HYPE has a unique revenue engine, combining exchanges and smart contract platforms, or becoming the highest-revenue blockchain.

Author: Ryan Watkins, Syncracy Capital Joint Venture

Compiled by: Felix, PANews

In the fourth quarter of 2024, Syncracy Capital significantly opened positions in HYPE and continued to increase positions in the first quarter of 2025. Recently, Syncracy Capital issued an article that disclosed multiple reasons for increasing its HYPE.

The following is the full text (this article has been deleted):

Hyperliquid has a unique revenue engine that combines exchanges and smart contract platforms, making it the most costly blockchain in the cryptoeconomy. And its vertically integrated design combines these two services through a unified interface, allowing Hyperliquid to aggregate users more effectively than any other platform to date, providing it with structural advantages in accommodating all financial services around the world.

In the long term, Hyperliquid has the potential to “disrupt” Binance by providing performance that outperforms other decentralized platforms and outperforming centralized exchanges in terms of cost, accessibility, auditability, composability, security and asset availability. At the same time, its smart contract platform has the potential to become one of the leading application ecosystems, leveraging Hyperliquid’s exchange and trader base as the foundation for its growth.

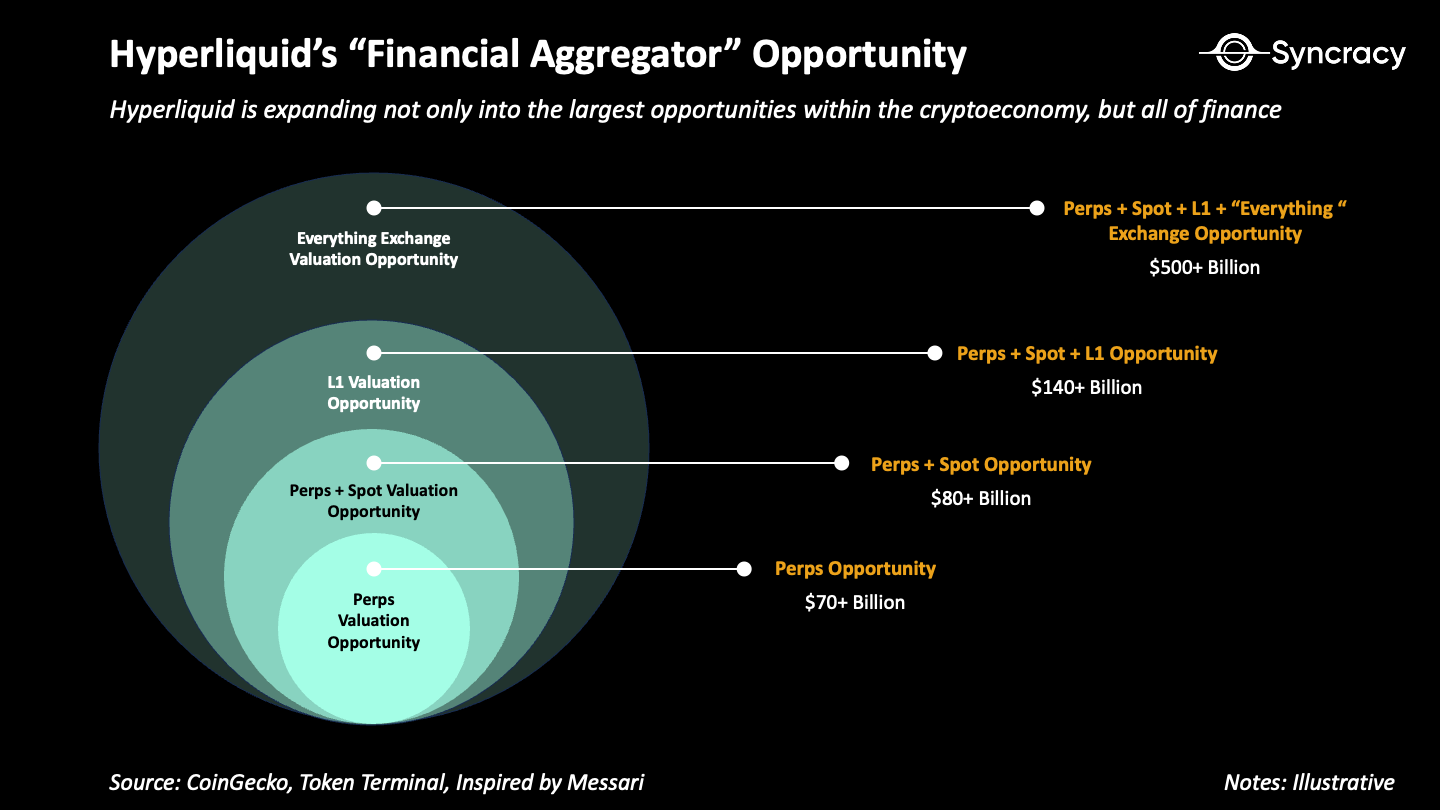

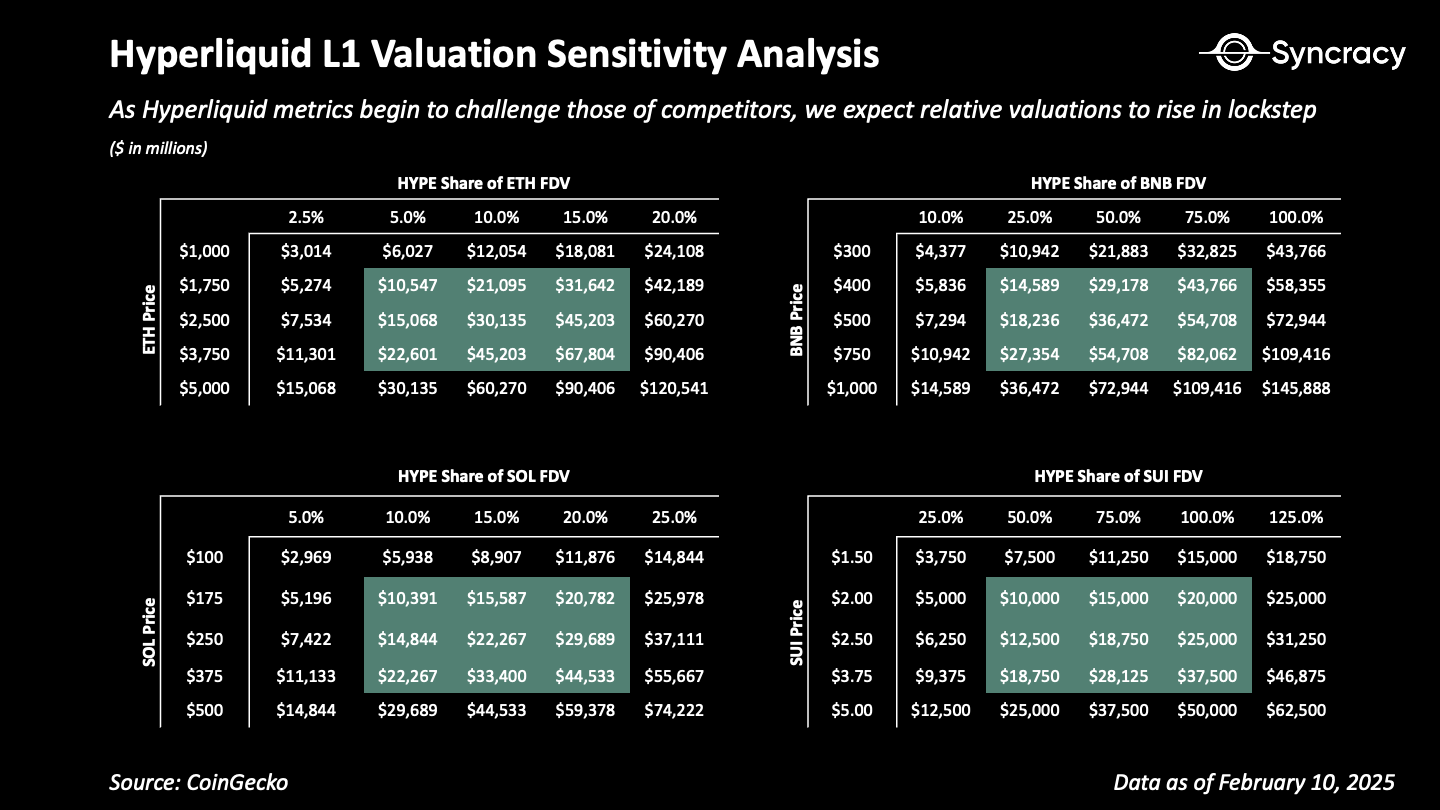

Syncracy estimates that its combined market size for exchanges and smart contract platforms will reach hundreds of billions of dollars in the next few years.

The art of progressive decentralization

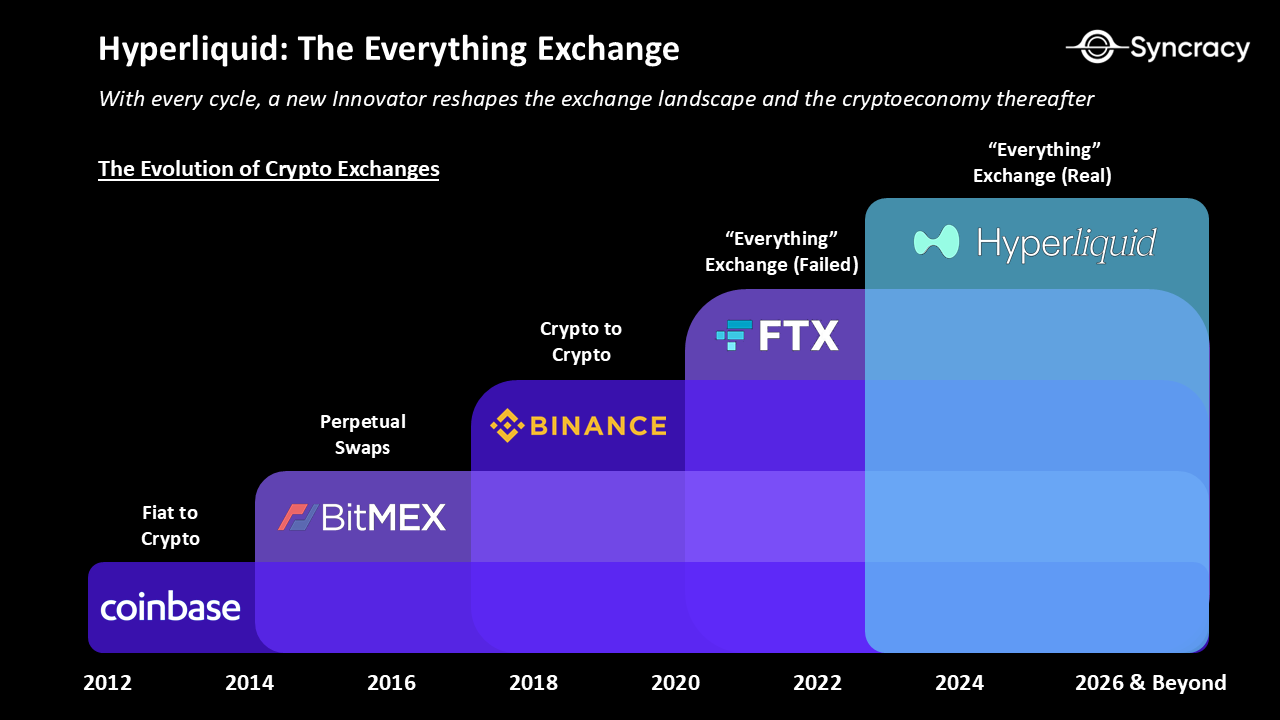

Trading is by far one of the killer applications in the crypto economy, but most transactions are still conducted on centralized platforms. Is it possible to create a decentralized exchange with characteristics similar to the origins of Bitcoin? This is the question that Hyperliquid co-founder Jeff Yan set out to answer when he launches a new exchange from the ruins of FTX in 2022.

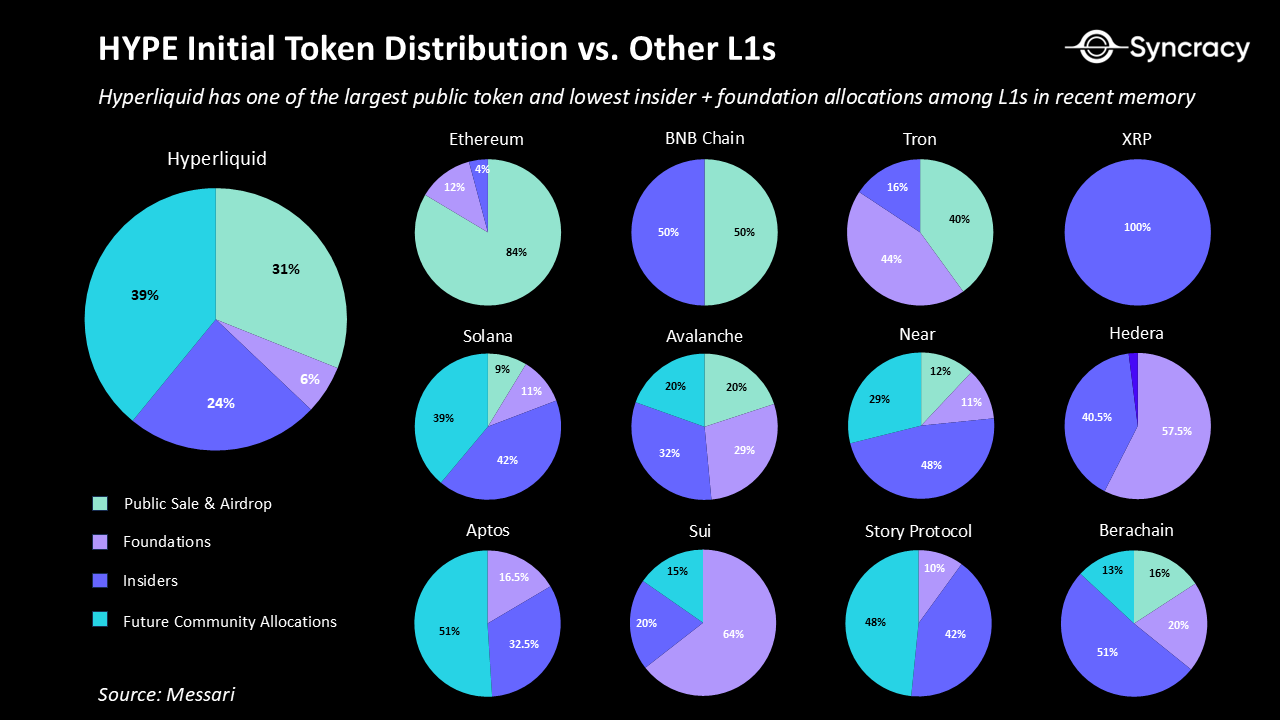

Hyperliquid did not receive any external funding from VCs and chose to fully fund it itself. This was a key decision that allowed the team to focus on developing the product without external pressure and ultimately allocate most of the ownership to the community.

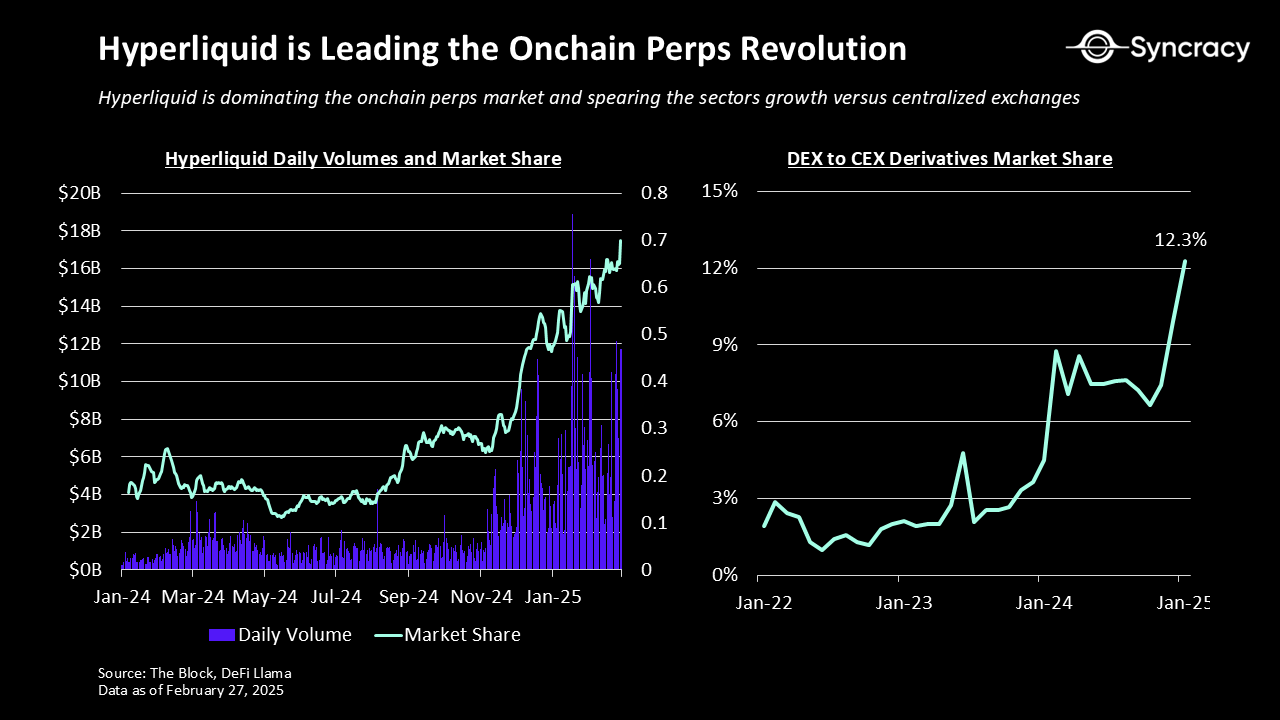

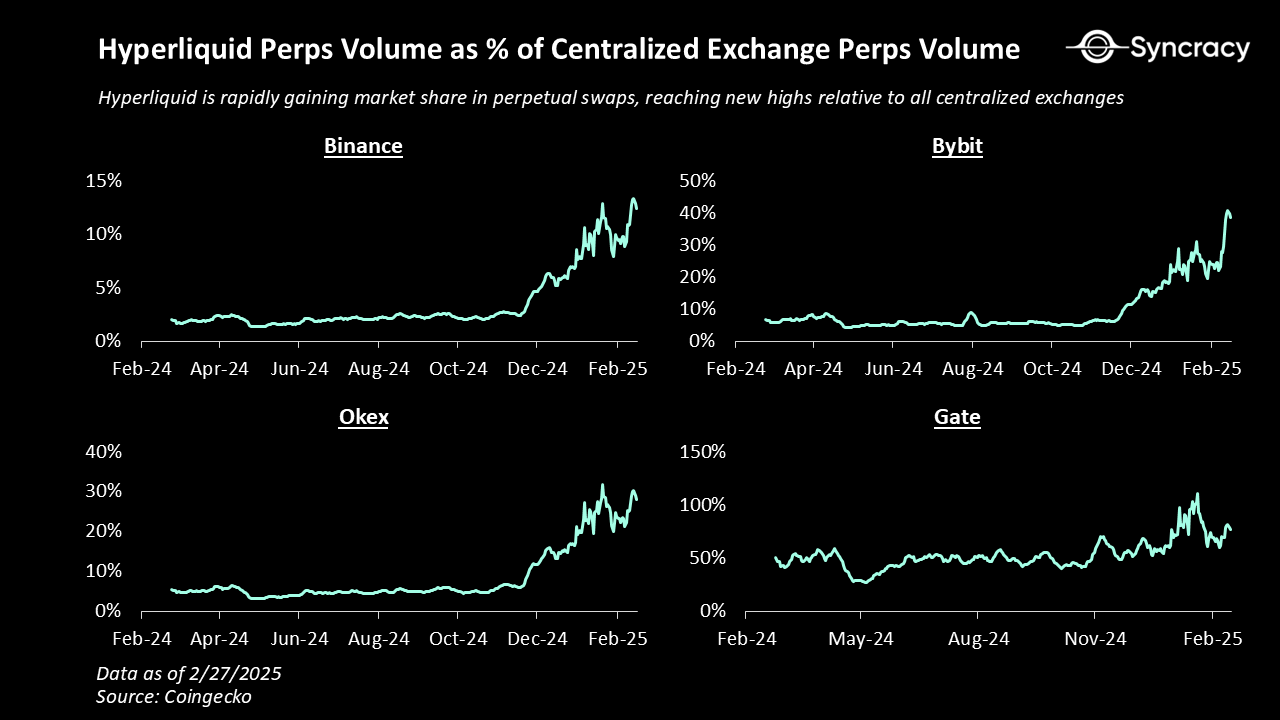

Two years later, Hyperliquid has become one of the fastest-growing projects in the crypto economy, accounting for more than 60% of the on-chain perpetual contract market. In this process, Hyperliquid has played a key role in leading the shift to on-chain perpetual contract trading, which currently accounts for approximately 12% of global transaction volume.

the key to success

Everything starts with the team’s product first concept. The team did not optimize for ideological purity. For example, from the beginning, the priority was not to maximize decentralization, but to provide the best on-chain trading experience. This strategy can be understood as progressive decentralization-a practical way to build successful projects in the crypto economy, which involves the team first finding a fit between the product and the market, and then gradually relinquishing control over time.

While decentralization and open source are critical to reducing counterparty risk and improving product scalability in the long term, most users prefer performance and usability to strict compliance with Cypherpunk principles. Therefore, in the two years leading up to the launch of HYPE tokens, the team improved the platform through direct contact with traders.

This feedback proved valuable because the Hyperliquid team often implemented feature requests and bug fixes within hours, building deep trust in the community. It also brings key product features such as order cancellation priority for traders, which allows market makers to quote smaller spreads, and Hyperliquid vault, which allows exchanges to quickly channel liquidity in new token pairs. The result is a high-performance chain with fixed order book (CLOB) capable of achieving throughput of 100,000 transactions per second (TPS) and sub-second finality, an order of magnitude higher than the performance of other platforms.

As transaction volume grows exponentially at the end of 2024, Hyperliquid drops 31% of its token supply to users. The airdrop was a huge success.

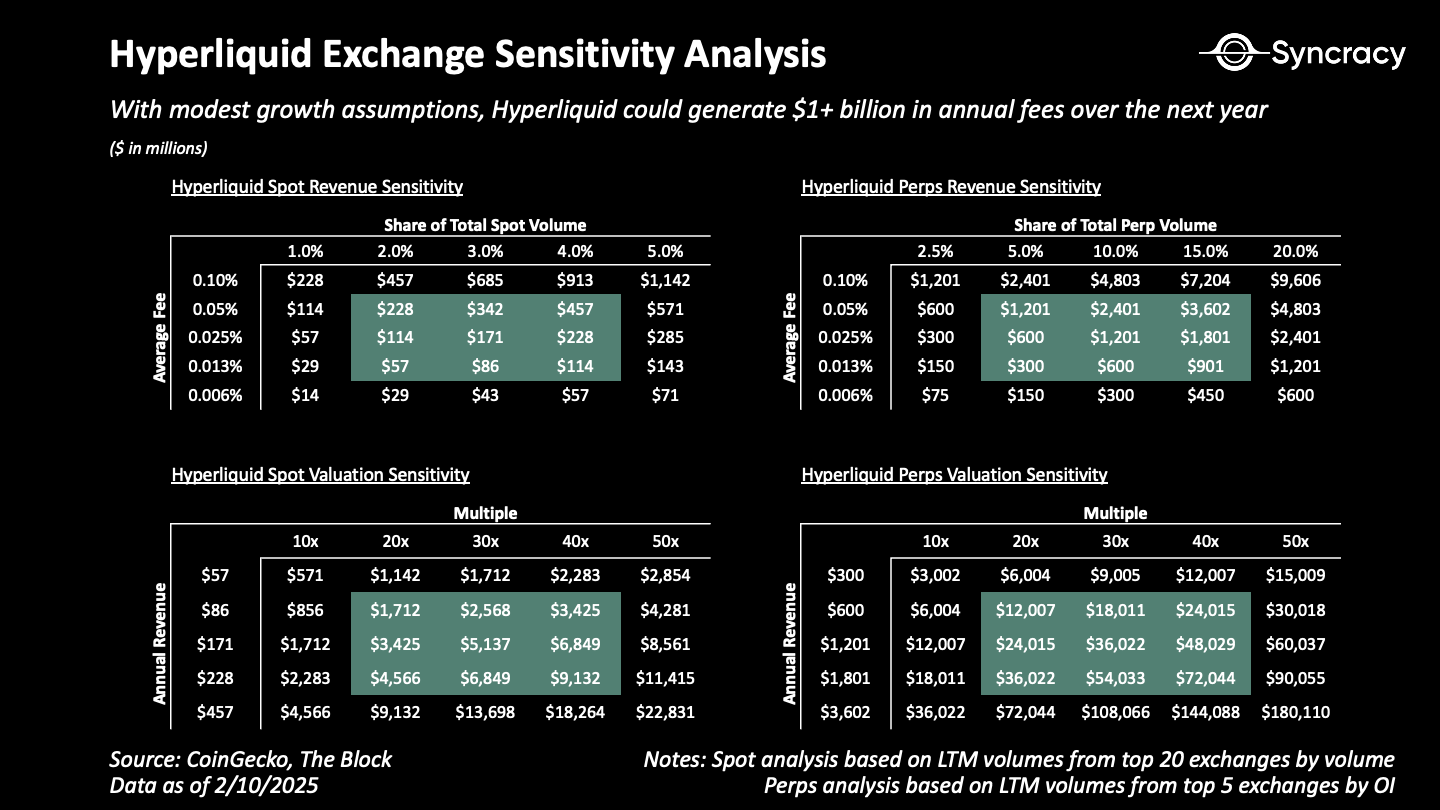

Crucially, HYPE tokens also have a clear intrinsic value, with a fee of US$228 million per year at the time. This not only provides recipients with an incentive to hold rather than sell, but also promotes large-scale buybacks due to high revenue and also provides buying momentum for HYPE. In addition, since there are no pre-assignments to any internal personnel outside the core team, large buyers must buy on the open market. It not only forces these participants to join Hyperliquid directly and simultaneously increase trading volume, but also highlights that Hyperliquid’s next step in development is not just a simple derivatives exchange.

Everything Exchange

Exchanges are winner-take-all markets, with factors such as liquidity network effects, scale efficiency, brand equity and regulatory moats concentrating trading activity on a small number of dominant participants. This model has shaped the landscape of financial markets for centuries, consolidating the dominance of the Chicago Mercantile Exchange in derivatives, the dominance of the New York Stock Exchange and Nasdaq in equities, and Binance’s dominance of the centralized crypto market. However, despite its size, no exchange can fully unify the liquidity of multiple asset classes on one global ledger-a concept known as “Everything Exchange.”

Bridging this gap requires more than just dominance in a single market, it requires infrastructure that can seamlessly integrate multiple asset classes, unify liquidity, and global scale. This is what distinguishes Hyperliquid’s design from traditional exchanges, providing a vertically integrated system that can operate on its own high-performance blockchain while integrating liquidity in the spot and derivatives markets.

Blockchain-based exchanges have structural advantages in terms of auditability, efficiency, security, composability and accessibility. Instead of entrusting assets to a centralized entity with opaque risks, users can use autonomous smart contracts as intermediaries to self-manage assets and trade them in a global 24/7, almost instant settlement market.

These benefits are not just theoretical. It has now driven the growth of trading volume on the chain. This trend is not only reflected in the data, but also in the strategies of Binance and Coinbase, two major exchanges in the industry, which have launched their own blockchains: Binance Intelligent Chain and Base.

Hyperliquid has taken its first step: expanding into the crypto spot market. The solution first is to let users send native assets on blockchain such as Bitcoin, Ethereum and Solana to Hyperliquid through a fixed interface. Hyperliquid will be the only on-chain CLOB with both multi-chain spot and derivatives markets.

Hyperliquid currently supports the only large-cap stock assets in the spot market, and is currently among the top 10 and top 5 chains in global DEX trading volume.

Hyperliquid may continue to outperform its platform because of the following advantages:

- Cost-transaction fees and management fees are significantly lower than CEX such as Binance

- Accessibility-Due to its global permissionless nature, users are easier to join

- Auditable-easy verification using the basic public key encryption technology inherent in blockchain

- Composability-easy for third parties to develop on it (such as builder code)

- Security-self-managed, decentralization will improve over time

- Asset availability-a faster and more transparent asset listing process

These advantages allow Hyperliquid to eventually expand beyond blockchain native assets. Hyperliquid may cover all assets around the world, including markets such as currencies, stocks, bonds, commodities, real estate, and even sports betting and forecasting. In fact, this transformation is almost inevitable. As wallets become popular, asset issuers will have an increasing incentive to list on the public chain to leverage the global investor base to increase distribution and achieve the lowest cost of capital.

It is estimated that the value of opportunities in the crypto economy today exceeds US$140 billion. In addition, opportunities outside the crypto economy (covering every asset class and exchange on earth) are worth at least more than $500 billion globally, not including large over-the-counter markets such as private exchanges and foreign exchange. Including these, market opportunities can easily reach trillions of dollars.

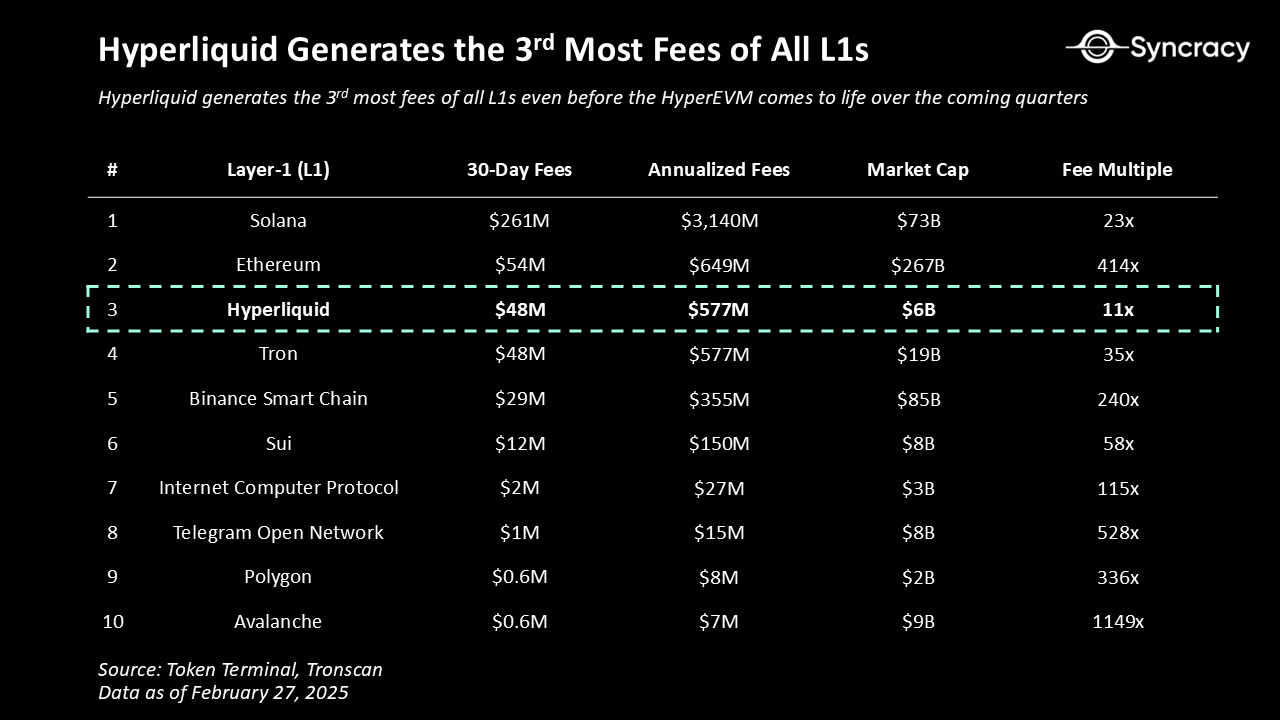

In its short history, Hyperliquid has generated annual revenue of US$577 million from its perps exchange and emerging spot markets alone. If any of the above theories are realized over the next 12-24 months, revenue is expected to grow exponentially in the future, likely to put Hyperliquid at the top of the crypto economy in terms of on-chain revenue (it already ranks third).

The Road to Financial Convergence

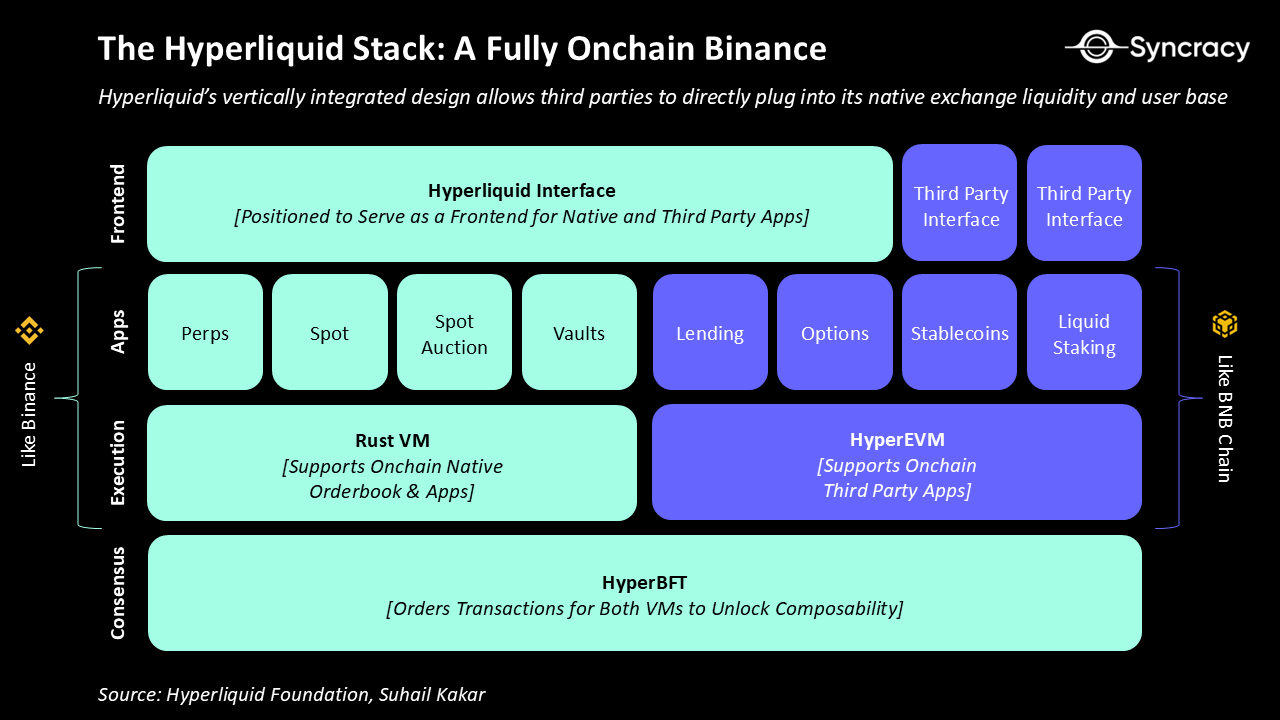

Previously, Binance and Coinbase launched BSC and Base respectively. These two chains are entities independent of the exchange and have separate capital statements and income statements. However, what would happen if Binance and BSC were merged? What if, in essence, you combined the two most profitable businesses in the history of the cryptoeconomy: exchanges and smart contract platforms? What happens if you access it through a single interface? This is the opportunity for Hyperliquid’s recent launch of HyperEVM, an EVM-compatible virtual machine that will run in parallel with its orderbook exchange.

Essentially, by closely integrating its interface, exchange and smart contract platform into one cohesive experience, Hyperliquid can gather users on a large scale.

Historically, these three have been dispersed in the crypto economy. Hyperliquid integrates the entire stack, only partially modularizing its application and interface layers-a design choice that creates potential strategic advantages. Unlike ecosystems that rely entirely on third-party applications and interfaces, Hyperliquid’s internal exchanges serve as both anchors and distribution centers, enhancing its network effects. The exchange is the preferred channel for third-party developers to build applications and issue assets, and can integrate directly with the flagship Hyperliquid interface. This creates a positive feedback: the more users there are on the exchange, the more liquidity available to the application. The more mobility the application is available, the more useful the application will be. The more useful the application becomes, the more sticky the Hyperliquid ecosystem becomes, and the more valuable Hyperliquid becomes over time.

In summary, the shared state between Hyperliquid Exchange and HyperEVM can bring many synergies and product innovations, such as:

- Advanced collateral management-a major brokerage application that allows traders to maximize the capital efficiency of the collateral-such as lending a liquid pledge HYPE through agreements like Aave, selling interest through income markets such as Pendle, while using the position as collateral for derivatives transactions

- On-chain structured products-an asset management application that leverages Hyperliquid vaults and derivatives to create on-chain structured products similar to Ethena

- Advanced Money Market-A money market agreement that integrates Hyperliquid’s derivatives exchanges to hedge collateral risk and spot exchange clearing, ultimately allowing it to provide borrowers with higher loan-to-value ratios (LTV)

- Privacy transactions-A privacy protocol similar to Tornado Cash that allows anonymous placing of orders on Hyperliquid’s exchanges (dark pools)

These examples only touch the surface-Hyperliquid’s deep integration between trading interfaces, order books, and smart contract ecosystems provides fertile ground for a new wave of on-chain finance.

Hyperliquid has several important levers to drive its ecosystem-a key competitive advantage in the increasingly saturated space of smart contract platforms.

- Loyal trading users-Unlike most emerging smart contract platforms, Hyperliquid already has a large, highly engaged user base. This solves the cold-start problem that has plagued ecosystems outside of Ethereum, Solana and Base, providing an instant market for developers ‘products

- Incentive Fund-Initially, Hyperliquid allocated 39% of its supply to community rewards and incentives, allowing it to launch multi-year, billion-dollar campaigns to attract users and builders

- Aid fund buybacks-Hyperliquid announced that it will begin using its aid funds to purchase ecosystem tokens to stimulate on-chain activity and support its communities

HyperEVM ecosystem builders were keenly aware of these advantages and structured their market-to-market strategies accordingly. Many are inspired by Jeff (CEO of Hyperliquid) and are highly aligned with HYPE holders, which may spur projects to airdrop their tokens to Hyperliquid users and HYPE pledgers.

In addition, a few projects have committed to allocating some of their funds to HYPE, which may increase revenue while creating additional demand for HYPE. This move is important to develop HYPE into a reserve asset for their respective ecosystems similar to ETH and SOL. As HYPE’s adoption in HyperEVM expands, its role as Gas, collateral and other things will further drive this narrative, potentially making HYPE’s valuation far beyond what can be demonstrated by MEV and execution fees themselves. Consolidate its core asset status alongside BTC, ETH and SOL.

risk

The development of Hyperliquid is not without risks. In addition to the execution risks inherent in an enterprise at any early stage, there are also the following risks:

- Centralization-Hyperliquid may not be able to distribute its validator set, which currently consists of 16 servers in Tokyo, globally without degrading performance; in addition, its inability to decentralize may pose regulatory risks

- Developer ecosystem-Hyperliquid is mainly developed by the core team, with little external contribution; most of the code is still closed source, and HyperEVM is in its infancy

- Bridge hackers-If Hyperliquid fails to decentralize its bridge infrastructure, its spot market may be disrupted; in addition, the lack of native stablecoin support creates unnecessary counterparty risk

- Business cyclical-Exchanges are cyclical businesses and declining interest in asset classes will lead to lower trading volumes and lower fees

The boundaries between financial markets are disappearing and merging into a single, combinable, ultra-liquid financial system. Over time, the collection of isolated ledgers, intermediaries, and clearing houses of the old financial world will be replaced by a unified, real-time, programmable economy.

Related reading: Transactions exceed one trillion dollars, daily liquidation amount of US$400 million, Hyperliquid has become a “casino” in the giant whale chain