Original author: Lazyvillager1, large fund investor and chief financial officer IBD

Original compilation: ChatGPT

Editor’s note: Market sentiment was over-sold due to negative factors such as SOL crimes and BYBIT hacking attacks. In particular, crypto assets were the first to be hit. The impact of tariff issues on BTC was misinterpreted. Although the market was traumatized in the short term, the flow of ETF funds was stable, and BTC still has the characteristics of “chaotic hedging”. Markets suffered a setback after Trump trade news and are expected to rebound by Friday. If tariffs are deadlocked for a long time or an agreement is reached, BTC may usher in relief. In addition, the market priced Friday’s event too low, and the actual impact may be greater. After a short-term correction, BTC is expected to return to the level of US$90,000.

The following is the original content (the original content has been compiled for ease of reading and understanding):

Let me start by stating my position directly: I go long and start long from a higher position, so there may be bias (even though we add a lot of positions at the lows).

Yesterday we mentioned that the 82 level was a very interesting point last night and it still is, but as prices rise or fall, the range of risks changes. Here, I will share some thoughts on why there is a degree of asymmetry in this position that is often difficult to obtain.

We believe that the current market situation is quite complex (and unique) because of the intertwining of multiple unique factors that have put pressure on pricing. So to predict what might happen in the future, we must first figure out how we got here.

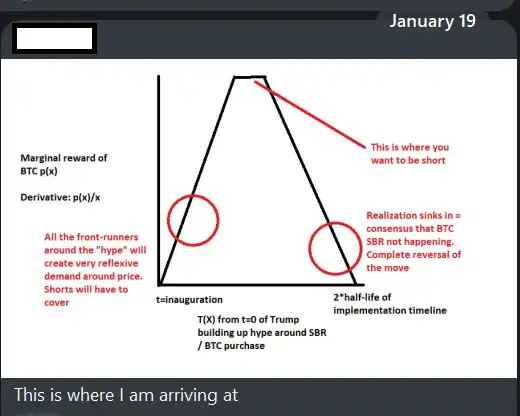

Since I tweeted “SBR-Lite-Lite” on January 23, I think we started to tend to short earlier than others (which needs to be verified further), and this stance is based on the view that a natural market recession alone, rather than other factors, is enough to push prices down.

Of course, there were also many positive factors at the time, such as the adjustment of FASB 121 accounting standards and increased interest in stablecoin payments, but I think these actual impacts were relatively limited and were difficult to shake the capital flow that previously supported the price of more than 100,000 (Saylor’s purchase demand + ETF inflow).

The upcoming tariff policy in early February further strengthens this view. We actually underestimated the market noise that this incident might bring, and digital assets responded quite violently to this, with a sharp decline of 10%(ETH fell even more). This range is very critical. It is worth noting that during this period, the stock market did not show a significant correction, and on the first trading day after the weekend, ETF inflows provided a significant buffer.

Subsequently, the market ushered in higher-than-expected CPI data. We believe that due to the gamma effect of the options market and the support of vanna and charm for the stock market, market pricing will not deteriorate significantly before OPEX (option expiration date). We expect OPEX to become a key point in the market recession, driving the release of a previously artificially suppressed downward trend.

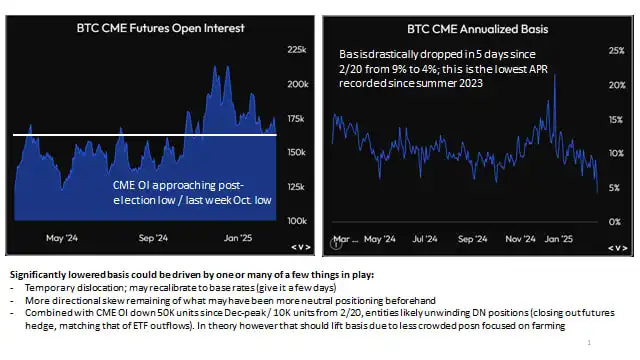

The following week (February 25), the basis of CME futures began to collapse, which caught our attention. I think many market analysts mistakenly believe that this change will have little impact on the market. However, the reality is:

“Looking back at last year’s market turmoil (but failed to effectively break through 50K-60K), the basis of CME futures was still high (reaching double digits), while local investors (natives) were generally more bearish than traditional institutions (Trad)(this can be seen from the stability of the basis or changes in interest rates).

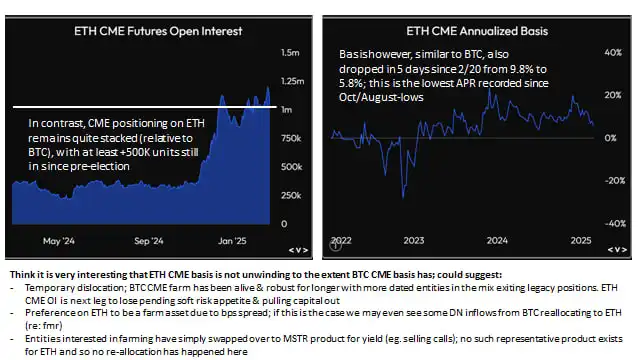

Now the situation seems to be reversed, with traditional institutions withdrawing funds, while the funding rate for perpetual contracts remains above 10%.

In my opinion, this mismatch is very noteworthy because the main demand driving price increases will be dominated by traditional institutions in the second half of 2024.

If this flow of funds is declining (affected by a variety of factors), then the funds may first not flow back, and second, it may imply that prices may fall back to previous levels. In other words, traditional institutions may be more inclined to collect earnings rather than make directional bets in the first half of 2024. By the fourth quarter of 2024, as the basis rises, they may start to increase directional bets, and now the situation is starting to reverse.

… This may indicate that demand for BTC is falling faster than expected, and we may need to reconsider including BTC in a short allocation.”

It is worth noting that the withdrawal signals from traditional institutions indicate that market liquidity has dried up and overall risk appetite has declined. This ultimately led to what we believed to be LTF (long-term trend) support level-just below $80,000, which is where we chose to cover short positions.

As an early trend judgment, we believe that market momentum has been oversold. A series of recent negative incidents (PF SOL crimes, BYBIT ETH hacking) have exacerbated this situation, although these incidents themselves are not the main drivers.

We chose to go long last weekend based on the following judgments:

“We have mentioned before that the divergence between the crypto community/retail traders and passive funds is widening. This divergence has been an important feature of the U.S. stock market over the past five years, and now the crypto market is showing a similar trend. ETF funds actively bought after a large-scale sell-off, while local investors were afraid to enter.

This is not a simple “event-driven” transaction, but a continuation and evolution of changes in market structure. I think if this incident had occurred in any previous week, the market’s reaction would have been more positive. The current caution, although reasonable, stems mainly from losses caused by leveraged buying. Since the market on weekends is mainly dominated by local investors, while transactions by traditional institutions mainly occur on weekdays, the vacuum effect of this capital structure makes the market’s short-term trend more biased.

The performance of this government window is the first time that a. Sell the news, and b. Profit-taking occurred in the market five days before the event, making the risk-reward of going long more attractive than at current levels.

I don’t think Saylor will announce a large purchase, or just a symbolic $50 million to $100 million. But the market may temporarily pick up, pushing him to deploy further funds, especially as the narrative of SBR’s progress is strengthened.

Most people may not realize it yet, but Trump announced that he would adjust the committee/working group arrangements to monitor them in a regular summit manner. As a result, the current level of the market (roughly 95/2.5/180) may become a natural return point, and as the news spreads, the market may digest and re-price it.

From the perspective of traditional institutions, the March/April tariff issue has been fully absorbed by the market, so any delays or improvements (such as reaching an agreement, tax rates below 25%, etc.) will bring room for upside. In short, I think the current market has priced at the worst. And Z/Trump’s display shows his tough attitude on foreign affairs, which may prompt Mexico/Canada to make concessions on tariffs, which will bring benefits.

In a weekend interview, Bessent mentioned a strategy to reduce inflation by controlling the yield on the 10-year Treasury bond. In addition, I believe that the Mexico/Canada tariff issue will become a benchmark for the future trend of Sino-US tariffs, so there may be further upside in the short term.

The market’s overreaction to the impact of NVDA’s earnings report (previously considered a liquidation event), coupled with CTA position adjustments and month-end rebalancing (LOs sold $6 billion causing momentum to run out), together contributed to a ‘perfect storm’ that ultimately pushed the market to rebound sharply.”

We have laid out ahead of schedule in the final stage of negative momentum in the market (although entering too early may be wrong). The extension of tariff policies has increased the weight of China’s tariff issues. This expectation was quickly absorbed by the market, resulting in a 10% correction in NVDA yesterday. I think it’s a highly emotional response that the market is still underestimating the correlation between NVDA and BTC-both of which are actually the core pillars of the current risky asset market. At the same time, the market has also ignored the United States ‘continued investment in the semiconductor field, and these factors may provide a certain buffer for the market.

Our margin of safety for long is mainly based on the following aspects:

1. The market is not currently pricing the upcoming summit

The summit is likely to disappoint markets, but we initially assumed that there would be no substantive progress in Trump’s first 100 days (he is more focused on foreign policy). Therefore, we need to re-evaluate the current pricing logic.

2. The market is inefficient in pricing tariffs

(1). The impact of the tariffs is not fully reflected in the U.S. stock market/S & P index (the market still believes to some extent that Trump is bluffing). However, we believe that the impact of tariffs is mainly a distributive effect rather than a direct impact-this is already evident in risky assets such as cryptocurrencies, such as the market turmoil during the first weekend of February and yesterday.

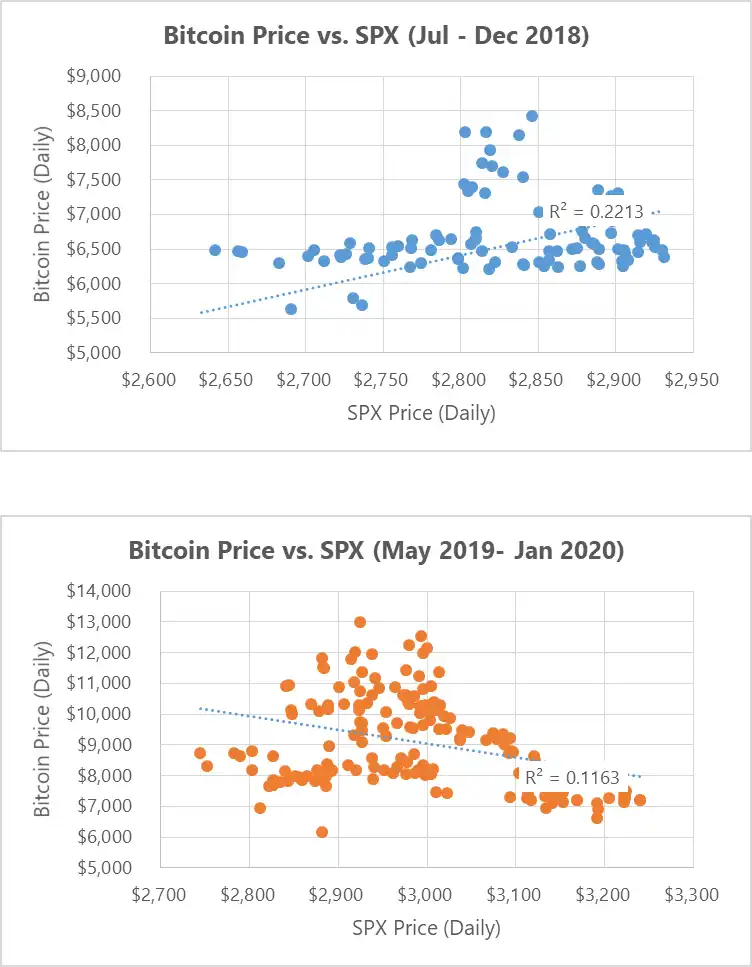

(2.) BTC has always been the market’s “chaos hedge”, falling first when geopolitical tensions heat up, but then rebounds strongly and stabilizes amid relative strength. Our research shows that during the 2018/19 Sino-US trade war, BTC showed a similar pattern.

For example, in May 2019, after the United States increased tariffs on US$200 billion of China goods to 25%, BTC increased from US$5500 to US$8000. In June, as more tariff threats emerged, BTC hit as high as $13,800. This shows that the correlation between BTC and SPX was broken during the trade war, and statistical regression analysis also supports this conclusion-compared to the correlation between BTC-SPX 50-70 in the past 2-4 years, the correlation was extremely weak during the trade war.

3. ETF flows remain stable, while negative flows slow

Market performance on Friday and Monday showed negative capital flows were decreasing. There was a total of more than US$1 billion in capital outflows (mainly short funds) last Tuesday and Wednesday, but only 1/10 of the amount triggered a similar market reaction yesterday, indicating that the market as a whole has released a large amount of “hot air”. The current open interest (OI) and price structure for BTC, ETH and SOL suggest that the market has returned to pre-election and even pre-Trump hype levels, which means that a large amount of speculative money has left the market. The previous “glass ceiling” may now become a “glass floor”, with a high probability of supporting above the $70 range, provided that no new negative catalyst appears.

4. Saylor didn’t buy last week and we don’t expect this to continue.

His silence may be temporary and will give the market additional support once he resumes buying.

Conclusion:

In the 80-85 range, we still remain long and believe that the market is expected to return to the 90 range. The overall upward trend is more operable, especially in the current situation of highly volatile market sentiment.

It is expected that this week’s downtrend may reverse (and may even start to stabilize today, after all, many views were written at lower levels), but it will not return to last week’s levels, and a clearer direction will probably be seen on Thursday/Friday.

Markets have been hurt by Trump’s trade policies, and the summit may be more procedural than substantive progress.

A clearer view:

·BTC will not benefit from the tariff game, further escalation may be a net negative, and it should not be expected to show a negative Beta against U.S. stocks (i.e., fluctuate in the opposite direction with U.S. stocks).

·Market momentum (momo) is oversold, especially those assets that were hit first. The outflow of funds from basis trading is mainly redistribution, which is affected by the compression of yields and the end of the “honeymoon period”(that is, the market has accepted that the government will not have substantial support in the short term). This may not be a temporary phenomenon.

·If tariffs only continue to tug or are eventually resolved, it will be a mitigating factor for BTC.

·Friday’s news that the market was mispriced and more likely “nothing burger”. The current market gives a probability of about 5-10%, but it should actually be closer to 25-30%.

“Original link”