The life-and-death transformation from “acclimatization” to “customization in China” hides the ten-year struggle of a Japanese company.

“China Limited” has become a hit, and Muji has quietly become popular again

Photo source of MUJI: Photo by Blue Whale journalist Wang Hanyi

Blue Whale News, February 27 (Reporter Wang Hanyi)“Is this a MUJI striped long-sleeved shirt? It was only sold for 178 yuan. I didn’t dare to think about it before.& rdquo; At the Muji Store in Chaoyang Joy City, Beijing, Zhang Ke (pseudonym), a consumer who had been discouraged by the price, lamented to reporters while gesturing for clothes. In her impression, MUJI clothes were all around 300 to 400 yuan.

Muji’s 178 yuan long-sleeved shirt Photo by Blue Whale journalist Wang Hanyi

In addition to this shirt, she also found a 28-yuan basic moisturizing skin care lotion for travel clothes, and many gadgets, snacks and daily necessities for less than 10 yuan. It felt like she had entered Uniqlo or Mingchuang Products. rdquo; Zhang Ke’s eyes lit up, the corners of his mouth curled up, and his expression showed unconcealed joy.

Blue Whale News reporters visited the store on the spot and found that Muji is quietly changing. It once showed its low-key and high-priced image, but now it has many more affordable products. Whether it’s the 7-yuan Everything Shovel, which is popular across the Internet, or the 3-yuan pen, consumers have more choices.

Photo by Blue Whale journalist Wang Hanyi, Muji’s affordable commodity

The seemingly ordinary scene of changes in the price of goods in the store reflects the subtle turn of MUJI in China, which was once a standard for the middle class. It is trying to tear off the label of expensive and use more restrained prices and more precise localization strategies to reopen the wallets of China consumers.

From acclimatization to customization in China”

In 2005, when MUJI opened its first store in Shanghai, China’s grocery market was still blank. It changes its civilian positioning in Japan to a light luxury. The same notebook sells for 38 yuan in China, compared with about 20 yuan in Japan; a USB fan is priced at 158 yuan in China, while similar products of Guangdong Mingchuang Products are only 29.9 yuan.

This double standard stems from a fatal flaw in its supply chain: goods produced in China need to be shipped back to Japan and then distributed to China. Under the superposition of the two tariffs, prices remain high.

What makes China consumers even more dissatisfied is the product’s unacclimatization. For example, the size of Japanese bedding does not match China standards, resulting in the quilt cover always shrinking on the mattress; kitchen supplies are designed for small units in Japan, which has become useless in China families. A home blogger once complained: MUJI’s storage box will never hold my wardrobe, just as its concept cannot hold the lives of China people. rdquo;

Since 2014, MUJI has started to cut prices with broken arms. According to Sina Financial, MUJI has adjusted prices 11 consecutive times in nine years, and some products have dropped by 50%. For example, an ultrasonic aromatherapy machine has been reduced from 380 yuan to 288 yuan. However, simple price cuts have had little effect, and its same-store sales in China will still fall by 6.6% in 2022.

Muji revealed to Blue Whale News that the real turning point began with the independence of China’s business department in 2019. Since the launch of the localization strategy in 2019, it has built a complete industrial chain in China from design, material collection, production to sales, and 70% of daily necessities and food categories have been developed locally in China.

MUJI said that this strategy not only reduces costs, but also improves the market adaptability of products. For example, China restricted products such as washed cotton bedding and Yunnan coffee will become hot products when they are launched. ldquo; MUJI plans to promote hemp clothing products by the end of March 2025. The development and promotion of this series of products also fully reflects the localization practice of MUJI in the China market.& rdquo;

From size improvement to scene reconstruction, MUJI began to deeply deconstruct Chinese lifestyle: the bedding size fully adapts to China standards, and a foldable mahjong table and smart toilet lid have been launched; Beijing’s flagship store has opened up Chinese tea space, and Shanghai stores have introduced freshly steamed hairy crabs and local baking. These changes made Li Zi (pseudonym), a consumer born in the 1990s, sigh: MUJI has finally understood the living room and kitchen of China people. rdquo;

V-shaped performance reversal”

The transformation of life and death from acclimatization to customization in China hides the ten-year struggle of a Japanese company.

Fortunately, MUJI has a good start in fiscal year 2025.

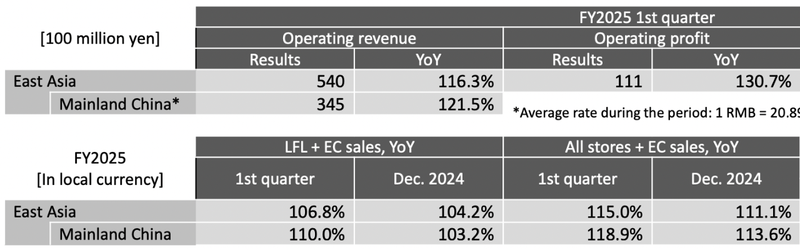

The financial report for the first quarter of fiscal year 2025 (September to November 2024) released by its parent company Good Products Project showed that the company’s sales increased significantly by 21.3% year-on-year to 197.6 billion yen; operating profit soared 58.2% to 21.9 billion yen. Behind this report card, which was described as far exceeding expectations, the China market contributed significantly.

Since September 2024, its same-store sales in China have increased for four consecutive months, sweeping away the haze of growth of less than 5% or even negative growth from 2016 to 2018.

From fiscal year 2022 to fiscal year 2024, revenue growth in China was 9.6%, 22.4% and 11.5% respectively. In fiscal year 2024, revenue in China exceeded 118.2 billion yen, accounting for 18% of the company’s overall revenue.

Photo source: Intercept from financial report

An unfinished experiment

Recently, in an exclusive interview with Blue Whale News, Muji said that Muji’s parent company, Good Products Project, is indeed discussing launching new small stores in the China market. In Japan, this business format is mainly concentrated near subways and railway stations, and mainly consists of low-priced goods with a central value line of 500 yen (about RMB 24).

However, MUJI made it clear that the implementation of this business format in China has not yet been determined and will not simply replicate the Japanese model. ldquo; Muji has always emphasized its brand positioning of reasonable prices. The brand prefers to make it easier for consumers to access Muji products through the layout of small stores, rather than simply taking the low-cost route." rdquo; Muji said.

In view of the strong performance in the first quarter of fiscal 2025, the Good Product Plan has raised its performance forecast for fiscal 2025 (September 2024 to August 2025). Sales were revised from 734 billion yen (approximately 35.3 billion yuan) to 754 billion yen (approximately 36.2 billion yuan), operating profit was revised from 55 billion yen (approximately 2.6 billion yuan) to 64 billion yen (approximately 3.1 billion yuan), net profit was revised from 38 billion yen (approximately 1.8 billion yuan) to 44 billion yen (approximately 2.1 billion yuan), and it is expected to set a record for two consecutive years.

But when MUJI shifted the price scale from the middle class to the general public, the ultimate challenge of this experiment may have just begun. An industry expert pointed out that how MUJI retains the soul of good products in de-luxuryization may determine whether it can truly cross the cycle and become a new classic in the era of consumption downgrade.