The power of emotion in financial markets has never been underestimated, but when the price of an asset must rely on the sentiment stimulated by news rather than the asset itself having new room for price increases to complete the rise, investors should pay more attention to controlling risks.

Author: Techhub Hotspot Express

Written by: Babywhale, Techhub News

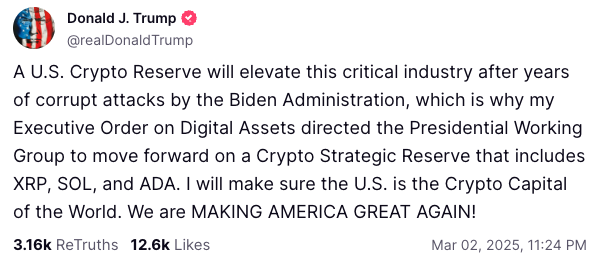

Yesterday evening, U.S. President Trump expressed his support for the cryptocurrency market in an article on his social media Truth Social.

Trump said in his first development,”After years of ‘corruption attacks’ by the Biden administration, U.S. cryptocurrency reserves will enhance the status of this critical industry, which is why my executive order on digital assets directs the President’s working group to advance strategic cryptocurrency reserves, including XRP, SOL and ADA.” I will ensure that the United States becomes the cryptocurrency capital of the world. We are making America great again!”

Later, Trump once again said that like other valuable cryptocurrencies, Bitcoin and Ethereum will also become the core of reserves. I also love Bitcoin and Ethereum!

The news is actually “old news”

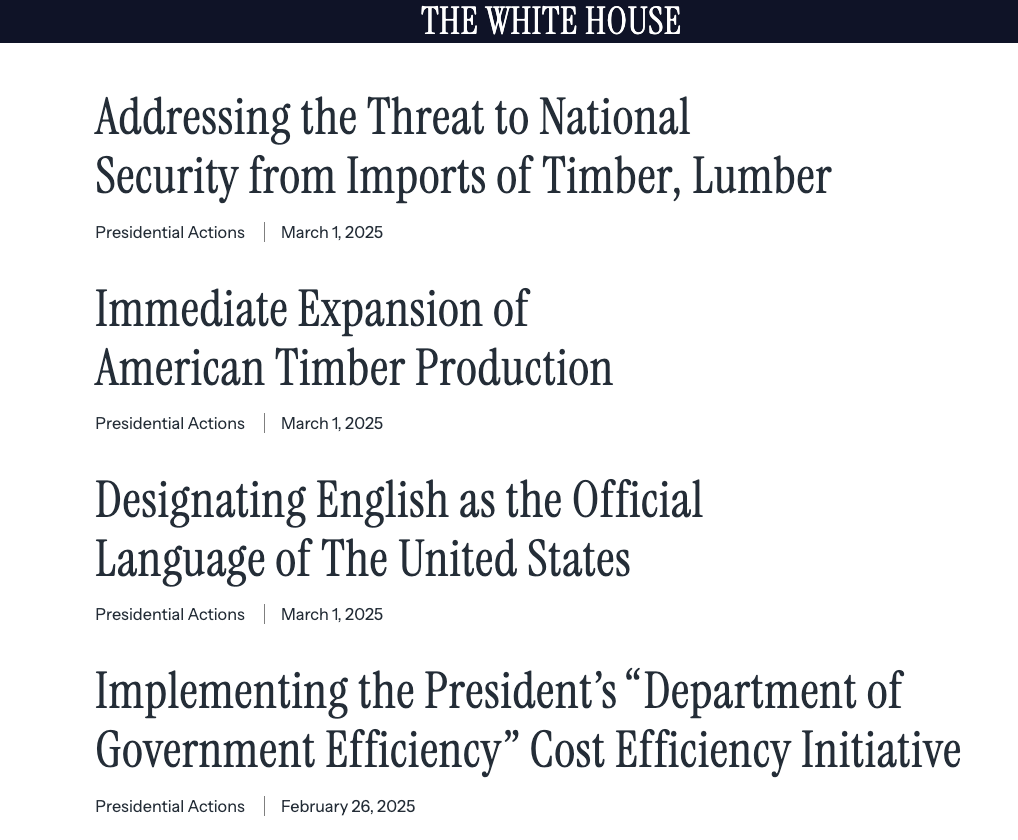

After looking through the presidential executive order page on the White House official website, I can almost confirm that this “news” that caused Trump to mention a short-term surge in assets is actually “old news.”

It can be seen from the relevant pages of the White House website that Trump has not signed a new executive order on cryptocurrencies. The national cryptocurrency reserves he mentioned in social media are actually still the digital asset reserves mentioned in the “Strengthening the United States ‘Leadership in Digital Financial Technology” signed in January. Only this time Trump clarified the assets that the reserve may contain: Bitcoin, Ethereum, SOL, XRP, and ADA.

In other words, Trump may be just cheering on the recent downturn in the cryptocurrency market. His so-called “advancement” work has actually been going on since the executive order was signed, rather than any “new progress.” It is worth noting that the signed executive order clearly mentions that the way to establish a national cryptocurrency reserve is to retain cryptocurrencies legally seized by the federal government through law enforcement actions. Whether there are other ways, the current US president has not yet made it clear.

“Emotions control prices” will lead to increased risks

In the current cryptocurrency market, whenever the keywords “Trump”,”cryptocurrency”, and “Bitcoin” appear at the same time, it will always cause a lot of market fluctuations. A few days ago, Bitcoin once fell below US$80,000 due to reasons such as the imminent implementation of Trump’s tariff policy. At the time of writing, according to OKX prices, the price of Bitcoin has rebounded to above US$92,000.

A closer look at an untenable positive sign can cause Bitcoin’s price to rise by nearly 10% in the short term. It can only be said that the market is looking forward to good news too much. However, in the face of a capricious president like Trump and the lack of new positive news in the cryptocurrency market that can shape the “war situation”, the sustainability of this violent rebound triggered by “old news” remains in doubt.

Of course, the power of emotions in financial markets can never be underestimated, but when the price of an asset must rely on the sentiment stimulated by news rather than the asset itself having new room for price increases to complete the rise, investors should pay more attention to the control of risks. Bitcoin’s rise in the past two years has also been based on the steady rise in the prices of risky assets represented by U.S. stocks. If this foundation is no longer, capital with a keen sense of smell may not choose to fight.