Original title: “U.S. stocks plummet in the early morning: The Big Seven evaporated more than US$500 billion, and the crypto market evaporated US$100 billion”

Original author: Alvis, MarsBit Mars Finance

In the early morning of February 28, although investors believed that they had successfully passed the test of Nvidia’s earnings report, US President Trump’s remarks once again triggered violent market fluctuations. U.S. stocks suffered a new round of selling. The S & P 500 index fell 1.59% to close at 5,861.57 points; the Nasdaq Composite Index fell 2.78% to 18,544.42 points; and the Dow Jones Industrial Average fell 0.45% to close at 43,239.5 points.

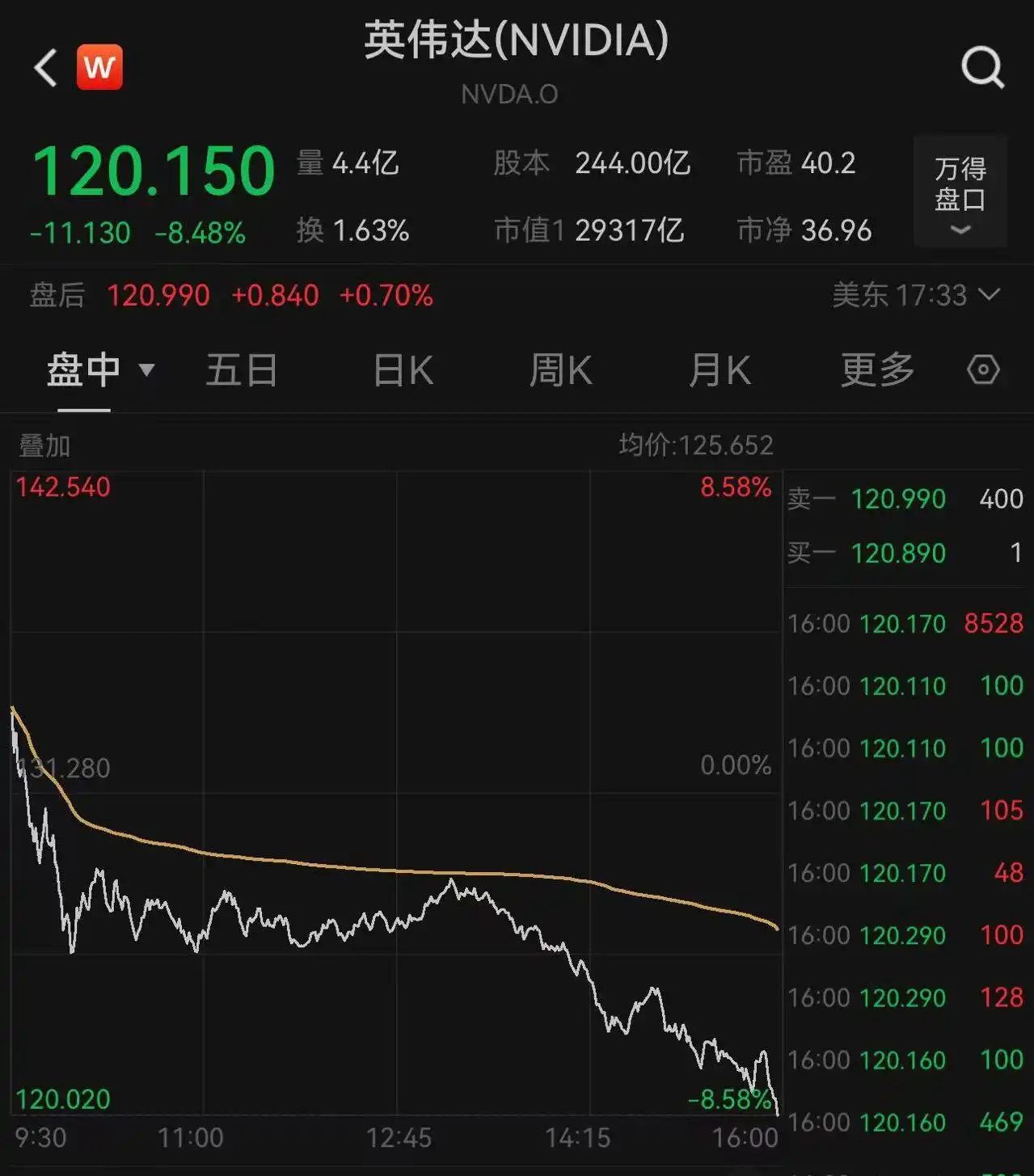

The plunge affected the “Big Seven” companies, the symbol of the bull market in U.S. stocks.Its total market value evaporated by approximately US$550 billion (approximately RMB 4 trillion). Among them, Nvidia’s share price rose from 2% at the opening to more than 8% at the close, and its market value shrank by more than US$270 billion, setting the largest single-day market value loss since January 27.

In Nvidia’s latest financial report, revenue and profit in the fourth quarter exceeded market expectations. The company also issued strong performance guidance, showing that demand for artificial intelligence chips continues to grow. However, despite the company’s outstanding performance, the decline in gross profit margins and the slowdown in data center revenue growth failed to ignite market sentiment.

James Demeter, chief investment officer at Main Street Research, pointed out that although Nvidia’s performance was excellent, the market environment at this time was extremely volatile.

In addition to Trump’s statement on tariffs, preliminary unemployment data released on Thursday also deepened market concerns about the U.S. economic outlook.The Labor Department report showed that the number of U.S. jobless claims increased to 242,000 in the week ended February 22, an increase of 22,000 from the previous week.

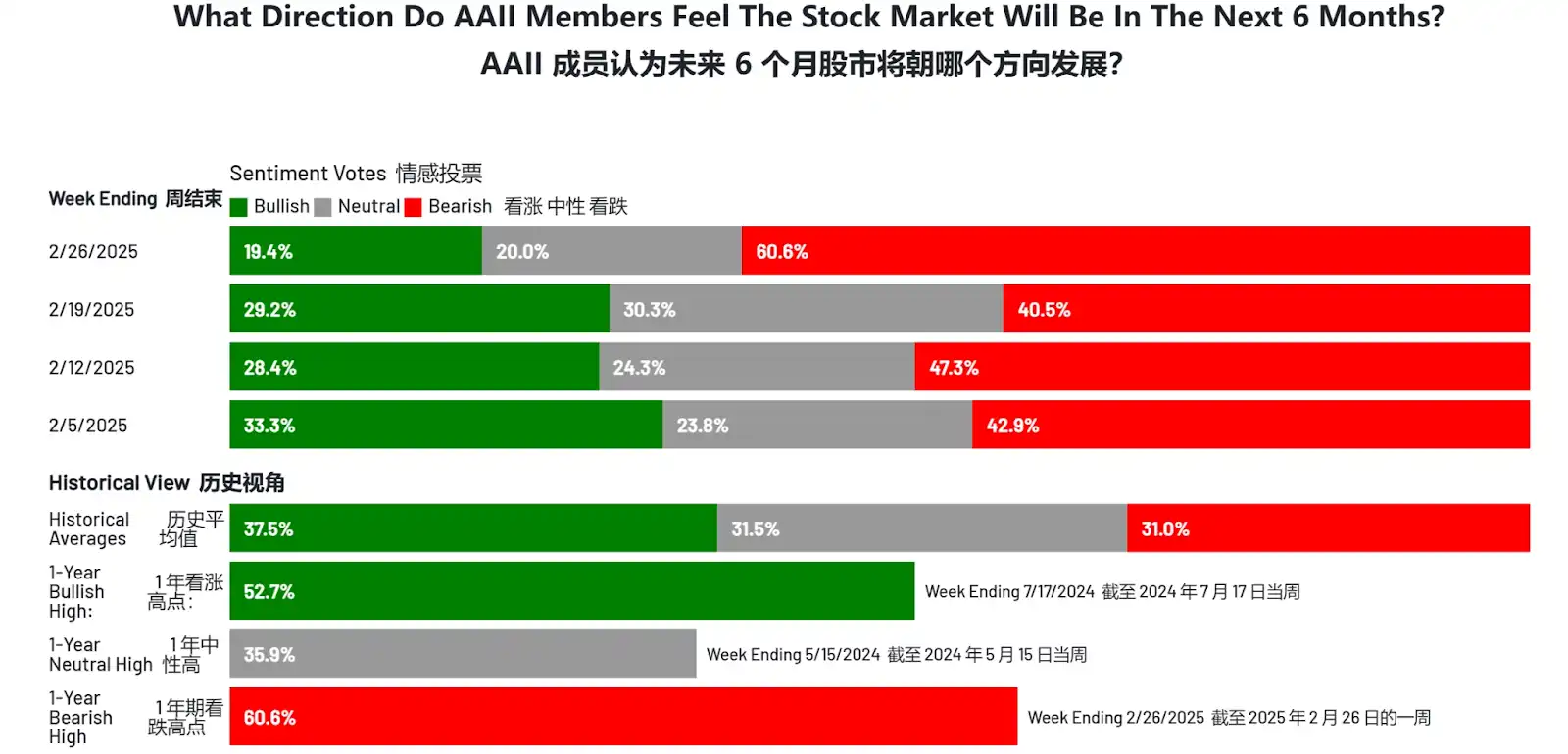

At the same time, retail sentiment has also changed significantly. According to the latest survey by the American Association of Individual Investors, more than 60% of respondents believe that U.S. stocks will fall in the next six months, a surge of 20% from the previous week.With U.S. stocks approaching historical highs, the pessimism of retail investors has instead exacerbated market uncertainty.

Crypto stocks have not been spared

Crypto-related stocks also suffered heavy losses, and according to Snowball data,Of the 14 crypto stocks listed in the United States, 11 fell and only 3 rose.

In particular, Coinbase’s share price has fallen by more than 30% in the past three weeks despite its earnings report released on February 13 showing a good outlook for 2024.

In addition, Microstrategy also fell nearly 9% in the early hours of this morning and more than 30% in the past three weeks.

The cryptocurrency market was also hit hard, with Bitcoin falling from a peak of $87000 to $82700, while Ethereum hit a new low of $2230.

The market value of the overall crypto market has dropped from US$3 trillion to the current US$2.9 trillion, wiping out US$100 billion.

In the past 24 hours, the total amount of open positions on contracts across the network exceeded US$332 million, and continued to be borne by long positions. In the past five days, the cumulative amount of funds sold out has exceeded US$4 billion.

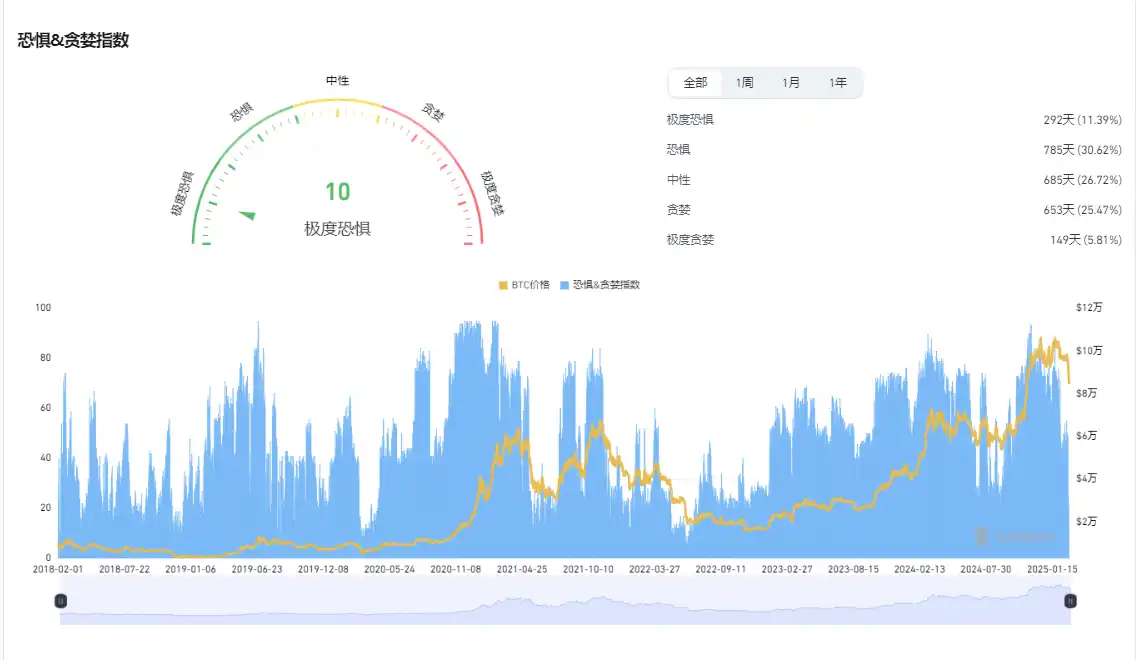

The current Fear & Greed Index is 12, which has hit a new low since June 2022. Market sentiment is in a state of extreme fear, and investors are full of worries or uncertainties about future price movements.

Why has Bitcoin been falling recently?

Trade war concerns cause bitcoin prices to fall

Although the U.S. government has vigorously promoted bitcoin policies, bitcoin prices have fallen against the backdrop of increasing market uncertainty, which seems to be contrary to expectations. Typically in times of economic uncertainty, cryptocurrencies such as Bitcoin are often regarded as high-risk assets and are therefore affected by factors such as geopolitical tensions and tariff threats. Especially amid concerns about a trade war, there is widespread panic in the market and investors have turned to safe assets. Although the U.S. government generally supports digital currencies, Bitcoin, a volatile asset, has lost its upward momentum in the current market environment.

Bitcoin ETF withdrawal highlights institutional investors ‘doubts

What further complicates the situation is the large outflow of funds from the Bitcoin ETF. According to Sosovalue data, Bitcoin has achieved net outflows for more than 7 consecutive days, with a single-day outflow reaching a record high of US$1 billion. The Bitcoin ETF has achieved a net outflow of more than US$2.4 billion in the past week. These divestments reflect the general uncertainty among institutional investors about short-term market trends.

SEC drops case or hints at crypto policy changes

The U.S. Securities and Exchange Commission (SEC) recently dropped enforcement cases against major crypto platforms such as Coinbase and MetaMask, signaling a change in regulatory strategy under the new leadership. Acting SEC Chairman Mark Uyeda and cryptocurrency supporter Hester Peirce played a key role in promoting this change. Paul Grewal, chief legal officer of Coinbase, said that the company will continue to work with regulators to promote positive developments in the cryptocurrency field.

Cryptography industry is confident in clear legislation

Overall, the crypto industry is optimistic about clear regulatory legislation. For example, the crypto legislation proposed by Senators Cynthia Loomis and Kirsten Gillibrand could lay the foundation for market growth and help the United States maintain its leadership in global crypto. Although bitcoin prices continue to be influenced by global economic and geopolitical factors, the complex relationship between trade wars and cryptocurrencies remains a major challenge for the market. The U.S. government’s support for Bitcoin may bring long-term benefits, but short-term economic pressures may still impact investor sentiment.

original link