Stable currency financial management is a “safe haven” in the current market downturn, but it is not risk-free.

Written by: Deep Trend TechFlow

Recently, the market has plummeted, and people are caught off guard when washing their faces in waterfalls.

Altcoins have fallen seriously, making it difficult to find profits; and opening contracts with leverage can make you lose everything. Although everyone likes to watch cool contract reversals, not everyone can do it.

However, if you look at DeFi mining yield farming, your ideas will suddenly become broad; especially some stable coin financial management pools, which are relatively ideal choices to hedge against market decline risks.

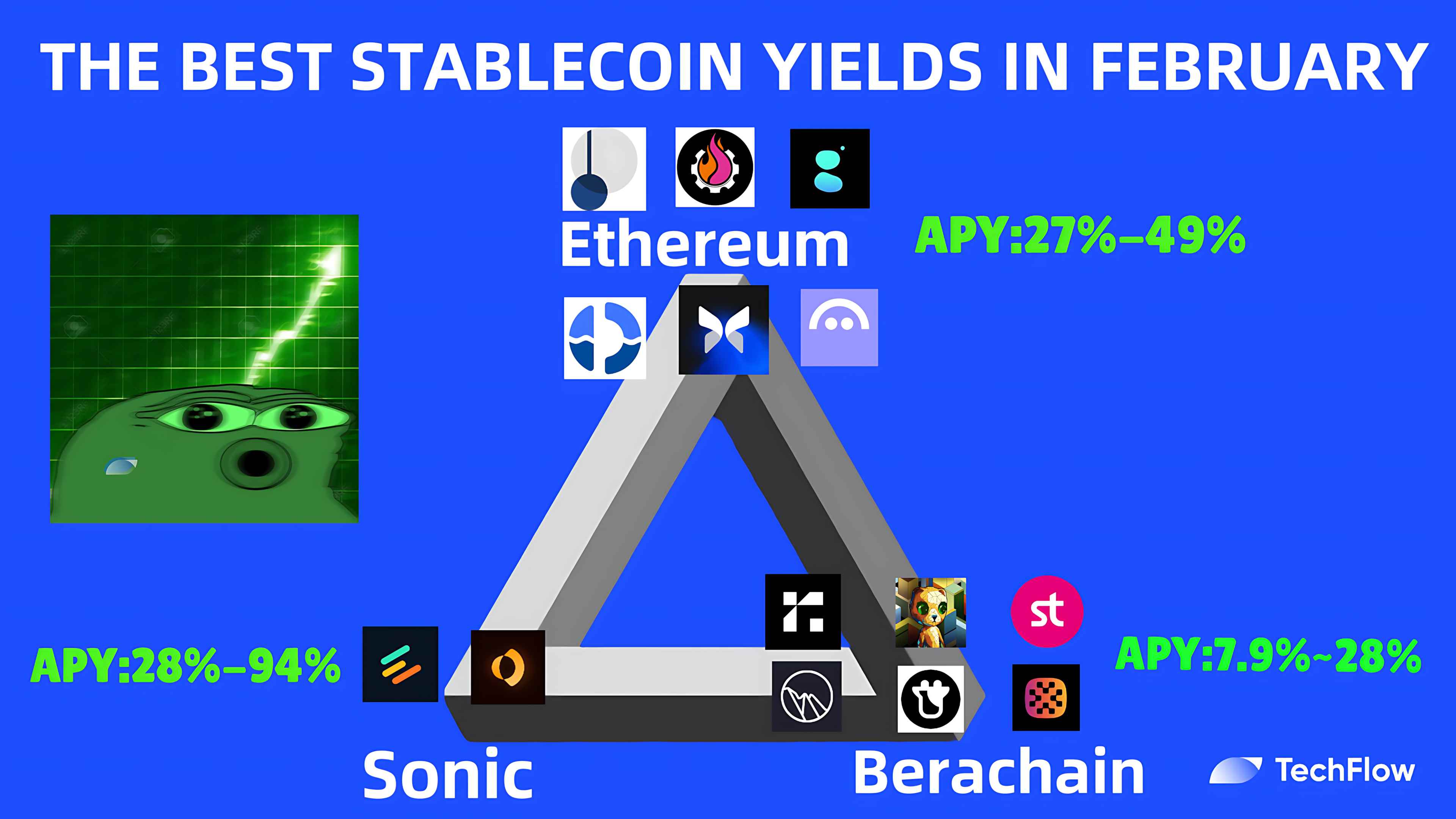

Recently, well-known crypto analyst Stephen| DeFi Dojo (@phtevenstrong) also posted a post detailing current opportunities for financial management in the chain, covering mainstream protocols on Berachain, Sonic and Ethereum.

At this time, it is indeed advisable to turn your attention to the stablecin financial management market. Xiaobian actually experienced the products and sorted out the essence of them, striving to provide everyone with a relatively stable income guide.

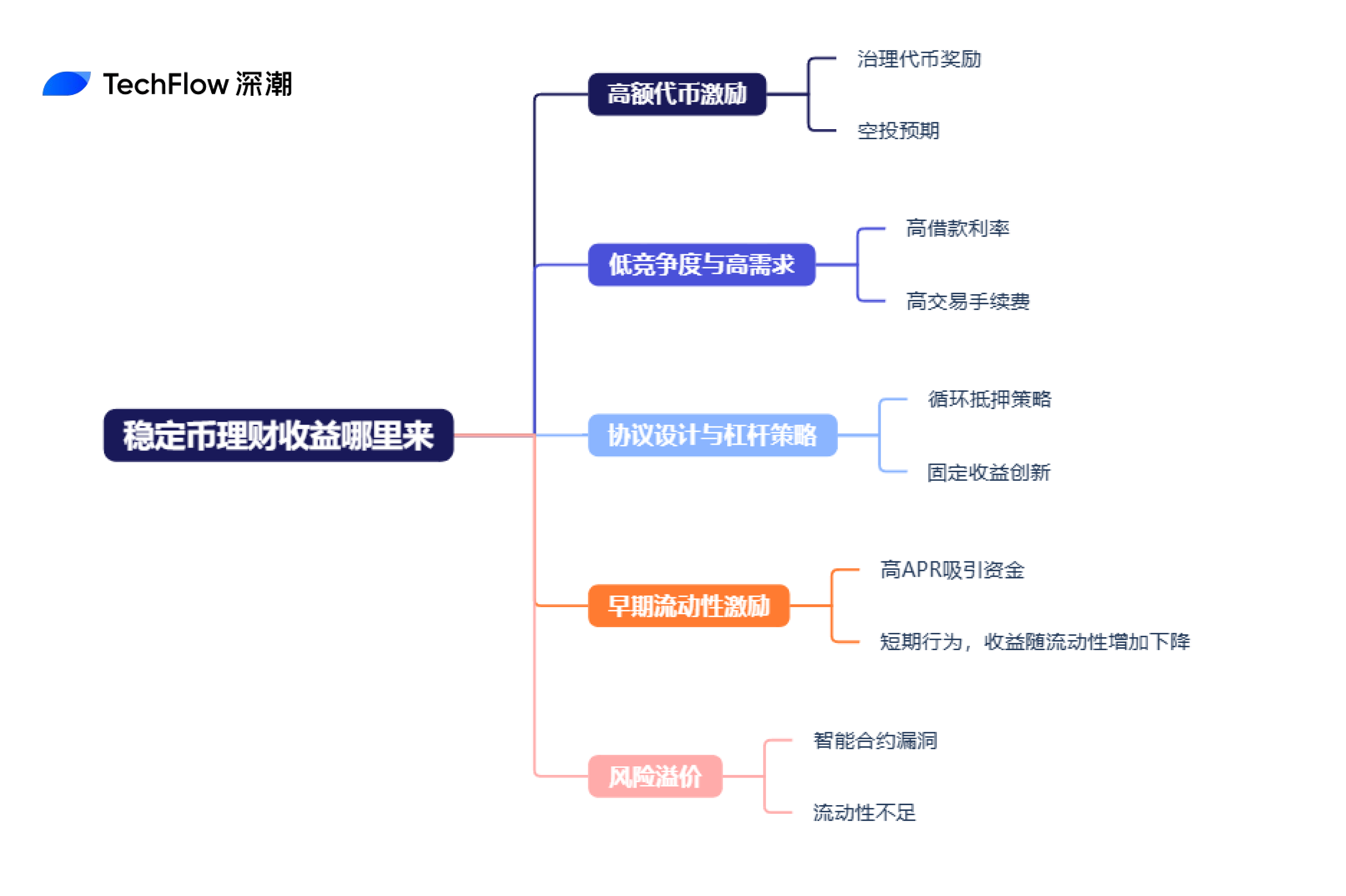

To manage stable currency, you need to know where high returns come from

"If you don’t know where the benefits come from, then you are the benefits.

Stable coins on different chains have their own characteristics due to differences in protocol design and ecology.

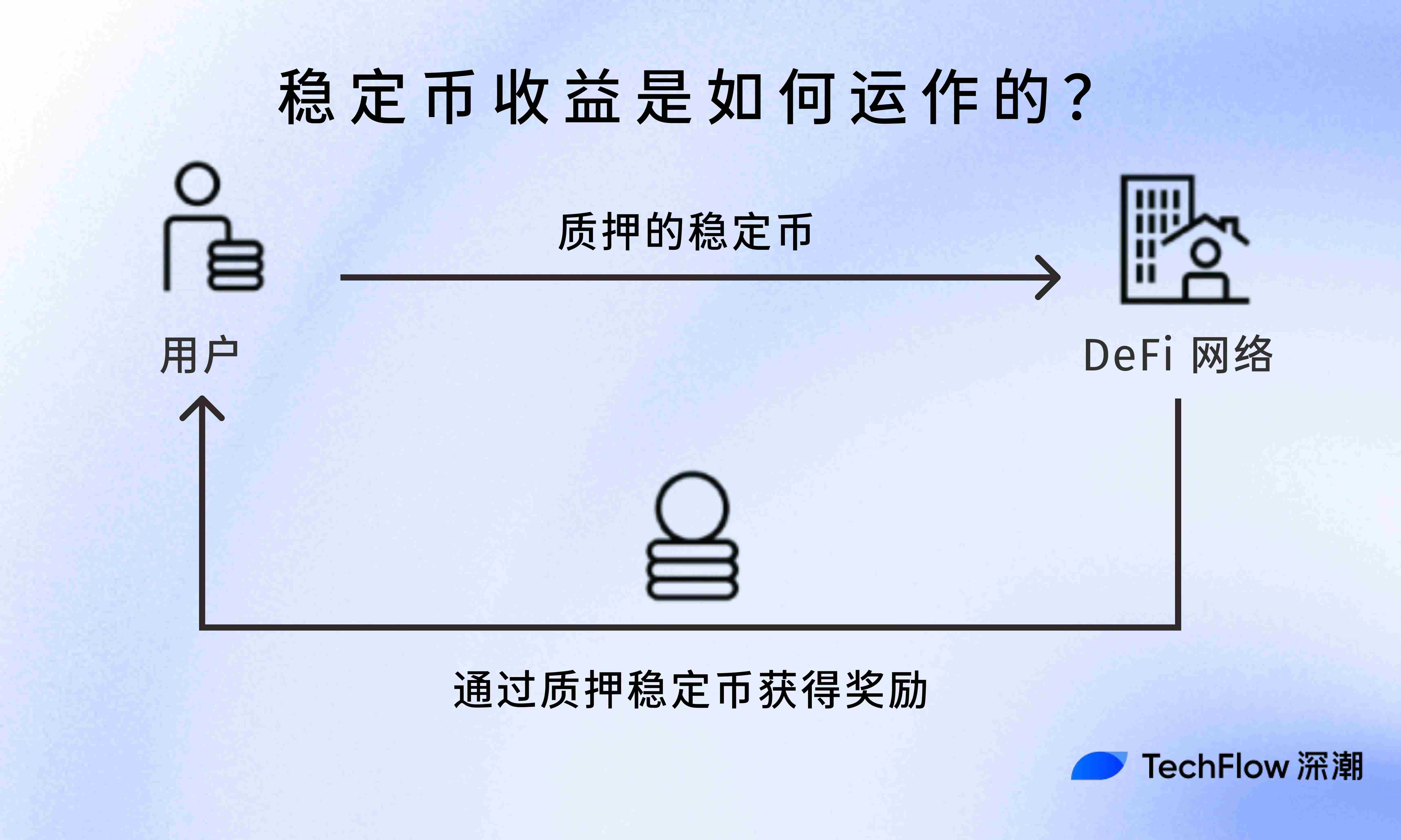

However, the sources of income from stablecoin financial management are similar. For example, participating in financial management through liquidity provision (Liquidity Provision), borrowing (such as Aave, Compound) or leveraging strategies (such as revolving mortgage). The income mainly comes from the transaction fees of the agreement, agreement rewards (such as governance token issuance) or borrowing interest rate differences.

But why are the financial returns of stablecoins surprisingly high on some new chains?

1. High token incentives

In order to attract users and capital inflows, emerging chains usually use high token rewards to encourage users to participate in their ecosystem. These rewards usually come in two forms:

-

Governance token rewards: Some chains distribute governance tokens (such as Berachain’s HONEY) to liquidity providers (LPs) to attract users to lock in assets.

-

Airdrop expectations: Some emerging chains have not yet issued tokens, and users will look forward to future airdrops and be willing to participate in high-risk income pools.

This incentive mechanism is very common in the early stages of the chain because it can effectively improve liquidity and attract more users and developers to join the ecosystem.

2. in factIt’s not that curly

Agreements on emerging chains usually have less competition and a small user base, but their ecological development requires high liquidity and capital. This imbalance between supply and demand can lead to the following phenomena:

-

Higher borrowing rates: Due to insufficient supply of funds and strong demand for borrowing, the borrowing interest rate of stablecoins was pushed higher, thus indirectly increasing financial income.

-

High transaction fees: In decentralized exchanges (DEX), insufficient liquidity leads to higher slippage and fees from which liquidity providers can profit.

3. protocol design andleverstrategy

Protocols on emerging chains often design some unique mechanisms or high-leverage strategies to attract user participation. For example:

-

Looping Strategies: Like Dolomite’s sUSDe cycle strategy mentioned below, users can amplify gains through low-cost borrowing and high leverage (5 times leverage brings 35% gain).

-

Innovative revenue model: Some agreements provide users with higher annualized rates of return through fixed-income products (such as Pendle’s 28% fixed income) or liquidity mining mechanisms.

4. Early liquidity incentives (Liquidity Bootstrapping)

Emerging chains often attract liquidity through high yields to build the depth and stability of their trading markets. This is what you often hear about Liquidity Bootstrapping:

-

High yields attract funds: By providing ultra-high APR (such as 20%-50%), attract large amounts of funds into the stablecoin pool.

-

Declining returns: This high return is usually short-term, and the yield will gradually decline as liquidity increases and the ecology matures.

5.

”The gift given to you by fate has long been secretly marked at a price.

Although the above design can significantly increase profits, it is actually compensation for the following risks:

-

smart contractsvulnerability: Agreements on emerging chains may not be fully audited and pose a risk of vulnerability.

-

insufficient liquidity: Insufficient funds may cause users to face a high slip point when exiting or be unable to successfully redeem assets.

-

Ecological uncertainty: There is great uncertainty about the future development of emerging chains, and agreements may fail due to user attrition or technical problems.

After understanding the principles of these financial benefits, let’s take a look at what stable currency financial pools are currently on the market with relatively high yields.

Berachain

Berachain does not need to introduce too much, just need to know the assets here:

-

BGT: Soul binding governance token for PoL rewards and governance.

-

HONEY: Native stablecoins anchored 1:1 to the US dollar can be synthesized and forged from multiple assets as stable payment and lending tools within the ecosystem.

-

BYUSD/USDC.e: Other stablecoins, such as dollar-bound stablecoins or Ethereum encapsulated USDC, are introduced through cross-chain bridging.

Two core DeFi protocols in the Berachain ecosystem, Infrared Finance and Stride Zone, currently have a liquidity pool of stablecoins that can carry out Yield Farming.

Infrared Finance

Infrared Finance is a key DeFi protocol in the Berachain ecosystem, backed by Binance Labs, focuses on simplifying Proof of Liquidity (PoL) participation and helps users maximize revenue through its vaults products.

Infrared has also built liquidity pledge products such as iBGT that are designed to enhance the user experience and drive growth in the Berachain ecosystem.

As of February 2025, InfraredNot yet issued its own token, but its liquidity pool has been deeply integrated with Berachain’s BGT incentive mechanism.

Stable currency financial management mechanism

-

Currency pair and pool: Infrared provides the following stablecoin liquidity pools (BGT-qualifying LPs):

-

HONEY/BYUSD: HONEY is Berachain’s native stablecoin, and BYUSD is another stablecoin on Bera

-

HONEY/USDC.e: USDC.e is a packaged version of USDC on Ethereum introduced to Berachain through cross-chain bridging.

-

-

operation mode: Users deposit HONEY, BYUSD, or USDC.e into a designated pool through Infrared’s DeFi interface to form a liquidity pair (LP Token) and earn transaction fees, PoL rewards (BGT) and potential HONEY rewards. Pool income can be compounded through @beefyfinance to further enhance long-term returns.

-

Current Earnings APY

-

HONEY/BYUSD:18.45% APY

-

HONEY/USDC.e:15% APY

-

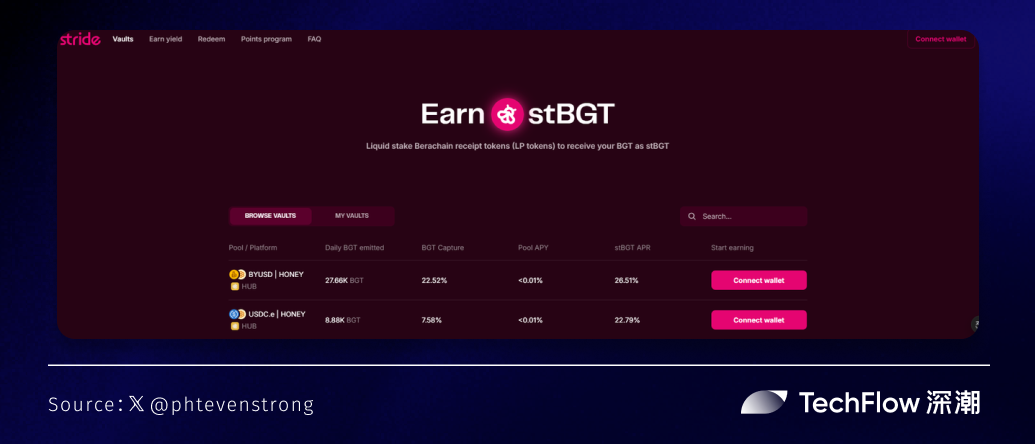

Stride Zone

Stride Zone is a cross-chain liquidity pledge agreement that serves ecosystems such as Berachain, Cosmos and Celestia. By pledging Berachain’s BGT as stBGT, Stride allows users to keep assets liquid while earning additional revenue. Stride supports stablecoin pools on Berachain to optimize revenue streams for DeFi users.

-

Currency pair and pool: Stride provides a stablecoin liquidity pool (BGT-qualifying LPs) similar to Infira:

-

HONEY/BYUSD:22.52% APY

-

HONEY/USDC.e:7.89% APY

-

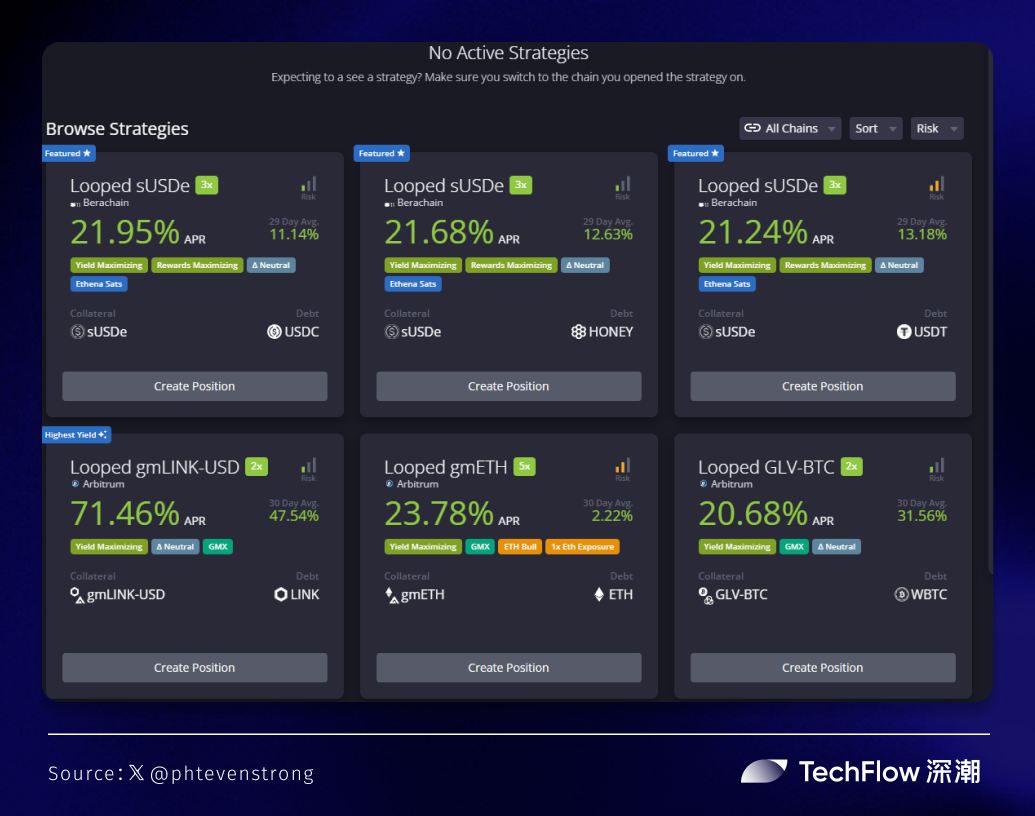

Dolomite

Dolomite (Dolomite.io) is a decentralized finance (DeFi) protocol that combines lending and decentralized exchange (DEX) capabilities to provide high-yield opportunities for Berachain users through leveraging cycles and automated strategies. Recently, Dolomite’s demand for borrowing assets for pre-storage has increased due to Boyco activities, which has made the project’s sUSDe strategic returns outstanding on Berachain.

Note: Boyco is a recent on-chain activity launched by Berachain. Through Boyco, users can deposit assets in the liquidity market before the launch of the main network. The total pre-deposit amount has exceeded US$2.19 billion. It is considered to be the largest on-chain incentive activity in history. One.

-

Currency pairs and assets: Dolomite mainly conducts leveraged operations based on a single stablecoin asset and does not involve traditional liquidity pools. Instead, it optimizes earnings through borrowing and recycling strategies:

-

sUSDe: A collateralized stablecoin issued by Ethena Labs, pegged to the US dollar 1:1, introduced Berachain through cross-chain bridges such as Wormhole.

-

lending assets: Users borrow GHO (Aave’s stablecoin) or USDC (introduced through USDC.e), and the borrowing cost is 1.66%(GHO) and higher (USDC, details unknown) respectively.

-

Operation Method 1:

-

manuallyleverLoop (sUSDe Loop): Users deposit sUSDe as collateral on the Dolomite interface, borrow GHO or USDC revolving sUSDe with 5 times leverage (LLTV: 83%), earn 8.32% of sUSDe’s underlying income, and achieve a maximum of 35% APY after deducting 1.66% of borrowing costs.

For new DeFi novices, there are a few concepts you need to understand:

LLTV (Loan-to-Value): Represents the ratio between the loan amount (Loan) and the value of the collateral (Value). The higher the LLTV, the greater the amount the borrower can borrow, but the higher the liquidation risk.

LLTV is 83%, which means users can borrow 83% of the value of sUSDe collateral to other assets (such as GHO or USDC). This is equivalent to 5x leverage (because of 100% 83%5), allowing users to amplify the benefits, but also increasing liquidation risk. If the value of sUSDe declines or borrowing costs rise, more than 83% of LLTV could trigger liquidation, causing some collateral to be sold to repay debt.

-

example: Assuming you mortgage $10,000 of sUSDe and LLTV is 83%, you can borrow $8,300 (83% &www.gushiio.coms; $10,000) of GHO or USDC to use it in a revolving operation and earn additional income.

Operation Mode 2:

-

Brategy strategy: The lazy version selects a low-risk automation strategy (called Brategy) without manual management. Automation provides approximately 21.95% APY.

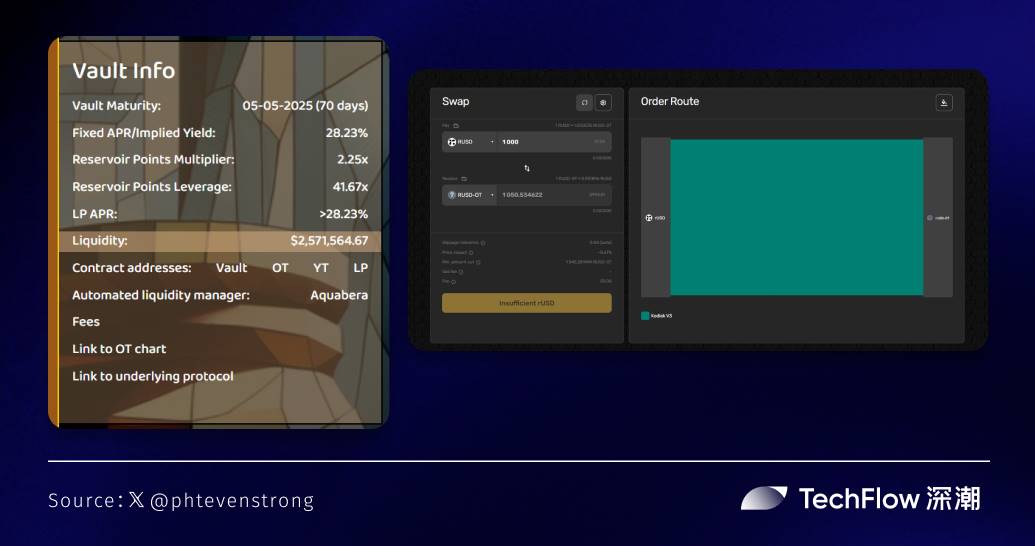

Goldilocks Money

Goldilocks Money is a Berachain-based DeFi protocol that mimics Pendle’s design and provides fixed-rate and fixed-term yield opportunities for stablecoins such as RUSD.

Goldilocks Money is currently attracting attention due to Berachain’s Proof of Liquidity (PoL) mechanism and ecological liquidity growth (exceeding US$2 billion as of early 2025).

-

Currency pairs and assets: Goldilocks Money provides fixed income mainly based on a single stablecoin asset and does not involve traditional liquidity pools, but optimizes income through fixed-term markets:

-

RUSD: The collateralized stablecoin issued by Reservoir, pegged to the US dollar 1:1, introduced Berachain through cross-chain bridging.

-

-

operation mode:

-

Users deposit RUSD on the Goldilocks Money platform, participate in the fixed income market for a fixed period (70 days), and earn a preset APRof 28%.

-

It is recommended to add RUSD liquidity through the liquidity pool (1% fee level) on Kodiak to improve market liquidity and potential benefits, but pay attention to slip point risks.

-

-

Current Earnings APY:

-

RUSD Fixed Income: 28% APY (70-day fixed period)

-

Sonic

The former Fantom, the L1 designed by DeFi gameplay master Andre Cronje, has now been renamed.

Recent data shows that Sonic’s net capital inflows and TVL continue to increase, which to some extent also reflects the inevitable opportunities for high mining returns in its ecosystem.

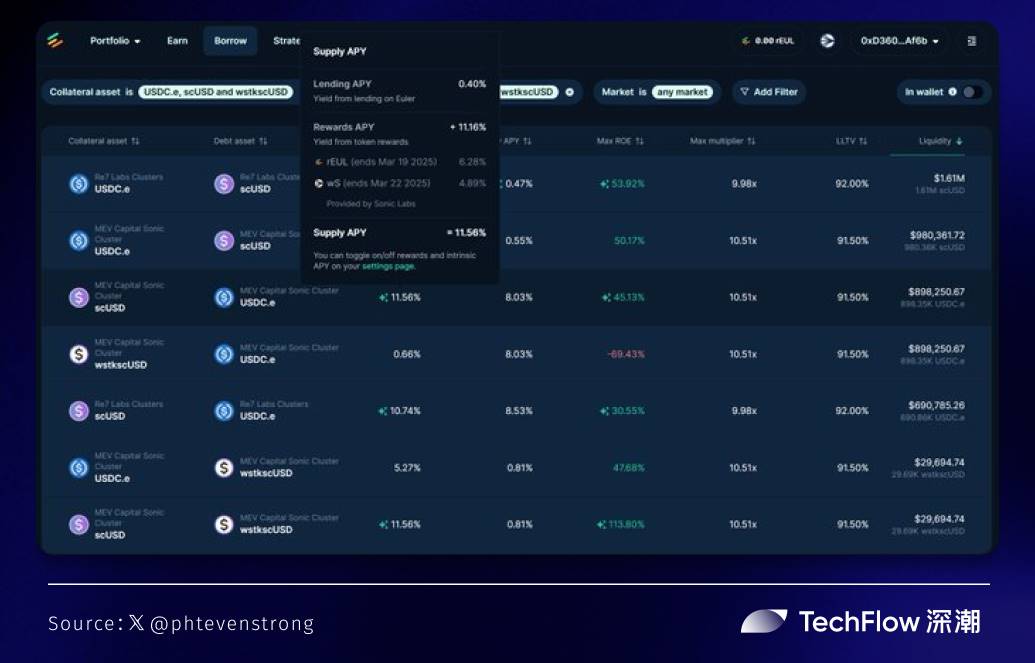

Euler Finance

Euler Finance is a decentralized lending agreement that provides high-yield stablecoin lending and recycling opportunities.

Background: In DeFi, borrowing means that users use assets (such as USDC.e) as collateral to borrow more money (such as other stablecoins) from agreements (such as Euler Finance). Looping refers to the reinvestment of borrowed funds into the same asset or pool to amplify returns.

-

Currency pairs and assets: Euler Finance provides stablecoin lending and recycling on Sonic, which does not involve traditional liquidity pools, but optimizes returns through the lending market:

operation mode: Users deposit USDC.e, stS or wS as collateral or borrowing assets through Euler Finance’s DeFi interface to conduct borrowing, rolling or pledge operations to earn transaction fees and additional rewards.

Among them, attention should be paid to:

-

USDC.e: USDC on Ethereum introduces a packaged version of Sonic through cross-chain bridging, pegged to the US dollar 1:1, and serves as a stablecoin for lending or collateral.

-

stS: Pledged tokens within the Sonic ecosystem, related to Sonic’s native token S, are used to provide liquidity or earn additional revenue.

-

wS: S’s wrapped Sonic token, obtained through pledge or liquidity provision, is distributed to users as part of the reward.

-

rEUL: Euler Finance’s Restricted EUL token is a 1:1 mapped version of EUL, the governance token within the Euler ecosystem. By locking EUL to generate rEUL, users can receive additional rewards (such as rEUL incentives on Sonic) and participate in Euler’s governance. rEUL incentives on Sonic provide users with a reward pool of up to $100,000 to attract DeFi users to participate.

-

wSintegral: Reward tokens within the Sonic ecosystem. Users can accumulate wS points by providing liquidity or borrowing operations, which can be used for future airdrops of Sonic’s native token $S. For players who want to operate, pay attention to sorting the market by depth of liquidity to ensure consistency of earnings (i.e., choose a pool with deeper liquidity, reduce slip point risk, and maintain earnings stability).

-

-

current earnings:in lending/recycling such as USDC.e,More than 50% APY

You want to ask why the income is so high?

The high revenue comes from the early incentives of the Sonic ecosystem (such as rEUL and wS rewards) and Berachain’s Proof of Liquidity (PoL) mechanism to attract users to provide liquidity. But high yields are often accompanied by high risks, such as lack of liquidity or market volatility.

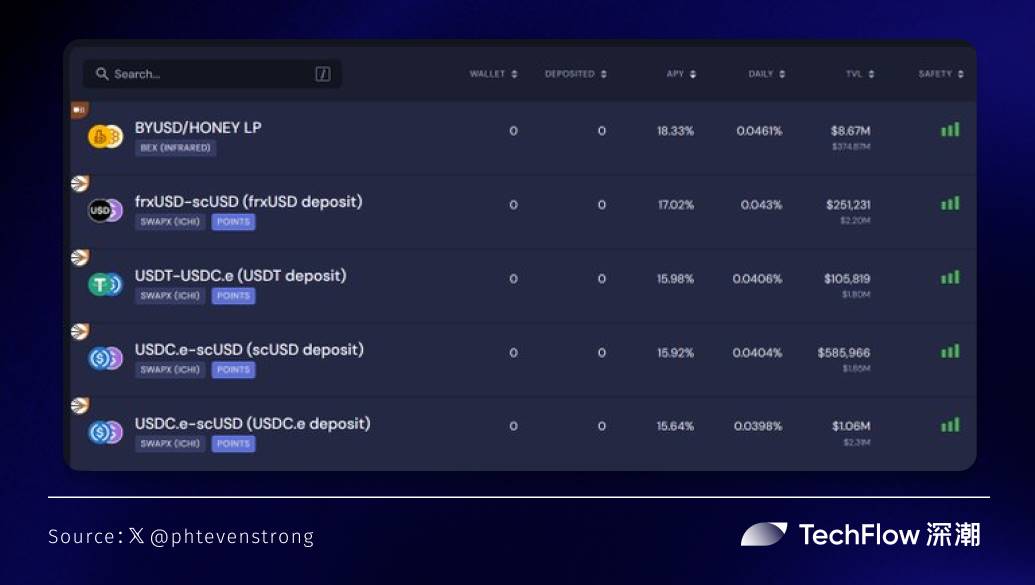

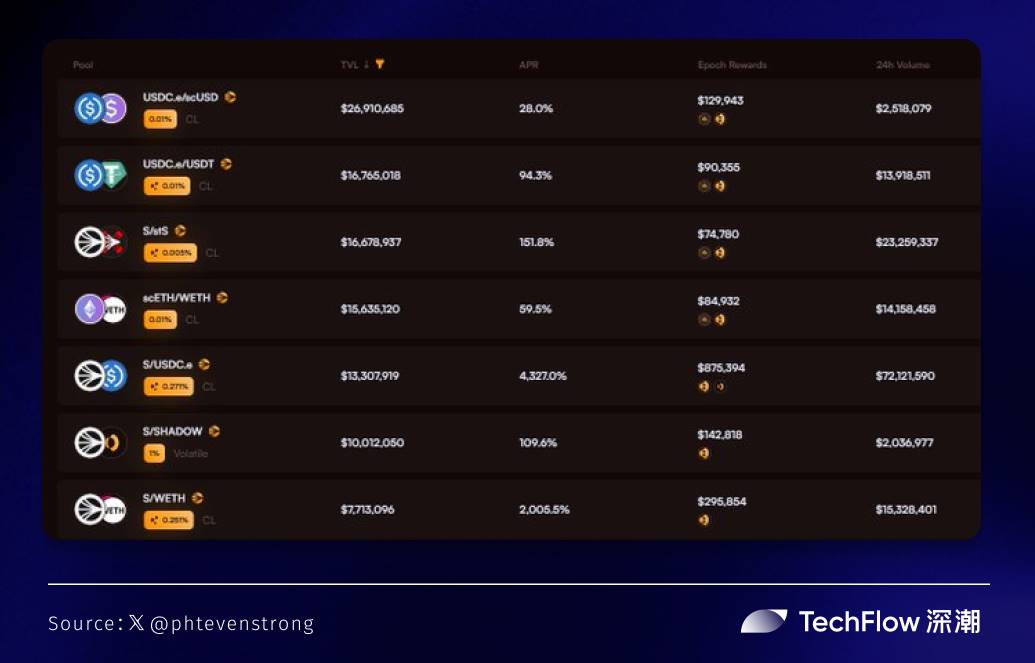

Shadow On Sonic

Shadow is positioned as Sonic’s native centralized liquidity layer and exchange.

Similar to Solidly, it provides a high-yield stablecoin liquidity pool and introduces unique mechanisms such as $S airdrop points, Gems rewards and x(3,3) incentive models.

Recently, Shadow’s native tokens have risen well, and the project has also attracted attention in the DeFi ecosystem due to the high APR of mining revenue and the upcoming $S token airdrop.

-

Currency pair and pool: Shadow offers the following stablecoin liquidity pools (BGT-qualifying LPs), leveraging its centralized liquidity design to optimize capital efficiency, combined with Sonic’s early incentives:

-

USDC.e/scUSD: USDC.e is a packaged version of USDC on Ethereum that introduced Sonic through cross-chain bridging. scUSD is a stablecoin within ShadowOnSonic or Sonic ecosystem, pegged to the US dollar 1:1.

-

USDC.e/USDT: USDC.e and USDT (Tether’s stablecoin, introduced through cross-chain bridging) form a liquidity pool.

-

-

operation mode: Users deposit USDC.e, scUSD or USDT into a designated pool through ShadowOnSonic’s DeFi interface to form a liquidity pair (LP Token) and earn transaction fees.

-

Current Earnings APY:

-

USDC.e/scUSD: 28% APY (50% is available immediately, the rest is unlocked via NFT)

-

USDC.e/USDT: 94% APY (50% is available immediately, the rest is unlocked via NFT)

-

Explanation of key concepts:

-

Concentrated Liquidity: Unlike traditional automated market makers (AMMs), Shadow allows liquidity providers (LPs) to concentrate funds within specific price ranges (such as narrow spreads for USDC.e and USDT), improving capital efficiency and increasing trading depth and returns, but also increasing the risk of price fluctuations.

-

x(3,3) incentive model: Using Sonic Ecosystem’s x(3,3) mechanism (improved version of ve(3,3) model), by locking in $SHADOW tokens to generate xSHADOW, users can receive agreement fees, voting rewards and additional incentives (such as $S points and Gems), driving long-term liquidity provision and ecological development.

-

$S integral: For reward points within the Sonic ecosystem, users can accumulate $S points by providing liquidity, which can be used for future airdrops of Sonic native token $S to enhance long-term revenue potential.

-

Gemsreward: The additional rewards provided by ShadowOnSonic are similar to points. Accumulating Gems can be redeemed for more $S airdrop shares, but it should be noted that some rewards (such as 50% of the 94% APR) are unlocked through NFT and may require a wait.

Ethereum

Old places, old ways to play, new benefits.

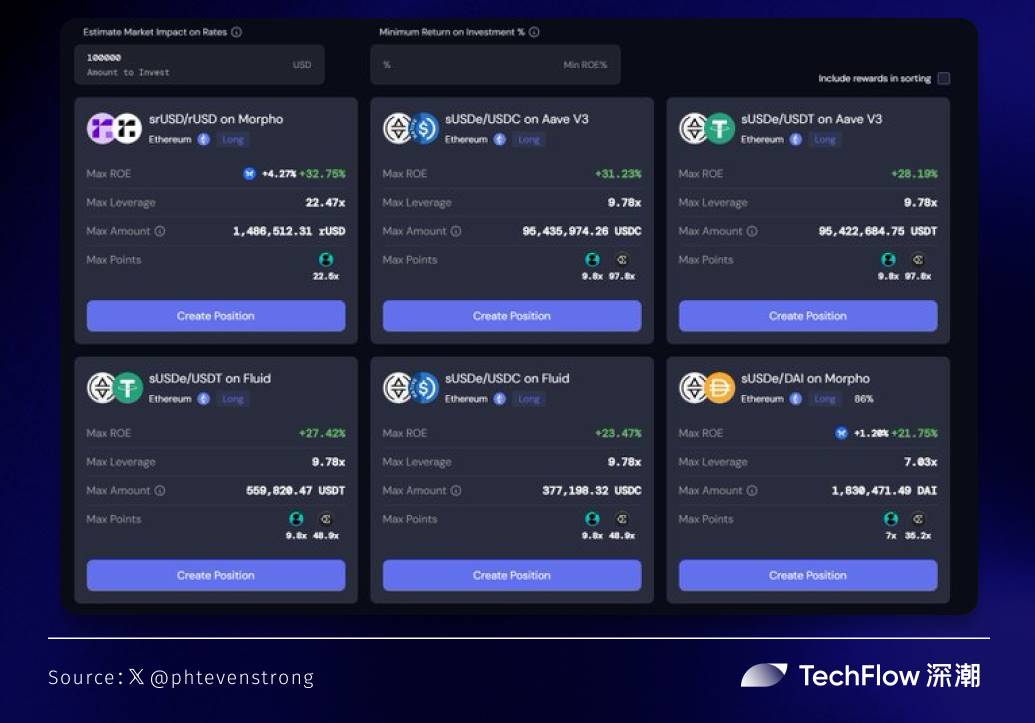

Contango

Contango (contango.xyz) is a leveraged income strategy running on Ethereum that provides users with high returns.

Users deposit stablecoins (such as sUSDe, srUSD, or rUSD) into Contango as a mortgage or borrowing basis, and then use the Morpho, Aave and 0xFluid Agreed to borrow more money to loop these assets and amplify the gains.

These agreements provide a deep pool of liquidity and low borrowing costs, and Contango cycles funds into these agreements through automation or manual operations, earning underlying returns and leveraging to amplify total returns.

-

Currency pairs and assets:

-

srUSD/rUSD: srUSD (Savings rUSD) and rUSD (Reservoir USD) are stablecoins issued by the Reservoir Protocol and pegged to the US dollar 1:1. srUSD is a pledged version of rUSD, and rUSD is locked in through Reservoir’s agreement to earn additional income.

-

sUSDe/USDC: sUSDe is a pledged stablecoin of Ethena Labs and is pegged to the US dollar 1:1. USDC is the mainstream stablecoin issued by Circle and runs on Ethereum.

-

sUSDe/USDT: sUSDe and USDT (Tether’s stablecoin, running on Ethereum) form a leveraged pair.

-

-

operation mode: Users deposit srUSD, sUSDe, or USDT as collateral or loan assets through Contango’s DeFi interface, via the aboveMorpho, Aave and 0xFluid The agreement performs a leveraging loop or pledge operation to earn basic income and additional rewards.

-

TANGO Rewards: Points rewards within the Contango ecosystem. Users accumulate TANGO points by participating in leverage strategies, which can be used for future Contango tokens or ecological rewards to enhance long-term revenue potential.

In particular, the author of the original post believes that these strategies require at least $100,000 in capital to avoid diluting profits with small amounts of money (big shots).

-

Current Earnings APY:

-

srUSD/rUSD(Morpho Labs): 36% APY (including TANGO rewards)

-

sUSDe/USDC(Aave): 31% APY (including TANGO rewards)

-

sUSDe/USDT(0xFluid): 27% APY (including TANGO rewards)

-

-

Why are the returns so high? The high benefits come from the Ethereum ecosystem’s early incentives (such as TANGO rewards) and the optimization mechanism of underlying protocols (such as Morpho, Aave) to attract users to participate in leverage strategies. But high returns are often accompanied by high risks, such as liquidation risks, illiquidity or market volatility.

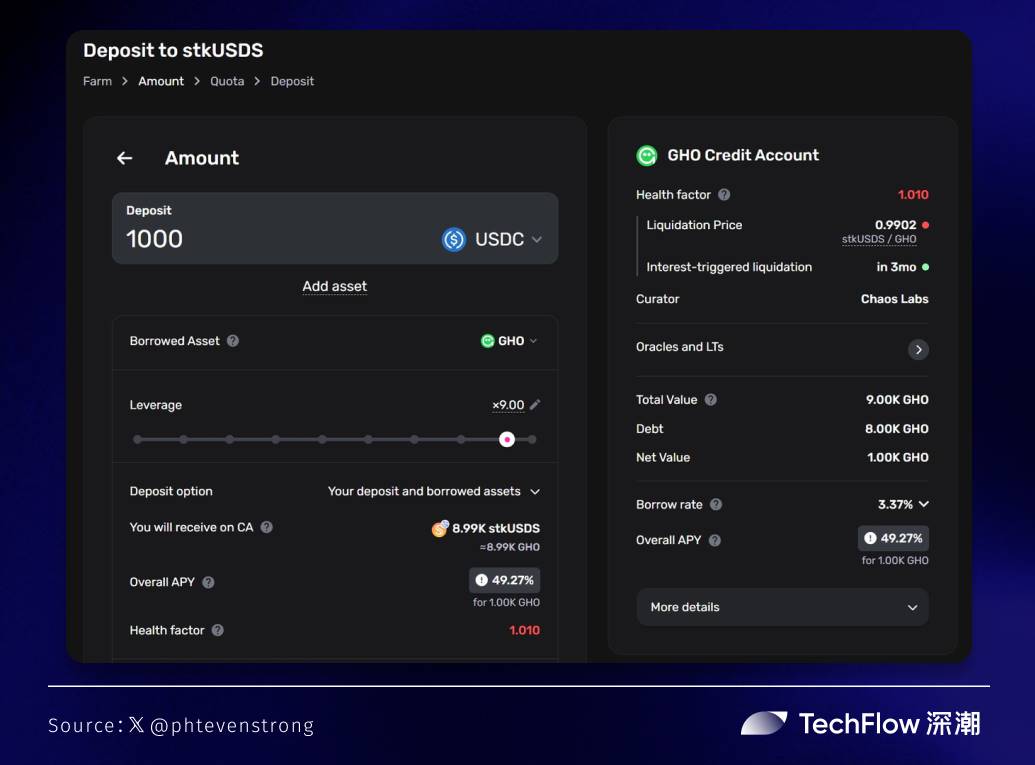

Gearbox Protocol

A decentralized leveraged lending protocol, running on Ethereum, allows users to borrow assets with up to 10 times leverage for DeFi activities such as trading, liquidity mining to generate revenue, and more.

Note: Gearbox provides a leveraged rolling strategy through the decentralized lending agreement on Ethereum to amplify the revenue potential of stablecoins such as sUSDe. Users deposit stablecoins (such as sUSDe) in Gearbox as a mortgage or borrowing base, and then borrow more funds through things like Aave and Uniswap to cycle these assets and optimize earnings.

-

Currency pairs and assets: Gearbox offers the following stablecoin leverage cycle strategies that do not involve traditional liquidity pools, but optimize returns through the lending market:

-

sUSDe: The pledged stablecoins issued by Ethena Labs are pegged to the US dollar 1:1 and generate sUSDe by locking USDe to earn basic income (such as 8%-10% APY). Users borrow GHO or USDC through Gearbox, recycle or invest in sUSDe to amplify the gains.

-

lending assets: Users borrow GHO (Aave’s decentralized stablecoin) or USDC (a mainstream stablecoin issued by Circle and running on Ethereum) for leverage cycles.

-

-

Current Earnings APY:

-

sUSDeleverCircular (borrowing GHO): About 49% APY (historical data, more than 30% for several consecutive weeks)

-

sUSDeleverCircular (borrowing USDC): About 30% APY (historical data, more than 30% for several consecutive weeks)

-

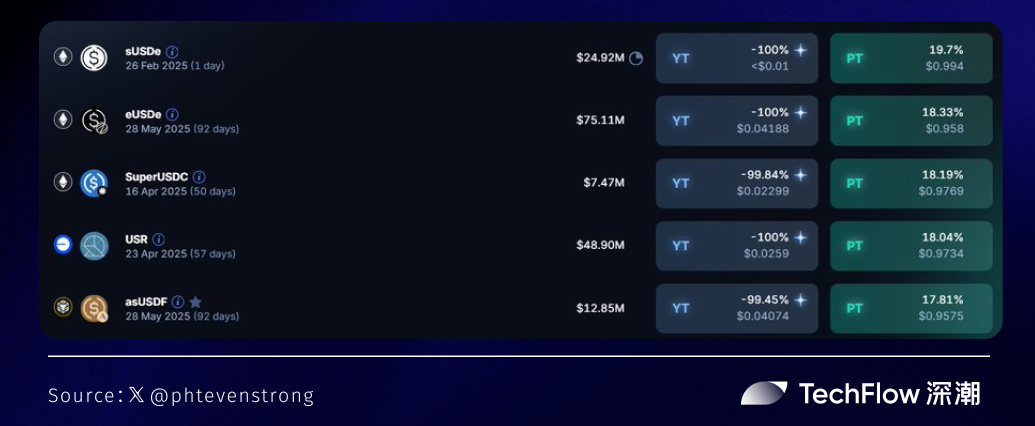

Pendle

I am an old friend, but I will introduce you too much.

Pendle’s fixed-income market and combinability have always attracted the attention of players on the chain.

-

Currency pairs and assets: Pendle offers the following stablecoin fixed income and liquidity strategies, which do not involve traditional liquidity pools, but optimize earnings through tokenized markets:

-

asUSDF: Pledged stablecoins in the Aave ecosystem are generated by locking in USDF, with a fixed income of 18% APY with a 92-day term.

-

eUSDe: Ethena Labs ‘pledged stablecoins are generated by locking in USDe, with a fixed return of 18.3% APY with a 92-day term.

-

Liquidity provision (LP): Users provide asUSDF or eUSDe liquidity through Uniswap or Pendle’s AMM, earning transaction fees (approximately 15% APY) and additional points (such as Syrup, Astherus, etc.)

-

-

operation mode: Users deposit asUSDF or eUSDe as basic assets through Pendle’s DeFi interface, participate in fixed-term markets or liquidity provision, and earn basic income and additional rewards.

The basic concepts you need to know may include:

-

fixed income market: Pendle allows users to tokenize stablecoins such as eUSDe into Principal Tokens (PT, representing principal) and Yield Tokens (YT, representing future earnings). Users can lock in eUSDe for 92 days to earn fixed income (such as 18.3% APY), or trade YT for leveraged income.

Through the collation of this article and actual experience, we find that stablecoin financial management is a safe haven in the current market downturn, but it is not risk-free.

Investors are advised to start with micro-testing, focus on the audit status, yield sustainability and liquidation risks of the agreement, prioritize low-risk strategies on mature chains (such as Pendle’s fixed income) or high-yield pools on emerging chains (such as ShadowOnSonic’s 94% APY), and diversify their investments to reduce risk.

For a more prudent consideration, you can choose the current stablecoin financial management services provided by CEXs. Due to the limited space, there is no inventory. The logic and operation are relatively more intuitive, and the risk of endorsing CEX’s reputation is relatively controllable; but the benefits seem to be inferior to the projects listed above.

Finally, before the market gradually recovers, stablecin financial management may become a wise choice for seeking progress while maintaining stability, but we must not ignore the costs behind the benefits, risks and rewards always accompany them.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern