It seems that the crypto industry may need to wait until 2026 to regain substantial momentum.

Author: Steven Ehrlich

Compilation and organization: Compare BitpushNew

In 2025, the Trump administration sent a series of “gifts” to the cryptocurrency industry.

The U.S. Securities and Exchange Commission (SEC) has suspended enforcement actions and investigations into major cryptocurrency exchanges and companies such as Coinbase, Gemini, Uniswap, OpenSea, Consensus Sys, etc. The White House has issued an executive order aimed at boosting U.S. leadership in the digital asset industry and expressed its intention to build a reserve of bitcoin.

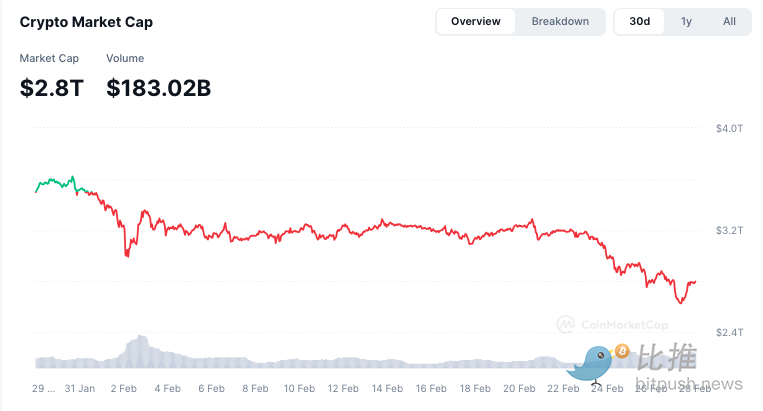

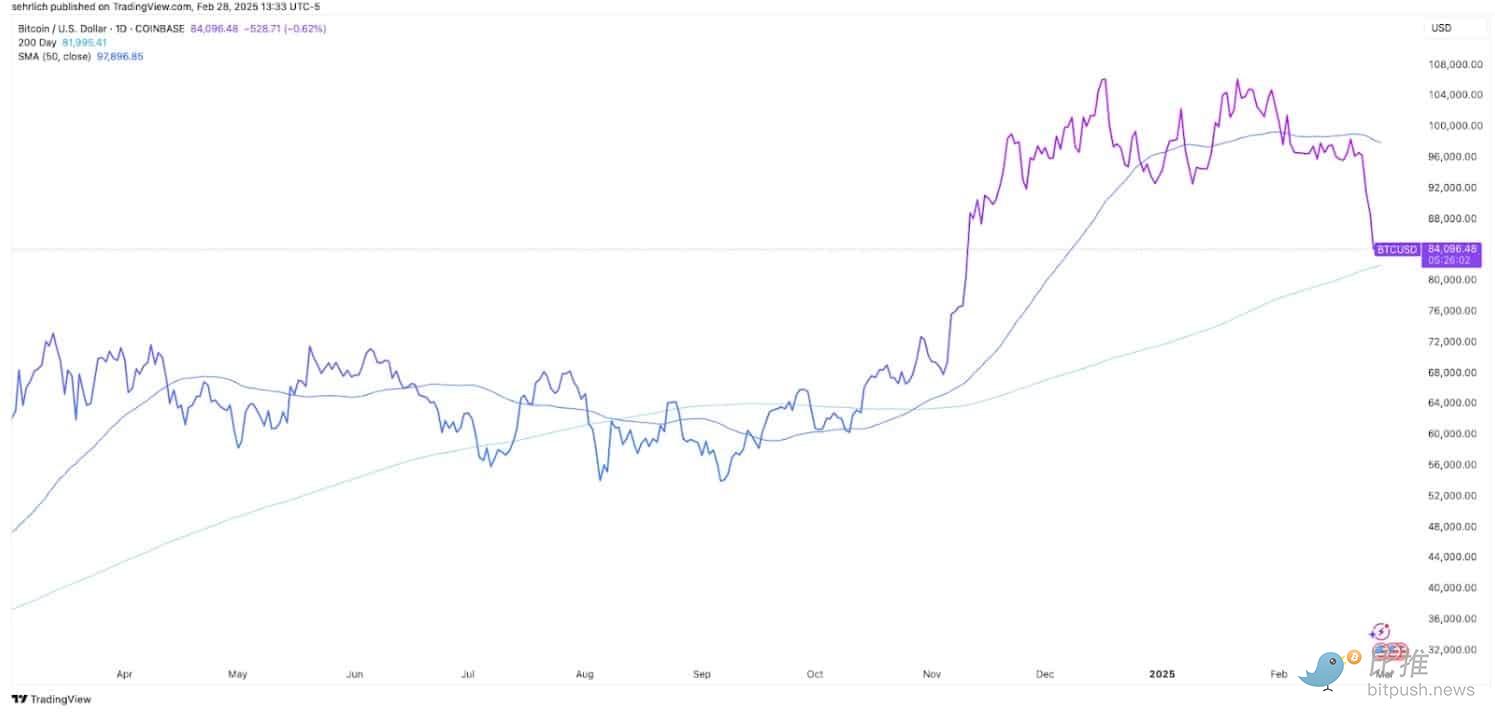

However, these measures are not enough to prevent the recent decline in Bitcoin prices and the overall negative sentiment in the crypto industry. As of writing, the current price of Bitcoin is US$84,000, which has fallen 18% since Donald Trump took office and nearly 23% from its all-time high. The total market value of cryptocurrencies has fallen 21%.

Kavita Gupta, founder and general partner of Delta Blockchain Fund, said: “It feels like all the good news in the cryptocurrency space has happened, and the positive developments in the industry seem to be just due to the whim of high-level politicians and the lack of due process and due diligence… The situation may change at any time and sustainability is in doubt.”

Currently, the three main forces driving the market down may push it further lower before it can regain its footing and start to recover. In fact, the crypto industry may have to wait until 2026 to see a continued bull market again.

Internal “backlash”

There are many reasons for the recent decline, the first being the behavior of cryptocurrency participants themselves.

For example, the industry was put into a bad spot by multiple meme farce, such as $MELANIA, and later $LIBRA, which even dragged Argentine President Javier Millay into a scandal. Now, memecoin issuance and trading activity across the industry is declining, raising questions about its long-term sustainability. For example, daily new token issuance reached a local peak of 66,471 on January 24, just six days after $TRUMP went online. On February 27, the day of the latest full data available, the number dropped to 27,741, a drop of 58%.

Brian Rudick, director of research at GSR, said of the data: “People used to think memecoin was the fairest and most effective form of speculation in the cryptocurrency space, but $LIBRA shows that this is not the case. Now you see a significant decrease in trading volume on the chain, and [although] memin is the first to bear the brunt, it is dragging down the entire cryptocurrency space.”

In addition, North Korean hackers ‘$1.5 billion hack of Bybit (the largest theft in cryptocurrency history) has once again raised questions about the safety of putting money into cryptocurrency. Gupta pointed out: “These hacking incidents have led the outside world to believe that even after 10 years of development, the industry has not yet truly matured.”

external headwinds

All of this negative sentiment within the industry is being amplified by investors ‘broader risk appetite.

Typically, the arrival of a new administration boosts consumer confidence, and business leaders initially welcomed Trump’s election because of his pro-business mentality. However, multiple new data show consumer confidence is weakening, possibly due to Trump’s threat to impose a 25% tariff on trading partners such as China, Canada, Mexico and the European Union.

The nonprofit think tank Conference Board’s consumer confidence index reported a decline in February for the third consecutive month, hitting its lowest level since August 2021.

The University of Michigan Consumer Sentiment Survey also showed a significant decline in consumer confidence. The report noted: “Consumer sentiment continued its downward trend at the beginning of this month, falling nearly 10% from January. This decline is widespread among age, income and wealth groups.”

The report also mentioned: “Expectations for inflation in the coming year rose from 3.3% to 4.3%, the highest level since November 2023, and have shown abnormally large growth for two consecutive months. The current reading is much higher than the 2.3%-3.0% range in the two years before the epidemic.”

Rudick pointed out: “Based on the latest data from the CME Fedwatch tool, the market expects to cut interest rates twice this year. But if these expectations disappear completely due to tariff issues, traditional markets could fall more than cryptocurrencies.”

How low will Bitcoin fall?

It is difficult to accurately predict how far Bitcoin will fall from now on.

Steve Sosnick, chief strategist at Interactive Brokers, said that even among commodities, Bitcoin is unique. “You know the supply and demand of crude oil, coffee or cocoa. Bitcoin does not have the same type of intrinsic need. It exists purely for speculative or investment purposes.”

However, Sosnick pointed to several technical charts that could provide some ideas on price thresholds investors should focus on.

One of the charts is the simple 200-day moving average of Bitcoin. At current prices, the asset is close to testing this important indicator for the first time since a clear breakthrough in mid-October last year. If that happens, which means the asset falls below $80,000, Sosnick believes the next threshold will be a “$60,000 high/$70,000 low range.”

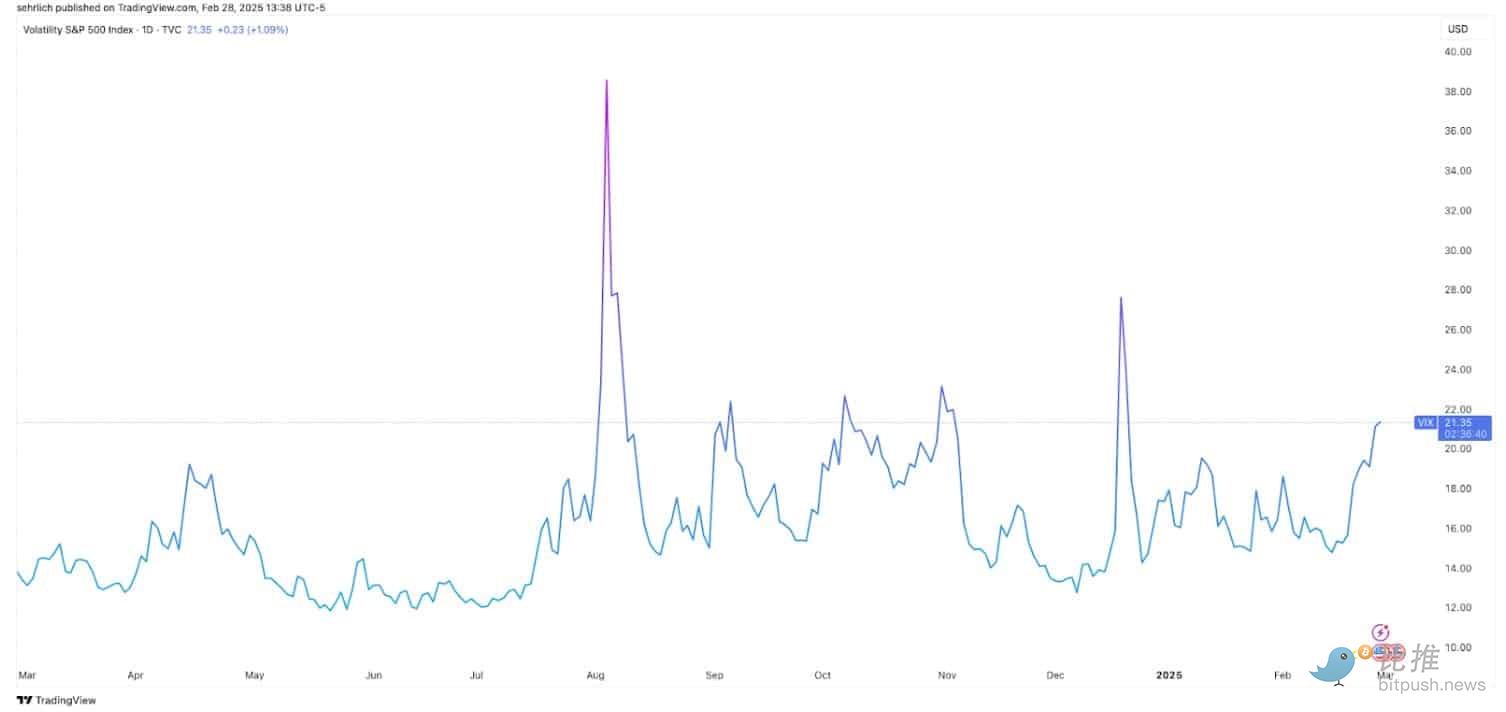

Despite negative investor sentiment, the market has not yet reached full-blown panic, according to the S & P 500 Volatility Index (VIX), which is still within its normal range of the past 12 months. “VIX is not at extremely high levels, which means we may not be out of the woods yet, because when VIX surges, the rebound tends to stop,” Sosnick said.

In the case of Bitcoin, this means it may fall again because investors have not yet reached the level of extreme panic. For example, when the Bank of Japan raised interest rates and lifted the yen carry trade, the VIX index soared in August; it is now well below its level.

Waiting for the wind: 2026?

Given that all these negative forces are affecting Bitcoin’s price, it seems that the cryptocurrency industry may need to wait until 2026 before Bitcoin and the industry as a whole regain substantial momentum. When asked what types of internal or external factors might play a role in this process, the answers were two: strategic Bitcoin reserves or legislation that would set the rules for the industry once and for all.

Although the cryptocurrency community has always wanted to establish a strategic bitcoin reserve, the White House executive order aims to assess something different: the federal reserve, in which the government will choose to hold the bitcoins it obtains through law enforcement actions, rather than the strategic reserve, in which the government will buy new bitcoins. (However, many states are assessing their strategic reserves, although few are making meaningful progress.)

Rudick believes that something like Bitcoin reserves could be good for the industry, but that is far from guaranteed: “[reserves] have always seemed very unlikely to me, but I think Bitcoin could easily go up to $500,000. Even if we didn’t get it in the form of a strategic Bitcoin reserve, I do think it’s possible for the United States to create a sovereign wealth fund and increase Bitcoin.”

But for Rudick, a more sustainable growth path is to enact market structure legislation that allows regulated companies to legally enter the space, but he believes the industry will have to wait until next year to make meaningful progress: “[Legislation] may not happen until 2026. But in my opinion, the reason why this is so important is that it’s what institutions need to enter on a large scale.”

As evidence, he pointed to Bank of America CEO Brian Moynihan’s recent statement that if the industry’s rules become clearer, his bank, which has reservations about cryptocurrencies, would consider launching stablecoins. (At least one source close to the negotiations in Washington believes stablecoin legislation may even be signed in 2025.)

But until then, the industry needs to remain stable to deal with these headwinds. After all, this dramatic volatility in investor sentiment is part of the huge risks of investing in cryptocurrencies.

Sosnick summarized the current market situation in one sentence: “The process of market rising is usually like climbing stairs, and when it falls, it is like taking an elevator. Bitcoin took the elevator to the top floor this time, and now it takes the elevator down to the basement. This is a highly volatile asset. If volatility is in your favor, of course it’s great-it’s something everyone is happy to accept and enjoy, but when volatility is moving in the opposite direction, it’s too bad.”

原文链接