In three months after launch, the number of downloads exceeded 1.3 million, 99% of which came from Southeast Asian markets.

The number of downloads exceeded 1.3 million! Byte overseas free short dramas are launched! Another red fruit?

Wen| DataEye Research Institute

Byte launched a free short drama App called Melolo overseas at the end of last year, marking the official start of Byte’s short drama journey overseas.

After more than three months of development, how has Melolo performed?

The following is a detailed disassembly:

1. The number of downloads exceeded 1.3 million times in three months after launch, 99% of which came from Southeast Asian markets

Melolo was the first to launch in Indonesia, the Philippines and other markets in mid-November 2024. So far, it has been launched in 30 countries/regions, covering Southeast Asia, South America, North America (excluding the United States and Canada), Oceania, Europe, Japan and South Korea and other regions. (It is worth noting that Melolo is not yet available in the U.S. market)

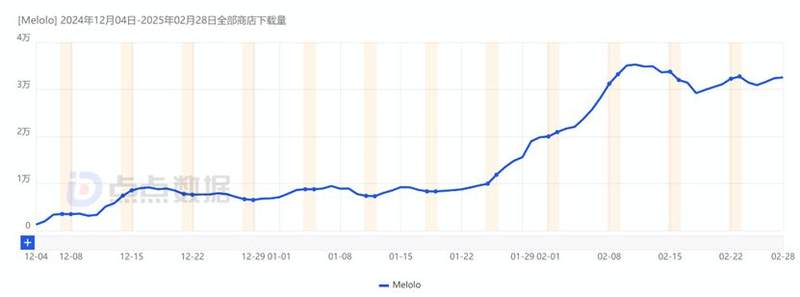

Base point data shows that from December 4, 2024 to February 28, 2025, Melolo’s estimated downloads from both terminals around the world have exceeded 1.32 million times.

Judging from the growth trend of downloads, Melolo’s downloads have shown a rapid growth trend since the end of January. On January 26, Melolo’s single-day downloads exceeded the 10,000 mark for the first time. On February 8, the single-day downloads exceeded 30,000 for the first time. As of now, its average daily downloads have stabilized at more than 30,000 times.

Source: Diandian Data

In terms of regional distribution, Melolo mainly focuses on Southeast Asian markets, and its top five markets in download volume are all Southeast Asian countries.

Among them, Indonesia performed particularly well, contributing nearly 60% of downloads, accounting for 58.85%. Vietnam, Thailand and the Philippines ranked second, third and fourth respectively, contributing 18.48%, 12.78% and 9.75% of downloads respectively. These four major markets together accounted for 99% of downloads.

Source: Diandian Data

It is worth noting that Indonesia is becoming an important market for short drama apps to go abroad, mainly due to its huge population base (population of 281 million, making it the fourth most populous country in the world) and rapidly growing smartphone shipments (2024 Smartphone shipments increased by 7% year-on-year) and mobile Internet penetration (penetration rate reached 82.26%).

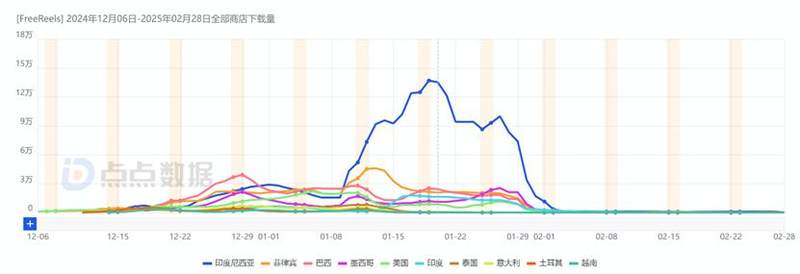

Compared with FreeReels, a free short drama application launched by Kunlun Wanwei during the same period, FreeReels has received more than 6.6 million downloads, and its downloads mainly come from Southeast Asia and South America. FreeReels ‘TOP5 download markets are Indonesia (36.54%), the Philippines (14.82%), Brazil (13.94%), Mexico (8.03%) and the United States (7.77%).

Source: Diandian Data

In terms of content, Melolo’s plays are mainly translated dramas, with a relatively low proportion of local dramas, and most of these sporadic local dramas are not exclusive dramas.

Base point data shows that Melolo’s rating is as high as 4.9 points, and five-star reviews account for about 95%. Observation of DataEye short dramas found that netizens ‘favorable comments on Melolo mainly focused on free, ad-free and interesting content, while the negative reviews mainly focused on issues such as the lack of appeal of system BUG content and the high proportion of domestic dramas and strange dubbing.

Source: Diandian Data

Melolo partial praise (Source: Diandian Data)

Some of Melolo’s negative reviews (Source: Diandian Data)

2. Melolo launch analysis: The launch volume is low, with FB and INS mainly invested

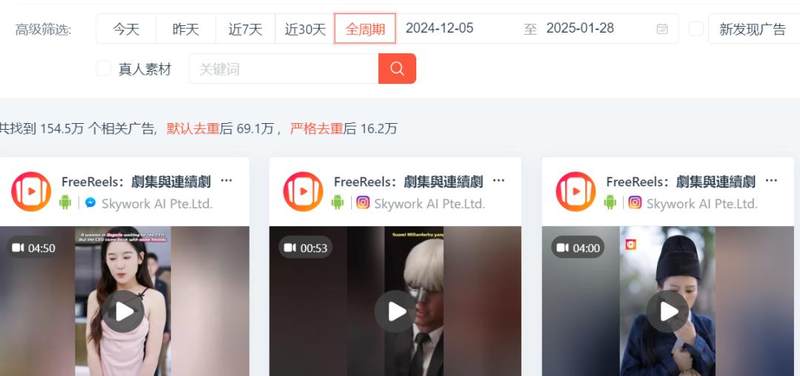

According to DataEye-ADX overseas short drama edition data, Melolo has been released since December 4, 2024, and has released nearly 5000 sets of de-duplication materials so far. In the same period, FreeReels, a subsidiary of Kunlun Wanwei, released 162,000 sets of de-duplication materials. (Roughly calculated, FreeReels releases more than 30 times as much material as Melolo)

Judging from the release trend, Melolo has gradually increased the release of materials since late January, reaching a peak of 853 groups on February 25. Subsequently, the amount of materials put in place declined slightly, but the average daily amount of materials put in place remained at around 700 groups.

Compared with competing products, Melolo’s overall launch volume is relatively low, which is in sharp contrast to Byte’s consistent promotion strategy of holding high and hitting high. In the February list of overseas short drama APP release materials, Melolo only ranked 46th.

Judging from the media choices, as Byte’s son, Melolo has still focused his main efforts on Instagram and Facebook, two popular media platforms, in the past 90 days. These two media platforms account for more than 97%. The Tik Tok platform has very little launch volume.

From the perspective of market launch, Melolo mainly invests in the Southeast Asian market. According to DataEye-ADX overseas version data, in the past 90 days, the Indonesian market ranked first in the volume of materials released, accounting for 43.18%. Vietnam and Thailand followed closely with 32.24% and 28.32% respectively, while the Philippines released 14.16%. Overall, Melolo’s launch regions and download trends are basically the same.

DataEye short dramas observed and analyzed the TOP40 hit materials and found that all were translated dramas, with about 53% in Indonesian, 33% in English, and 15% in Thai. In terms of media placement, 45% launched Facebook and 55% launched Instagram.

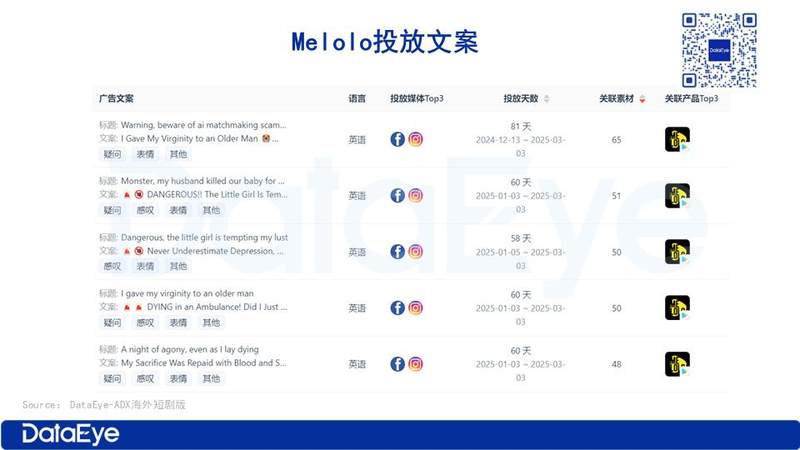

Judging from the launch copywriting, Melolo’s popular launch copywriting is very titled, and the advertising copywriting is similar to the domestic short drama copywriting.

For example, some headlines use a warning tone to stimulate users ‘curiosity. Such as Warning, beware of ai matchmaking scam…& rdquo;(Warning, beware of artificial intelligence matching fraud).

There are also titles that create a tense and dangerous atmosphere, creating an impulse for users to explore the story behind it. Like Monster, my husband killed our baby for …& rdquo;(Monster, my husband killed our children to kill them) and Dangerous, the little girl is teasing my lust (Dangerous, the little girl is teasing my lust).

In terms of media delivery, it is mainly concentrated on the two popular social media platforms, Facebook and Instagram. These two platforms have a large user base and high activity. They can provide extensive communication channels for these copywriting with strong emotional stimulation and suspense, effectively reaching a large number of potential users.

At the level of social media communication, Melolo’s marketing efforts are not large. As of now, Melolo’s official account has only been posted on Facebook, and has only 254 fans. It has not been updated since the end of December, and has not yet been posted on other platforms such as YouTube and INS.

3. Summary

(1) Summary of Melolo’s current situation

Overall, Melolo is still in the testing and exploration stage overseas, and its overall performance is as follows:

1. The download volume performance is acceptable but the market concentration is high: As of February 2025, Melolo has more than 1.32 million downloads worldwide, and the average daily download volume has stabilized at more than 30,000, but 99% come from four Southeast Asian countries (Indonesia 58.85%, Vietnam 18.48%, Thailand 12.78%, and the Philippines 9.75%). High-priced markets such as North America and Europe have not yet made efforts.

Although Melolo has achieved certain results in the Southeast Asian market, the market concentration is too high and there are certain risks. Once there are policy changes in the Southeast Asian market (such as review of short drama content) or the rise of local competing products, it may have a great impact on Melolo’s development.

2. Conservative delivery strategy: Unlike Byte’s consistent large-scale promotion strategy, Melolo’s overall delivery volume is low and ranks low in the overseas short drama APP release material rankings. Moreover, the launch is mainly concentrated on Instagram and Facebook platforms (accounting for 97%), and the TikTok traffic pool is not fully utilized.

3. The content is mainly translated dramas and lacks local characteristics: Melolo’s plays are mainly translated dramas, and local dramas account for a low proportion and are not exclusive. Content homogenization is serious, and content with local characteristics and exclusive advantages is lacking. This may affect user loyalty to the platform and Retention rate.

4. There is a clear gap between competing products: Kunlun Wanwei’s free short drama application FreeReels has been downloaded 6.6 million times and has penetrated the U.S. market (accounting for 7.77%). Melolo has not yet entered the United States, and the download volume is only 20% of FreeReels. In addition, overseas platforms such as Netflix and YouTube are accelerating the layout of micro-short dramas and squeezing the living space of independent short drama apps.

(2) Advantages and disadvantages of making short dramas by byte

Advantages:

1. Brand influence: Byte’s TikTok has a huge user base and high brand awareness around the world. As of 2024, the number of monthly active users of TikTok worldwide has reached 1.56 billion, which is a key to Melolo’s promotion and user acquisition. Provides a certain brand endorsement and traffic base. Byte’s TikTok for Business has also accumulated rich overseas marketing experience and resources, which can provide support for Melolo’s marketing promotion.

2. Technical strength: Byte has leading technical strength in algorithm recommendation, big data analysis, etc. It can achieve accurate content recommendation and advertising through analysis of user data, and improve users ‘viewing experience of short dramas and advertising. Conversion rate.

3. Content ecological collaboration: The successful model of domestic short dramas (such as Hongguo short dramas) has fully verified users ‘strong demand for short dramas. Byte can accelerate overseas content iteration and optimization by reusing script libraries, production teams and algorithm recommendation experience.

At the same time, ByteDance is widely deployed in the overseas entertainment field. Its business covers multiple sectors such as short dramas, novels, comics and content creation tools. It owns a series of products such as Fizzo, Fizzo Novel, My Tpia and Fizzo Toon, which can form a closed loop of IP adaptation-short drama development-user paid content with Melolo.

Disadvantages:

1. Insufficient localization: Melolo’s translated dramas account for too high a proportion, with problems such as poor dubbing quality and obvious cultural barriers, and fail to deeply integrate into local narrative styles (such as the strong demand of Indonesian users for localized content). As a result, users have a weak sense of identity and belonging to the platform content, which affects the platform’s user loyalty and market competitiveness.

2. The delivery strategy is not flexible enough: Compared with competing products ‘high-intensity advertising strategies (such as FreeReels’ large-scale marketing), Melolo’s delivery strategy is relatively conservative, resulting in limited user growth.

As Byte’s first offshore short drama product, Melo lo is still in the testing stage and faces core challenges such as insufficient content localization, insufficient launch efforts, and squeezing competing products. Byte’s core advantages lie in its technical reserves, global operating experience and TikTok’s traffic potential, while its shortcomings focus on cultural adaptability and lack of flexibility in market strategies.

If Byte can rely on its own ecological advantages to make up for the shortcomings of localization and operations, Melolo may be able to replicate TikTok’s globalization success and become the next dark horse in the short drama market.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.