We continue to share the same view-SOL passing ETFs is not yes or no, but When.

This study will be divided into several parts:

(1) Is the recent collapse of Solana an end or a new beginning

(2) New Chain War is beginning

(3) Guidance of the subsequent primary market

01.Is the recent collapse of Solana an end or a new beginning?

1.1 Value targets on Solana

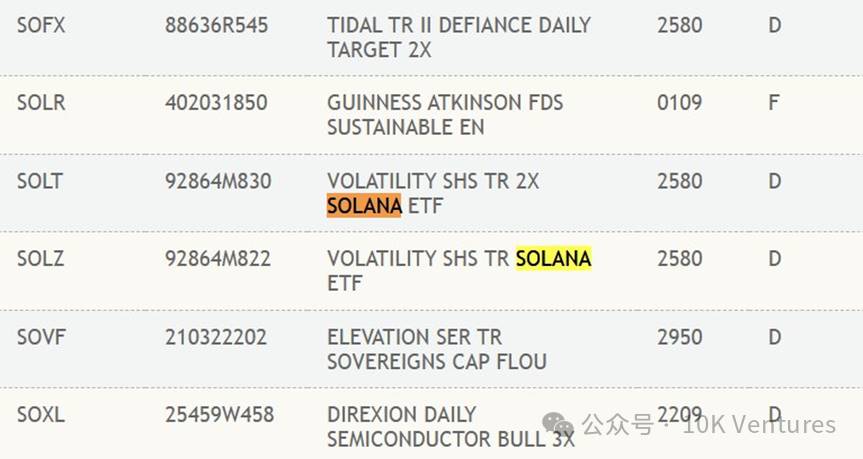

It is only a matter of time before Sol passes the ETF, which is in May and June.

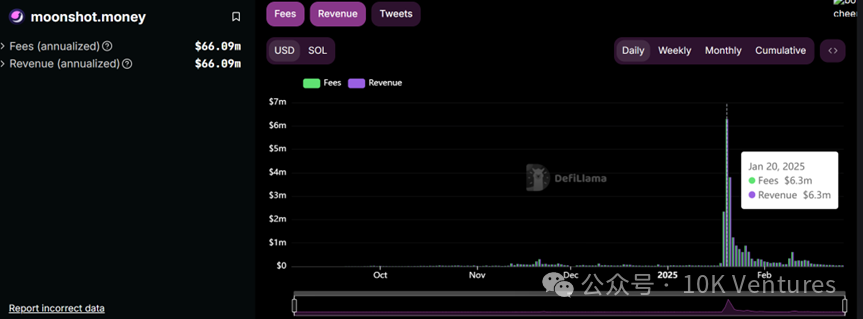

As Trump’s circulation of coins on Solana once reached US$14 billion, Solana/TRUMP began to gradually break through the circle. Presumably, as Trump gradually reached ATH, friends outside the circle around you may be asking how to buy Trump and Solana. It was also that day that Moonshot, as a very web2 userfriendly crypto broker, reached historical ATH, with a single-day income of US$6.3 million.

While Trump/Solana is gradually breaking the circle at the retail level, the launch of SOL ETF is also in full swing. As of February 27, 5,The latest development of SOL ETF is that it has been put on DTCC (just as I am writing this article, news reports that SOL ETF has been put on DTCC).DTCC (Depository Trust Clearing Corporation) is the largest financial transaction back-office service institution in the United States. It is responsible for the centralized custody and settlement of stocks, bonds and other securities, and provides settlement and custody services to major exchanges including NYSE and Nasdaq.When a commodity or security is listed on DTCC, it means that it is included in DTCC’s centralized custody and settlement system. This does not directly mean that the commodity or security will definitely be on the Nasdaq.

However, it is worth noting that the first BTC ETF will be launched on DTCC on October 23, 2023, and the subsequent BTC ETF will be launched on Nasdaq on January 11, 2024 (two and a half months); the first ETH ETF will be launched on DTCC on April 26, 2024, and the subsequent ETH ETF will be launched on Nasdaq on July 23, 2024 (three months).

So we continue to uphold our unanimous view that SOL passing ETFs is not yes or no, but When. The time should be 2-3 months later, and from mid-May to June.

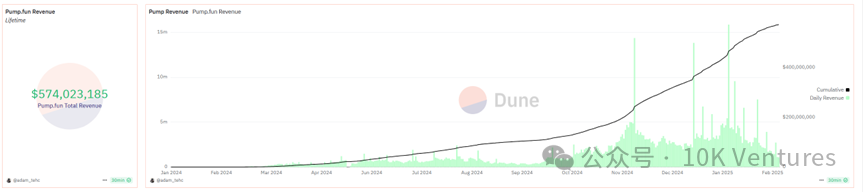

Pump.fun remains one of the best cash flow decentralized companies in the currency circle.

Pump.fun was born in early 2024. It will have a certain trading volume in mid-2024 and will become completely popular after October 2024.Pump.fun is a one-stop meme coin launch platform. After users create a token, they only need to pay a fee of 0.02 SOL to minte the token and immediately add it to the Pump.fun market.Pump.fun uses bonding curve to define prices. The more user coins you buy, the price will rise along a predefined curve. 100% of the tokens are sold through a curve, ensuring that there is no unfair advantage. This model eliminates the need for creators to provide initial liquidity and reduces financial barriers. Meme coins on Pump.fun can be traded within the platform, and users can buy and sell coins at any time based on the joint curve model. Once the market value of the token reached 100k, the token was automatically migrated to Raydium (but now it is discovered that Pump.fun deployed its own liquidity pool and began to seize the Raydium market). The liquidity was then deposited into Raydium and 17% of the liquidity tokens were burned.

As of February 27, 2025, priced at $140/sol, it is approximately $574 million in first-year revenue and is currently one of the most successful products in the crypto industry.

Before 21 years, the growth path of VC coins was usually to find VC financing, issue coins on the exchange while accessing the main network, and slowly start doing business after having coins. After 21 years, the model became to develop while financing, then airdrops, go to the exchange, and continue to do business. The problem is that after the collapse of FTX, Binance was the only one who dominated, which led to the complete loss of the project party’s bargaining power to deposit coins in the past. After all, there would be no best liquidity without Binance. The project party needs to donate a large number of tokens to Binance/BNB Holder. Projects that lead to Binance will definitely have huge selling in the early stages, originating from airdrops/project parties/market makers, etc., so retail investors have no way to make money in the secondary market. In order to deal with the above problems, the project party can only continuously increase the valuation in the primary market, in exchange for only 2%-5% of the tokens to Binance.

In the past, what attracted retail investors most attention to in the crypto market was the secondary wealth-making effect. In 21 years, they could earn anything they bought at Binance, and VC coins could rise several times. However, since the valuation of the primary market was too high, retail investors were unable to make the profits they wanted in the secondary market, and they would not participate at all (of course, shorting with high valuations can also make money).

Therefore, the popularity of Meme coins gradually increased after the end of 23 years and reached its peak at the beginning of 25 years. Putting aside the cultural/cult/communication perspective, from the perspective of retail investors, the advantages of Meme are: 1.100% fully circulated, without the seemingly selling pressure of VC coins;2. The market value of early participation is low enough, and the odds are extremely high;3. It can change its fate against the sky, and it will turn over in the crypto market, not double;4. It’s also gambling, why should I accept such an expensive project from your VC?

If you play 1sol in an internal market within 100,000 yuan of pump.fun. Once meme coins can be traded to 10m, it will be 100 times the gain, which is 100sol; if you trade to 50m, it will be 500 times the gain. Not to mention pumpfun also appeared in god discs such as act/pnut, which also created the myth of meme benefit in sol.The behavior of retail investors in Pump.fun playing in-house is like the operation of VC investing in early projects.

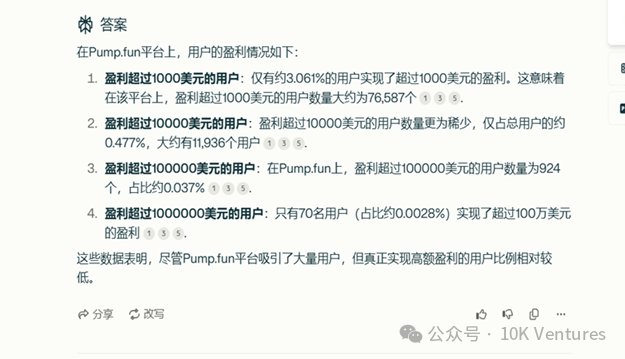

Pump.fun is a product that amplifies the extreme gambling nature of human nature. Especially in mass madness, when KOL calls for orders, users will only buy without thinking about the meaning of the token itself and the chip structure behind it. In the context of raydium and pumpfun still drawing percentages, the negative-sum game results in a very small number of users making profits. However, casinos don’t need to win half or 80% of their users. It only needs a very small number of users to have a very high benefit effect.Casinos only need to make retail investors feel that they can make money and have the possibility of getting rich quickly, which is enough. In such small trial and error casinos, it is difficult for retail investors to lose all their money. Individual investors will continue to gamble again and again after failing. In a negative-sum game, the exchange and the team that distributes the plate are the biggest winners.

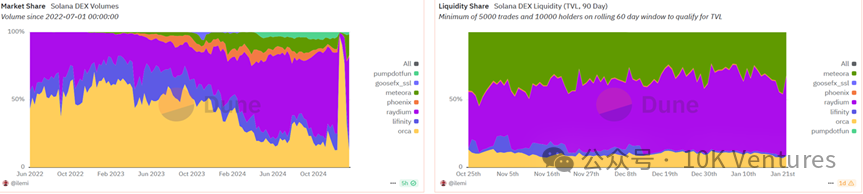

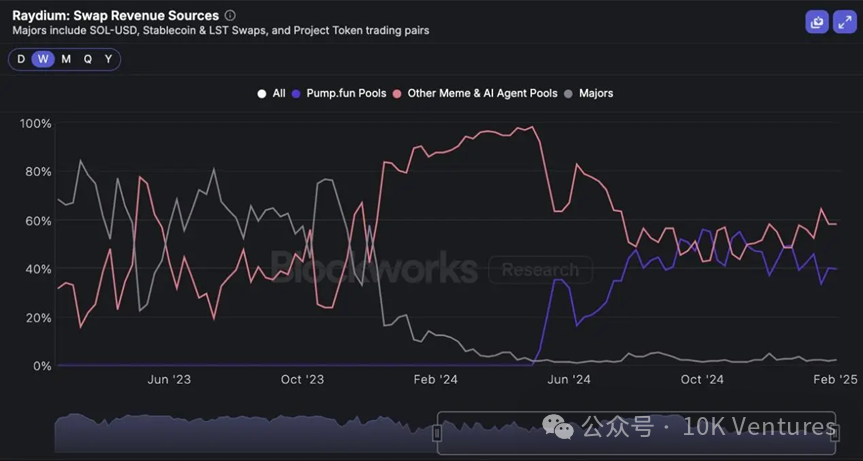

Raydium’s market share may gradually decline as Pump.fun starts to make dex

The original head dex on Solana is Orca, and the Orca trading model is more of the mainstream tokens on Solana, such as Sol/Bome. But since Pumpfun and Raydium were bound, Raydium has become meme’s main battlefield. In addition, it can also be seen that the liquidity on solana is mainly occupied by Raydium/Orca/Meteora.

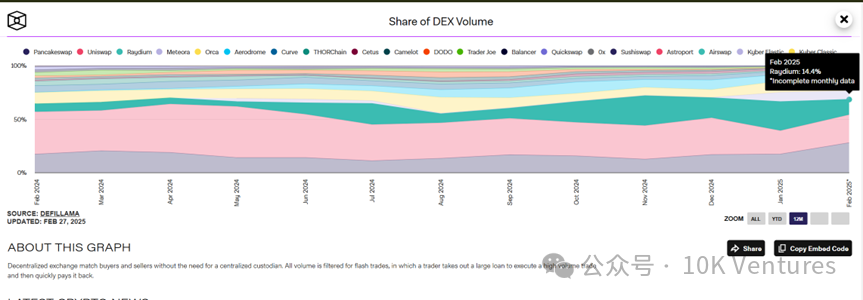

After the internal trading of Pump.fun ends, meme coins will trade in Raydium. In January 2025, the index of dex to cex trading volume reached nearly 20%, breaking through the 15% ceiling we used to call. According to our annual report, what Meme coins are actually grabbing is the market share of mid-tail VC coins. Especially after the Trumps issued meme coins in Solana, the dex market share on Solana further increased. In December 2024, the market share of raydium(solana) vs uni(ethereum) was 19% vs 34%, but on January 20, Raydium’s market share was already equal to Uni, both at 25%. In the recent week of trump trading, Raydium’s market share even exceeded Uni’s.

Raydium received 0.25% per transaction, of which 0.22% belonged to LP and 0.03% was bought back by Ray. Ray has more utility than Uni. Due to regulatory issues, Uni only has governance functions, while Ray can also be used for transaction fee payments and IDO functions, and 12% of the fees incurred by Raydium’s transactions are used to repurchase Ray.

Since April 1 last year, tokens launched from Pump.fun have contributed US$346 billion in transaction volume to Raydium, accounting for half of the total traffic of the DEX. Among the US$197 million in fees collected by the platform, US$104 million came from pump.fun transactions.

Nowadays Pump.fun may test AMM internally, which means Raydium’s uniqueness no longer exists. In fact, we have always wondered why Pumpfun doesn’t do such a profitable business itself and needs to distribute the most profitable profits to Raydium. This is very unreasonable.

JUP+JLP’s Token utility is very good, so it is recommended to continue to pay attention

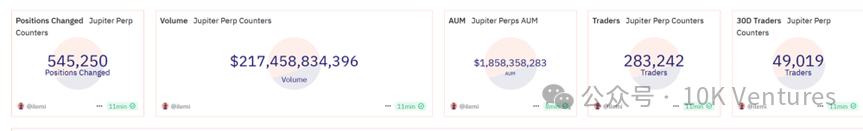

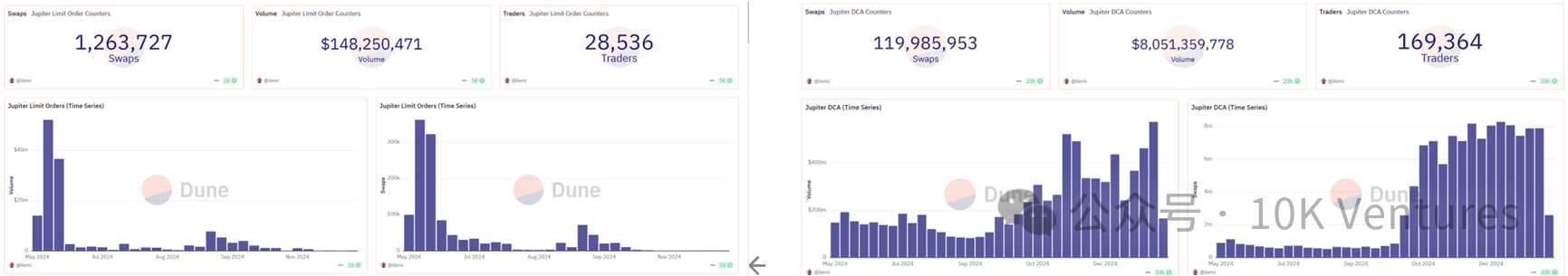

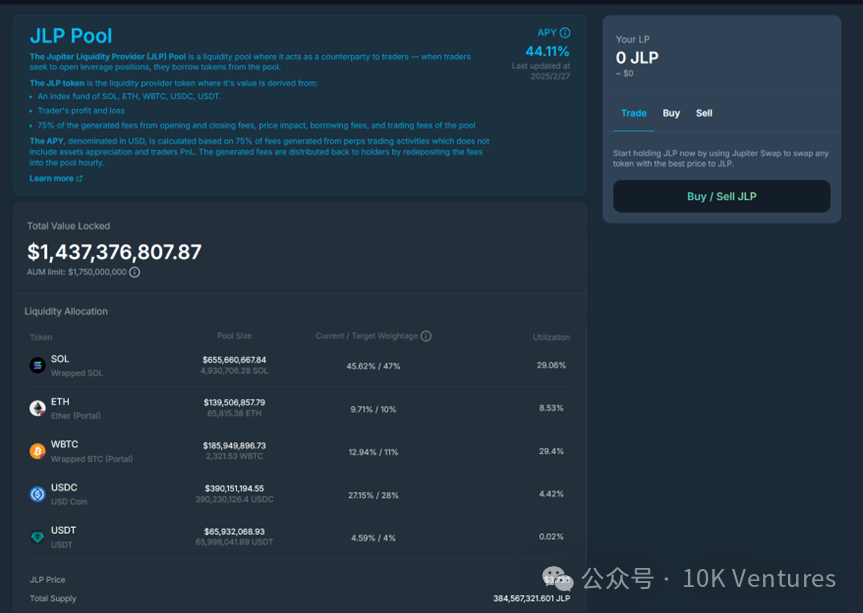

Jupiter is the largest perpdex and spot aggregator on Solana. Jupiter’s core businesses are mainly: 1. dex aggregation; 2. perp dex; 3. DCA;4. Limit orders. Jupiter does not charge users any fees in spot aggregation transactions, but charges a % platform fee in Limit and DCA businesses,It can be seen from the trading volume below that Perp dex trading volume is the main revenue contribution point.In perpetual contracts, Jupiter earns 0.06% of the AUM of users opening and closing positions as a source of revenue, followed by the cost of opening positions. Secondly, Jupiter launched the JLP pool, allowing users to inject liquidity into the pool and become LPs and retail investors to gamble against each other.Part of Jupiter’s trading fees and retail opening fees are deposited into the JLP pool, so the value of the JLP pool is rising. JUP’s token utility is also constantly improving. Currently, 50% of JUP’s agreement fee is used to repurchase JUP, which brings a certain price guarantee to JUP.

JLP can be seen as gambling with retail investors in contracts to earn fees and user profits/losses. According to the law of large numbers, contract exchanges that can still open positions in a negative-sum game will definitely earn forever as long as time goes on. JLP decentralized the original CEX contract office model, allowing retail investors to add liquidity to the pool and bet against other retail investors who play contracts. As long as the time is extended, they will make money. After all, if the time is short, LP will also lose money. There is the possibility of losing money. JLP is actually a good financial management scenario. Excluding the increase in assets in the asset pool (the one-year increase in SOL ETH BTC), the asset appreciation caused by the pool’s handling fees + capital rates + user net losses also reached an annualized 44.11%.

1.2 Will the collapse of Meme bring about a counterattack from VC coins?

Since the end of January 2025, BTC has fluctuated downward from a high of US$110,000. On February 26, it plunged more than 6% in a single day to US$88,189. SOL prices have been under simultaneous pressure, driving Meme coins (such as BONK and WIF) on the Solana chain to drop by more than 30%.

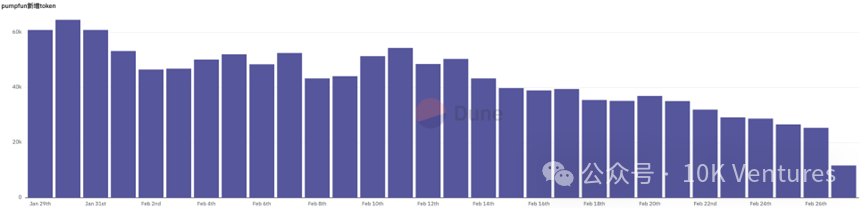

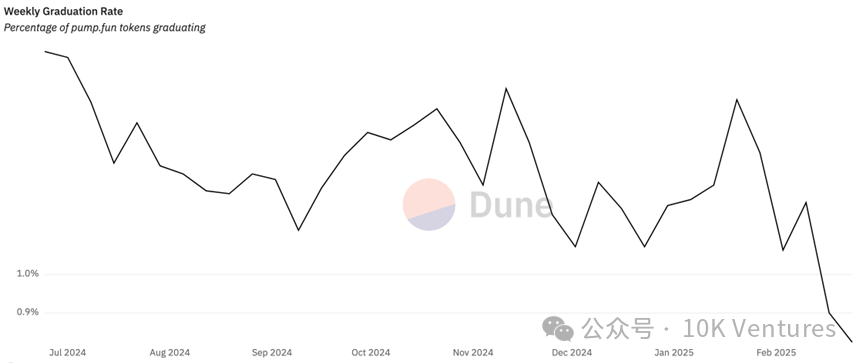

The number of new coins added to pump.fun has dropped from 60,000 to less than 30,000 per day. Partly due to the market’s aesthetic fatigue of the one-click coin issuance model, the proportion of new coins successfully graduating(reaching the liquidity threshold) has dropped from 1.5% to 0.8%, reflecting that the market’s elimination of low-quality projects has accelerated, and only a few projects can survive after speculative funds are withdrawn.

On January 18, the Trump family issued coins (TRUMP, MELANIA), which triggered market revelry and controversy. The opening price of TRUMP coin was US$0.1824, and it rose more than 43860% to US$80 in 48 hours. Celebrity endorsements became the core driving force for the short-term surge in Meme coin.

On February 15, Argentine President Javier Millay publicly supported the Meme coin called $LIBRA on social media, saying it was designed to support small businesses and economic development in Argentina, and attached the token contract address. The price of the token soared to US$4.96 in half an hour, and the market value was once close to US$5 billion. However, due to the team’s large-scale cash-out (approximately US$107 million), the price fell to below US$0.6, causing heavy losses to investors. The incident triggered global doubts about political Meme coins, and the market was worried that celebrities would abuse their influence to harvest retail investors under the regulatory gap.

Many leading Meme tokens that once dominated hot spots have fallen sharply from historical highs, with a general decline of more than 80%.

AI 16Z (AI Agent leader): plunged from US$2.49 to US$0.34 (-86%), mainly due to the decline in market popularity for AI Agent narratives.

AIXBT (Cryptographic Intelligence Platform): From US$1.06 to US$0.21 (-80%). Despite the support of giant whale positions, the sector correction combined with shrinking liquidity put pressure on prices.

SWARMS (Decentralized AI Network): A drop of 90%(US$0.63 0.06), reflecting the market’s abandonment of AI concept tokens that lack practical use cases.

Trump Family Coins (TRUMP, MELANIA): TRUMP fell from US$85 to US$13 (-85%), and Melania fell by 95%(US$180.86), mainly due to regulatory doubts and the bursting of the bubble after traffic was dispersed.

Early hot spots such as AI Agents have entered a squatting period. Most leading tokens rely on traffic hype and lack technical support. Once the popularity of the community declines, they will face the risk of collapse. This round of plunging confirms the fierce nature of Meme coins, and investors need to be wary of narrative tokens with no real value.Quit when you are good, play with the new rather than the old, and have no faith is the essence of Meme coins on the chain.

There is a view that since pumpfun became popular, there have been no new track innovations in this industry.In the past two years, fewer and fewer founders have told the world that I am using blockchain to change the world, and more and more founders have admitted that this track is a big casino. Maybe the end result of inventing a new track and developing a new CA is the same. They are both painting a Christmas tree, but the Christmas tree on the new track will be smoother, and the Christmas tree on the CA will be quickly pulled up and smashed. Three years ago, the team invented a new track and told a new narrative. It’s different now. Now you just need to issue a new CA.

But now that pumpfun’s traffic and hotspots seem to have ended, can this give the team that really does something a chance? Let us wait and see.

02 New Chain War is starting

2.1 Berachain

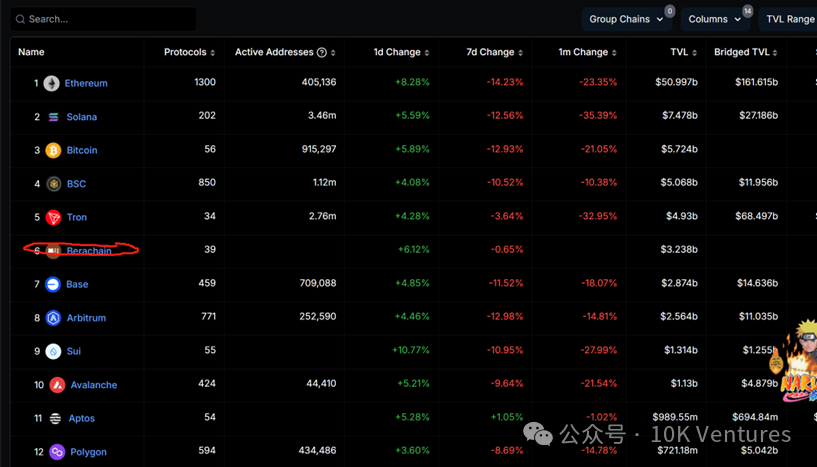

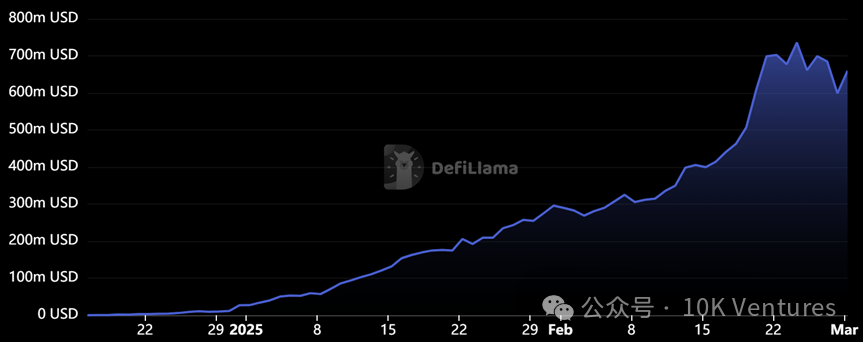

Berachain is the fastest-growing public chain in TVL recently. TVL has grown rapidly from the initial US$500 million to the current US$3.2 billion, thanks to the unique POL (proof of liquidity) consensus.

POL mainly involves three tokens:

1. Bera, native gas token,gas fee token and stake token

2. BGT, governance token, is a SBT+ reward token that can be turned into Bera in one direction (bera cannot be turned into BGT). After participating in Berachain’s defi, users receive BGT rewards, and then users can choose whether to become Bera.

3. Honey, stablecoin. You can deposit collateral in the vault to make Honey, BGT hodler to manage the vault.

POL is different from POW/POS/POH in that it rewards the contribution of defi liquidity provider purely, which rewards more users participating in the system. POL can bring very strong ecological growth to the early stage of the project.But this is also a double-edged sword. The inflation rate of BGT in the first year will be 10% of total supply, which will bring 50 million BGT to the market. Considering that all BGTs will be circulated to the market, adding the current circulation volume of 107 million Bera will bring up to nearly 50% additional circulation to the market.Since BGT is in the hands of large DeFi participants (e.g., early teams, key partners) and there is very little BGT in the hands of individual investors, it is not groundless that large companies will bring potentially serious selling pressure. Berachain co-founder DevBear sells tokens at a real-name address.He received about 200,000 BERA from the airdrop (which in itself was unreasonable because the airdrop rules were made by them), and then he exchanged some of the tokens for assets such as WBTC, ETH, BYUSD.

Therefore, we will not be too aggressive in predicting Bera’s price, but we are optimistic about the rapid growth its POL will bring to the ecology.

If Bera is led by KOL and big households, it may become a classic Christmas tree + script to see who runs faster.

2.2 Sonic

Another public chain ecosystem worthy of attention is Sonic. Sonic’s TVL soared eightfold in a month, bucking the trend despite the sluggish market. The APRs of major DeFi mining pools remain high, forming a dual cycle of currency price and APRs.

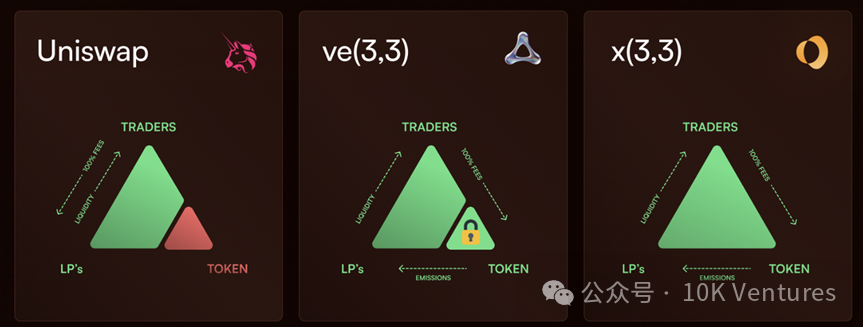

Soinc was once a public chain Fantom. In the previous cycle, it used DeFi projects such as SpookySwap, Beefy Finance, and Scream brought by Andre Cronje to ignite the market’s attention to Fantom’s ecosystem. At the same time, Andre Cronje also became a manifestation of Fantom’s public chain IP and influence. With AC returning to Sonic, what is different from four years ago is that AC has brought a new gameplay: x(3,3).

x(3,3) is vividly reflected in ShadowExchange, and users can pledge SHADOW to obtain xSHADOW. However, the user’s redemption share will change over time. If you unlock it within 15 days, you will need to redeem it for a discount, and it will be fully redeemed at 1:1 after 60 days. The degree of discount decreases linearly during this period.

Since immediate withdrawal requires a 50% discount, part of the discounted income is shared by the remaining pledgers. Such a model allows long-term pledgers to obtain:100% agreement fees, voting incentives and remaining exit incentives.The x(3,3) model not only attracts the capital of long-term pledgers, but also solves the exit problem of ve(3,3).

After DeFi led the money back, Sonic also started meme marketing. Although AC himself bluntly stated that he did not have a favorable impression of meme, he still held the meme competition. For example, community mascots GOGLZ, TinHatCat and AC’s cat have all experienced explosive currency price growth with Sonic’s prosperity. However, unlike the memecoin in Solana and Base ecosystems, the memecoin Sonic relies more on ecological subsidies and competition marketing, and does not have a general market consensus. We believe that Sonic meme is just a short-term speculative target.

At the same time, NFT in the Soinic ecosystem has also brought significant wealth effects. The core NFT in Sonic’s ecosystem is Derp, which has a strong consensus among the Soinc team. AC also replaced its FateAdventure avatar with Derp. 10K was concerned when the Derp floor price was 600S, and as of February 28, it had skyrocketed to 2300S.

In addition, Game is also a key focus of Soinc’s ecosystem. Its representative projects are Fate Adventure, Sacra, and EstforKingdom. Its related tokens $FA,$SACRA, and $BRUSH all increased significantly to varying degrees.

Sonic’s public chain relies on DeFi to attract TVLs and has complete ecological applications. Token S is a good target. After the market correction, the market value has dropped to around 2.3 billion yuan, and it is still worth opening a position. Assets in Soinc’s ecosystem are DeFi:Shadow, NFT:Derp, Meme:GOGLZ, and Game:FA.

2.3 Sahara

Sahara AI is our first round of investment in the ai x crypto project in 2023. Sahara is building a platform where anyone can monetize AI models, datasets, and applications in a collaborative space. Users can manually train models without permissions, provide training data, and use codeless tools to create customized AI models.

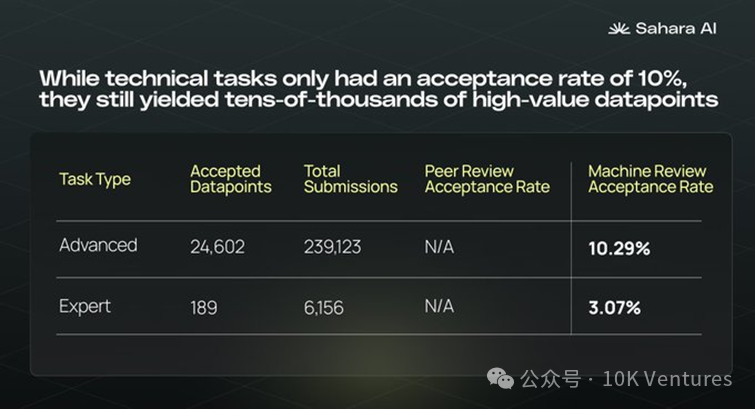

Recently, Sahara has some interesting business data to share. In the past, we would charge whether the quality of the data generated by decentralized data annotations could meet the data needs of large models. From data from Sahara Test season1, we see that although the acceptance rate for advanced tasks is only 10%, they still generate more than 24000 high-value data points that are critical to testing the safety and robustness of AI models. Low acceptance rates for these tasks indicate the difficulty of planning high-quality, domain-specific data sets. These tasks require contributors to generate marginal adversarial inputs designed to test the boundaries of the LLM. Overall, Sahara improves data quality through measures such as automated inspection and marking of low-quality submissions, decentralized peer reviews, machine reviews of complex binary characters, and ultimately Human QA reviews. Subsequently, Sahara will launch Test Season 2 to continue to expand the content of data annotation.

In addition, Sahara released the Sahara Incubator Program.The program aims to discover and support the world’s most promising AI x Web3 innovation projects, provide selected teams with all-round resource support, including in-depth technical guidance, ecological integration and financing acceleration services, and help the long-term development of AI-native projects. Sahara AI As a pioneer in the intersection of Web3 and AI, it is committed to building an AI blockchain platform for a collaborative economy and has long focused on the research and development of AI infrastructure and intelligent applications. And promote decentralized innovation in AI through blockchain technology.

The incubator plan will focus on the two major tracks: AI infra and AI application, and teams with MVP maturity and above are welcome to participate. Successfully selected projects will have the opportunity to fully access the Sahara AI ecosystem, receive exclusive technical support and market expansion resources, and will also provide investment opportunities to help the team connect with the investment network and jointly create the next generation AI x Web3 products.

03 Guidance for subsequent primary market

-

The only consensus reached at the Hong Kong Consensus Conference was the need to invest in projects with business models. The most different feature of this cycle from the previous one is that projects have emerged. In addition to selling coins, stable business models have emerged. Currently, it seems that transaction-related (cex/dex, lending, perp, brokerage, wallet), asset management (earning volatility), stablecoins (trading chips + cross-border payments), and new public chains (new casinos, also transaction-related) are evergreen trees of blockchain. These tracks all show strong revenue growth in 2024. We won’t go into details here on the income situation of cutting-edge companies such as Pump.fun/Ethena, but non-giant startups such as Solv (Bitcoin Asset Management), Particle (dex), and Moonshot (Broker) can also achieve a year’s revenue of US$10 million +, which has begun to prove the revenue ability of currency companies.

-

“As the business competition cycle in the currency circle lengthens, the requirements for entrepreneurs will also become higher. Now, foresight alone is not enough. We must also have leadership, continue to make correct decisions over a long period of time, and be able to build efficient organizations.

-

Returning to People game, people first, we should amplify the weight of people and focus on three things: whether making the right decision at a critical moment is the result of luck or thinking, whether we can be good at building an efficient organization and the tenacity to rise from the bottom.

-

Make anti-common sense decisions, find excellent founders who are anti-common sense, and stay away from accumulated projects. Cycle shocks are fatal to unstable team organizations.

-

Product experience comes first, and then think about what tracks and products will be needed by the blockchain industry in 5 years.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern