The “American exceptionalism” deal may be coming to an end.

Author:Flip Research

Compiled by: Shenchao TechFlow

American exceptionalism has generally receded

Warren Buffett often mentions the concept of a tailwind for the United States in his annual letter, referring to the long-term advantages of the U.S. economy on a global scale. His view has always been proven correct, and this philosophy has helped him achieve amazing returns over multiple generations, making him one of the greatest investors in history.

However, I think this trend is changing rapidly. As of the end of 2024, I only hold a small amount of U.S. stocks and cryptocurrencies. In this article, I will elaborate on the logic that supports this trade and explain why I think we may see a decline in the U.S. Dollar Index (DXY) and continued sluggish performance in U.S. stocks (and thus cryptocurrencies) in the future.

The Rise of AI: Global Competition and Value Transfer

In the past few years, the rise of AI has undoubtedly been one of the most important trends. AI is rapidly changing the way we live, and the pace of this change is accelerating. Behind this trend is the joint promotion of multiple factors:

-

Computing power is growing exponentially in accordance with Moore’s Law, and GPUs are further empowered by the powerful parallel computing capabilities, and NVIDIA has always been a leader in this field.

-

Scientific and technological breakthroughs, such as the birth of the Transformer architecture, have laid the foundation for improving the performance of AI models.

-

Large-scale investment from governments and private companies. For example, the world’s seven major technology companies (commonly known as Mag7) are expected to invest more than $300 billion in AI in 2025 alone.

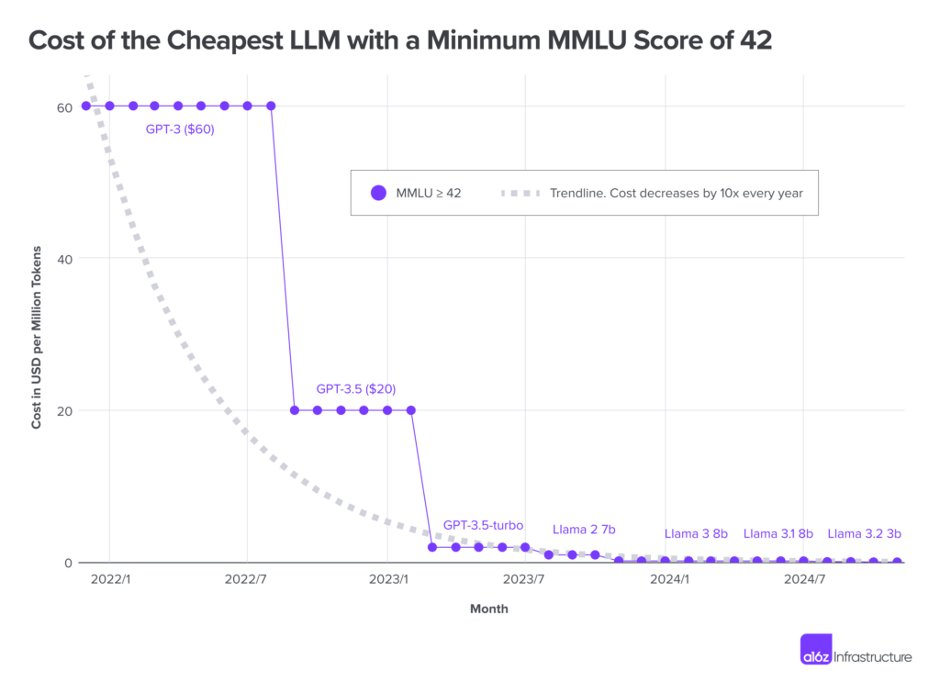

The combined effect of these factors significantly reduces the reasoning cost of AI models (that is, the cost of using AI models). A16z estimates that this cost has dropped 1000 times in the past three years.

In particular, the release of DeepSeek r1 has accelerated this trend. Many call this AI’s Sputnik moment, similar to the technology race sparked when the Soviet Union launched its first artificial satellite in 1957. The difference is that this time the competition focuses on building the most powerful Big Language Model (LLM) worldwide. At present, we can see that reasoning costs are falling rapidly and even approaching zero.

So who will capture these values?In the short term, value will flow down the industrial chain to the application layer, that is, those based on LLM Enterprises and businesses built.However, in the long run, as LLM performance continues to improve,Competition between application layers will become more intense and development will become more convenientAt the same time, there will be more and more plug-and-play solutions. Eventually, these values will be transferred directly to individual users.

I believe that the next 2-3 years will be a critical period of change in the AI field, and its impact will far exceed most people’s expectations. That’s why I firmly believe thatAI-based robot technology will gradually show greater competitiveness,Because hardware interfaces have higher barriers to competition than software applications.

From an investment perspective, there are obvious dislocations in this field. No matter which country in the world you are in, your portfolio is usually concentrated in the S & P 500 (S & P). This trend has been further amplified with the popularity of index funds. Many ordinary households invest their idle savings directly into S & P 500 ETFs (such as VOO), and investment forums also generally recommend investing all your money in the S & P 500 and then never looking back. The traditional 60/40 stock/bond portfolio is almost history. As a result, the S & P 500 currently accounts for more than half of the global stock market value, with a total market value of approximately US$55 trillion. This concentrated investment phenomenon may ignore the new opportunities brought by the rise of AI.

Technological change and global value transfer

Although global financial capital is highly concentrated in the U.S. market, the most transformative technology of our generation is redistributing value to the global population. This is probably one of the most powerful balancers we have ever seen–a gradual reconfiguration of value according to population distribution. So what does this mean for the United States? Although the United States controls more than half of the world’s financial capital, its population only accounts for 4.2% of the world’s population.

Of course, some of the above views have been simplified in order to convey the information more clearly. For example, Mag7 (the seven major technology giants) is aware of these potential risks. Companies like Meta have taken action to reduce reasoning costs by building open source models such as Llama, while also investing in robotics and application levels. However, these facts do not change the core logic of the overall argument.

The Trump Effect: Concerns about America’s Global Position

There is no doubt that Donald Trump is changing the landscape of global politics and the Make America Great Again (MAGA) movement marks a sharp departure from traditional political discourse. However, while Trump claims that his policies will make America great again, I thinkHis policies are significantly weakening U.S. influence on the global stage and may eventually lead to a gradual decline in U.S. prospects.

To understand this, we first need to understand why the US dollar can become a global reserve currency. On the face of it, this can be attributed to the strong driving force of the U.S. economy:The U.S. economy accounts for approximately GDP 26% of the total, and has a stable, open and highly liquid capital market.

However, this does not fully explain the global dominance of the dollar. If it were just economic factors, we should have seen that other currencies are used in proportion to the size of their economies. However, the fact is that the U.S. dollar participates in nearly 90% of global transactions.What really supports the dollar is the political and military power of the United States.Whenever a country behaves too strong, the United States imposes sanctions on it and asks allies to do the same. For example, the recent policy banning the export of high-performance GPUs to China is a stark example. This model is not new. Historically, the pound was once the global reserve currency, relying on Britain’s military power until the decline of the British Empire lost this status.

However, Trump is rapidly changing the traditional political and military positioning of the United States. His American-first philosophy emphasizes putting domestic affairs first while weakening the emphasis on traditional alliances and global military commitments:

-

General tariff threats:Trump has launched broad tariff threats against all trading partners, including long-time allies. This has not only intensified anti-American sentiment (for example, in countries such as Canada, where boycotts of American products have emerged), it has also forced trading partners to turn to other countries and establish closer economic ties.

-

Isolationist military policy:Trump pursues an isolationist military policy that weakens NATO’s influence, while requiring NATO members to increase defense spending to 5% of GDP. This policy has prompted many European countries to compromise, start increasing defense budgets and reducing dependence on the United States, which has undoubtedly weakened Trump’s main influence in Europe.

-

Europe’s tendency towards independence:This trend is unfolding in real time. Today, German election winner Friedrich Merz publicly said he will quickly push Europe together and achieve independence from the United States. This statement highlights the gradual erosion of Europe’s dependence on the United States under Trump’s policies.

-

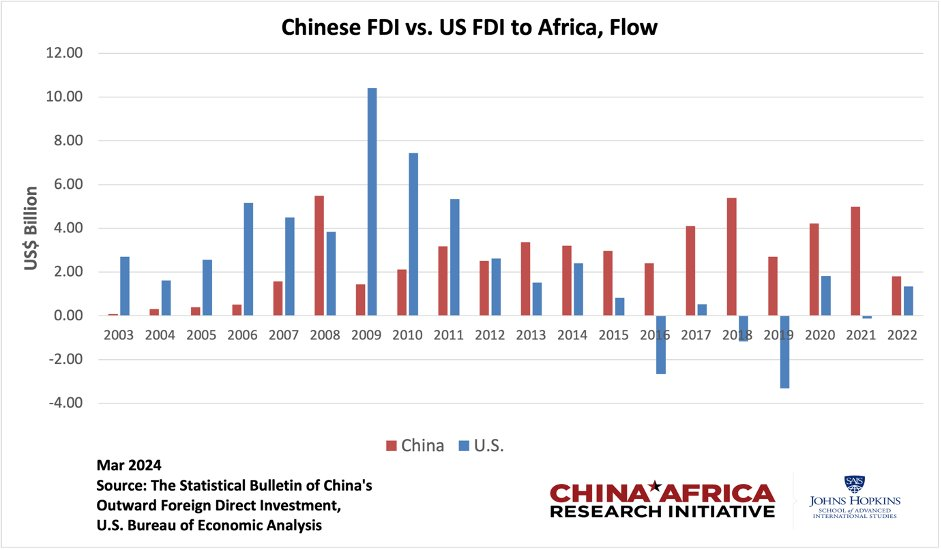

Cuts in foreign aid:The Trump administration has significantly reduced the U.S. foreign aid program, which has long been an important tool for the United States to exert influence around the world. At the same time, China has adopted a completely different strategy, especially pursuing expansion policies in Africa and ensuring access to valuable resources and critical supply chains through methods such as the Belt and Road Initiative.

-

Tilt towards Russia:The Trump administration seems to be focusing on ending the war in Ukraine at all costs, which has led to a deepening of relations between the United States and Russia, which ranks only 11th in the world in terms of GDP.“”—— This policy choice not only alienates the United States ‘traditional allies, but also threatens to weaken its global strategic position.

The Fed’s Dilemma

Current political and fiscal policies in the United States have put the Fed in difficult choices. Many of the isolationist policies pursued by the Trump administration are not economically justifiable. Economics has long proven thatAutarchy policies are nowhere near as global cooperation。For example, the law of comparative advantage clearly illustrates the advantages of international division of labor.

Although the overall performance of the U.S. market remains strong, some signs of weakness are beginning to emerge. The labor market is gradually cooling, and corporate investment is also decreasing. This is mainly because companies tend to reduce long-term investment in an uncertain policy environment. GDP growth in 2025 is expected to be 2.2%, which is a moderate growth level.

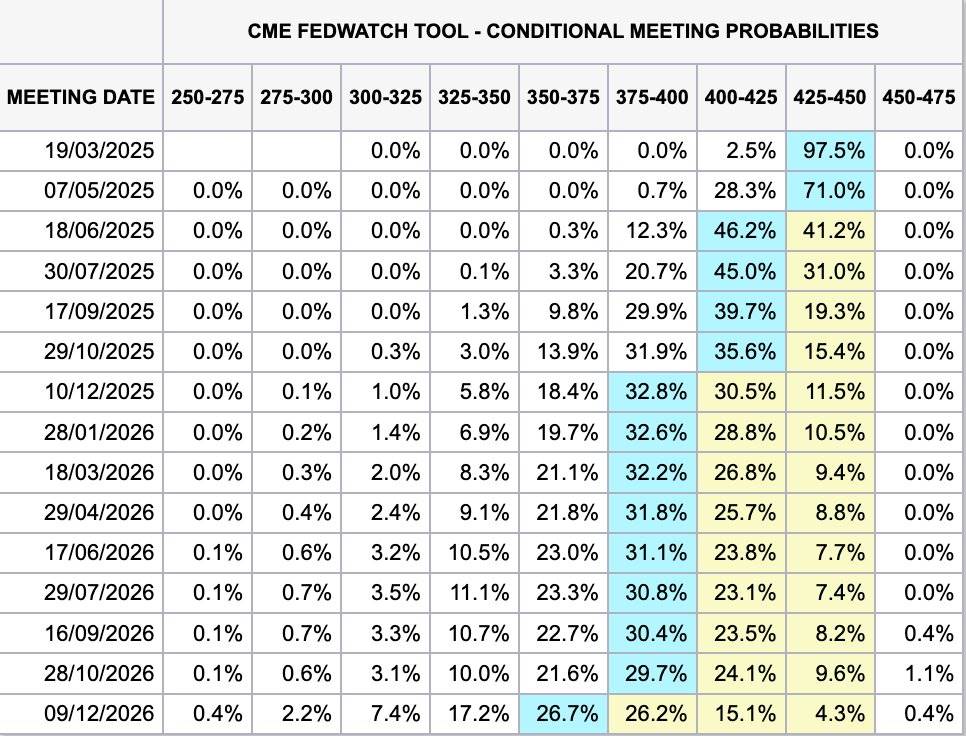

At the same time, inflationary pressures remain. The consumer price index (CPI) increased by 3% year-on-year in January this year and has continued to rise over the past six months. This contradictory trend of rising inflation and slowing economic growth makes it necessary for the Fed to find a balance between the two. As of now, the market generally predicts that the Federal Reserve may only cut interest rates once or twice this year.

Observing capital flows is always an important way to understand the market. The market’s gains last year were mainly driven by expectations of deregulation and increased liquidity. However, this year’s market sentiment is diametrically opposed, and is more affected by tightening policies. However, it should be noted that the Federal Reserve’s Quantitative Tightening (QT) program will be gradually relaxed in the first half of this year, which will inject additional liquidity into the market.

conclusion

“The US exceptionalism deal may be coming to an end, and the reasons behind it are complex. But as a proverb goes:“Market irrationality may last longer than investors ‘solvency.& rdquo;

So, why now? In my opinion, the Trump administration is the catalyst for this change. He has transformed the global political landscape in a way unseen in decades, forcing traditional allies to reassess their positions and causing serious damage to the United States ‘standing on the international stage.

The current situation is already very fragile, and it only takes a small trigger to trigger huge changes. For example, EU leadership may unite EU countries by simply saying no to Trump’s position on Ukraine, or allies may start forming a new trade union to cope with uncertainty about U.S. policy. In fact, we have already seen signs of this trend in the policies of the new German leadership.

However, the U.S. economic situation does not provide much confidence. At the same time, the impact of artificial intelligence (AI) transformation is also beginning to emerge. For example, China’s stock market has performed significantly better than the U.S. stock market this year, which may reflect the different development paths of the two countries in the technology field.

As for cryptocurrencies, I think institutional investors view them as high-risk assets in the risk spectrum and will adjust the flow of funds based on the aforementioned trends. In the crypto space, institutional investors are often given a halo, and many members of the crypto community (especially the crypto Twitter community CT) have high expectations for their investment behavior. However, these agencies don’t actually have any inside information (probably even less than the CT community knows). Therefore, when markets undergo drastic corrections, they may suffer losses as severe as ordinary investors. As for whether MicroStrategy (MSTR) has a Ponzi scheme, this is another topic worthy of in-depth discussion.

: All of the above opinions are my personal opinions and reflect my own portfolio positioning. The content is highly condensed to cater to the reading habits of the encrypted Twitter community (CT focus is shorter). Please always do Your own research (DYOR) and draw conclusions based on your own judgment.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern