The growing stablecoin market will attract more developers and builders, making it possible to generate new DeFi primitives from the ecosystem.

Author: Poopman, IOSG

Compiled by: Shenchao TechFlow

The author of this article is a cryptocurrency enthusiast who also got lucky with Memecoins and is now exploring legal investment opportunities in 2025, so I can explain to my dad that I am in a serious business.

Things I will mention in the article:

Cryptocurrency market in 2024;

What comes after Memecoin;

If the market remains bearish, things I will focus on;

2024, the year of Bitcoin and Solana

2024 will be a cruel year unless you are a BTC super player or trench warrior. Venture capital, liquidity, diamond hands and true believers have all been destroyed, and when artificial intelligence explodes, the future of cryptocurrencies looks even dimmer.

BTC hits $100,000, ETFs are approved, BTC dominance reaches 60%, and TradFi adoption accelerates. 2024 is indeed the year of BTC.

Solana,A tokenized platform. At its peak, SOL’s daily trading volume was US$36 billion, accounting for approximately 10% of the Nasdaq’s average daily trading volume, which is huge for cryptocurrencies. Memecoin / AI coins make this possible.

HyperliquidIt is a BBH (Big Black Horse) in this market. They rejected venture capital, a bold move, and the approach they adopted after the airdrop demonstrated the strong need for non-KYC permanent trading and thick platform liquidity.

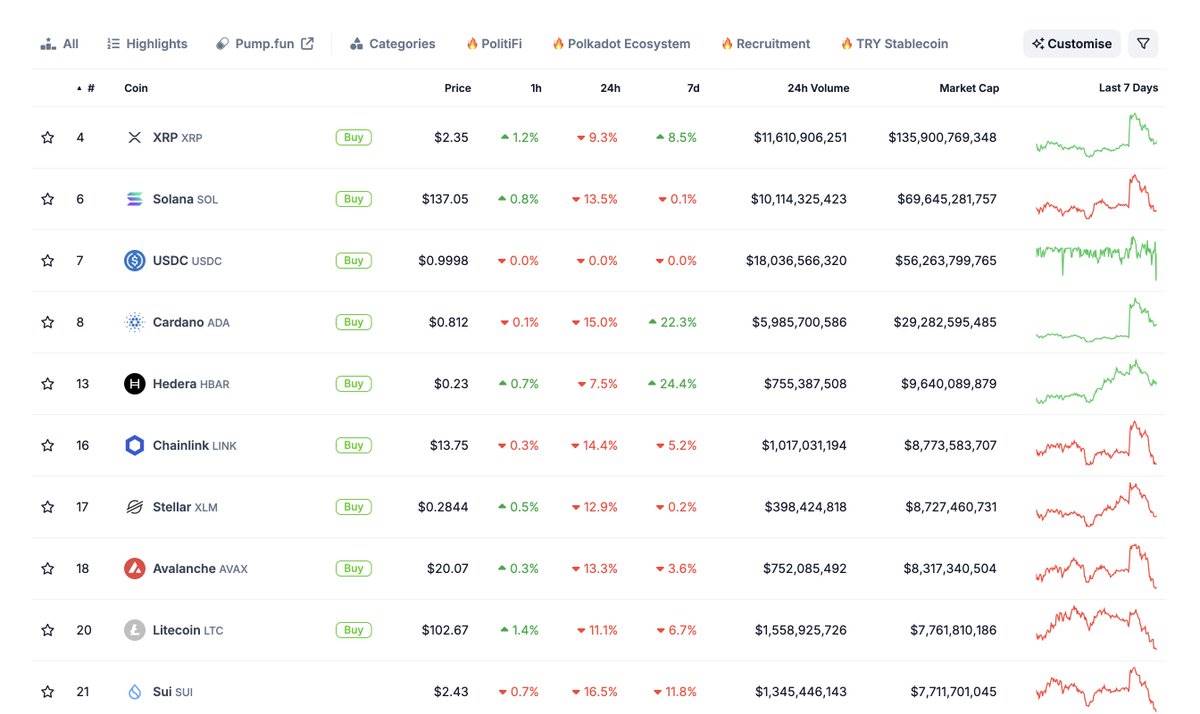

XRP, ADA, any Dino coins. Well, Uber drivers and the U.S. government seem to like them, so I’ll give them these.

Other than that, I don’t recall any pumps on the market that can last longer than two weeks.

2025, from casinos to the new DeFi + U.S. cryptocurrency

After TRUMP fell, I found that market profits did not flow back into AI tokens. So I converted all assets except some SOL positions into stable assets (which seems a bit silly now).

It is becoming increasingly clear that after months of PVP, people are tired of Memecoin and AI virtualization software.

The entire field of artificial intelligence has been destroyed, with most tokens down 70-80% from their peak.

The incident of $LIBRA actually determined the fate of the story.

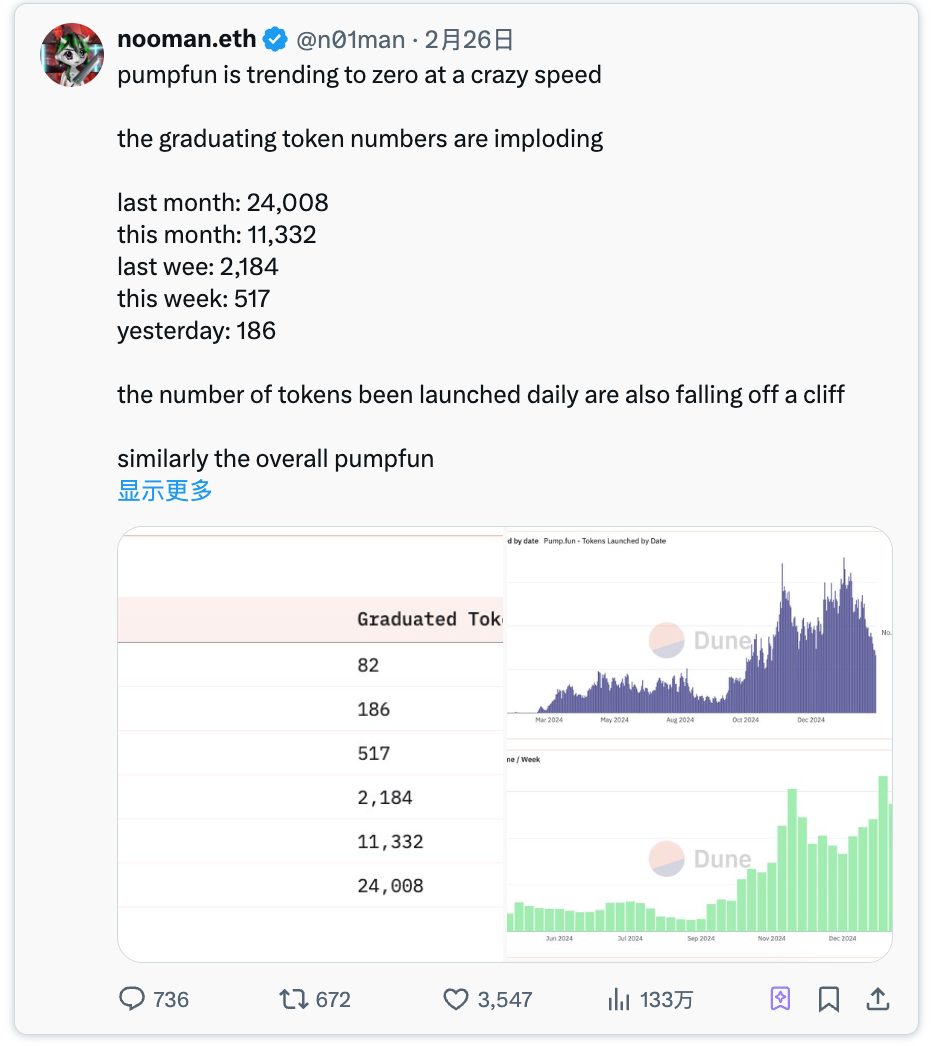

Simply put, Pumpfun is going to zero.

so MemeWhere did all the coin money go?

Due to the lack of a foreseeable catalyst, the wealth effect of Memecoin is fading, creating a vicious cycle that causes players to stay away from Memecoin.

At the same time, in today’s crypto market:

-

Lack of breakthrough innovation in the encryption field

-

Existing altcoins continue to stagnate, ETH is in trouble

-

Fundamentals suddenly become less important

-

The old version of Memecoin has disappeared

-

Newly listed tokens have a low survival rate, with only a few tokens lasting more than 2 weeks.

That sounds very pessimistic.

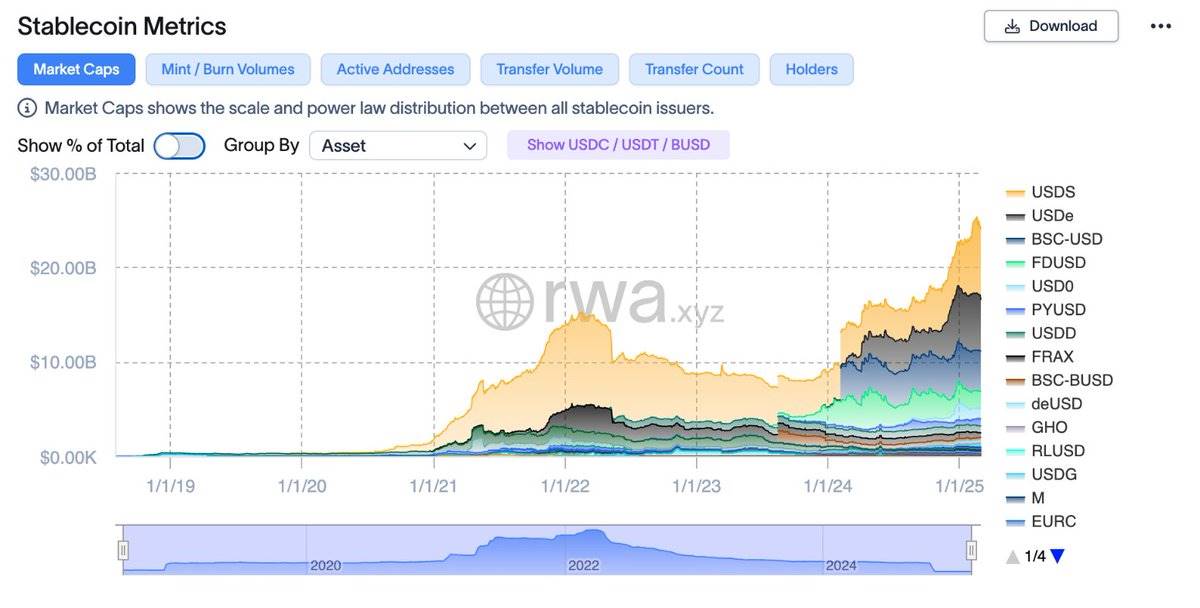

In this calm situation, I think investors will prefer safe-haven investments, which is why I believe that by 2025 most of the money will flow into fiat currency-backed stablecoins.

Some of them hope to use their assets to earn some passive gains.

Therefore, stability that generates revenue, such as USDe or USDS, is very attractive to them.

stablecoinsIt’s the new oil.

https://app.rwa.xyz/stablecoins

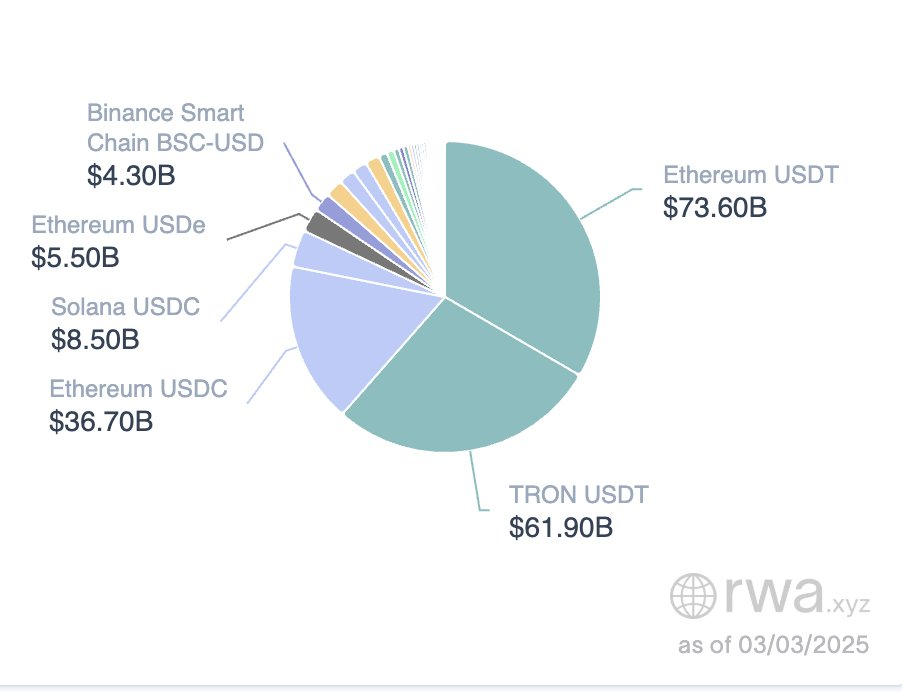

Although the artificial intelligence and Meme markets are being hit hard, stablecoin TVL is still growing steadily, with a month-on-month increase of 3% and exceeding US$220 billion as of this writing.

Someone who wants to be safe and reliable. They chose legally backed stablecoins. USDT and USDC maintain 90% market dominance, thanks almost to their widespread adoption on different exchanges and payment platforms.

People who want to use stablecoins will choose revenue-generating/decentralized stablecoins. For example, USDe, USDS, DAI and USD0. So far, the industry has only had a 10% share, but they have actually had an amazing year, with total TVL growing by more than 70%.

Okay, I’ll cut the crap. The current situation is:

90% of fiat currencies support stablecoins

10% stable yield

I believe there is still room for development in the new stablecoin (earnings) because:

1/Low-volatility options with yields are always attractive to cryptocurrency enthusiasts.

2/New stability mechanisms and capital efficiency strategies can be innovated to increase yields.

3/stablecoins have found PMF in cryptocurrencies, which can be used both as currency and as investment tools.

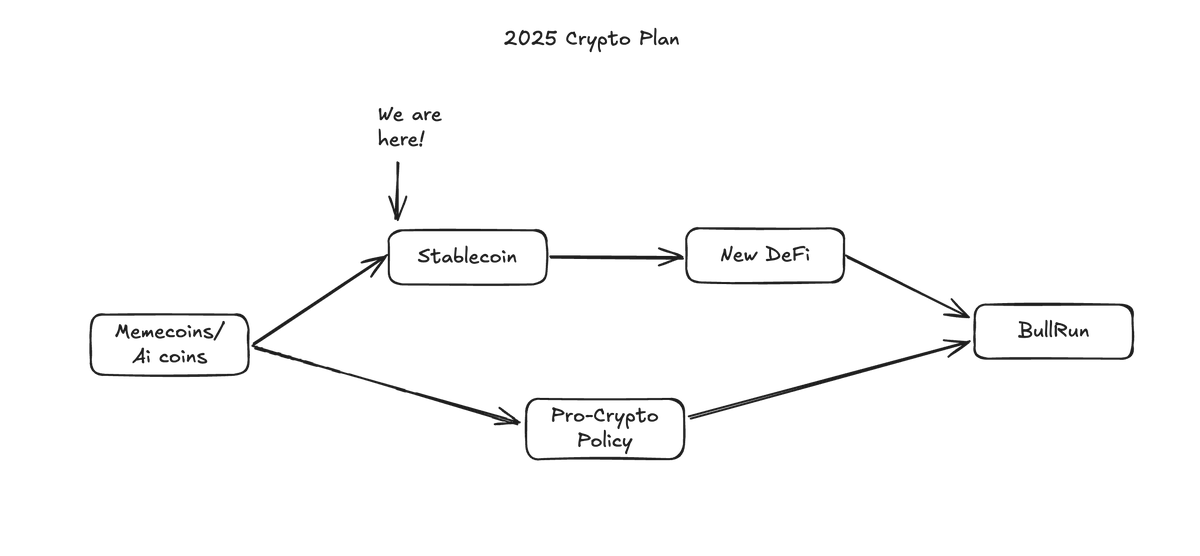

This is the prototype of my 2025 encryption plan.

My 2025 bearish cryptocurrency plan

If there is no innovation/narrative in 2025, I believe the market will go in two directions:

-

Growing stablecoin market drives DeFi innovation

-

Support encryption policies and vigorously promote encryption technology made in the United States.

1. stablecoins and new DeFi innovations

Over the next 3-6 months, more and more stablecoins will emerge as dollar-based tokenization strategies designed to generate competitive returns using different types of collateral or strategies.

Given their composability and stable price stability, they can easily work with different defi agreements and create synergies with each other. Existing DeFi integration examples include:

-

Interest rate swaps related products such as@pendle_fi ,@spectra_finance Is a great design that allows users to speculate on asset returns, effectively creating new markets for YG assets (including stablecoins).

-

money market@MorphoLabs,@0xfluid These can achieve leveraged income farming and bring significant contributions to economic activities to stablecoins.

-

Dex is similar@CurveFinanceIt also provides a good place to guide stable liquidity.

Among them, my favorite innovations are those that create new asset classes, such as pendant’s YT-USDe, which creates a new market on top of Lego and provides an additional layer of revenue for stable earners.

In addition to revenue optimization, I would also like to see some innovations in CDP design, especially ideas that can get rid of excessive collateral and minimize liquidation risks, which can make decentralization stable again.

After all, I expect to see more innovation emerging in the growing stablecoin market, because this is where more and more money will flow in.

2. Policies that support encryption have promoted the development of encryption in the United States.

Recently, Trump announced an attempt to promote the crypto strategic reserve program, which includes a basket of American-made currencies, such as SOL, XRP, etc.

Although there is still uncertainty about whether crypto reserves will be approved by the government, Trump’s impact on the crypto market cannot be ignored.

Some examples of Trump’s pro-cryptocurrency stance include:

-

Gary Gensler was fired the first day.

-

Retain all BTC seized by the United States to build a national strategic BTC reserve (such as the Silk Road BTC is an example)

-

Launched the WiFi DeFi Fund and launched TRUMP, which is very suitable for encryption.

-

SEC withdraws charges against exchanges and cryptocurrency projects such as Coinbase,Uniswap Kraken

In addition, the Trump team may cultivate the domestic cryptocurrency industry. As a result, we can expect more positive regulation against a basket of U.S. currencies or the cabal.

NFA, but I will pay close attention to these tokens because Trump has a lot of influence.

summary

As mentioned earlier, this is just a brainstorming and intuitive topic. None of these views is supported by statistics. So please don’t think of it as an alpha.

Anyway, here is a summary for those who are too lazy to read:

-

Given the lack of cryptocurrency innovation and market enthusiasm, if the market remains bearish in 2025, I expect demand for stablecoins to increase.

-

Assuming investors want to put their stablecoin into use, I estimate that in the long run, revenue-producing stablecoin products can account for 20-30% of the entire stablecoin market (e.g. stETH)

-

This growing stablecoin market will attract more developers and builders, making it possible to generate new DeFi primitives from the ecosystem.

-

In the long run, Trump’s pro-crypto policies will benefit the cryptocurrency industry.

-

In addition, his policies may be conducive to the development of domestic cryptocurrencies.

Therefore, it makes sense to monitor crypto tokens in the United States, because some news can already push tokens to a climax.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern