The current crypto market has retreated from fanaticism, with retail investors leading to increased volatility, and market adjustments may create opportunities for long-term investment and new narratives.

Write an article:Michael Dempsey

Compilation: Vernacular blockchain

Today, the crypto market is at an interesting stage. We are only 8-12 weeks away from the peak of market mania, but news keeps coming in that the government, once the most complained about by the crypto market, is now embracing this asset class and its technology. However, despite this, the market is in a downturn I have not seen in a long time.

The joke of “developers do something quickly” in the past seems pale and powerless now. Because the “developers” have taken action, they have chosen to free up market freedom and remove many restrictions and attacks on the encryption field. So the future of this industry today, frankly, depends entirely on us.

So, what happened? No one is sure, but these are some thoughts I had this morning.

1. Macro level

I don’t plan to review in detail the crypto market trends over the past few months, but I would like to say that it’s quite interesting to watch market psychology change and soften between our president and the factors that influence the market.

https://www.gushiio.com/mhdempsey/status/1878788617004548287

In 2024, many people made money on the so-called “Trump Deal,” specifically, betting that the market underestimated Trump’s chances of winning and the policy changes that followed. However, it now seems that Trump’s deal is over-buying, both at the medium-term market level and at the short-term crypto market level. Trump’s election (and the weeks that followed) may have been a typical “cash and sell” event. After all, Bitcoin soared from the $70,000 range to $106,000 after his election victory, and the market entered a correction phase. As with many situations in the crypto market, the entire market is once again ahead of reality.

I won’t discuss market trends too much here, but I suggest you pay attention to Smac and read his recent articles on volatility and so on. From a medium term perspective, I may be slightly more bearish than Smac, but he may be smarter than me, so I suggest you go and see his views.

Now, let’s talk about something not entirely about price.

2. Stop outsourcing market narratives to retail investors

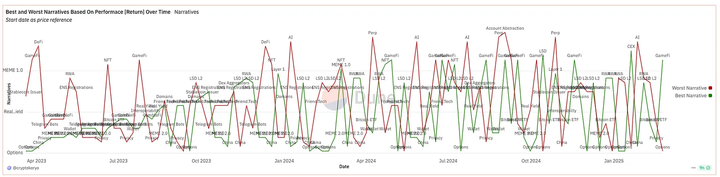

Crypto Market Narratives Dune Dashboard

This may sound strange, but I think the crypto market has largely outsourced speculation and narrative building to the smallest participants (individual investors) and those at the very edge of the risk curve. This has led to a chain reaction that allows speculators who may not be mature and highly gullible to become the ones leading the market narrative that often spreads through the echo chambers of the crypto industry (Crypto Twitter, trader Group chats, differences between European, American and Asian markets, etc.) before it is the turn of institutions to participate. Some institutions themselves also use investment analysis methods similar to retail investors, which exacerbates this phenomenon.

These narratives drive large fluctuations in market prices and absorb large amounts of capital, especially in periods where new market participants lack entry. The rotation of funds is calculated almost on a weekly basis, with Token experiencing a crazy rise and then plummeting by more than 80%. This market dynamics cannot support long-term investment, nor attract new capital into the crypto market (other than BTC), nor can it promote long-term industry construction.

I think what really needs to be done is for project parties to think more forward-looking about how to position their products in the encryption field. In other words, project owners should proactively create new narratives rather than passively pandering to existing narratives.

Some people may think that the only important thing in the crypto market is to “gamble” for a Token, hoping to make more money. But even within this framework, different narratives can still be constructed around this core logic.

Typically, the largest projects (L1 and L2) follow certain market narratives, hoping to drive long-term development through short-term TVL growth. The problem, however, is that large projects adjust much slower than small projects, so when they finally turn towards a narrative, that narrative is often dead. We have recently seen examples of AI narratives. TAO captured most of the values early on and successfully shaped the narrative, but the subsequent small “GPT Shell” project actually weakened the influence of this narrative.

We have also seen similar situations in other concepts of “X + encryption”, such as:

-

NFT (Art + Encryption)

-

Invest in DAO (investment funds + crypto)

-

RWA (Traditional Finance + Crypto)

-

OHM (Fool + Encryption)

Recently, we have seen the rise of Memecoin on a larger scale (“cultural” speculation + encryption, or narrative meta-games + encryption). In the future, we are likely to continue to witness similar cycles.

All crypto projects ultimately want to create a core user group (we often call it a “community”) that is aligned with the project in terms of ideological and economic interests. With this in mind, if you are building a project, your goal should be to build a “propaganda agency” early on that can spread the narrative. As an organization, foundation, or a small group with far more money and influence than individual investors (after all, you have issued coins or raised funds), your task is to create a narrative you truly believe in and promote to the market why that narrative matters and why your project dominates it. Rather than trying to get a piece of an existing narrative that already has market awareness. Competition is a game for losers, and competing for existing narratives is particularly difficult.

Bet on the future you believe in and become the Schelling Point Protocol for that future.

3. Power Law and Compound Interest Growth (Power Law Compounders)

As an investor, covering areas ranging from venture capital to crypto markets to public market stocks, I have found that consensus varies significantly in different markets. Many people like to compare the open market to the crypto market, but there is a core misunderstanding that actually reveals what’s wrong with the crypto market today and that’s why some people (maybe just me) are disappointed.

Over the past 5 to 15 years, public market investors have gradually “discovered” the concept of long-term compounding ROI at the company level, especially as large companies become bigger than anyone expected and accumulate value far beyond market perception. These companies often have multiple characteristics, such as being able to take full advantage of changes in technology waves and having a broad vision from the beginning. This investment logic means that compared with investing in companies that fluctuate violently and may surge but may also retract by more than 80%, investing in high-quality companies that can grow steadily in the long term and have relatively controllable retractions is a better choice.

In the open market, this trend has made it more difficult for hedge funds to survive. “Mag7″(referring to Microsoft, Apple, Google, Amazon, Meta, Tesla, Nvidia) and some companies with compound interest growth characteristics have created huge upward momentum in the core index, making it difficult for hedge funds to outperform the market if they do not bear higher risks. As a result, many fund managers have begun to shift to a concentrated investment strategy of long-term holding, usually allocating a certain proportion of Mag7 stocks, while claiming to achieve a smaller retracement in a big bear market such as 2022 (but the reality is that many fund managers still invested in speculative technology stocks and were eventually eliminated by the market).

1) Compound interest growth dilemma in the crypto market

Hedge funds in the crypto market face similar challenges, especially Bitcoin. Bitcoin (in my opinion) has a very high risk/return ratio and runs through multiple core narratives such as “new currencies”,”anti-inflation assets”, and “crypto market indices.” Bitcoin often becomes the benchmark index for all liquid crypto-asset strategies. Similar to open market hedge funds, many crypto hedge funds perform well in the market’s rising cycle, but essentially rely on leveraged long strategies, resulting in fierce retractions when the market falls, and their performance in safe-haven years is much lower than Bitcoin, ultimately leading to long-term underperformance of market benchmarks.

In the crypto market, there were few real “compound interest growth” assets in the past, except for L1 public chains like ETH and SOL. This is because infrastructure projects are easier to achieve long-term growth when they expand horizontally. However, some teams are trying to break this limitation, but an open question is: Can existing Token economic models support this goal? Or, if you want to truly build a project with compound interest growth characteristics, should you build a company from scratch rather than launch Token too early? (This may also be an important reason why project parties should not issue Tokens too early.)

2) The future of compound interest growth projects

We have a lot to think about this, but regardless, we think this market dynamics will change in the crypto space. Some founders are beginning to view their projects as potential compound growth assets with a broader strategic vision than in past market cycles. This shift is expected to bring more rationality to the crypto market and establish a core set of benchmarks. Currently, the crypto market lacks a batch of assets with good risk-adjusted returns, which forces market participants to choose highly speculative shitcoining and frequent capital rotations. If real compound interest growth projects emerge, the market investment logic may change accordingly.

4. Conclusion

As Bitcoin and the entire market slowly fell from about $95,000 to $80,000, I thought about how to build lasting value in the crypto space, an idealistic and even utopian view that was somewhat ironic. This correction in the market is one of the most orderly sell-offs I have seen in recent times. However, when you see an entire industry retreat from “faith,” I think this is an opportunity to build a new investment framework, shape a new narrative, and establish a unique fundamental perspective in the “ruins” of markets that wash away low-belief investors.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern