Dynamic TAO: Your No-Nonsense Guide

Original author: Yau Teng Yan, founder of Chain of Thought

Original compilation: ChatGPT

Editor’s note: The article pointed out that the launch of dTAO solved the unfair and centralized problem of Bittensor’s early reward allocation. Through a market-driven mechanism, TAO rewards in subnets were linked to demand, and more rewards flowed to subnets with high demand. This change changes the previous validator-led reward allocation to pricing through the Alpha token market to ensure that high-performing subnets receive more rewards and stimulate activity and innovation across the network. Although it still faces manipulation and liquidity issues, dTAO has taken an important step in a decentralized and market-driven direction.

The following is the original content (the original content has been compiled for ease of reading and understanding):

A year ago, I wrote about Bittensor’s economic challenges. Now, with the launch of dTAO, the network is finally beginning to solve these problems.

This change is long overdue. Bittensor’s growth has exceeded the ability of root verifiers to fairly evaluate new subnets. Influence is concentrated at the top, and sometimes this influence is not completely neutral. dTAO solves this problem by letting requirements, not gatekeepers, decide which subnets will prosper.

To be honest, understanding dTAO was not easy at first. It took a while to piece together all the details.

This is also the reason why I wrote this article: to disassemble it in easy-to-understand language to prevent you from feeling my confusion at the time. And summarized my main gains.

Why dTAO?

First of all, it’s worth asking: What problems is dTAO designed to fix?

verifier bottleneck

Under the old system, freshly minted TAOs were allocated based on validator votes. In theory, this kind of “verifier democracy” makes sense, but it has problems in practice.

As more and more subnets come online, top validators simply cannot keep up. There are too many subnets, the signal is too miscellaneous, and the bandwidth is not enough to evaluate them fairly.

Over time, the system fell into apathy mode-a few subnets with good connections received most of the rewards, while new subnets struggled to get support.

conflict of interest

Many top validators also happen to be owners of subnets. By controlling the allocation of rewards, some people assign higher weights to their subnets, thereby actually increasing their rewards.

Some even called the previous system more like “distributing TAO to their friends.”

In extreme cases, verifiers reach private agreements or revenue sharing agreements with subnet owners, creating centralized risks, distorting reward allocation, and undermining trust in the system.

poor coordination

Verifiers have their own set of weight-allocation methods to determine rewards, but these methods are not always consistent with the overall goals of the network.

To make matters worse, the staker who provides financial weights cannot directly decide which subnets will receive rewards. Most pledged TAOs are concentrated in the hands of a few validators, who actually dominate the entire reward distribution pattern.

dTAO-Important changes

Before dTAO went online, reward allocation was very simple. Each block produces 1 TAO (that is, 7,200 TAOs per day), which are assigned to the subnets based on the weights assigned by the root verifier. Each subnet allocates TAO to its contributors in a fixed proportion: subnet owners 18%, miners 41%, and validators 41%.

For pledgers, everything revolves around Root (subnet 0). TAO holders pledge behind the verifier, and in return, they receive newly minted TAO. This process is direct and predictable.

But this is over.

Under dTAO, rewards are no longer distributed through the weight of the validator. Instead, TAO rewards flow through a market-driven system, using subnet tokens, also known as Alpha tokens.

The price of these Alpha tokens reflects the market demand for a certain subnet. The higher the demand, the higher the price, which means the more valuable the subnet is.

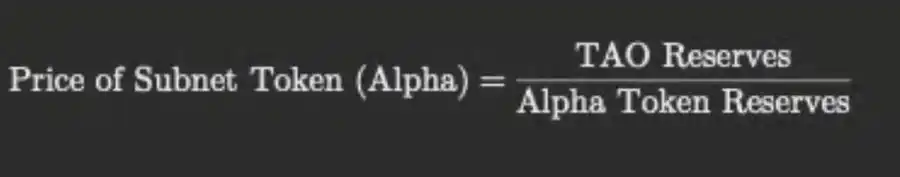

Subnetwork tokens use a constant product automated market maker (AMM)-the same pricing mechanism used by Uniswap. The price at any moment is determined by the ratio of TAO reserves to Alpha token reserves in the subnet’s mobile pool.

So, rewards are no longer randomly allocated, and the TAO reward share of a given subnet is now determined by how the market views its value.

·Higher Alpha token price → Reflecting strong market demand → More TAO rewards

·Lower Alpha token price → Reflecting weak market demand → Fewer TAO rewards

Imagine two subnets competing for rewards:

·Subnet A token price = $100

·Subnet B token price = $50

Because subnet A has a higher token price, it receives a larger share of TAO rewards per block than subnet B.

This mechanism creates a self-regulating system where the market believes that subnets that create more value (perform better) will receive more TAO rewards, while subnets that perform poorly will naturally see lower rewards.

This mechanism ensures that capital flows to the most productive subnets.

award allocation

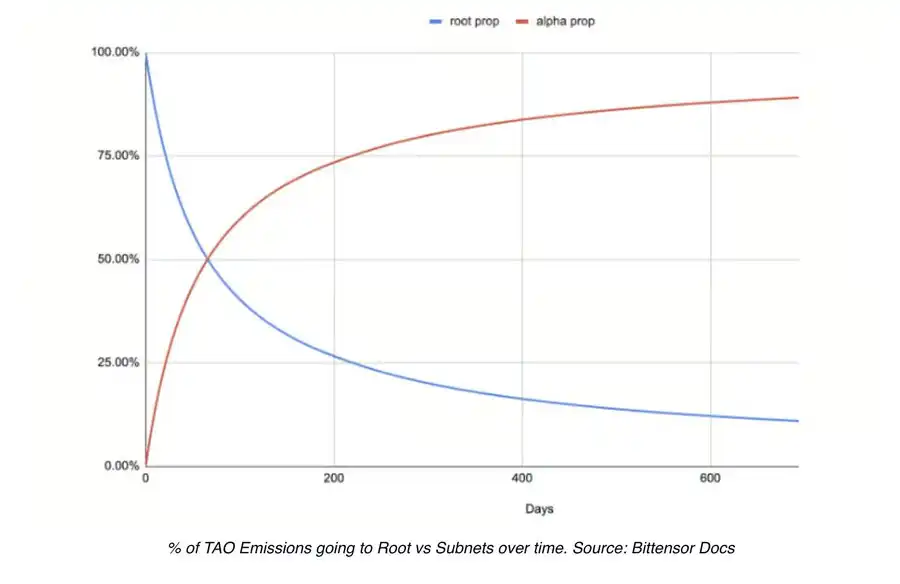

It took me a while to piece together the actual situation of reward allocation, so let me summarize it as succinctly as possible. The chart below is worth referring to many times in the next article. I found it to be one of the most informative visualizations, showing the ratio of TAO rewards assigned to Root to Subnet over time.

What happened to the Root Network?

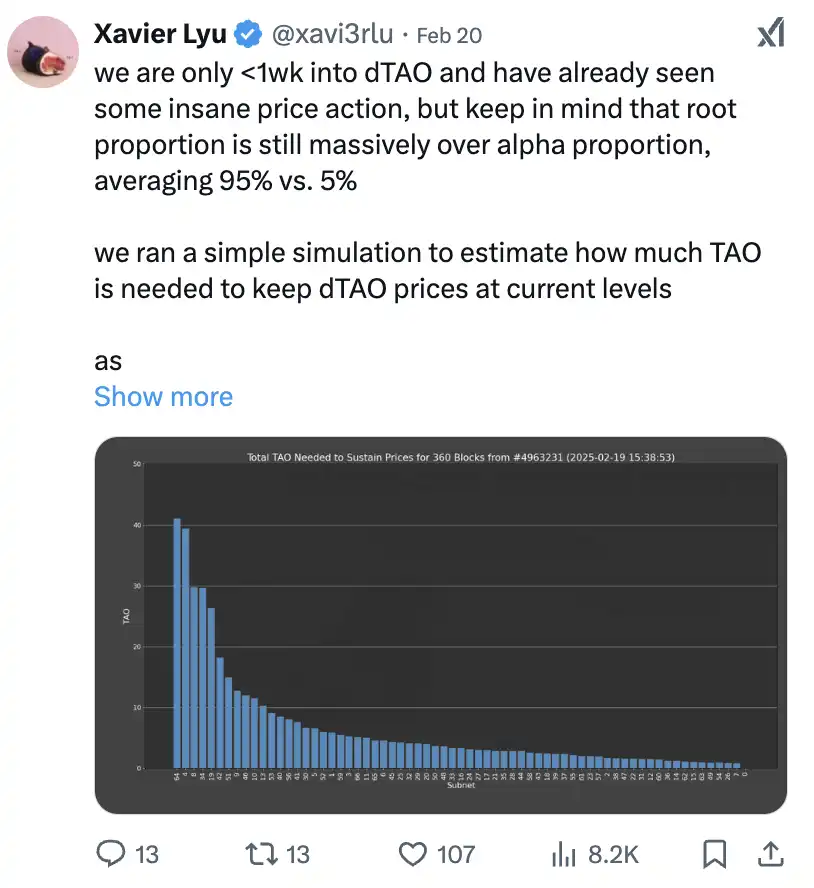

In the early stages of dTAO (as it is now), pledgers on Root (subnet 0) will still receive most of the TAO rewards. The reason is simple: there is not much in circulation at present.

The pledge weight of each subnet verifier depends not only on the share of Alpha tokens they hold in the subnet, but also on the number of TAOs they pledge in Root.

Because Alpha tokens were still scarce in the early days, Root verifiers held disproportionate influence across the network.

This resulted in the majority of newly minted Alpha tokens being automatically “sold back” to TAO and distributed to TAO pledgers on Root.

Currently, this is very beneficial to Root pledgers. Since most of the rewards still flow to Root, the profits are very rich, with the annualized rate of return (APR) reaching as high as 60-70% in the past few days.

But this won’t last long.

As more Alpha tokens enter circulation, their weight in the network will increase, and their influence will gradually shift away from Root verifiers. Over time, dTAO ensures that rewards are no longer concentrated at Roots, but are distributed more evenly across the network.

After approximately 100 days, the TAO rewards received by the Root pledger are expected to balance with the subnet Alpha token.

What happened to the subnet?

Subnetworks no longer directly allocate newly minted TAOs to miners and validators, but instead use Alpha tokens-their own local currency-to reward participants.

How Alpha Tokens Work

Alpha tokens are minted per block, per subnet, starting with 2 Alpha per block (this is twice the TAO minting rate). The casting rate is dynamic, and the higher the price of the Alpha token, the lower the casting rate.

Like TAO, there is a hard cap on the total supply of each Alpha token of 21 million tokens, and follows the same halving plan, with the first halving occurring when the total supply reaches 10.5 million-a point expected to be reached in less than two years.

Each subnet operates an AMM pool, where TAOs are paired with Alpha tokens. The price of Alpha is dynamically determined based on the ratio of TAO to Alpha tokens in the pool.

When you pledge TAO to the subnet pool, you will receive the same amount of Alpha tokens at the current market price. Later, if you cancel the pledge, you can exchange the Alpha token into TAO at the market price.

When people say they are “buying” or “selling” subnet tokens, they are actually just pledging or unpledging TAO into the subnet pool. There is currently no independent mechanism for directly purchasing Alpha tokens.

Reward allocation method

For each block, the protocol scans the Alpha token prices of all subnets and dynamically determines how much newly minted TAO to inject into each subnet’s pool.

·Higher-priced subnets (meaning greater demand and utility) will receive more TAO rewards.

·Subnets with lower prices receive fewer TAO rewards.

Subnetworks must now earn TAO rewards by generating actual demand for their Alpha tokens. This creates a competitive, market-driven environment where success must be achieved through hard work and only the most adapted subnets survive.

Subnetworks can no longer earn rewards by going through the motions; they must prove their worth.

Those subnets that demonstrate true utility and keep the Alpha token price high will receive more TAO rewards; while those that perform poorly will naturally decline as their rewards will gradually dry up.

To prevent short-term price fluctuations from distorting reward allocations, the system uses an exponentially weighted moving average (EMA), which smoothes volatility and ensures that TAO reward allocations remain stable even if sudden price fluctuations occur. As a result, changes in Alpha prices are reflected in TAO reward allocations lag-which usually takes days rather than hours.

timetable

The following is a breakdown of key stages to help you foresee future developments. Please note that these are only rough time frames and conceptual milestones, not fixed.

Start-up phase (Day 0-Day 1)

·Fountain 2 Alpha (start new casting) per subnet and block.

·Since the Alpha token is not yet in circulation, Root will receive approximately 100% of the TAO reward.

·The verifier’s pledge weight is entirely based on TAO.

·TAO pledgers on Root have the most income.

Early adoption phase (Day 2-Day 30): We are in this phase now

·As the subnet begins to minte Alpha, more Alpha tokens enter circulation.

·Verifiers in the subnet begin to accumulate Alpha, and the pledge weight gradually shifts to the subnet.

· Root still receives most of the TAO rewards, but its dominance begins to decline.

Transition Phase (Day 30-Day 100)

·Alpha supply in the subnet is growing rapidly due to high casting rates.

·Subnet verifiers with more Alpha start to exceed TAO-based Root verifiers in pledge weights.

· Root’s TAO reward share dropped significantly.

·By the 100th day, the pledge weights of TAO and Alpha will reach a balance, that is, TAO pledge no longer dominates in the calculation of verifier weights.

Post-transition phase (Day 100-Year 1)

·Subnet verifiers dominate reward allocation.

· Root continues to receive TAO rewards, but the reward rate slows down significantly.

·Verifiers who are adapted to pledge Alpha tokens in the subnet will benefit the most.

Long-term (Year 1 and beyond)

· TAO rewards are determined almost entirely by market-driven subnet pledges.

· Root still allows TAO to pledge, but the reward is small, and the weight of TAO is close to 0.

·In terms of reward allocation, the network is completely decentralized.

What has happened so far

All subnet token pools initially had only 1 Alpha/1 TAO, which can be said to be a fair boot model.

Shortly after the launch of dTAO, the price of Alpha fluctuated violently. Some subnets surged to 5-10 TAO/Alpha in the first few hours, driven mainly by speculators who wanted to make a profit through high rewards. Prices for some other subnets remain between 0.1 and 0.2 TAO, possibly due to the influence of big brands or lack of early marketing.

But the early price boom may not last long, for the following reasons:

Automatic sale of Root rewards: Many of the newly minted Alpha tokens are automatically sold back into these subnet pools to pay rewards from TAO pledgers on Root. This puts downward pressure on prices.

·Selling pressure: Miners, validators, and subnet owners earn Alpha tokens (which are cast at a faster rate than TAO) and then exchange them back to TAO to cover operating costs.

Warning: In the early stages, relative inflation for subnet Alpha tokens is very high. Low liquidity, highly volatile prices.

The best place I found to track prices on subnet Alpha @BackpropFinance.

As of now, Alpha circulation per subnet is less than 0.4%, so you will often see low market values, but fully diluted valuations are very high, often in the billions of dollars.

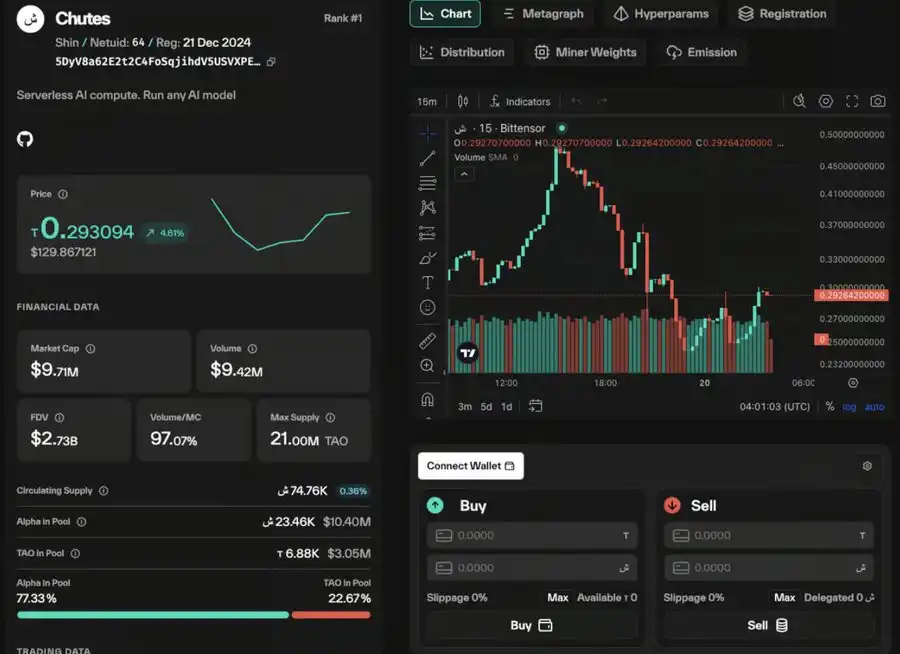

For example, one of the most popular recently is Chutes, which provides serverless GPU resources from @rayon_labs (subnet 64). It displays a market value of approximately $9.2 million, but has a fully diluted valuation of $2.6 billion, which is quite staggering compared to TAO’s market value of approximately $4 billion.

Given severe inflation and continued selling pressure, I expect these fully diluted valuations (FDV) to eventually fall back to more realistic levels.

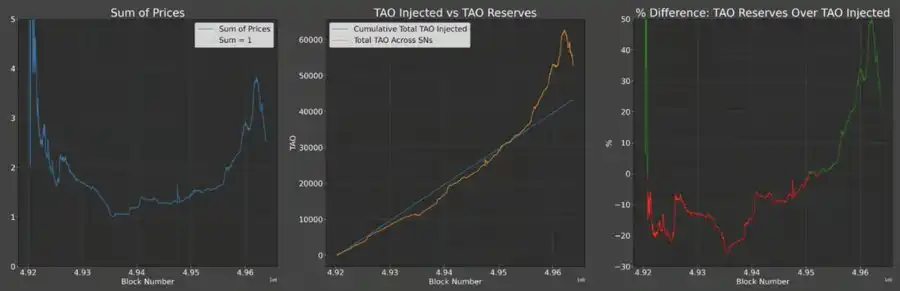

One indicator that can be tracked is the ratio of the total FDV of all subnet tokens to the TAO market value (see the leftmost chart above). It is currently between 2-3 times, but it is clear that this situation is unsustainable in the long term.

However, it remains a low-liquidity environment, which means that even small “blind” purchases or sell-offs by traders can quickly drive price fluctuations. In the past day alone, we have seen the price of subnet tokens surge by 100-200% and then cool down quickly.

How to get subnet Alpha tokens

Choosing the right subnet is the first step.

Not all subnets are the same, so look for practical, active communities and strong miners ‘participation-tools such as Discord, X, and GitHub can help you discover real market momentum.

Once you find a subnet you like, you need a Bittensor wallet. A good wallet is the official Chrome extension from @OpenTensor Foundation. You can only use TAO pledge to obtain subnet tokens, so there is currently no mechanism to exchange directly with ETH, USDC or SOL.

A benefit? Holding Alpha tokens allows you to earn more coins because newly minted Alpha tokens will automatically accumulate into your balance. When you want to exit, you can cancel the pledge and convert it back to TAO at the exchange rate in the pool. This exchange rate may be different than when you pledged it, so you may actually lose TAO.

My thoughts on dTAO

The best thing about dTAO and Bittensor subnet tokens is that they allow everyone to really focus on the construction of each subnet. There is real Alpha here-you can actually get upside opportunities by doing research-and before, you just had to buy TAO.

And that’s the point.

I am taking the time to gain a deeper understanding of what these subnets are doing and understand their product vision and business model.

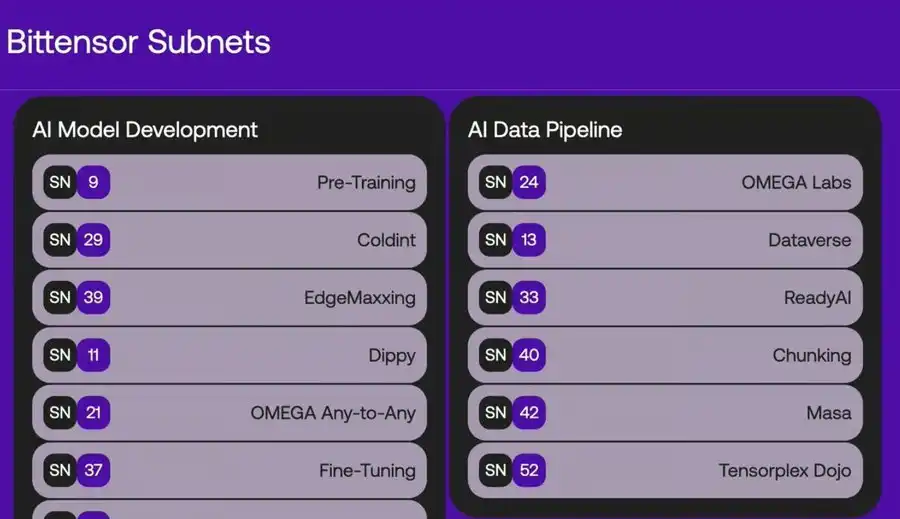

And it’s actually very interesting. Many subnets are led by technical teams with deep AI expertise and are handling scientific research from AI model development to protein folding and advanced visual models.

These subnets are at different stages of development. Some subnets are still in their early stages, focusing on building miners ‘communities, while others have begun to generate valuable output and gain commercial partners.

If I gave some advice about subnet tokens, it would be this: Patience may be your best strategy.

dTAO is a system designed for the long term, transitioning gradually, rewarding those who take the time to understand it deeply. If you like a specific subnet, stepping in gradually as small regular purchases (rather than investing large sums of money at one time) can help you weather periods of volatility while allowing liquidity to grow gradually.

For those who don’t like subnet fanaticism, you may be able to continue to pledge your TAO on Root for the next few months. The APR there will gradually decline over time, but it is still worthy of respect.

Of course, there will be people who want to play volatile “lottery tickets”, and if they can accurately grasp the timing of entry and exit, they may be able to significantly increase their TAO holdings. However, this is a very risky game.

some thoughts

dTAO is an important step in the right direction. But it’s not a perfect system (is there a perfect system?)

Manipulation can still occur

Switching to the Alpha-based pledge model introduces a new set of risks. In theory, it creates better market-driven incentives, but in practice it still leaves room for use. If the token price of a certain subnet collapses, malicious actors may take advantage of the opportunity to buy Alpha tokens at a low price and use it to manipulate rewards.

Currently, dTAO alleviates this problem by integrating Root pledge rights, making it more difficult for any single entity to hijack rewards. However, as Root weights gradually decrease, subnets will require stronger security mechanisms to prevent hostile takeovers. Subnet owners can still reach private agreements with large validators or miners-the medium is now Alpha, not TAO. Although the system is more decentralized, it still cannot avoid the possibility of a game theory alliance.

1,000 subnets?

The fee doubles every time a new subnet is registered. But over time, prices also decay, halving approximately every 38,880 blocks-that is, approximately half every five days. This means that if demand remains stable, a new subnet may be launched every five days.

What happens when we have a thousand subnets?

At such a large scale, no individual can reasonably track all the rewards, performances and opportunities across the network. The amount of data will be too large, too many variables, and too much noise. AI-based analytical tools will become a necessity rather than a luxury, helping pledgers find their way among overwhelming options.

For those launching new subnets, initial mobility will be key. They need to create an initial wave of demand for their Alpha tokens, otherwise their reward share will remain negligible.

Over time, the real winners will be those subnets that demonstrate real utility, establishing strong correlations between usage and Alpha prices. Subnetworks that fail to attract use may gradually disappear and their tokens drift towards zero.

DeFi on Bittensor

I am pleased to see that future upgrades may bring DeFi-like mechanisms into the ecosystem, further improving capital efficiency.

One possibility is to adopt a Uniswap V3-style liquidity pool that allows concentrated liquidity rather than the constant product AMM model. Another possibility is unlicensed liquidity provision, in which external LPs can deposit funds into Alpha-TAO pairs and earn transaction fees.

None of this currently exists-but if it does, it could fundamentally change the rules of the game, making subnet tokens more attractive to trade and pledge.

More capital → more liquidity → more capital.

Bittensor revival

Last month, in my personal forecast for 2025, I wrote that Bittensor could see a revival:

Bittensor spent most of last year in trouble-as a “veteran” of cryptographic AI, ignored by emerging narratives. Despite the wave of AI tokens and AI proxies, TAO still has difficulty keeping up.

Now, with the launch of dTAO, this situation is changing. Interest has surged, and for the first time, the network is forcing everyone to pay attention-not just TAO, but also what each subnet is building.

Congratulations to the Const and Opentensor team, and to all those who have worked hard to make it all possible. I admit that I had doubts about this.

This is not just an upgrade. This is the beginning of Bittensor’s revival, a process that will unfold over many years.

related resources

· Opentensor’s dynamic TAO FAQs

· Taostats (a great resource for tracking network and subnet data)

· Taopill (Overview of each subnet’s functions and key achievements)

·Backprop finance for monitoring subnet token prices

·Wombo’s automated subnet evaluation paper

·Many great tweets from @bloomberg_seth,@Old_Samster (@CrucibleLabs) and@xavi3rlu (Latent Holdings)

· @taowww.gushiio.comsdotai / @brodydotai: Bittensor’s Best Newsletter

· @TAOTalkPod: Bittensor’s excellent podcast

“Original link”