused enough and will easily give up when they encounter difficulties.

Teams launching AI agents on the Virtuals platform should receive at least 40% of the tokens to achieve incentive consistency.

It is acceptable to reserve 15 – 20% lock-in tokens for teams, including founders, existing team members, consultants, and shares reserved for future team members and consultants.

So you may ask, why does the team want to get more than 20% of the token supply?

Ideally, a large proportion of the tokens should be set aside for marketing incentives to acquire new users and retain existing users. This may include pledge rewards, airdrops, partner incentives, participation incentives, liquidity pool incentives, creating new liquidity pools, etc. Web3 developers typically reserve 40 – 50% of their token supply for the “community” category.

Because Memecoin has a wider distribution of token holders, creators usually do not need to reserve additional tokens for community incentives, they only need to reserve 10 – 20% of the token supply for themselves. The difference between AI agents and Memecoin is that the team building AI agents needs to recruit and retain AI engineering talents and bear infrastructure costs.

In addition, once the team wants to expand from a decentralized exchange (DEX) to offline, listing on a centralized exchange (CEX) and hiring a market maker will incur additional costs. Ideally, the team should reserve some tokens for future financing and off-chain listings. In regular token economics terms, this category is often referred to as a “treasury”,”strategic partner”,”liquidity” or “investor”, and Web3 developers typically reserve 20 – 40% of the token supply for this purpose.

Given that in a typical Web3 space, the total percentage of tokens controlled by teams and vaults is approximately 90%, and that teams launching AI agents on the Virtuals platform are typically committed to building a $1 billion token over a few years, it is acceptable for teams to obtain 40% to 90% of the token supply in their first purchase transaction.

Therefore, from the perspective of incentive consistency, teams should obtain as much of the initial token supply as possible.

3. financial position

Startups are often short of funds, and running an AI token development team is often costly. A team of three developers and contractors can easily exceed $250,000 in salaries, infrastructure costs and marketing expenses over the course of a year. Ideally, the team should have enough money to maintain operations for at least 12 months so the team doesn’t easily abandon the project after a few months due to a lack of money.

As an entrepreneur, you should first use your personal savings to be self-reliant and not pay yourself or just the minimum wage until you reach product-to-market fit (PMF) or achieve specific milestones. Your own investment is important. If you don’t invest your personal savings yourself, why should others invest? There is no free lunch in the world, and high risks mean potential high returns.

From a financial perspective, teams should invest as little money as possible in acquiring tokens as they need cash more to pay for future operating expenses.

In terms of capital expenditure, the AI agent development team needs to make certain trade-offs.

4. Initial market value

From the perspective of bonding curve optimization, incentive consistency and financial situation, obtaining 40 – 50% of the token supply seems ideal. However, let’s look at the initial token trading market value generated by these transactions.

- Team receives 40% of token supply → Total token market value 17000 VIRTUAL (approximately US$25000)

- Team receives 45% of token supply → Total token market value 20000 VIRTUAL (approximately US$30000)

- Team receives 50% of token supply → Total token market value 24000 VIRTUAL (approximately US$36000)

For any meaningful AI proxy token, the market value of $40000 is seriously undervalued, which seems to be an opportunity for investors to pick up money. People who buy between $40000 and your fair value ($300,000-$3 million) are entering at extremely low prices.

Unfortunately, the people who can enter openly at this price point are not your future loyal community members. They are sniper robots that sell off if there is a short-term uptrend, which can damage the health and price trend of the tokens because their departure will increase volatility.

If you want to share the rising gains from this entry price, why share it with these robots? They don’t bring any value, and you could have shared them with future loyal community members who would support you for the long term, or with influential people (KOL) who would help raise the visibility of the projects you build.

Based on the above, you may think that issuing at fair value is ideal. You can estimate fair value by looking at similar AI agents on the Virtuals platform. Suppose you calculate the fair value at $1 million.

With this number, you bear the risk that the issuance may not go smoothly. What does this mean? It refers to the trend of prices falling all the way. Ideally, you want to see prices go up all the way, because “price increase” is the best marketing tool in the crypto world. You want to reward early believers and loyal supporters; you also want to ensure a certain margin of safety between the offering price and fair value valuation to ensure a smooth offering.

From this perspective, you should issue at a price that is 30 – 50% below fair value to ensure a successful issuance. However, if you think that the fair value of the AI agent’s market value is $1 million, and a 30% discount is $700,000, to issue at this initial market value, you need to invest 47000 VIRTUAL (approximately $70000), which is a lot for a small startup.

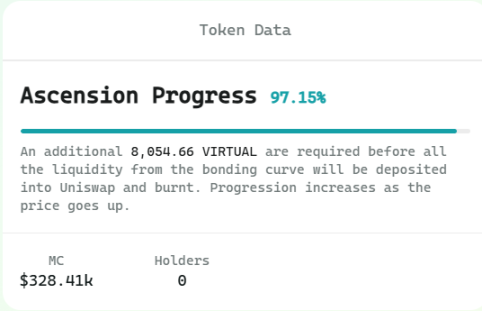

“Graduation” mechanism

The AI agent “graduated” when the team invested 42000 VIRTUals (approximately US$63000) into its bonding curve liquidity pool. This amount can either be invested by the creator in the first transaction or accumulated by market participants after the token is issued.

Once 42000 VIRTUAL is accumulated in the bonding curve liquidity pool, the AI agent will enter the Uniswap (or Meteora) liquidity pool, have access to Virtuals 'GAME framework, and be listed on the Virtuals platform's main website.

Once the AI agent meets the graduation conditions, a new liquidity pool is created on Uniswap (Ethereum-based Base Chain) or Meteora (Solana Chain)

The “graduation” of an AI agent in its first transaction is often seen as proof of commitment by the development team and is immediately bought in by snipers and community members. In other words, Aixbt and Vader, the two largest native AI agents on the Virtuals platform, were originally launched as prototype AI agents, and they reached graduation conditions over time.

conclusion

There are trade-offs between financial status and initial market value for AI agency projects. You want to be close to fair value issuance to avoid snipers and avoid financial losses, but you also want to invest as little money as possible so you have enough money to maintain future operations. In any case, teams should receive at least 40% of the token supply at the time of initial purchase to achieve long-term incentive consistency.

Teams should ideally set aside at least $250,000 to cover operating expenses for the next year. However, if the team wants to meet the “graduation” criteria from the launch, the total financial needs could rise to approximately $400,000 due to the cost of 42000 VIRTUAL.

We launched our AI agent (Vader) with an initial market value of approximately $15000, reaching an all-time high of $160 million. We made countless mistakes and learned a lot along the way. Here, we hope to share what we have learned with like-minded founders building AI agents, provide them with funding and incubate support.