Bitcoin miners face the survival test of shutdown prices. When the price falls below the critical point of electricity cost, the shutdown of mining machines may trigger a reduction in market selling pressure and a rebound in prices.

Author: Luke, Mars Finance

In the mine late at night, the roar of mining machines resounded endlessly, like a symphony that never ends. However, when the price of Bitcoin hovers around $85,000, this computing power jungle is undercurrent-more than half of the mining machines are standing on the edge of the cliff, facing a cruel choice: continue to burn electricity bills and persist in mining, or decisively press the shutdown button? This silent game points to the bottom-level survival rule of the cryptocurrency market-shutdown price. Once it was seen as a weathervane at the bottom of the market; now it is teetering in the torrent of mining machine iterations. Can Bitcoin still rebound by shutting down its price? The answer may be hidden in this battle between computing power and cost.

Off price: The oxygen line that miners breathe

In Bitcoin’s digital world, miners are pioneers who rely on computing power to make a living, and electricity is the oxygen they rely on to breathe. The shutdown price is like the minimum oxygen concentration in this jungle. Once the Bitcoin price falls below a certain critical point, the proceeds of mining cannot cover the cost of electricity, and miners can only choose to shut down.

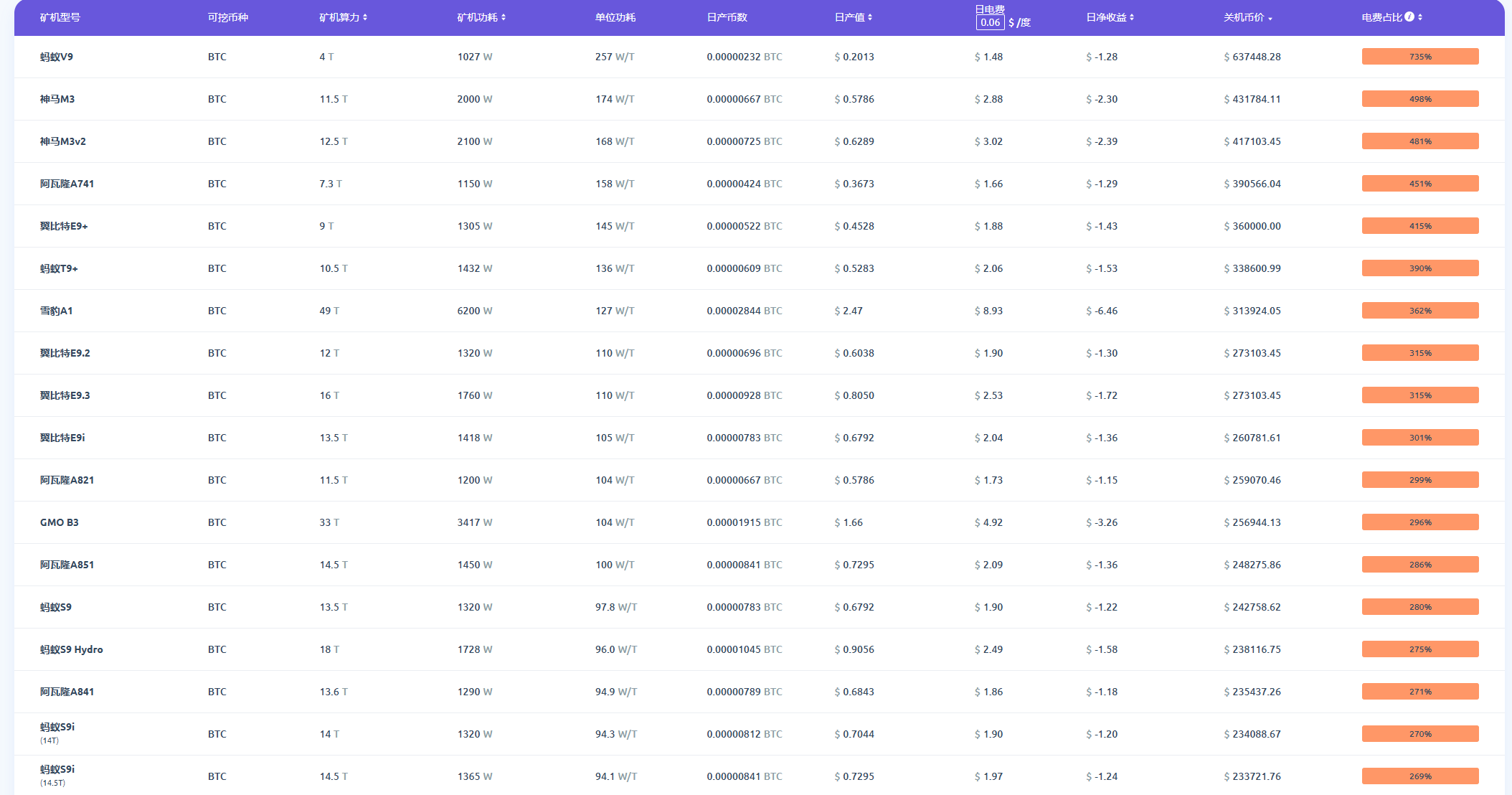

Accurate calculation formula for shutdown price:

Shutdown price =(daily power consumption of the mining machine × electricity price) ÷ (daily bitcoin output × mining pool fee coefficient)

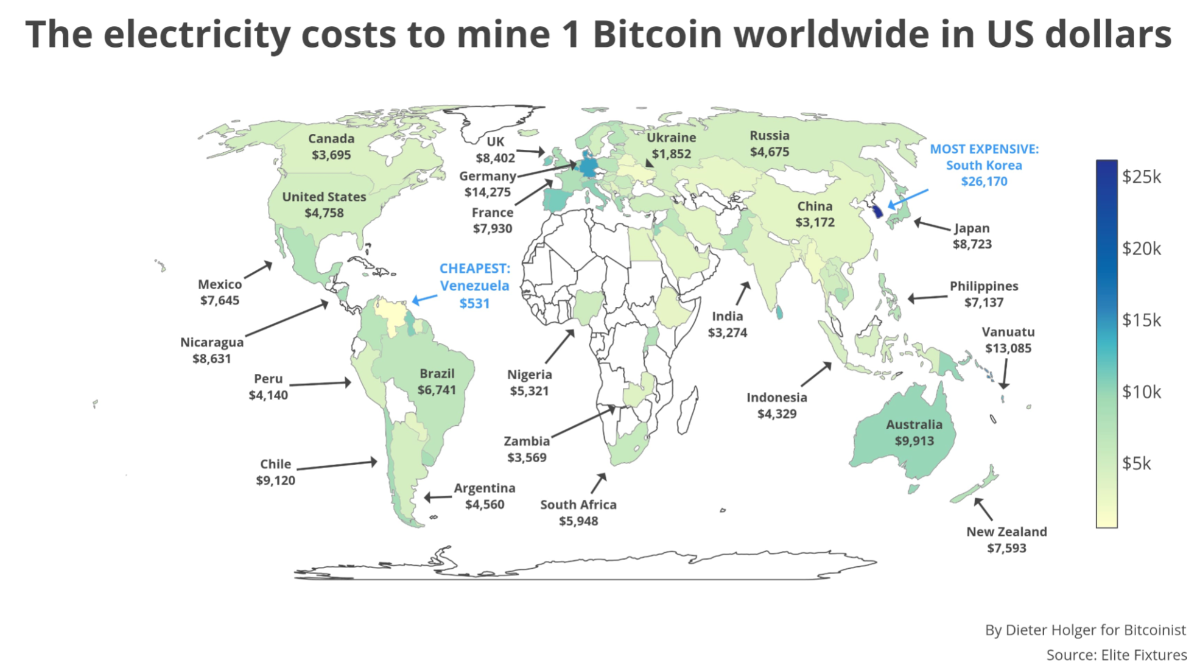

Taking Ant S19 as an example, it consumes 72 kilowatt-hours per day (electricity price is US$0.06/kilowatt-hour) and produces about 0.0002 BTC. The shutdown price is just close to US$85,000, which coincides with the current market price. This is no coincidence, but a reflection of half of the industry’s life hanging on a thread.

But the shutdown price has never been a static number. It follows the footsteps of miners to corners with lower electricity bills, dances with the pace of difficulty adjustment of the Bitcoin network, and continues to be reshaped under the impact of a new generation of mining machines. Just like a dynamic dance, after the old mining machines stopped, the computing power of the entire network dropped, and the survivors regained their breath due to reduced competition; every two weeks, the difficulty adjustment is waved like a baton to ensure a smooth rhythm of block output; At the same time, new mining machines such as the Ant S21XP were born, reducing the proportion of electricity bills to 35%, causing the industry’s cost line to suddenly move downward. It is the resonance of these factors that makes shutdown prices a secret compass to spy on the bottom of the market.

Historical code: Rebound fireworks ignited by shutdown prices

Opening the historical ledger of Bitcoin, the shutdown price is like a beacon of hidden mystery. Whenever the price touches its light, the market will always usher in a turning point.

December 2018

Bitcoin plunged from US$20000 to US$3150, and Bitmain’s S9 mining machine (shutdown price is about US$3500) was shut down on a large scale. In the following six months, the currency price rebounded to US$14000, an increase of 344%.

March 2020

“Black Thursday” halved the currency price to US$3800, and the computing power of the entire network dropped by 30%. After the shutdown wave, Bitcoin launched an epic bull market, surging to $65000 in 15 months.

Bear market in 2022

When the currency price fell below US$20000, North American listed mining companies were forced to sell their inventory of Bitcoin to pay for electricity bills. However, as computing power dropped by 26%, the currency price rebounded again in early 2023.

Why does this “bottom out when you turn off your phone” plot always work? The answer lies in the self-healing of the market ecology: miners sell about 900 bitcoins a day to pay for electricity bills, and the wave of shutdowns makes this selling pressure disappear; at the same time, the shutdowns price is regarded by institutions as the “bottom line of cost”, attracting funds to bargain bottom; Difficulty adjustment is like a spring. The deeper the pressure is, the stronger the potential for rebound. However, this familiar script is now cast with a layer of uncertainty under the shadow of the new mining machine.

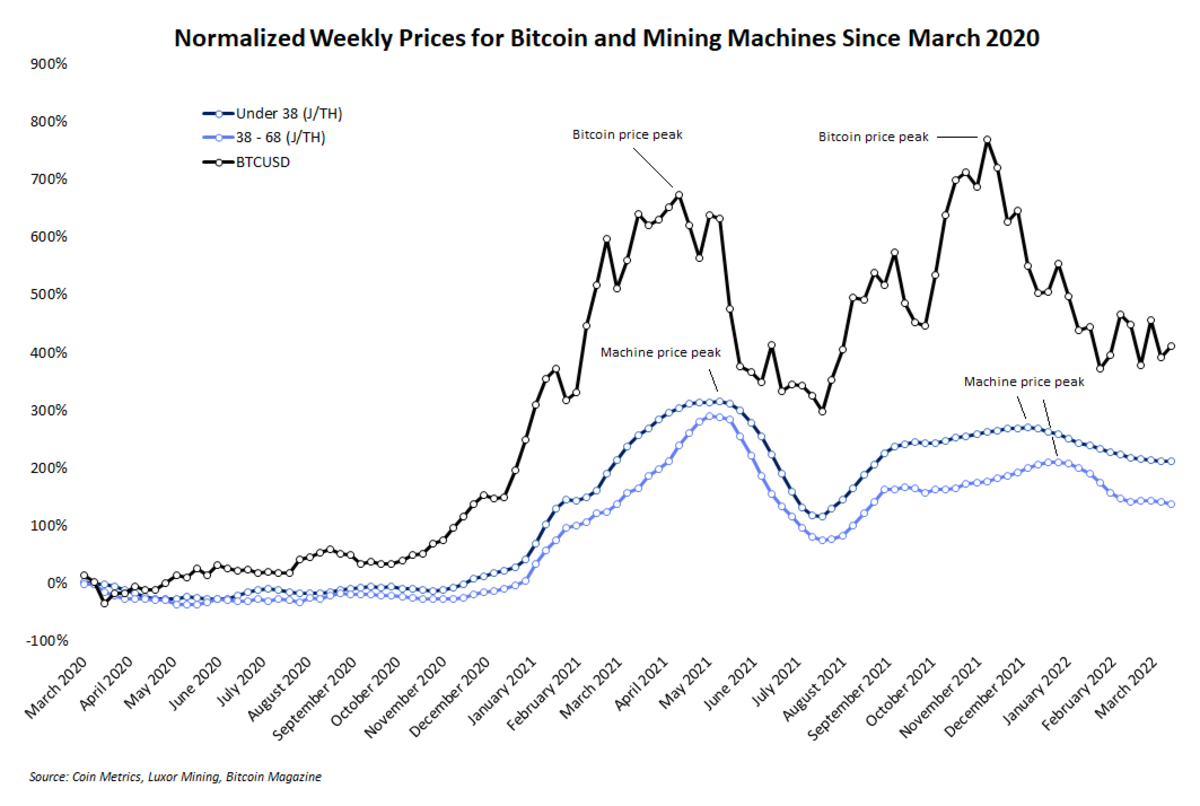

Mining machine evolution: The breaker of the shutdown price curse?

When the Ant S21XP lowered the shutdown price to US$29,757, while the old Shenma M30S + was dying near US$85,000, a knockout match of “computing Darwinism” was underway. From the Ant S9 (28nm chip, energy efficiency ratio 100J/TH) in 2016 to the S21XP (5nm chip, energy efficiency ratio 15J/TH) in 2024, energy efficiency has increased nearly 7 times in eight years, which can be called a leap from steam engine to magnetic levitation. The new mining machine not only has lower costs, but also uses computing power to crush the old mining machine out of the stage. According to estimates by the University of Cambridge Blockchain Research Center, when the S21 series accounts for 20% of the computing power of the entire network, the shutdown price center will move down by 40%. This makes one wonder: If the shutdown price falls to US$30,000 in the future and the Bitcoin price fluctuates in the range of US$40,000 -60,000, will the classic “shutdown rebound” occur again?

The impact of this mining arms race goes far beyond the numbers. Analysts at Morgan Stanley once pointed out in a report: “The improvement in mining efficiency is reshaping the cost curve of Bitcoin, and the fluctuation range of shutdown prices may compress from tens of thousands of dollars to thousands of dollars.” At the same time, large mines lock in profits through futures hedging and cheap electricity, further reducing the sensitivity of shutdown prices. The curse of history seems to be quietly cracked by technology and capital.

The crossroads of shutdown prices: rebound or silence?

The market is divided into two factions over the future of shutdown prices. On the one hand, there are “failure theorists” who believe that the iteration speed of miners has exceeded price fluctuations, and the anchoring effect of shutdown prices is disintegrating; the rise of Bitcoin spot ETFs has also blurred the correlation between miners ‘selling pressure and price. On the other hand are “evolutionists” who firmly believe that the technological dividend will eventually reach the physical limit of chip manufacturing (approaching 1nm), and that rising global electricity costs, especially under carbon neutrality policies, will offset some of the efficiency gains. CoinMetrics data shows that the global Bitcoin mining machine market will reach US$5 billion in 2023, a year-on-year increase of 25%, but electricity costs have also increased by 15% in the past five years. No matter which faction dominates, the shutdown price is quietly changing: the fluctuation space has narrowed, the rebound cycle has been shortened from several months to several weeks, and “super miners” with new miners and cheap electricity have gradually become the dominant market.

So, can Bitcoin still rebound based on shutdown prices? At the current price of $86,900, the answer is unclear. The magic of shutdown prices has ignited the flames of rebound many times in history, but now it is facing new tests. If prices drop further, new generations of mining machines such as Ant S21XP (shutdown price is approximately US$29,757) may still be able to stabilize their position, while the large-scale shutdown of old mining machines may reduce selling pressure, attract funds to enter, and trigger a slight rebound. However, if prices fluctuate at high levels, such as the US$80,000 -90,000 range, the traditional triggering effect of shutdown prices may gradually fail, and Bitcoin’s trend will rely more on the game of macroeconomics and market sentiment. Arthur Hayes, founder of BitMEX, once pointedly pointed out: “Don’t expect shutdown prices to save the market like in the past. Future fluctuations will come more from external capital wrestling.”

At the same time, market analysis adds more clues to this judgment. Bitcoin hit its largest decline (-15%) in the past three days since the FTX crash. 10x Research founder Markus Thielen warned in a client note on Wednesday that in a worst-case scenario, Bitcoin could fall to the US$72,000 -74,000 range before being expected to rebound. By analyzing the actual price of short-term holders (the average cost of buying BTC at addresses held for less than 155 days, currently about $82,000), he pointed out that this level is a key demand area-historically, Bitcoin has rarely fallen below this line for a long time in the bull market, while in the bear market it can be under pressure for a long time.

Thielen also mentioned that there is a lag in the correlation between Bitcoin and global central bank liquidity indicators. If liquidity tightens, the decline may intensify, but the support already touched by $82,000 may pave the way for a rebound.

Epilogue: Survival inspiration from the computing jungle

For ordinary investors, the change in shutdown prices is a vivid survival lesson. When the market cheers that “the shutdown price is here,” don’t forget to check the models and proportion of computing power of mainstream mining machines; the “inventory/debt ratio” in the financial reports of mining companies such as Marathon and Riot may be a secret clue to selling pressure. More importantly, the shutdown price is not a crystal ball, but an X-ray of the market ecology, reflecting the game between computing power, cost and humanity. Just as the Bitcoin network always pursues the longest chain, shutdown prices will continue to be reborn in the pursuit of profits by miners and the evolution of technology. A rebound may no longer be inevitable, but this adventure in the computing power jungle will never end.