① Xing Yiteng of the National Energy Administration pointed out that photovoltaic involution competition has not yet been fundamentally resolved;

② Hangzhou Steel Co., Ltd. announced on the 17th day that the stock price was seriously deviated from fundamentals and there was a high risk of speculation;

③ The three major U.S. stock indexes collectively closed down, with Nvidia falling more than 8%.

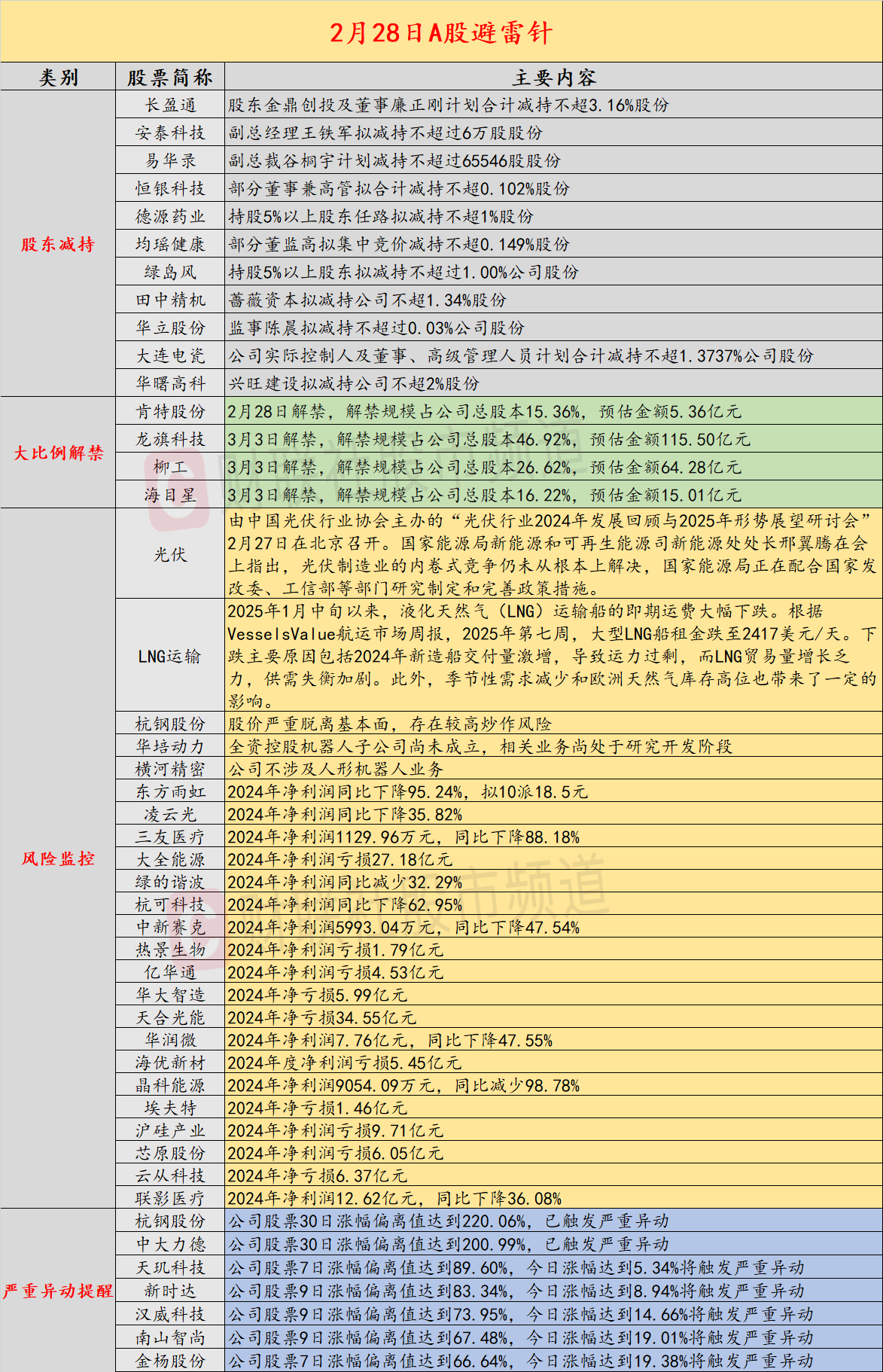

Introduction:Cailian invested in lightning rods on February 28. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) Xing Yiteng of the National Energy Administration pointed out that photovoltaic involution competition has not yet been fundamentally resolved;2) More than 90% of companies believe that the price trend of imported iron ore in March was high and low; the company’s key concerns include: 1) On the 17-day 13-board Hangzhou Steel Co., Ltd. announced that the stock price was seriously deviated from fundamentals and there was a high risk of speculation;2) Yokogawa Precision warned the risks that the company did not involve humanoid robot business; key concerns in overseas markets include: 1) The three major U.S. stock indexes collectively closed down, with Nvidia falling more than 8%;2) The growth rate of the U.S. core PCE price index in the fourth quarter was revised upward from 2.5% to 2.7%.

economic information

1. The “Photovoltaic Industry Development Review in 2024 and Situation Outlook Seminar in 2025” sponsored by China Photovoltaic Industry Association was held in Beijing on February 27. Xing Yiteng, director of the New Energy Division of the New Energy and Renewable Energy Department of the National Energy Administration, pointed out at the meeting that the convoluted competition in the photovoltaic manufacturing industry has not yet been fundamentally resolved. The National Energy Administration is cooperating with the National Development and Reform Commission, the Ministry of Industry and Information Technology and other departments to study and formulate and improve policy measures.

2. The latest quotation from Shanghai Nonferrous Metals Network shows that on February 27, the price of domestic battery-grade lithium carbonate fell 4.20 yuan to 75,300 yuan/ton, hitting a new low for more than a month and falling for two consecutive days.

3. Regarding the views on the March price index, 54% of the iron ore industry companies in the survey sample believe that the average price in March increased compared with February, 38% of the iron ore industry companies believe that it is bearish, and 8% of the companies believe that the average price in March is basically the same as in February. In terms of price trend, 68% of enterprises believe that the iron ore price trend in March will rise first and then fall, 9% believe that it will fall first and then rise, 13% believe that it will fall unilaterally, 3% believe that it will rise unilaterally, and 7% believe that it will fluctuate; judging from the ending value and the opening value, 7% of enterprises believe that the ending value of iron ore prices in March is higher than the opening value (low before and high after), and 93% believe that it will be high before and then low.

Company warning

1. Hangzhou Steel Co., Ltd. in 17 days and 13 boards: The stock price is seriously deviated from fundamentals and there is a high risk of speculation.

2. Huapei Power: The wholly-owned robot subsidiary has not yet been established, and the related business is still in the research and development stage.

3. Yokogawa Precision: The company does not involve humanoid robot business.

4. Changyingtong: Shareholder Jinding Venture Capital and director Lian Zhenggang plan to reduce their shares by no more than 3.16%.

5. Antai Technology: Deputy General Manager Wang Tiejun plans to reduce his shares by no more than 60,000 shares.

6. Yi Hualu: Vice President Gu Tongyu plans to reduce his shares by no more than 65546 shares.

7. Hengyin Technology: Some directors and senior executives plan to reduce their shares by no more than 0.102%.

8. Deyuan Pharmaceutical: Ren Lu, a shareholder holding more than 5% of the shares, plans to reduce his shareholding by no more than 1%.

9. Junyao Health: Some directors and supervisors plan to conduct centralized bidding to reduce their shares by no more than 0.149%.

10. Green Island Style: Shareholders holding more than 5% of the shares plan to reduce their shares in the company by no more than 1.00%.

11. Tanaka Seiki: Rose Capital plans to reduce its shareholding in the company by no more than 1.34%.

12. Huali Shares: Supervisor Chen Chen plans to reduce the company’s shares by no more than 0.03%.

13. Dalian Electric Porcelain: The company’s actual controller, directors and senior management plan to reduce their shares in the company by no more than 1.3737%.

14. Huashu High-Tech: Xingwang Construction plans to reduce its shareholding in the company by no more than 2%.

15. Dongfang Yuhong: Net profit in 2024 will drop by 95.24% year-on-year, and it is planned to be 18.5 yuan for 10 groups.

16. Ling Yunguang: Net profit in 2024 will drop by 35.82% year-on-year.

17. Sanyou Medical: The net profit in 2024 will be 11.2996 million yuan, a year-on-year decrease of 88.18%.

18. Daquan Energy: Net profit loss in 2024 will be 2.718 billion yuan.

19. Green harmonics: Net profit in 2024 will decrease by 32.29% year-on-year.

20. Hangke Technology: Net profit in 2024 will decrease by 62.95% year-on-year.

21. China-Singapore SAC: The net profit in 2024 will be 59.9304 million yuan, a year-on-year decrease of 47.54%.

22. Hotview Biotech: Net profit loss in 2024 is 179 million yuan.

23. Yihuatong: Net profit loss in 2024 will be 453 million yuan.

24. Huada Intelligent Manufacturing: The net loss in 2024 is 599 million yuan.

25. Trina Solar: The net loss in 2024 will be 3.455 billion yuan.

26. China Resources Micro: Net profit in 2024 will be 776 million yuan, a year-on-year decrease of 47.55%.

27. Haiyou New Materials: Net profit loss in 2024 is 545 million yuan.

28. Jingke Energy: The net profit in 2024 is 90.5409 million yuan, a year-on-year decrease of 98.78%.

29. Evert: The net loss in 2024 will be 146 million yuan.

30. Shanghai silicon industry: Net profit loss in 2024 is 971 million yuan.

31. Xinyuan Shares: Net profit loss in 2024 is 605 million yuan.

32. Yuncong Technology: The net loss in 2024 will be 637 million yuan.

33. Lianying Medical: Net profit in 2024 will be 1.262 billion yuan, a year-on-year decrease of 36.08%.

Overseas warning

1. The three major U.S. stock indexes collectively closed down. The Dow fell 0.45%, the Nasdaq fell 2.78%, and the S & P 500 fell 1.58%. Large technology stocks fell generally. NVIDIA fell more than 8%, and its market value fell below 3 trillion US dollars. Broadcom fell more than 7%, Tesla fell more than 3%, Amazon, Google, and Meta fell more than 2%, and Microsoft and Apple fell more than 1%. Semiconductor and blockchain sectors were among the top losers, with Strategy falling more than 8%, ARM and Asme falling more than 6%, Kolei and Jianan Technology falling more than 5%, AMD and Qualcomm falling more than 4%, and Coinbase falling more than 2%. Real estate, insurance, and defense aviation sectors rose, with Haike Aviation rising more than 13%, and Raytheon Technology rising more than 2%.

Most popular Chinese stocks fell, with the Nasdaq China Golden Dragon Index closing down 0.93%. Jinshan Cloud fell more than 13%, Shangrong fell nearly 5%, Ideal Car fell more than 3%, and Alibaba fell nearly 2%.

2. COMEX gold futures closed down 1.46% at US$2,887.8 per ounce;COMEX silver futures closed down 2.19% at US$31.86 per ounce.

3. The annualized quarter-on-quarter revision of the core personal consumption expenditure (PCE) price index of the United States in the fourth quarter was 2.7%, with an expected growth of 2.5%, and an initial growth of 2.5%.

4. Sources said that due to uncertainty about sanctions and tariffs, OPEC+ is cautious about increasing April oil production as planned. Russia and United Arab Emirates hope to continue to increase oil production in April, while other member states, including Saudi Arabia, favor postponing it.

5. Since mid-January 2025, spot freight rates for liquefied natural gas (LNG) carriers have dropped significantly. According to the VesselsValue Shipping Market Weekly Report, in the seventh week of 2025, the rental rate of large LNG ships dropped to US$2417/day. The main reasons for the decline include the surge in new shipbuilding deliveries in 2024, resulting in excess capacity, while the growth of LNG trade volume is sluggish and the imbalance between supply and demand is intensifying. In addition, seasonal demand reductions and high natural gas inventories in Europe have also had a certain impact.