Governance dynamics are seen as indicators of future stability and growth, but project technology updates have the same impact as governance dynamics.

Author:Tulip King, Encrypt KOL

Compiled by: Felix, PANews

Key insights:

-

Increased market sensitivity: Markets respond similarly to different events. Although the content of events varies (from risk parameter adjustments to technical consolidations), broader market sentiment and liquidity conditions play a leading role in shaping prices.

-

Governance as a core driver: A significant proportion of events are related to governance proposals and execution decisions, particularly around Maker and its related protocols (including Sky Protocol). The cautious and consistent market response to the proposals highlighted investors ‘concerns about long-term risk management and strategic capital flows. Governance dynamics are seen as indicators of future stability and growth.

-

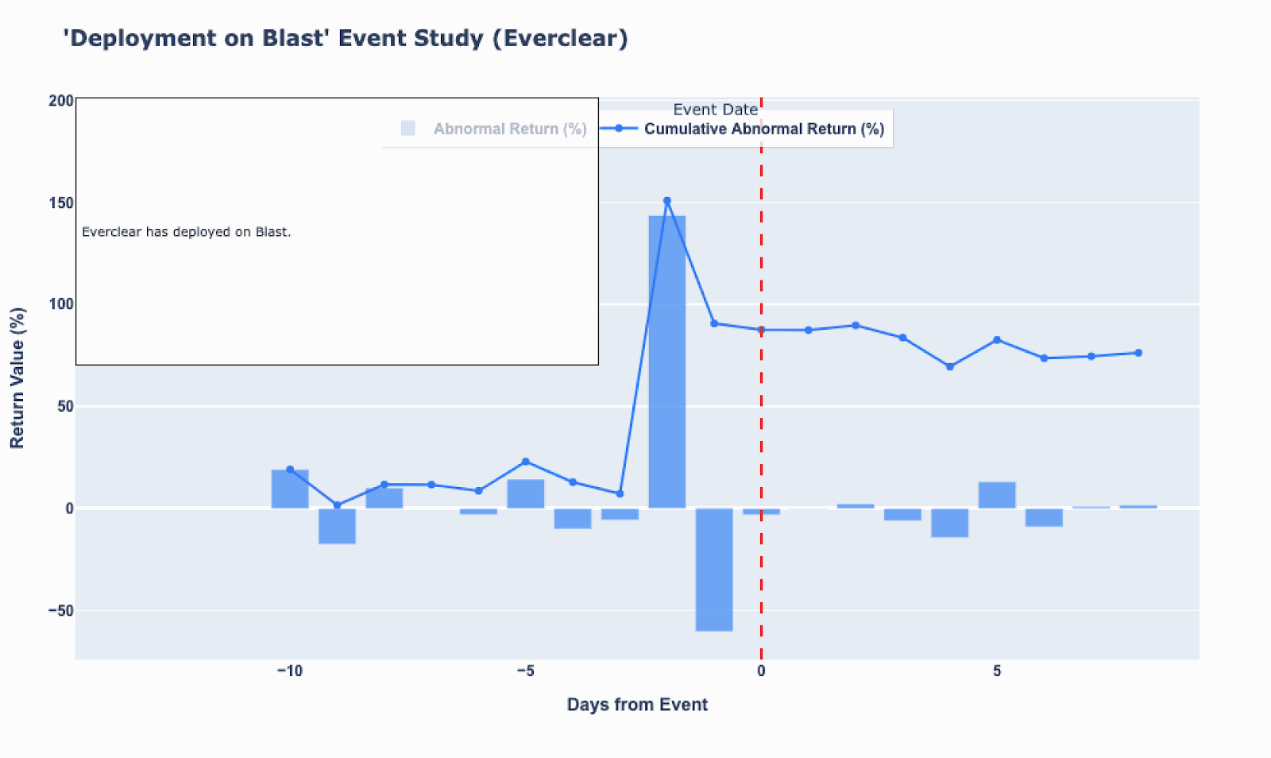

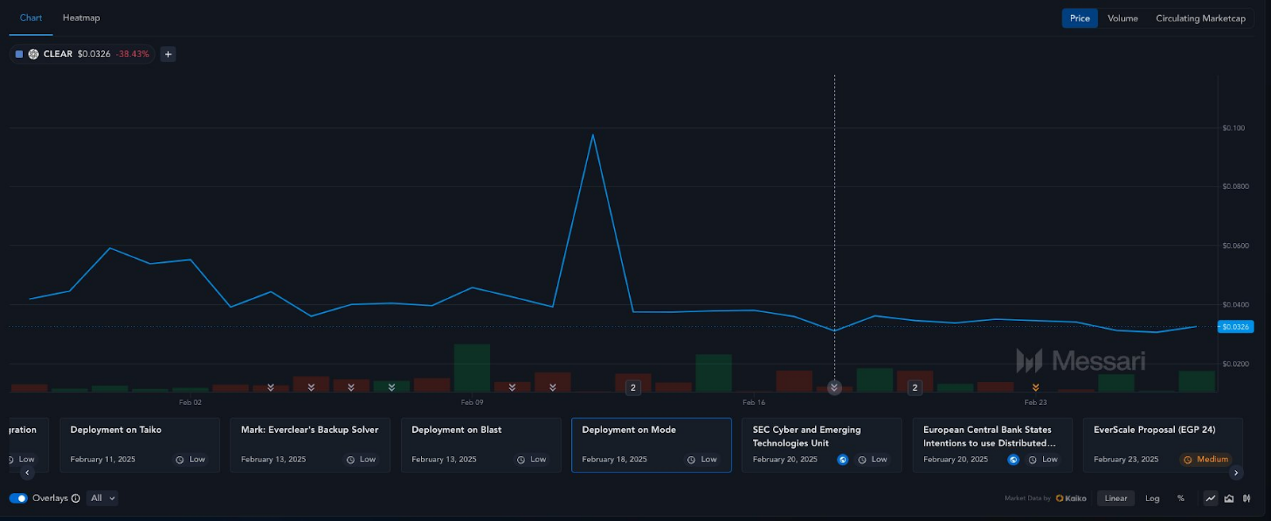

Integration and expansion are equally important: technical announcements such as Everclear integration, Onyx’s smart wallet, and Virtuals’s AI pledge program have also triggered responses commensurate with governance dynamics. This consistency suggests that business expansion that promises to improve network efficiency and cross-chain liquidity is equally influential, and strengthens the market’s overall risk-reward assessment during this window.

Weekly theme

This week, the market’s attention was focused on governance and risk management proposals, reflected in repeated implementation proposals and adjustments to key agreement parameters. Discussions on cutting core fees, changing liquidity parameters, and revising stabilization fees are not just routine updates; they also reflect a general desire for investors to make sound decisions that strike a balance between short-term tactics and long-term strategic positioning.

Another important theme is technology integration and ecological expansion. Announcements about integration with new networks such as Linea, Polygon, Chain XCN Ledger and new products such as AI pledge and smart wallet deployment indicate that market participants are actively rewarding projects that enhance interoperability and operational efficiency, driving optimism about future network scalability.

Finally, there is a potential theory about expected pricing behavior. As many events were concentrated around mid-February, the price increase before the event and the rapid stabilization after the event suggest that the news may be partially absorbed by the market before its official release. This expected trend strengthens the view that regardless of specific events, the overall market environment is in a passive mood, and each event is expected to trigger similar adjustments.

Key assets

Maker and Sky Protocol: Maker stands out for the key governance events it publishes regularly, including implementation proposals and parameter adjustments. Sky Protocol is often mentioned along with Maker, showing consistent and unusual reactions that highlight the importance investors attach to governance narratives and capital flow systems.

Everclear: Everclear has gained market attention through its integration announcements and the EverExpansion program. The steady response surrounding the Everclear integration event suggests investors are enthusiastic about cross-chain interoperability and expect these technology collaborations to improve liquidity management and enhance operational efficiency.

Virtuals Protocol and Onyx: Virtuals Protocol moves into the AI pledge space, and Onyx has announced the launch of a smart wallet, marking it as an asset that drives innovation. Unique product enhancements suggest that in addition to governance, investors are also focusing on operating innovative tokens, diversifying their risk exposure, and looking forward to long-term availability improvements that translate into continued value growth.

looking ahead

In the coming week, it is recommended to remain vigilant about the development of improving the governance structure and risk management framework. As the agreement finalizes adjustments and new proposals enter the voting stage, pay attention to changes in voting sentiment and liquidity, which may have a broader impact on market stability. Pay close attention to Maker and Sky Protocol’s announcements as they continue to adjust risk parameters and develop their capital flow systems.

On the technology front, continue to focus on announcements related to cross-chain integration and innovative product launches, such as further updates to Everclear and progress in on-chain liquidity channels. These developments may not only drive incremental benefits, but may also fundamentally change network dynamics. Investors should monitor whether these moves begin to exceed market expectations or trigger a re-pricing of risk relative to Bitcoin.

In addition, observed expected behavior suggests that the market may price in advance. That means any deviation or surprise in the upcoming announcement could trigger a more volatile re-rating. Investors can consider focusing on assets that can be improved using stable governance frameworks and innovative operations.

conclusion

The market paradigm in February was defined by governance-driven realignment and integration/expansion events. Abnormal return trends suggest that market responses are similar regardless of the type of event (whether it is adjustment of risk parameters or the introduction of technological innovations), indicating a broader and more systematic sensitivity to major events. This emphasizes the importance of tracking governance proposals and innovation-driven events as they together shape investor sentiment and asset pricing in seemingly homogeneous ways.

For investors and market participants, do not view these events in isolation. Instead, understand that the crypto ecosystem is currently in a closely intertwined phase of process realignment (governance changes) and operational progress (integration and product enhancements). Therefore, it is recommended to fully understand governance voting and integration updates, especially assets such as Maker, Sky Protocol, Everclear, Virtuals Protocol and onyx, as they are at the heart of the changing narrative of the market.

By focusing on both governance stability and technological innovation, stakeholders can better predict future market trends and identify assets with long-term upside potential. This comprehensive perspective not only guides investors in judging immediate price responses, but also guides investors in evaluating which projects will lead the next stage of development in the crypto market.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern