Original title: The Last Cycle: An ETH Denver Retrospective

Original author: TraderNoah, member of the Theia team

Original compilation: ChatGPT

Editor’s note:ETH Denver reflects the transformation in the crypto industry-less speculation and more pragmatism. Market participants can be divided into old players, technology builders, new entrants and speculators, and fewer and fewer people are actually making money. The encryption industry has entered a new stage, with an obvious trend of institutionalization, and the growth of the pure encryption native market has slowed down. With the clear regulation, stablecoins and on-chain finance will usher in large-scale applications, and the traditional VC cash-out model has been widely recognized. The rise in 2024 is more a game of funds. After the bubble burst, the industry faces a realistic choice: either create real business value or continue to wait for the next speculative cycle.

The following is the original content (the original content has been compiled for ease of reading and understanding):

There are not many new faces, extravagant marketing spending is reduced, and industry trends are shifting in a pragmatic direction. Legacy projects from the past still exist (such as infrastructure projects in 2018 that were barely alive, or VC institutions that had just received excessive financing burned money for marketing), but compared with previous years, this phenomenon has decreased.

background

There are currently two main categories of people in the industry: encrypted native groups and new entrants.

It can be further subdivided into four subcategories:

Encrypt native mercenaries

Crypto Native Technicians

Low-quality new entrants

High-quality new entrants

Encrypt native groups

This group is mainly composed of technology groups (VC/investors, VC-supported projects), focusing on large market opportunities and focusing on building actual products. At this event, they accounted for more than two-thirds of the crypto native community, and mainly focused on AI/DePIN and financial technology directions.

The number of mercenaries is much less than in previous generations. The reasons may be as follows:

·The market on the chain is cold

·Future growth will be more institutionalized

·Most of the mercenaries have either been out of the game or have made enough money, so there is not much left behind, and few of them are willing to devote themselves to the game.

new entrants

New entrants can be divided according to ability level.

Low-quality new entrants: Mainly in soft skills-related jobs (BD, growth, ecology, etc.), usually working in declining L1/L2 projects or companies with sufficient funds but lack direction. These people may be crypto enthusiasts, or they may just stay because of the high salary and low work intensity in the industry.

High-quality new entrants can be divided into technicians and mercenaries:

·Technicians mainly come from traditional finance, building in fields such as on-chain finance and stablecoins, or infrastructure experts such as AI, DePIN, and security, focusing on technology and capital layout with huge market potential but still in the early stages.

·Mercenaries are usually young entrepreneurs aged 18-25 who have witnessed the wealth accumulation of their predecessors in 2021 and hope to replicate the path of success. They are charming, intelligent, and even a little anti-social personality. This group is not large, but it often attracts a lot of industry attention.

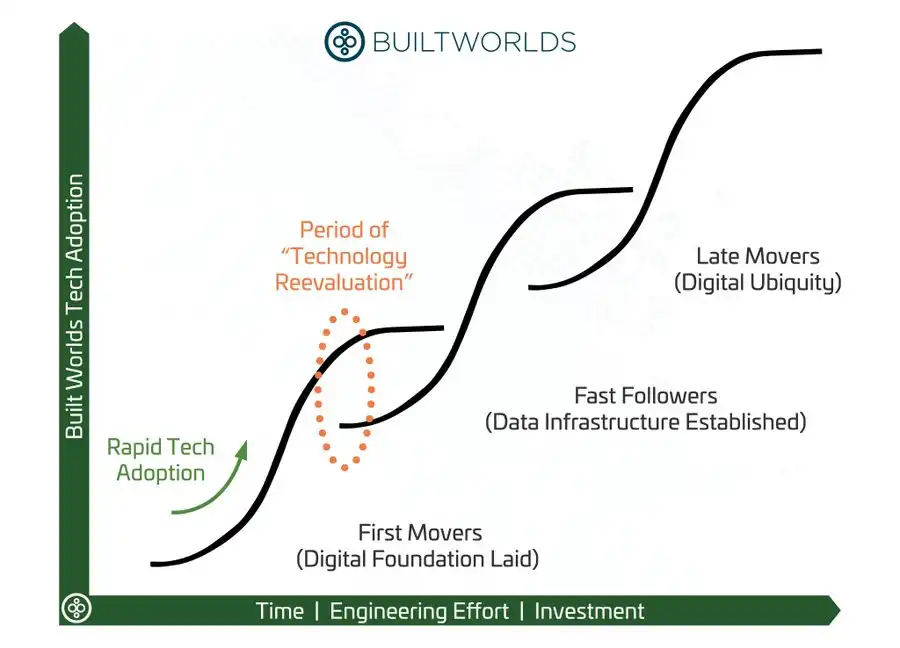

Re-evaluation phase

Why is blockchain technology facing large-scale application while our token prices are plummeting? Why are some groups optimistic and others pessimistic? The answer is simple: We are at the end of one S-curve and the beginning of another S-curve.

Review of the crypto industry group

2009-2011: Edge technology geek

2011-2016: Dark Web/Gambling Era

2017-2019: The first cycle of ordinary people

2020-2021: DeFi summer, the first/second cycle for ordinary people

2022-2024: Speculator/Vulture Capital, Ordinary People’s Second/Third Cycle

The above is a highly general classification, but I think it is basically accurate. Early entrants to the crypto industry often fall into one of three categories: technology geeks, criminals, or just catching the right time.

People who entered the crypto industry before 2017 can now be roughly divided into three situations:

You are already rich and choose to retire

Consider cryptocurrency as a way of life

Still can’t make money

After DeFi Summer, a large number of newcomers poured into the encryption industry, indicating that the group entered after 2020 is closer to the general public than before. Many of these people have achieved wealth growth, but extreme wealth accumulation is rare compared to the early groups.

Their current state can be roughly divided into:

A few have become financially free and retired

Most people have moderate wealth and have options.

Some people are in a state of “pre-prosperity” but gradually feel disillusioned with the industry

In 2024 and beyond, people from all walks of life will be exposed to cryptocurrencies, but only those who can spot business opportunities and are highly capable will survive. We may see a large number of executives with traditional finance or Web2 experience entering the venue.

Looking back at the group of participants in the encryption industry, those who are still active can be roughly divided into three categories:

“Pre-rich” but entry time before 2022: Many people have failed to seize opportunities in the past 5-10 years, and many people feel disillusioned with the industry.

“Post-rich” and deeply believe in encryption (quasi-religious believers, such as ETH Maxis, Link Marines): These people still believe that ETH is a “currency”, but they have not actually put into work for many years and are out of touch with the market.

New entrants, seeking business opportunities: They have not been affected by past market fluctuations and remain optimistic.

Among them, the most pessimistic are usually the first group, who have deep jealousy and resentment towards the industry and realize that most of the accumulation of wealth comes from luck or gray methods.

The second group of people firmly believes that ETH is still a “currency”. They publish high-spirited speeches on podcasts or work in fund companies, but have long been out of touch with market reality.

The third group of people remains optimistic because they have not been tempered by past market cycles, or they are still focused on their beliefs. Nowadays, the regulatory framework is gradually clear, stablecoins are being adopted on a large scale, and financial markets are accelerating their development towards tokenization.

Future development direction?

The entire industry has basically reached a certain consensus in the next few years, but those who cannot benefit from the new landscape will often selectively ignore reality. In the future, new marginal users will pay more attention to how cryptocurrencies create value in their real lives. We may see:

·On-chain financial applications ushered in significant growth

·Encryption technology is being used more in terms of security and reducing back-end operating costs

However, growth in the pure crypto native market may slow down, which is less favorable to token fund inflows and may be one of the reasons for the downturn in the mobile market.

The current industry is in a transition period where supervision has not yet been implemented but is coming. In the future, liquidity may shift to compliant open market stocks rather than token assets. In addition, many on-chain financial products may require authentication to attract institutional customers, leading to the fragmentation of on-chain financial markets into gray/black market and compliance markets.

Uncertainty means risk, and while the long-term trend of the industry is positive, it may not be beneficial to everyone’s portfolio.

ETH Denver: A wake-up call for the industry

ETH Denver and its market trends before and after have sounded a wake-up call for the entire encryption industry. Today’s market participants face a realistic choice:

·Shift to building or investing in real businesses and promote the practical application of blockchain technology;

·Continue to pray for the restart of “crypto casinos” and look forward to the next bull market bringing huge profits.

As projects with real business value emerge and opportunities for “crypto casinos” are relatively reduced, this option becomes increasingly obvious.

In fact, many industry participants (companies, traders, funds) are already dying, only to be reluctant to accept reality because of long feedback cycles or excessive capitalization in the market.

All this transformation begins with the Bitcoin ETF in 2024 and will finally come to fruition in 2025 with Trump’s inauguration. The market is gradually developing in a more rational direction, and the space for blind speculation is getting smaller and smaller.

In the early cycles (2017, 2021),”ordinary people” may still be willing to immerse themselves in Ponzi games and pretend to be ignorant. But eight years have passed since the first craze of crypto-mania, and more and more people have accepted reality:

VC-TGE (Token Generation Event)-The old routine of cashing out is essentially a money game, but as long as this path is still profitable, it will not be changed, but fewer and fewer people are willing to continue to be a fool.

The crypto industry is in the midst of a structural transformation, the casino era is fading, and real business models are emerging.

The market rise in 2024 is mainly driven by the wealth effect driven by bitcoin and the meme coin hype cycle. But this time, traders knew that they were only participating when there was money and had no faith in any narrative.

Now that free capital dividends have disappeared, gamblers have retired, industry participants who rely on market liquidity can only begin to reassess the impact on their portfolios.

“Original link”