Written by: Jialiu, BlockBeats; Sego, encryption enthusiast

Speculate money in a bull market, do research in a bear market.

This cycle is all cursing VC coins, so do you know which VC invested in a project with the highest coin issuance rate? Who has the highest deposit rate on trading platforms? If you don’t buy VC coins, will you do it? Which institutions are worthy of long-term follow-up?

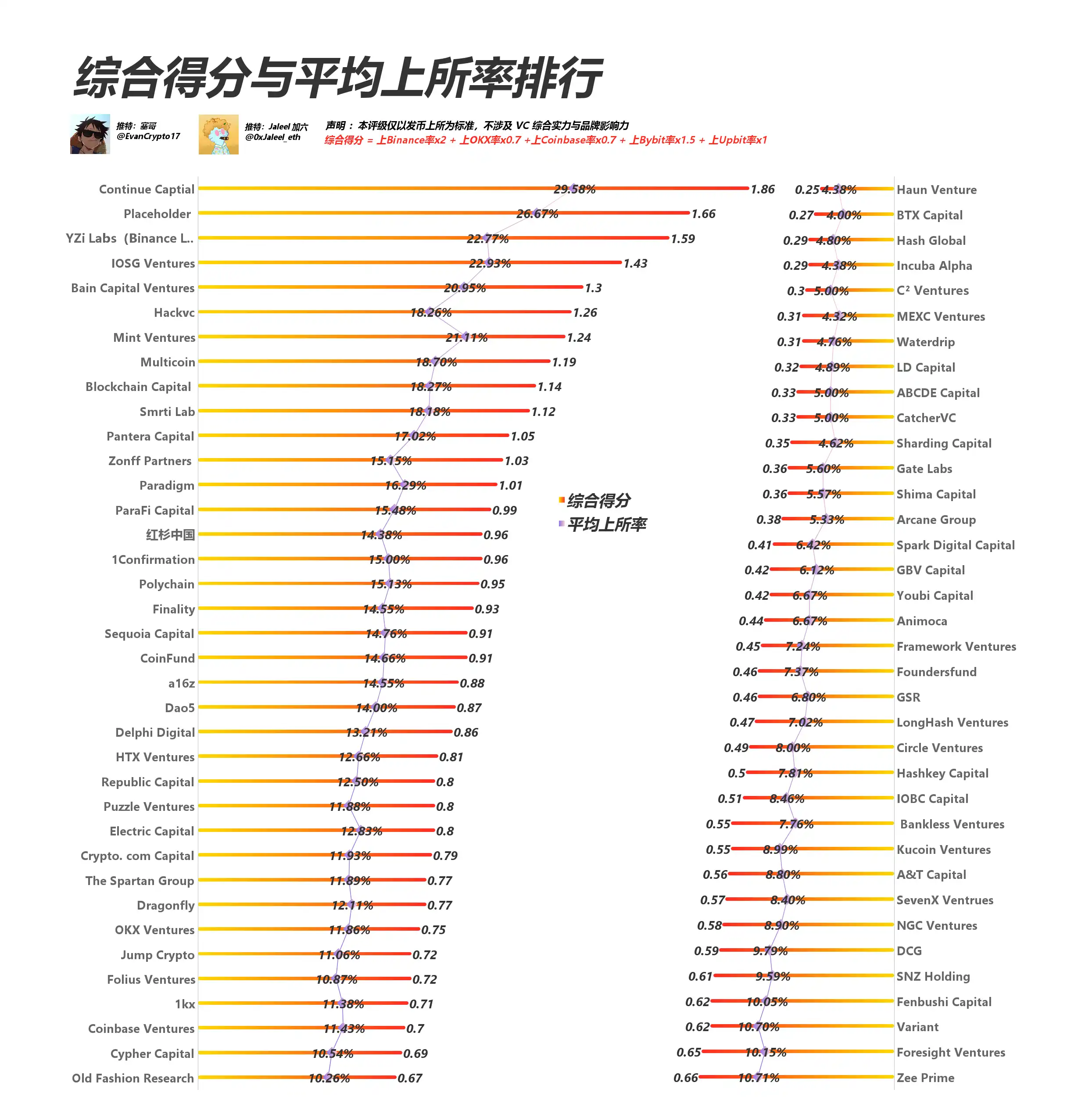

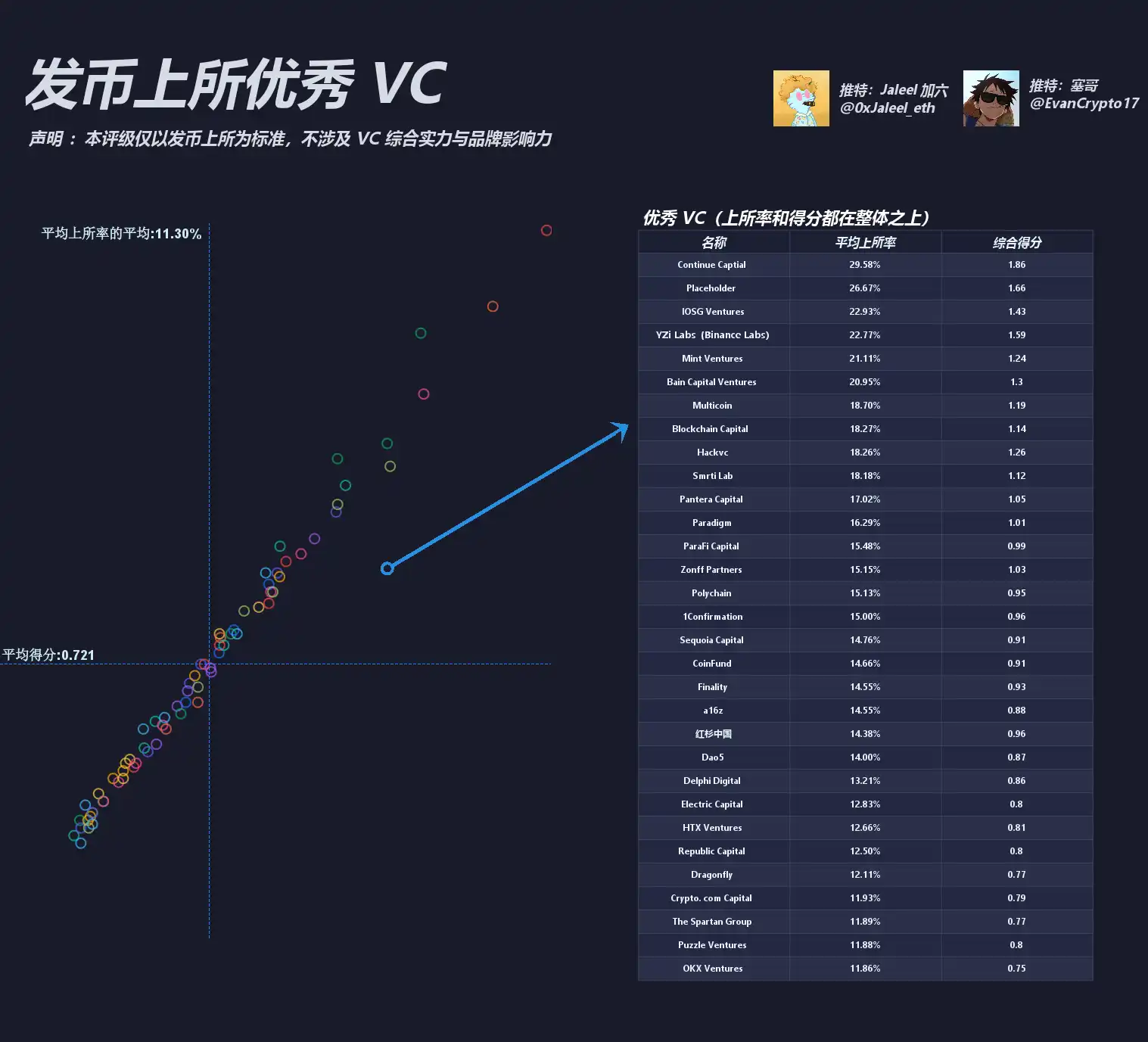

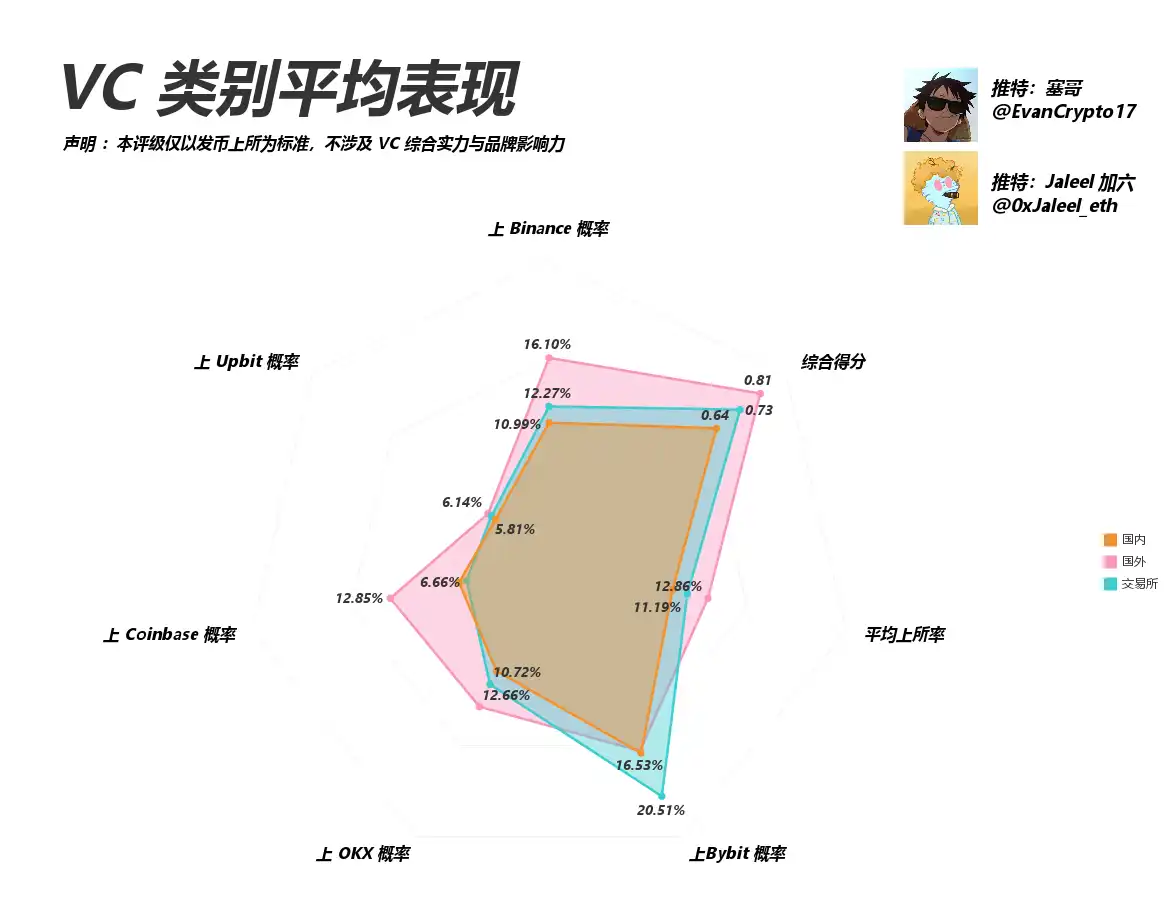

On the basis of continuing the core indicator of “investment project listing efficiency”, we have selected a total of 73 VCs, including 35 domestic VCs, 30 foreign VCs, and 8 trading platform VCs. Statistics were made on the number of coins issued by the projects they invested in, as well as the number and probability of listings on the five major trading platforms: Binance, Bybit, Upbit, Okx and Coinbase. For example, Binance rate on a project = number of Binance on a project/total number of investments. And we introduced trading platform weight parameters that are closer to the current market landscape: Binance2, Bybit 1.5, Upbit 1, Okx & Coinbase 0.7, and finally visualized them with the most hardcore and intuitive charts to break down the performance of crypto VC from this perspective.

It should be reminded that this report still focuses on the dimension of “online trading platform for investment projects” and does not provide a complete evaluation of VC’s comprehensive strength and long-term brand influence. It is for reference only.

Let’s talk about the conclusion first

Based on the listing results of previous investment projects of each VC, and combined with the five weights of “BN, Bybit, Upbit, OKX, and Coinbase”, the recalculated ranking results show several key changes:

T0 level: Continue Capital, Placeholder, YZi Labs (Binance Labs), IOSG Ventures, etc. are still at the top, but there is a certain divergence in rankings and scores in terms of the difference between “Go to Bybit” or “Go to Upbit”.

T1/T2: Bain Capital Ventures, Mint Ventures, Hackvc, etc. have successively entered the high-scoring matrix;Polychain, Multicoin, Paradigm, Zonff Partners, etc. still maintained stable performance.

T3/T4: VCs that have previously focused on GameFi or specific tracks, such as OKX Ventures, SNZ Holding, The Spartan Group, Animoca, and NGC Ventures, have also fluctuated in this ranking.

T5: Funds with relatively small size or more localized layout score slightly lower in terms of global currency efficiency, but the possibility of subsequent outbreaks is not ruled out.

At the same time, it should be noted that projects that are newly launched or have not yet been issued are not counted. Therefore, if a VC focuses on earlier fields such as seed rounds and research institutes, its potential has not yet been fully converted into the listing indicators.

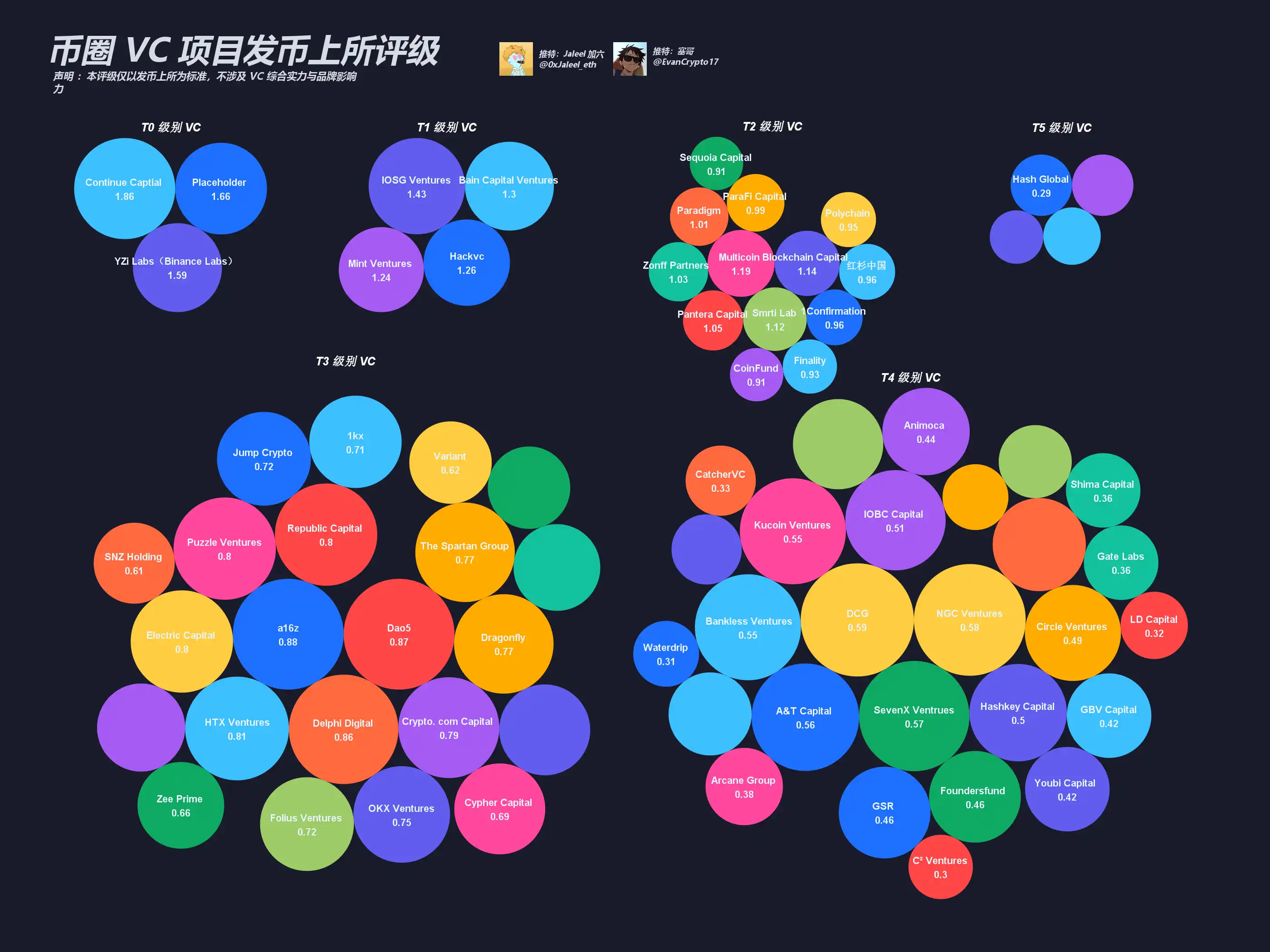

T0: Comprehensive score 1.5

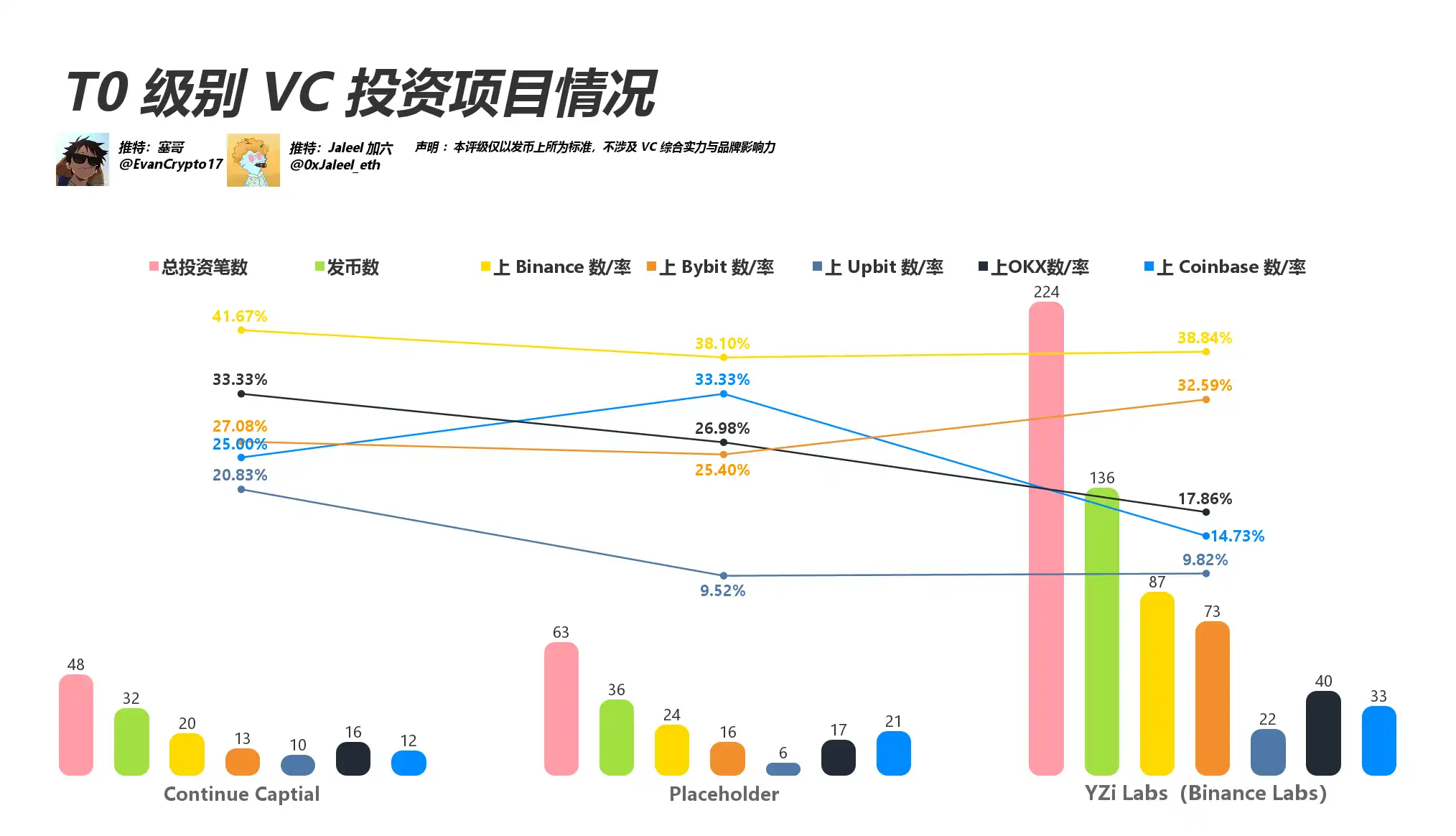

Key institutions: Continue Capital;YZi Labs (Binance Labs);IOSG Ventures;Placeholder. It can be seen from the chart that these four companies have obvious “multi-platform and multi-track” characteristics:

Continue Capital: The number of investments is relatively small, but the ROI and deposit rate are quite outstanding. It is worthy of being a horse. Continue Capital’s ratio in “Upper BN” continues to remain high, while “Upper Bybit” also performs well.

YZi Labs (former Binance Labs): Needless to say, although CZ recently stated that 80% of YZi Labs ‘investment is a loss, this data statistics show that YZi Labs has the largest overall investment amount, and the volume of projects it has issued is also very large, occupying a unique “home” channel.

Placeholder: The number of projects is not too large and it is not high-profile in the industry, but the projects invested in are still relatively “precise”. Many investments are concentrated on infrastructure tracks. After issuing coins, they can land on multiple head trading platforms faster, and the comprehensive score remains at the T0 level. On the other hand, Placeholder partner Chris Burniske recently expressed his views on the market,”I still believe that this is a correction in the mid-term bull market and the peak of the cycle has not yet arrived. Even if Bitcoin continues to pull back, it will not change my view. It is not a good idea to waver and sell at this time. The sell-off at this moment will go short when it goes up.”

Summary: The T0 level relies on hard-core resources and accurate capture of high-quality projects; among them, some VCs with “trading platform background” can even lead the project to “get to the office quickly”, while pure research VCs rely on investment research capabilities. Climb to the top.

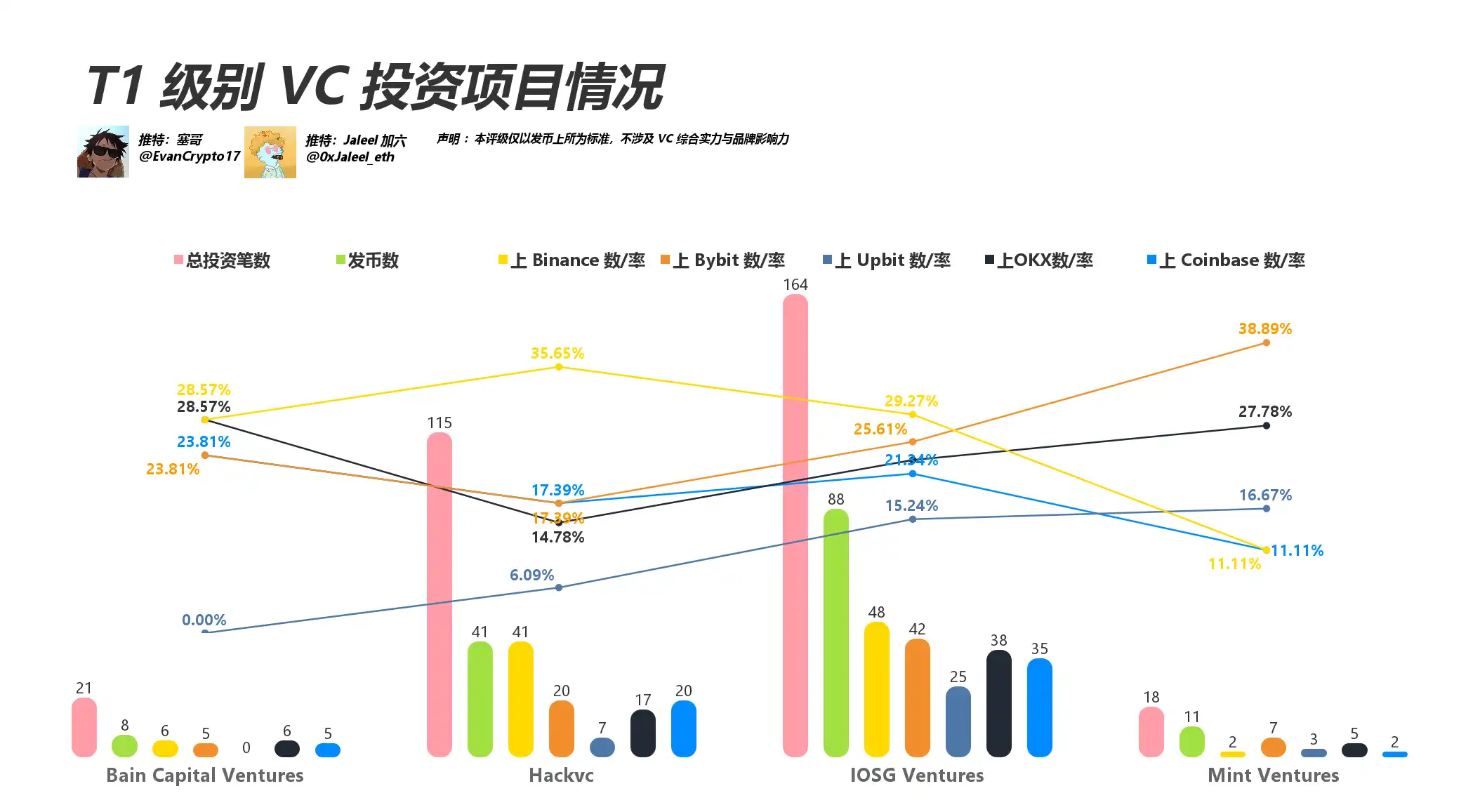

T1: Comprehensive score = 1.2

Representative institutions: Bain Capital Ventures;HackVC;Mint Ventures; In the new chart, T1 level VCs also have obvious strength convergence:

Bain Capital Crypto: Steady sales, large amounts, and deeper individual projects. The control over “Upbit, Bybit” is getting stronger and stronger.

HackVC: The number of investments is large and scattered. As the market share of Bybit, OKX, and Coinbase rises, the number of successful online betting projects in the past is also increasing;

IOSG Ventures: It has always been known for its “wide-ranging net and in-depth research.” The success rate of listing fluctuates between 20 and 30%. In the past year, the number of listings on Upbit, Bybit and other platforms has increased significantly.

Mint Ventures: The project is small in size but outstanding in efficiency. It once reached 30%+ in the “Bybit” dimension, which is a typical example of “specialized strategy.”

Summary: The listing success rate of most projects in the T1 camp is in the range of 15 – 30%, and there are often no serious “shortcomings” trading platforms, which are in the state of “blooming everywhere”.

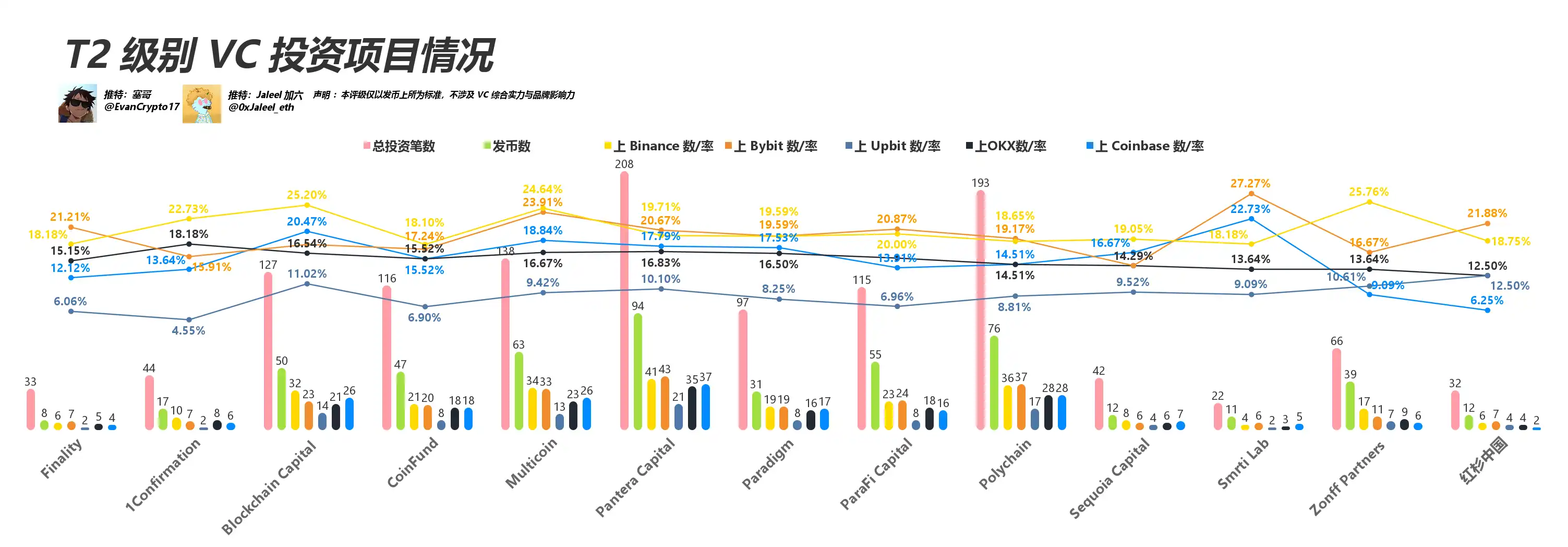

T2: Comprehensive score = 0.9

Multicoin and Pantera: Maintain excellent results of 20%+ in Binan and Bybit respectively. There are also a certain number of Upbit, OKX, and Coinbase, but the difference is not large.

ParaFi: The number of projects is moderate and has been deeply involved in investing in early Ethereum projects. For example, the most famous CouncilSys also participated in many early DeFi projects Aave; in this statistics, their performance in the “Upbit” link is slightly lower, but their access to OKX and Binance remain at around 15 – 20%.

Sequoia Capital: Traditional top-level VCs usually adopt a “few but more” strategy. There are not many investments in statistics, but the success rate of issuance projects when they are launched in mainstream companies is good.

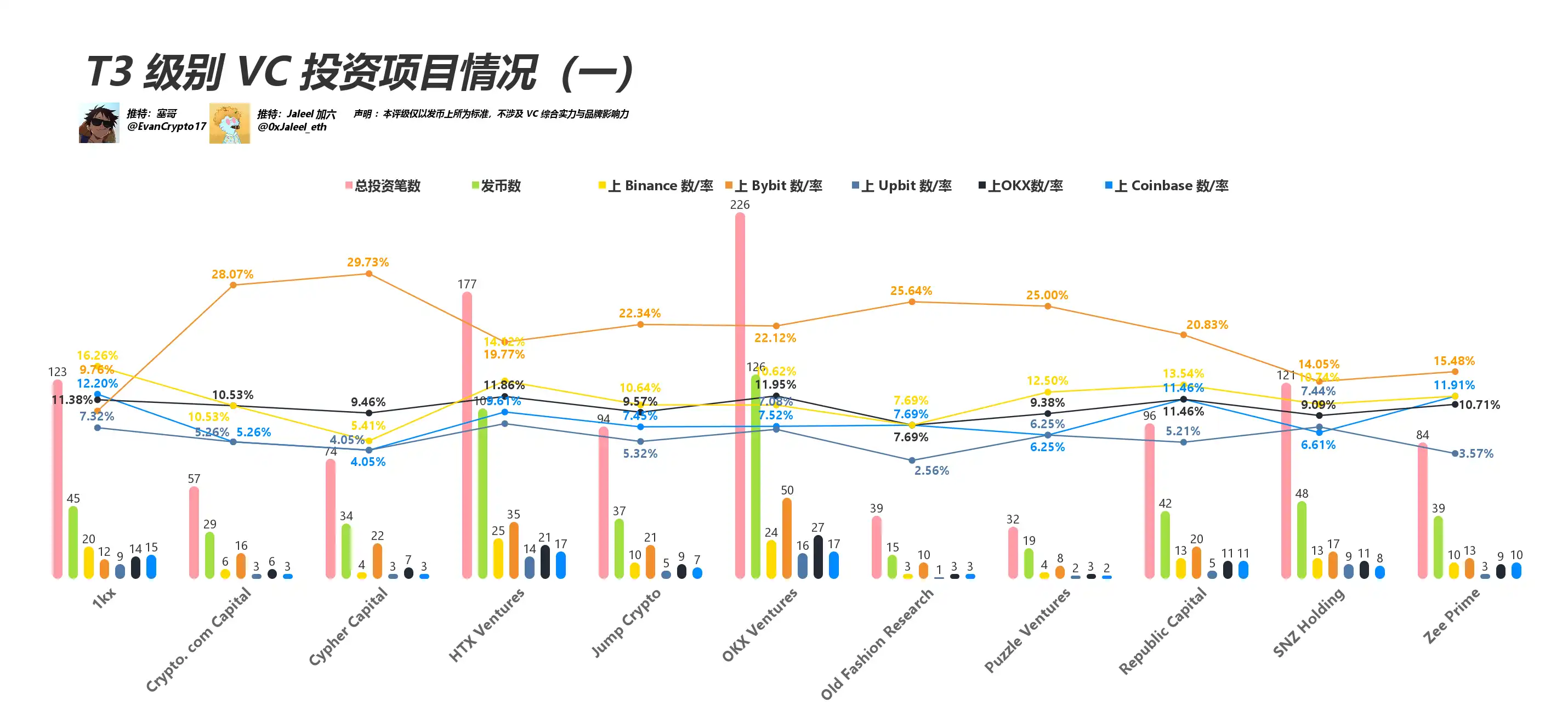

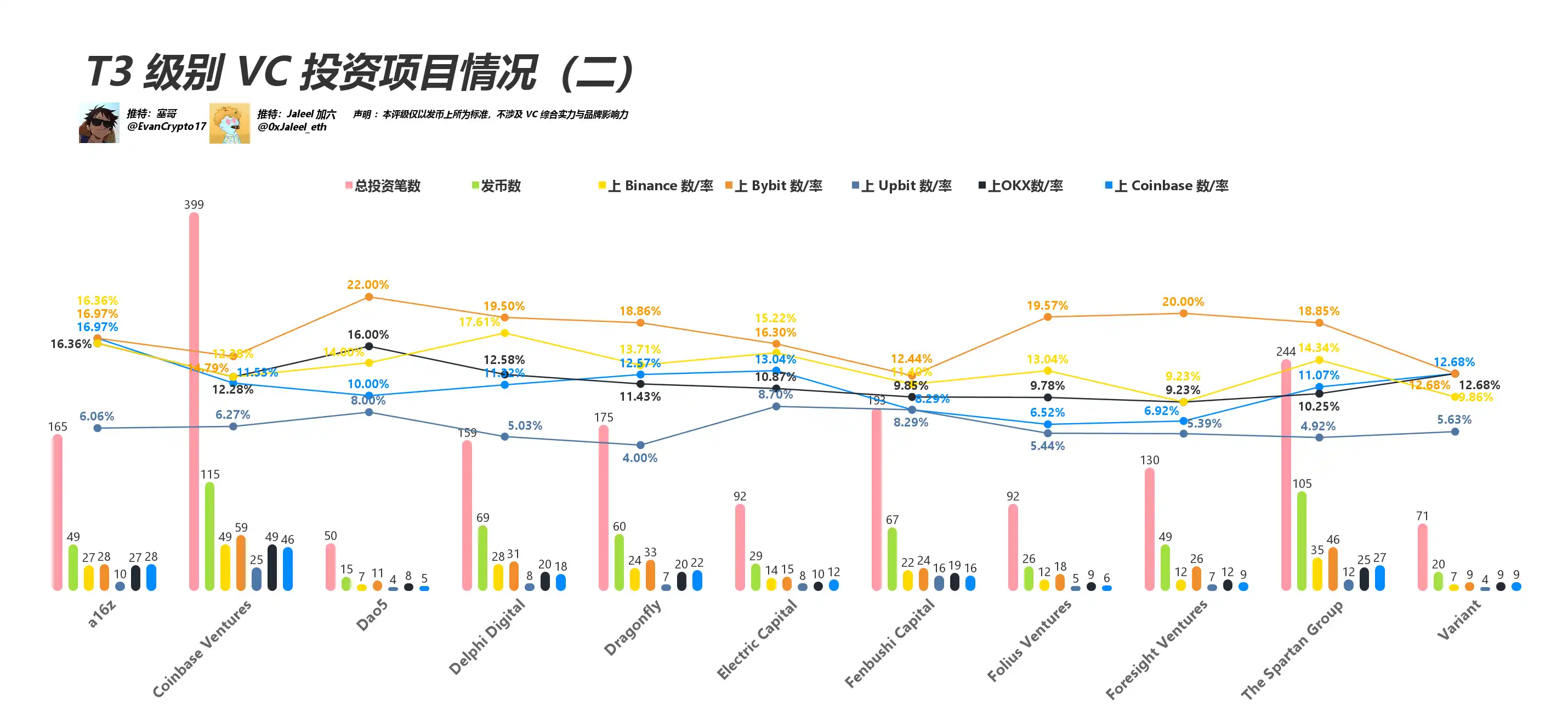

T3: Comprehensive score = 0.6

The T3 echelon is the most complex, including well-known large companies such as a16z, Coinbase Ventures, and Dragonfly, as well as Jump Crypto, HTX Ventures, and Dao5 backed by trading platforms or new funds.

a16z: The coverage is extremely wide, the number of investments exceeds 150, and the coin issuance and listing rate fluctuates between 10 and 20%. Due to too many projects, the average level is diluted;

Coinbase Ventures: The statistics do not count its own resources “on Coinbase”. Despite this, the deposit rate in Bybit, Binance, OKX and other aspects still exceeds 10%;

Dragonfly: An established international fund focuses on early projects, and many DeFi and infrastructure have successfully landed in mainstream institutions;

Jump Crypto, HTX Ventures: They have a trading platform background, but here only statistics the launch rate of their invested projects on third-party trading platforms, so the numbers do not fully reflect their true resource advantages.

Summary: There are many T3 institutions, and the average deposit rate is mostly in the range of 5 – 20%. Many people invest heavily in the “early stage of investment” or “own ecology” and do not necessarily use “rapid issuance of coins and rapid listing” as their main strategy.

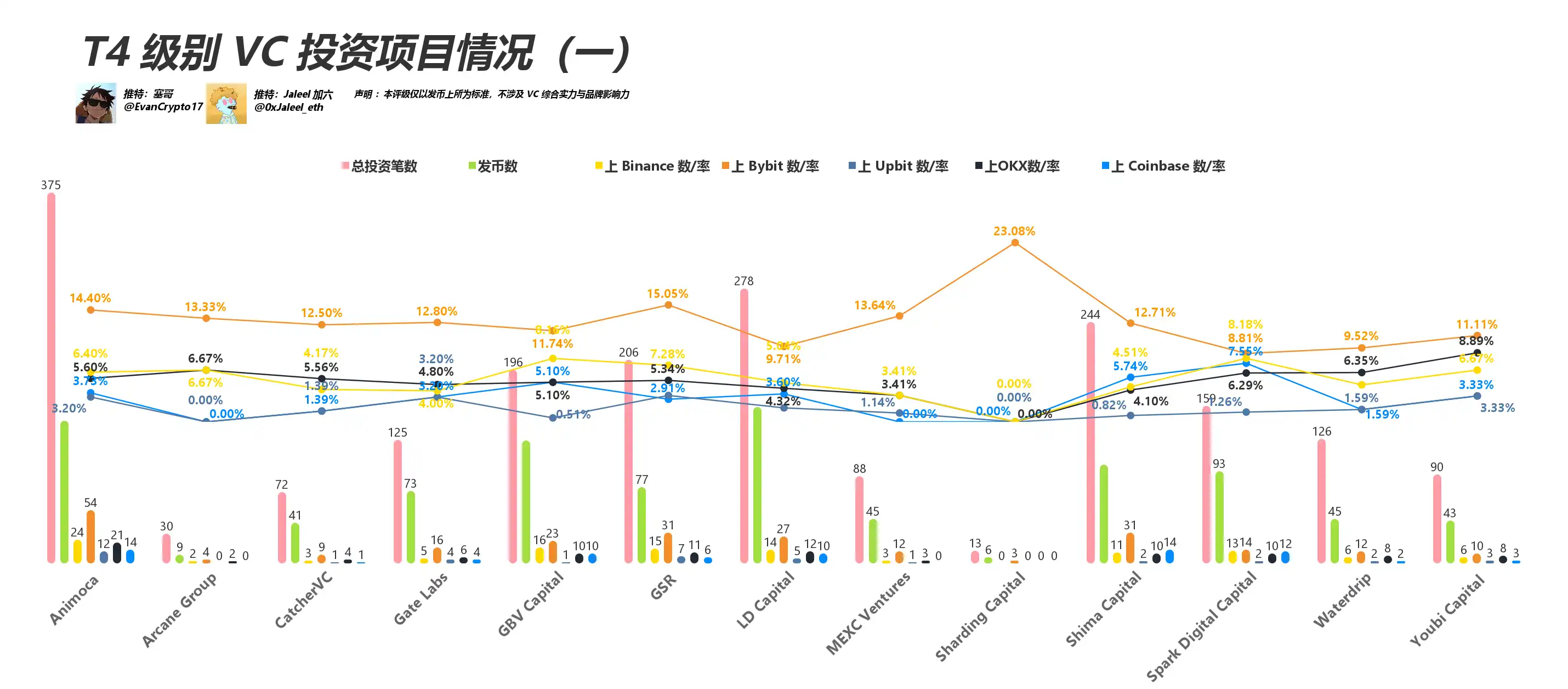

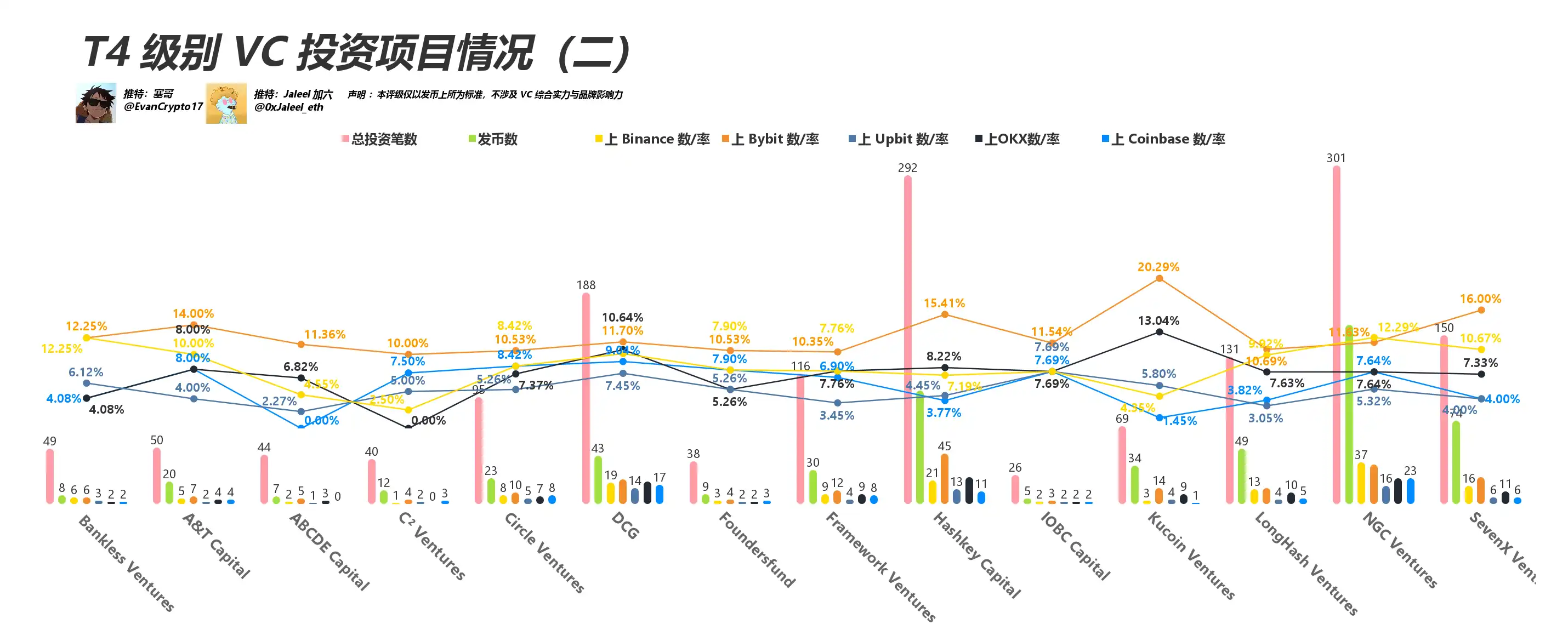

T4: Comprehensive score = 0.3

T4-level VCs often show average results under the single indicator of “listing efficiency”, but some institutions have unique advantages in specific fields or regions:

Animoca: GameFi/NFT Track Godfather Fund, many of the hundreds of investments are not in a hurry to go to the firm or are only active on DEX;

LD Capital, GBV: They received a lot of exposure in the last bull market, but the sales were quite scattered, and the overall currency deposit rate fell in the range of 5 – 10%;

MEXC Ventures: It relies on trading platforms, but this statistics only focuses on third-party exchanges, so the efficiency of listing coins is naturally low;

Shima Capital, Arcane Group: They prefer incubation and regional market layouts, have fewer coin-issuing projects, and many of them have not yet reached the CEX launch stage.

Summary: T4 does not mean worthless, but that their layout is more diverse and early, or the projects are mostly self-sufficient and do not have “coin issuance + mainstream institute” as the core demand. Because of this, it is very likely to breed the next wave of dark horses here. Once certain projects enter tokenization and are successfully launched in the later stage, their statistical results will be greatly improved.

Regional distribution of VC: Who is working on a global scale?

In the new “Regional Distribution of VC” map, we rearranged the list of VC in the three camps of trading platform, overseas, and domestic. We can see that:

Trading platform department: BN, HTX, OKX, Cryptocom, etc. still occupy an eye-catching position in the picture, and the words YZi Labs are the most eye-catching;

Overseas VC: Traditional giants such as Sequoia, Multicoin, Paradigm, and Delphi Digital are still concentrated in the Western world, but there are also some “cutting-edge” cross-regional layouts;

Domestic VC: Continue Capital, IOSG Ventures, Sequoia China, Puzzle Ventures, etc. further break the track and boundaries, and the trend of collaborative investment in the world has become increasingly obvious.

Based on this calculation of weights (Binance2, Bybit 1.5, Upbit 1, Okx & Coinbase 0.7), if domestic and overseas institutions can quickly deposit coins on emerging trading platforms such as Bybit and Upbit, they will also have higher scoring flexibility.

If there is a VC that focuses on an independent public chain ecosystem or has a Token backed by physical assets, its value capture ability will be underestimated in this indicator system.

Therefore, the deposit rate cannot fully measure the level of VC. This analysis still only focuses on the single indicator of “deposit” and does not represent the true quality or long-term return of the project. Other dimensions such as project revenue, token liquidity, and zeroing of invested projects are not reflected in this round of weight rankings.

original link