Holders are gradually taking profits, but extreme fanaticism has not yet emerged in the market.

Author:Ignas | DeFi Research

Compiled by: Shenchao TechFlow

In June 2021, when ETH dropped from $4,300 to $2,150 and the price halved, I chose to sell all my assets.

At that time, I was exhausted by the high intensity of the bull market. Continuous research and work exhausted me physically and mentally. I very much longed for everything to stop. When my portfolio shrank by 50%, I thought it was a sign of a bear market, so I decisively cleared my position and felt relieved.

However, the market then rebounded quickly, with ETH soaring 125% to $4,800. I could only wait and see off the sidelines. Although I made some gains by holding stablecoins, I missed this rally.

Now, I feel like we are in a similar stage again, but this time my mental state is stronger. I chose to firmly hold on to my assets and wait for the market to recover.

But what if I’m wrong? What if this is really the beginning of a bear market?

Current market sentiment is dominated by fear:The impact of Trump’s tariff policies and the stock market at an all-time high may trigger a plunge, which in turn drags down the cryptocurrency market.At the same time, you may noticeWarren Buffett is holding a lot of cash, which makes you wonder if he knows something we don’t. Smart people on social media platform X have issued pessimistic forecasts claiming that the market is about to collapse.

this is the so-called Goblin Town(Common name for market collapse).

Still, I choose not to be overwhelmed by these fears, uncertainties and doubts (FUD) and hope to help everyone calmly analyze the current situation by sharing some market data and insights.

Is Bitcoin still in a bull market?

Here are a few indicators from CryptoQuant to help determine whether the price of Bitcoin is overvalued (expensive) or undervalued (cheap).

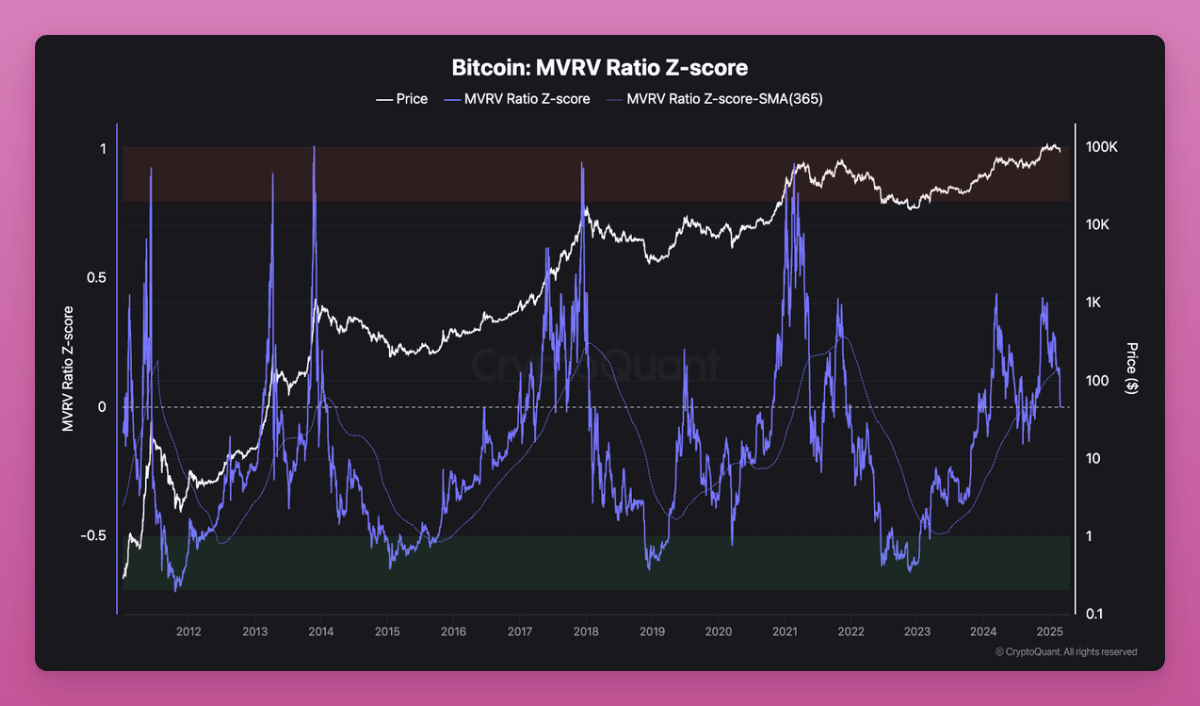

MVRV Z-Score indicator

The MVRV Z-Score is used to measure whether the price of Bitcoin deviates from historical trends, indicating that it is overvalued (red area) or undervalued (green area).

-

Currently, bitcoin prices have not entered the overvalued area, but they are also much higher than the undervalued area.

-

The market still has room to rise, but it is currently in the middle of the cycle rather than early.

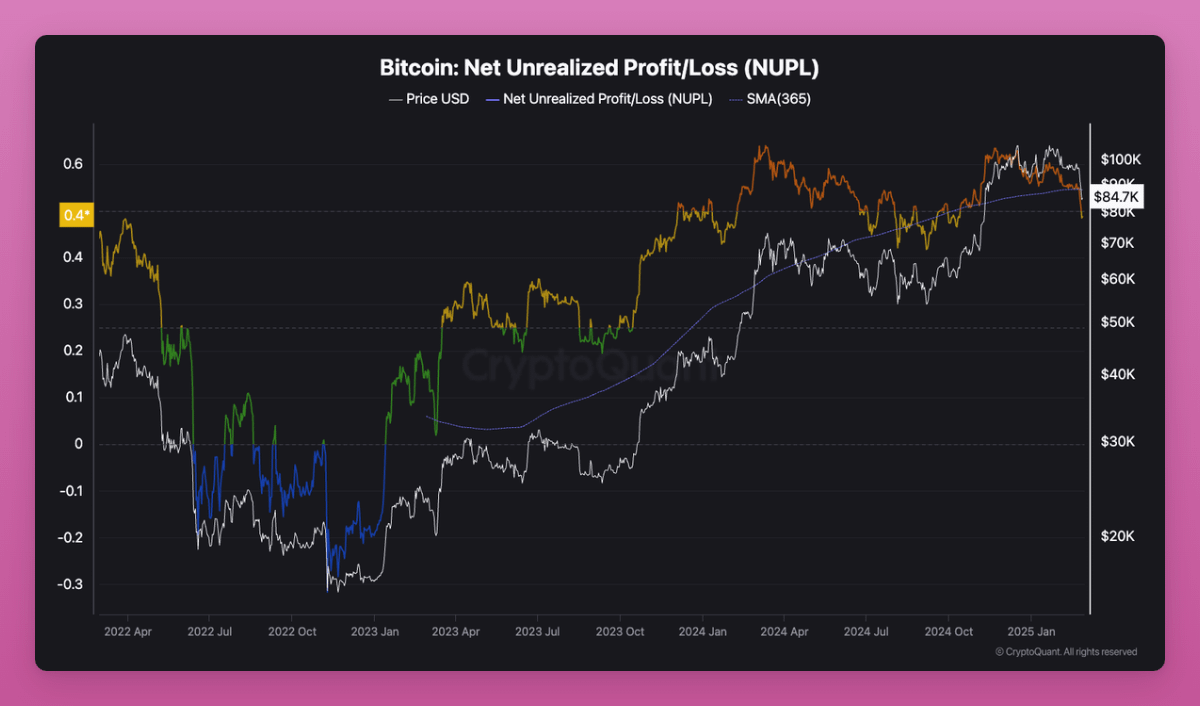

NUPL (unrealized net profit/loss)

The NUPL indicator measures market sentiment through unrealized profits, whether it is fear, optimism or fanaticism.

-

It is currently in the optimism/denial stage (~0.48), indicating that the vast majority of holders are still profitable.

-

Historically, when NUPL is above 0.6, the market usually enters a greedy/fanatical phase, signaling a peak.

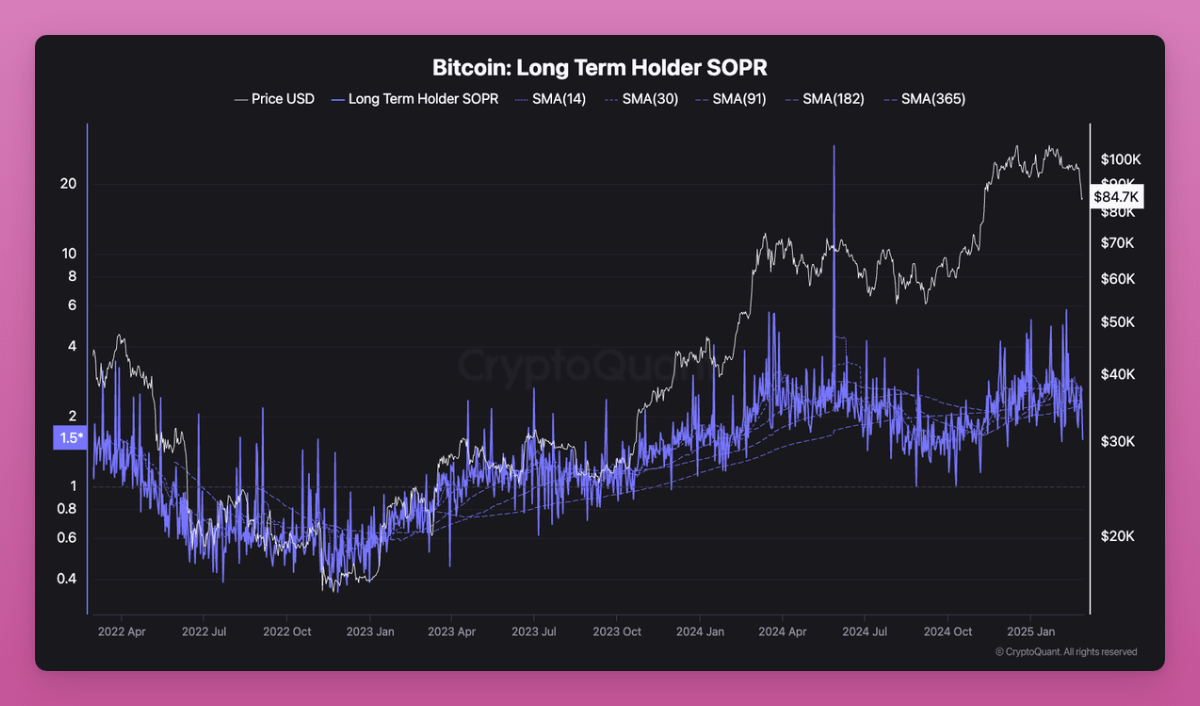

Long-term holders SOPR (Spending Export Profit Margin)

SOPR tracks the behavior of long-term holders and determines whether they are selling assets at a profit or a loss.

-

The current value is 1.5, indicating that long-term holders are taking profits, but the selling is not aggressive.

-

In a healthy market uptrend, it is normal for long-term holders to continue profit-taking.

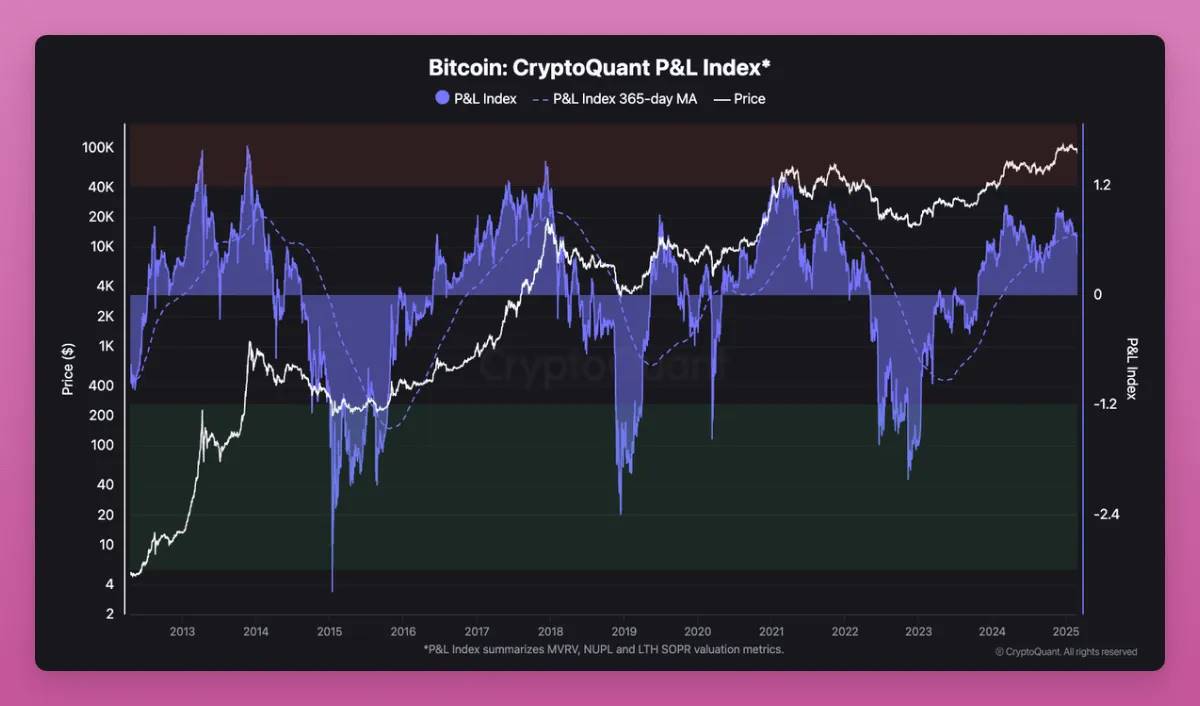

CryptoQuant P L Index

The index combines MVRV, NUPL and SOPR data to assess overall market valuations.

-

Currently above its 365-day moving average, confirming that the bull market is continuing.

-

When the index exceeds 1.0, it may indicate the formation of a top of the market cycle.

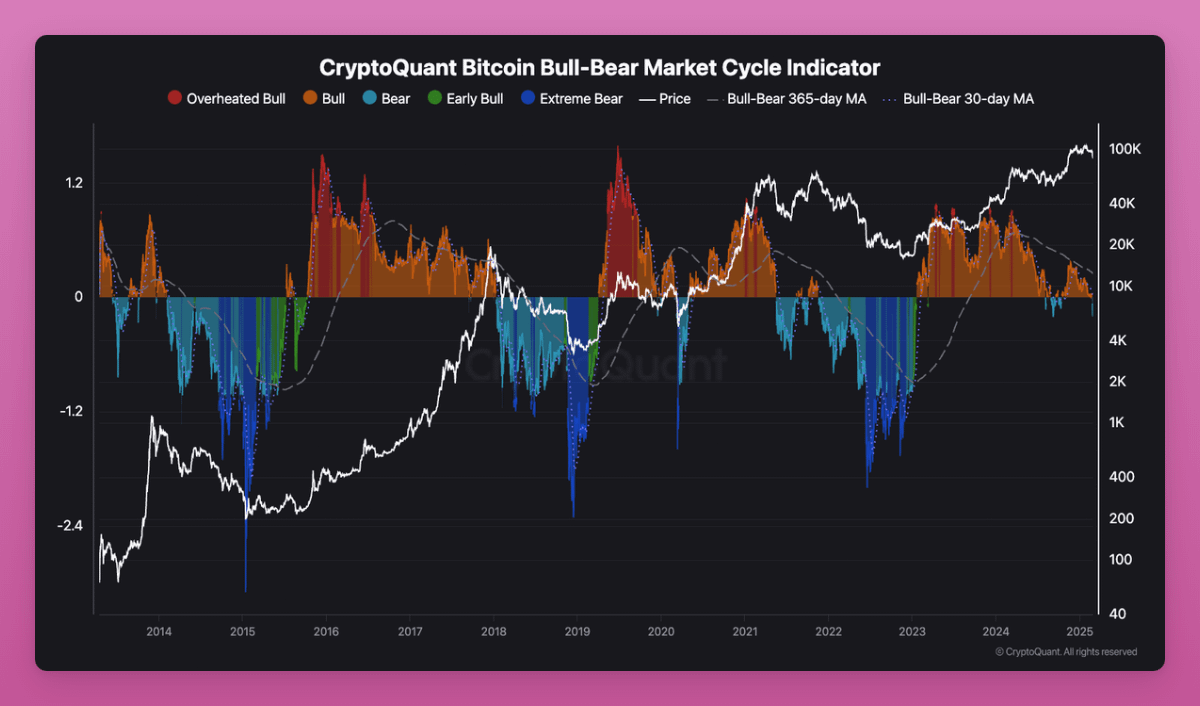

CryptoQuant Bitcoin Bull-Bear Cycle Indicator

If you only focus on one Bitcoin indicator, I recommend this. This is a momentum indicator based on the P L index that is used to track Bitcoin’s bull-bear cycle.

-

Bitcoin is currently firmly in bull market territory (orange), indicating a strong upward trend in the market.

-

But it has not yet entered the overheated bull market area (red), which historically has often marked the top of cycles.

Summarize what will happen next?

-

Bitcoin is currently in the middle of a bull market cycle.

-

Holders are gradually taking profits, but extreme fanaticism has not yet emerged in the market.

-

There is still room for further growth before prices reach high valuations.

If history repeats itself, Bitcoin still has the potential to rise before hitting the top of the main cycle.

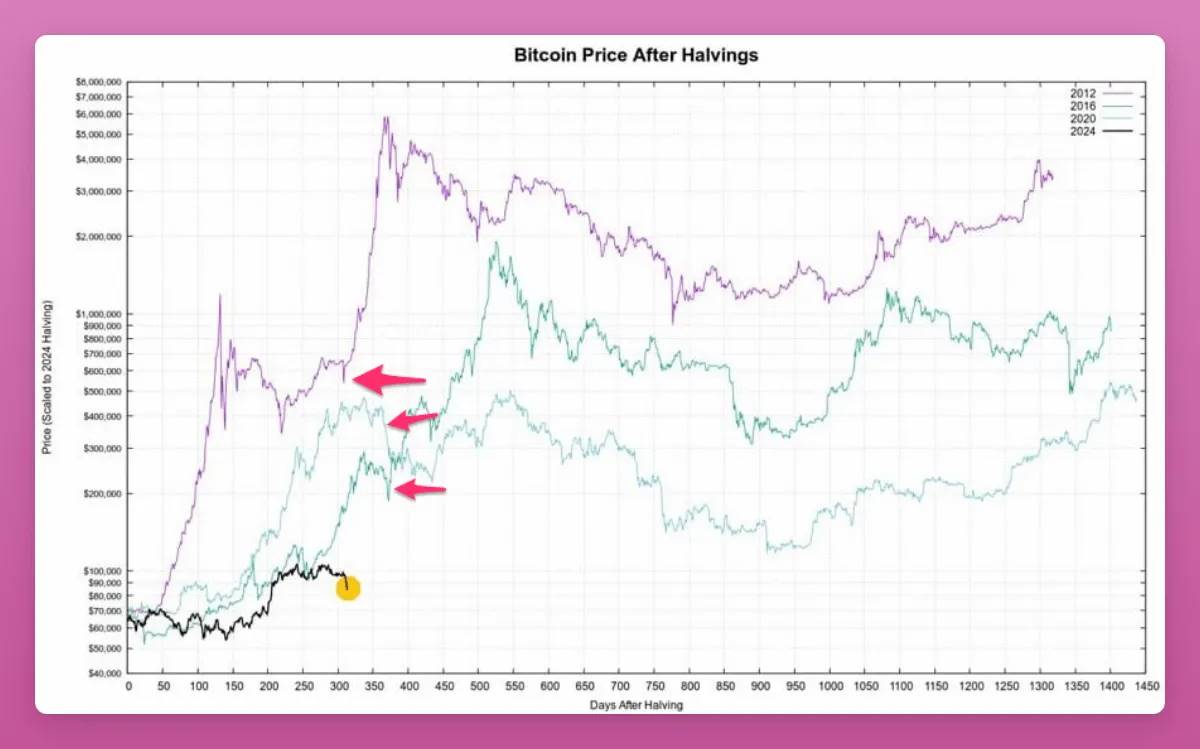

Interestingly, a chart CZ shared on X (Twitter) reflects my feelings about the future direction of the market:

“I wouldn’t read charts, but CZ said so on X.

Currently,Bitcoin has been confirmedbull market, but has not yet reached the level of fanaticism seen at the top of past cycles.On-chain data shows that the market still has room for growth, but some holders are beginning to take profits.

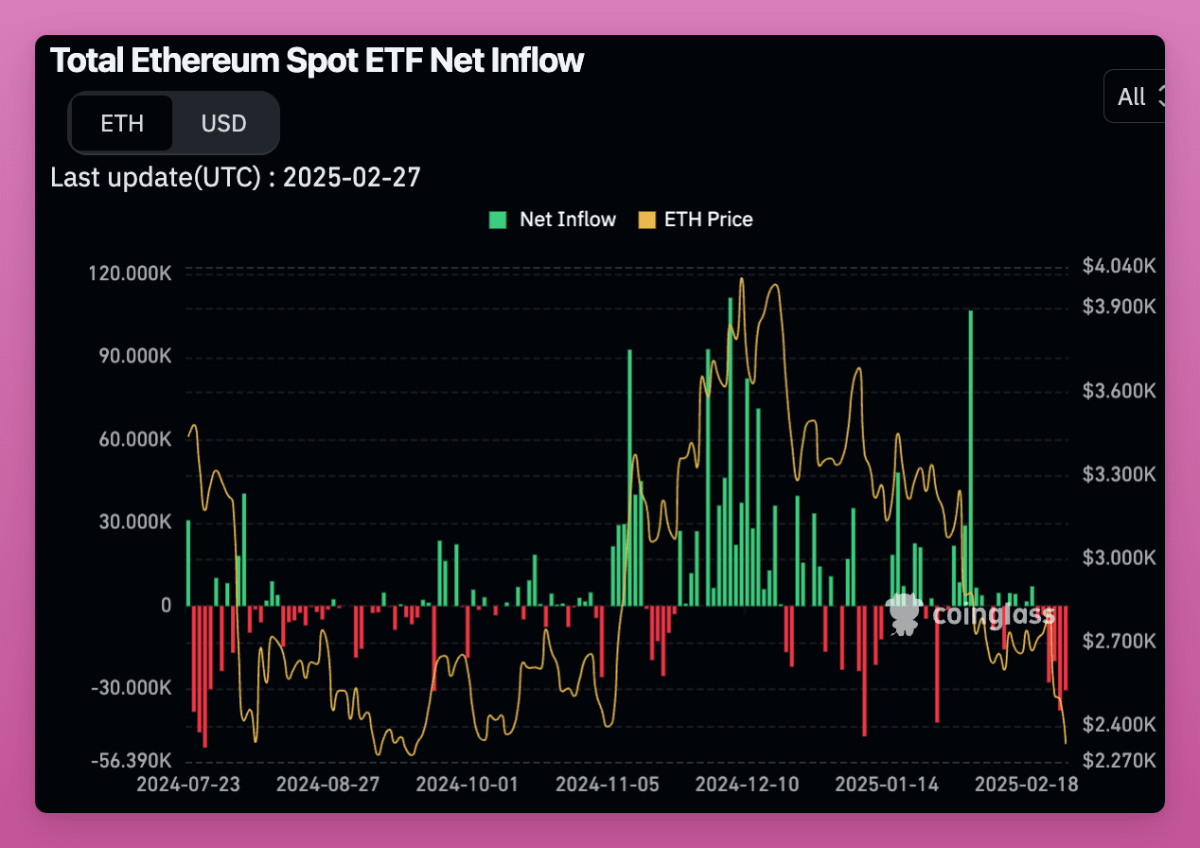

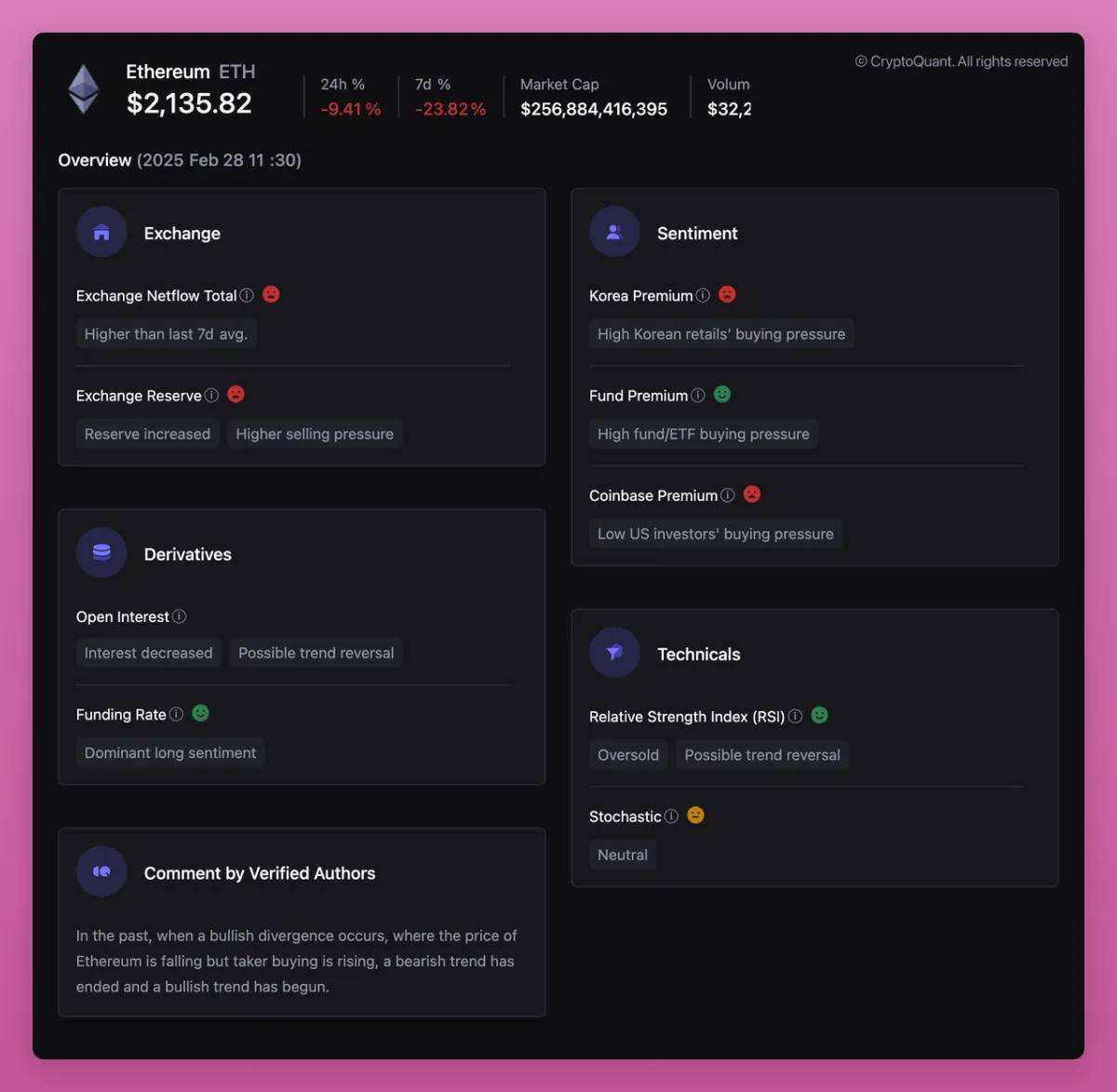

The current situation of Ethereum: worrying

In the past two years, the price of ETH to BTC has dropped by 70%. Since December 2024 alone, it has dropped by 48%!

In addition, the outflow of funds from the ETH ETF did not show any positive signals.

Is ETH the most attractive risk-reward opportunity currently?

I shared some views on X that catalysts for ETH are gradually accumulating:

-

There has been a change in the leadership of the Ethereum Foundation (EF)(Aya has left, but new executive directors have not yet been announced).

-

Starting to expand L1, although it is only adjusting Gas restrictions at present, the idea of this transformation itself is of great significance.

-

Pectra has launched EIP-7702 (simplified approval mechanism) and EF’s Open Intention Framework, which will significantly improve the user experience in L2.

-

Community interest in memecoins has gradually waned, and more people have begun to pay attention to the fundamentals of Ethereum.

-

The popularity of MegaETH shows that: 1) people are still keen on innovative L2, and 2) the successful L2 further verifies the concept of modularity.

-

Base announced a reduction in block time from 2 seconds to 200 milliseconds and launched L3 (a concept similar to MegaETH). Although I personally am not a fan of Base.

-

Ethereum is still the best public chain for asset tokenization, and even BlackRock is endorsing it.

-

The price of ETH has been seriously oversold, really very low, haha.

Implementation of L1 extensions may take years, and improvements in user experience require support from multiple partners (for example, Base has not yet joined the Open Intention Framework).

Ethereum’s future outlook: bullish or bearish?

My biggest concern is that ETH may miss out on this bull market completely and will not become a worthwhile buying opportunity until the next bear market.

But market sentiment could shift quickly. If the Ethereum Foundation and the wider community can make substantial progress in:

1) Extension of L1,

2) Significant improvement in the L2 modular user experience,

3) The community gets rid of its current loser mentality and

Then ETH may rebound strongly and dominate in the second half of this cycle.

However, for now, SOL’s market value is only 3.8 times that of ETH, it provides a better user experience, and its Lindy effect is increasing over time (as long as the network remains stable).

These factors will pose challenges to ETH’s dominance in the smart contract space.

Altcoins: Indicators to pay attention to

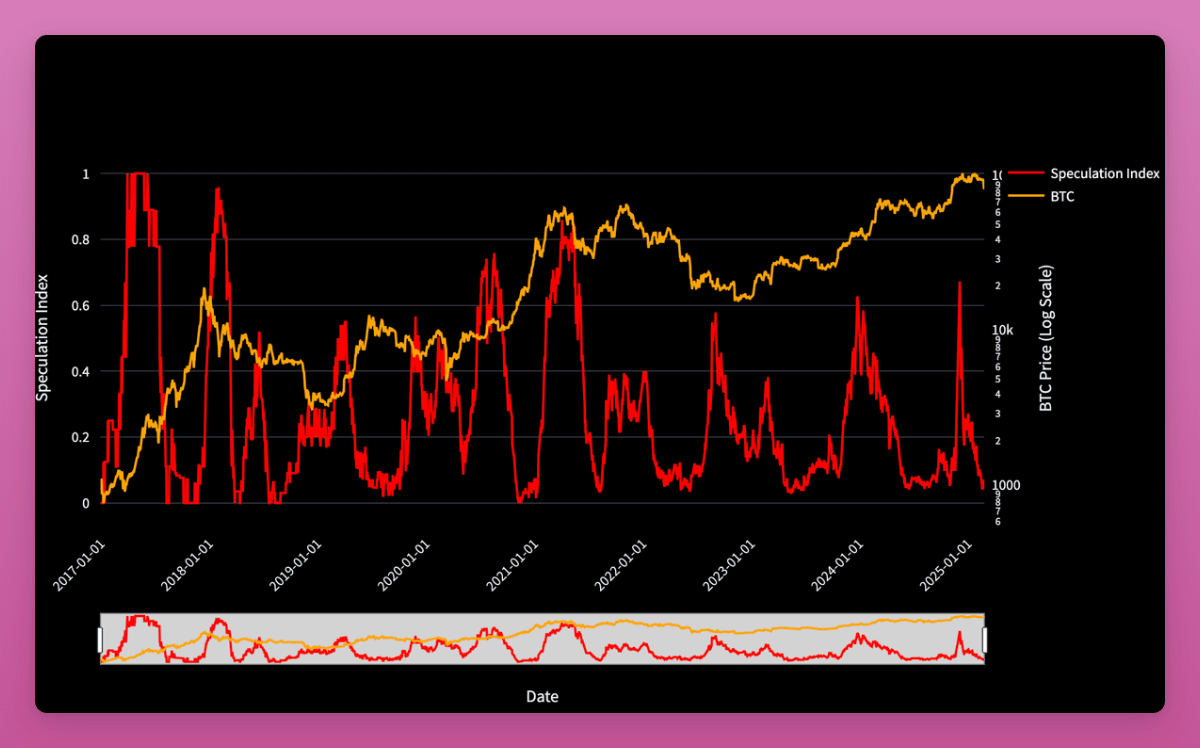

Strong speculative index(Robust Speculation Index) can measure whether altcoins outperform Bitcoin over multiple time frames.

-

Current indicators are at a low level (approximately 0.0-0.2), which suggests that Bitcoin is outperforming most altcoins.

-

Historically, when speculative activity is at low points, it usually paves the way for a rebound in altcoins.

Aylo shared a similar Crypto Breadth chart on X (Twitter), pointing out that the altcoin may have hit bottom. If Bitcoin’s strength continues, we may be able to look forward to a wave of altcoins.

Question: Which altcoins should I buy?

When selecting altcoins, I will base myself on the following criteria:

-

There will be no large-scale token unlocking events in the short term.

-

Product Market Fit (PMF) is good, that is, the product can meet market demand and be recognized by users.

-

Revenue sharing mechanisms (such as token repurchase) are an important bonus.

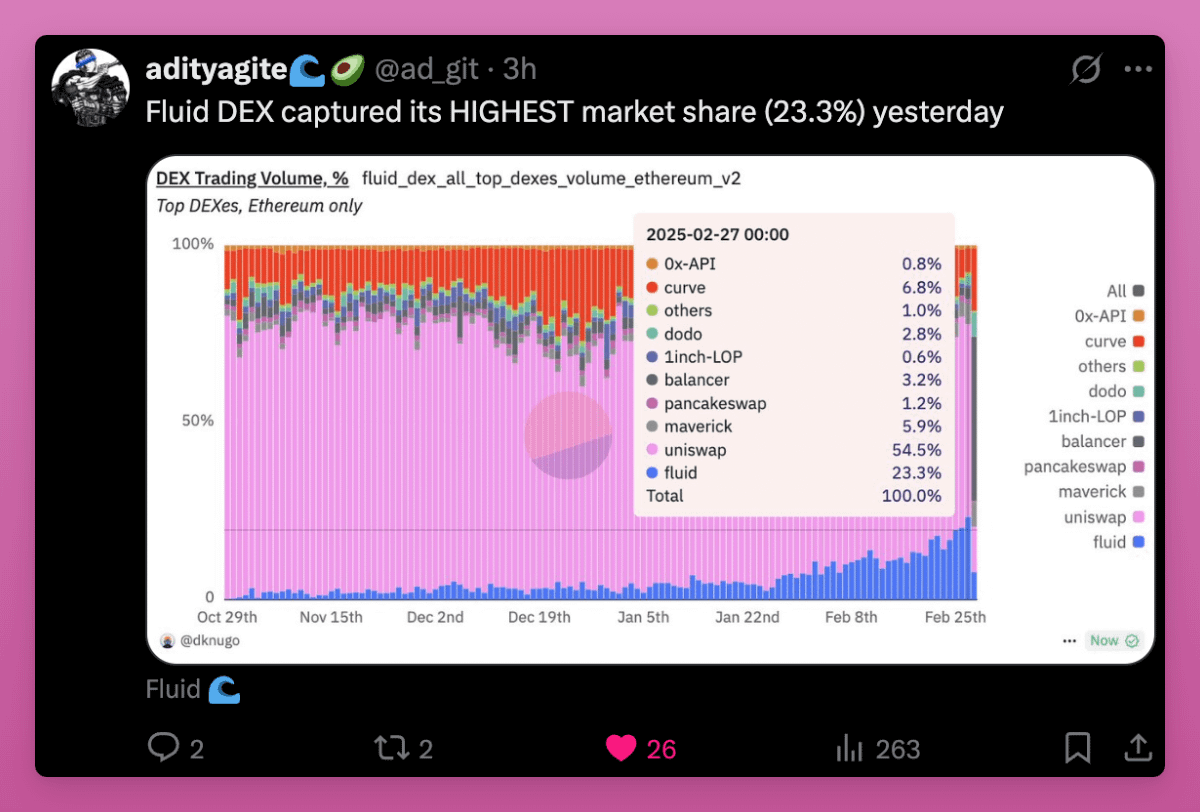

FLUID is a decentralized lending protocol that has just been launched a few months ago, but it is already able to compete with Uniswap in terms of transaction volume on decentralized exchanges (DEX). Recently, FLUID announced that it will soon launch a token repurchase program, which makes me confident in its future development.

Other altcoins worth paying attention to:

-

ENA: Successfully withstood Bybit hacking and multiple rounds of liquidations. A $100 million financing was recently completed at a price of $0.4. In addition, more and more protocol and centralized exchanges (CEX) are adopting sUSDe, which makes me very optimistic about its potential. The problem is that ENA’s massive token unlocking is coming and could put pressure on prices.

-

$SKY (formerly MKR): Taiki’s analysis mentioned some highlights:

-

$30 million in token repurchases per month (approximately 1.9% of supply).

-

The supply of USDS (formerly DAI) is near an all-time high.

-

SPK Farming increases token demand and revenue sources.

-

Stabiloin regulation may be a positive factor.

-

-

$KMNO:Dominating the lending market on the Solana chain, TVL (total locked positions) is as high as US$1.8 billion, while the market value is only US$85 million. This suggests that its valuation may be undervalued. The problem is that the users on the Solana chain are more traders than profit farmers. But this situation may change at any time.

-

Sonic’s $S: Its DeFi ecosystem is expanding rapidly (including the deployment of key protocols such as Aave), in addition to a planned 200 million $S airdrop, a premium user experience, and growing attention on X. More importantly, there are no large-scale token unlocking events, which provides it with a more stable price base.

-

HYPE: There is a lot of discussion on X about its excellent token economics and strong community that deserves attention.

-

PENDLE: When markets start focusing on fundamentals and speculators look for yields, Pendle is a very promising choice.

-

AAVE: We are undergoing adjustments in token economics, and the upgrade to version 3.3 has brought stronger revenue performance.

What else have I missed?

In addition, I am very looking forward to the upcoming token airdrops for MegaETH, Monad, Farcaster, Eclipse, Initia, Linea and Polymarket.

macroeconomic environment

I fully believe in the value of Bitcoin as digital gold. Compared to gold, Bitcoin supports self-custody and is more transferable, which makes it more attractive.

The current macroeconomic environment provides excellent test scenarios for Bitcoin: tariff policies, war, fiscal deficits, and large-scale currency overissuance all provide potential benefits for Bitcoin.

In my 2025 blog post,”Truths and Lies about Cryptocurrencies,” I quoted BlackRock’s research: Bitcoin sometimes sells off early in major macro events. However, chaos and uncertainty, as well as potential currency overissuance, will ultimately provide strong support for Bitcoin.

Current Market Observation

I think the current market volatility is triggered by Trump’s sudden departure from the established global order. This uncertainty has led to short-term panic in the market. However, people will gradually adapt to these new global realities.

Essentially, the world has not changed anything that really undermines the fundamentals of cryptocurrencies. On the contrary, we can see more and more good news every day:US Securities and Exchange Commission(SEC) Some lawsuits against cryptocurrencies have been dropped, a new cryptocurrency bill has been introduced, and even the government’s overall attitude towards cryptocurrencies has gradually turned positive.

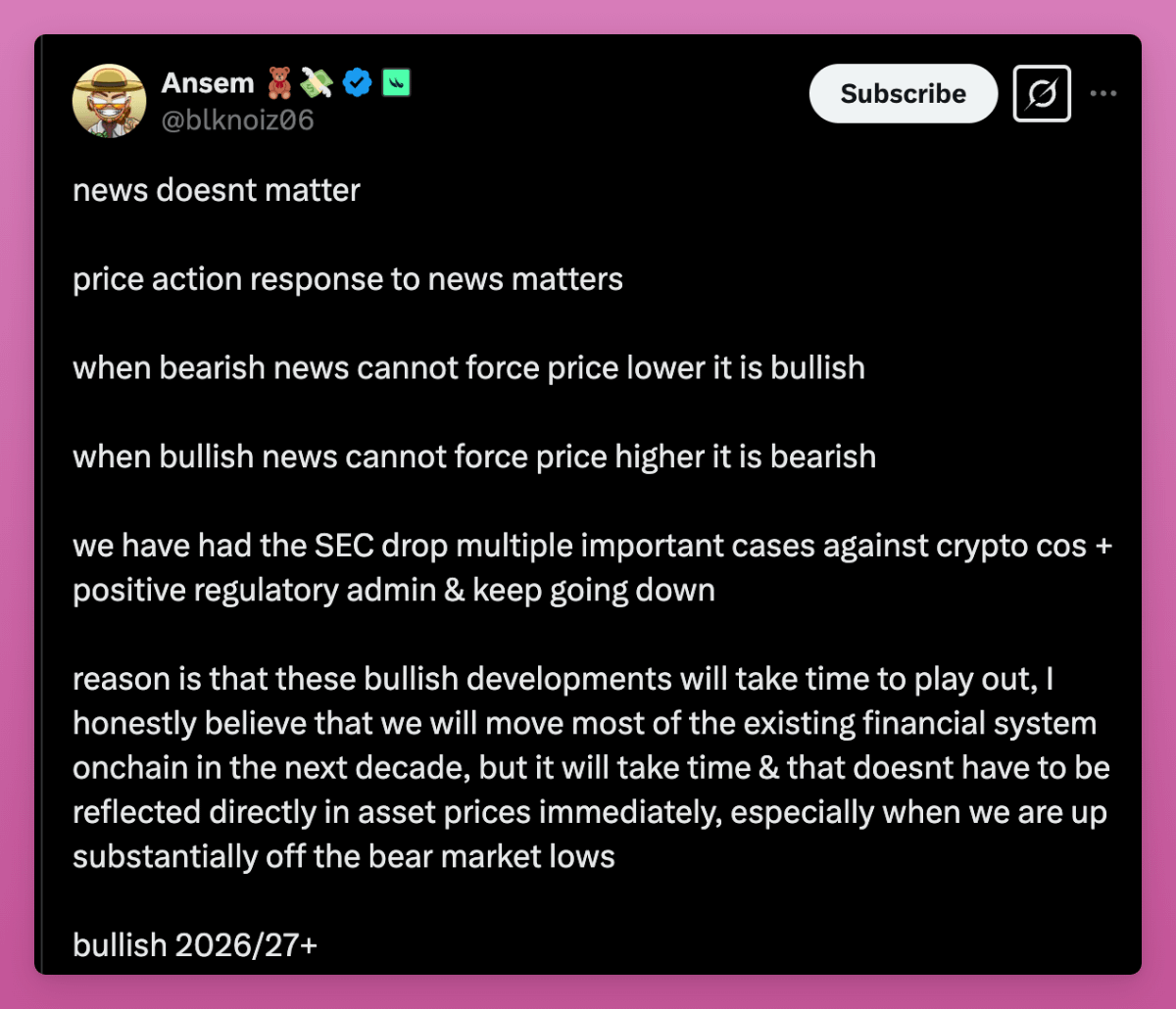

However, one point made by Ansem is worth noting:When good news fails to push prices up, it is a bearish signal.This suggests that the market may take some time to digest and adjust the status quo.

Still, I still hope the market will adjust faster than his optimistic forecast for 2026/27.

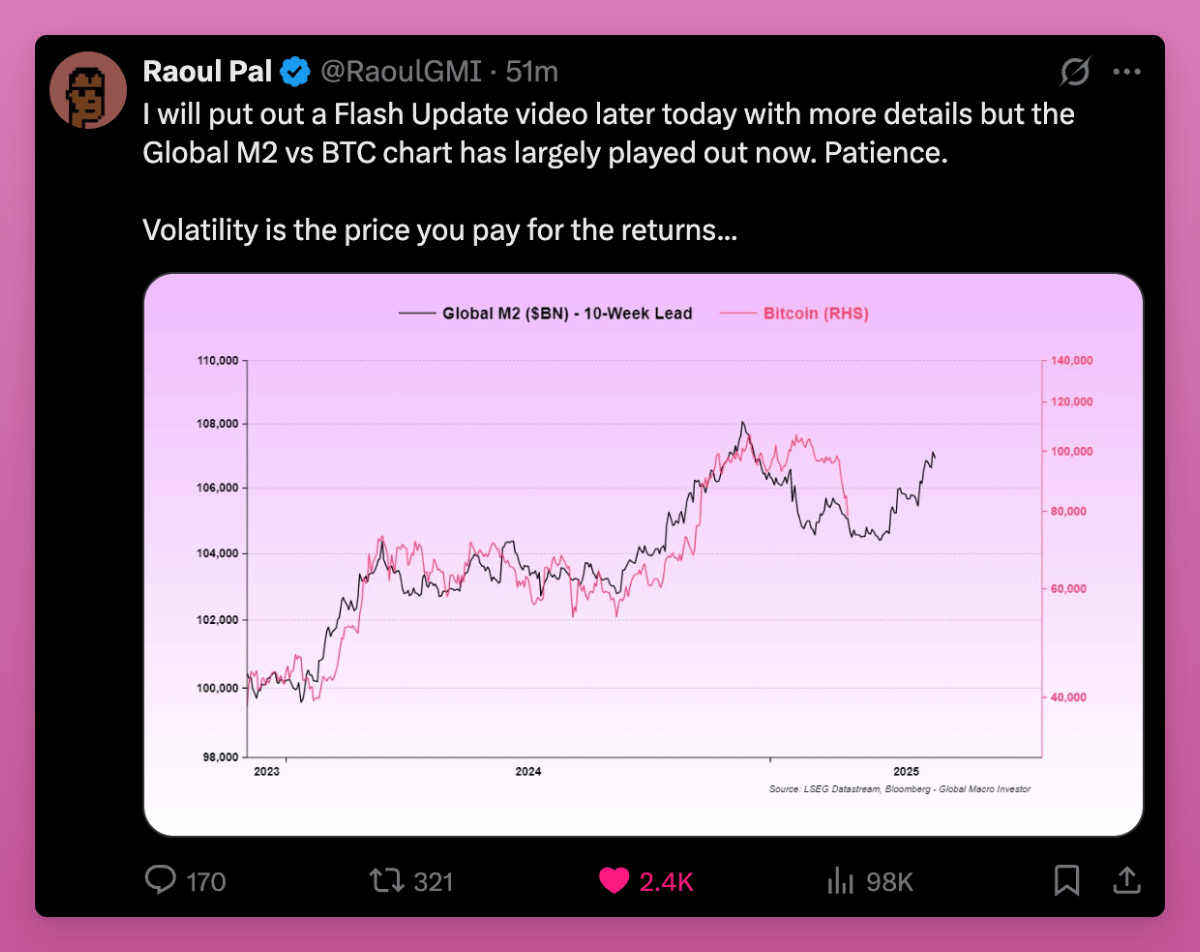

If Raoul Pal’s analysis and charts are correct, Bitcoin prices should catch up with the growth trend of global M2 supply by 2026. M2 supply is an important indicator of global currency circulation. If Bitcoin can match it, it will further consolidate its status as digital gold.

summary

All in all, I remain confident in the cryptocurrency market and believe that as long as I remain patient, I will eventually pay off.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern