Forget about the top seven U.S. stocks and welcome the top ten of China.

The trend of global technology stocks is “rising from the east and falling from the west”, and many public offerings are fighting for the Science and Technology Innovation Composite Index

Photo source: Visual China

Blue Whale News, March 5 (Reporter Ao Yulian)“The main line of this round of bull market is very clear. This is a round of technology cattle unseen in China’s stock market!& rdquo; Wu Weizhi, founder of China-Europe Ruibo, recently issued a document saying.

The AI affirmative action initiated by DeepSeek has made China’s technology an elephant that cannot be ignored, and funds are accelerating into the technology track, especially the science and technology innovation board where hard technology gathers. The Science and Technology Innovation Board Composite Index has become another phenomenal product after the China Securities A500. Currently, there are more than 30 public offerings, and a total of more than 50 related funds have been declared.

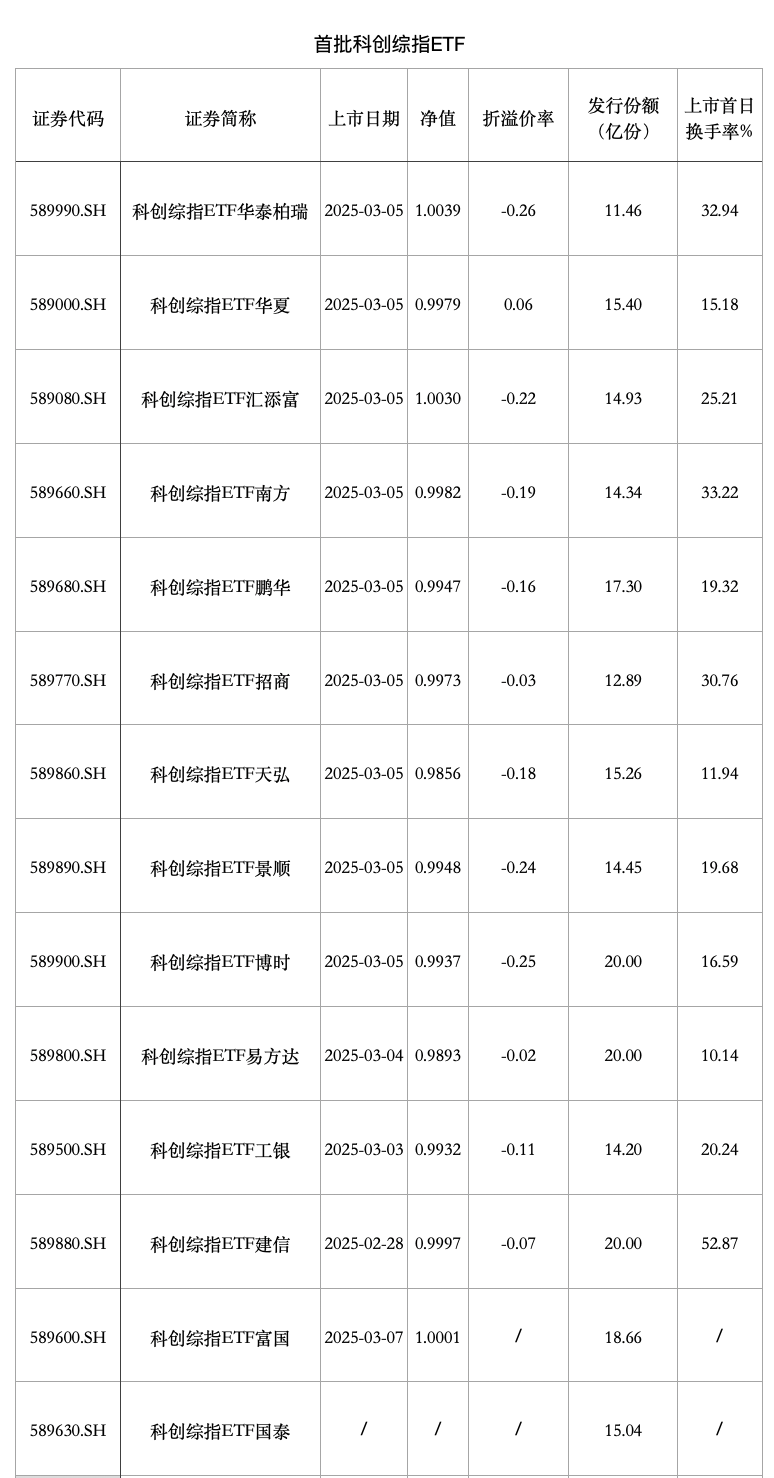

On March 5, Cathay Pacific and Shanghai Stock Exchange Science and Technology Innovation Board Composite Index ETF announced that the contract came into effect and raised 1.504 billion yuan in funds. So far, all 14 of the largest single-product Science and Technology Innovation Index ETF at the beginning of the year have completed fundraising, raising a total of 22.4 billion yuan. Among them, CCB, Yifangda and Bosch all raised 2 billion yuan.

Also on March 5, nine Science and Technology Innovation Composite Index ETFs were listed on the Shanghai and Shenzhen Stock Exchanges. On the first day of listing, except for the China Science and Technology Innovation Composite Index ETF, the other eight companies all closed at a small discount, with a discount range of 0.02%-0.4%. ETFs sold more on the first day of listing, and small discounts were the norm.

“The company’s task is to sell 200,000 yuan per person, and we have hired several customers to buy it. I think the Science and Technology Innovation Board has risen a bit sharply, and customers will sell it as soon as it goes public today. rdquo; A brokerage business office employee told reporters that the commission was around 1,300 yuan.

At present, except for Fuguo and Cathay Pacific Science and Technology Innovation Index ETFs that have not yet been listed, the remaining 12 Science and Technology Innovation Index ETFs have been traded on the floor, and real money has been invested in the Science and Technology Innovation Board. However, due to the recent shocks in the science and technology innovation board and the different pace of opening positions, there are currently 10 companies with net worth below the face value of 1 yuan.

The above-mentioned 14 only seized the lead, and many institutions were queuing for admission tickets. At present, the issuance pattern of the Science and Technology Innovation Composite Index is probably: small institutions increase in number, and large institutions issue ETFs.

The official website of the China Securities Regulatory Commission shows that Jiashi, Xingye, Xingyin, and Xizang Dongcai have applied for ETFs and are still waiting for approval; 12 companies including Suxin Fund, Guojun Asset Management, Fuguo Fund, and Boshi Fund have reported index enhancement funds, while China-Europe Fund, Great Wall Fund, and Yongying Fund have reported over-the-counter index funds.

At present, it seems that the three institutions of Fuguo, Boshi and Tianhong are using a two-pronged approach to enhancing the ETF+ index.

Since February, the market style has been distinctive. Except for hard technology sectors such as AI and humanoid robots, the money-making effect of other sectors is actually not strong. Driven by the market, the marketing of fund companies has also turned to technology. From the technology team of China-Europe Fund, the technology corps of Invesco Great Wall, to the science and technology innovation cow of China Asset Management Fund, they have reassessed the China series of live broadcasts and publicly raised the battle against the technology track.

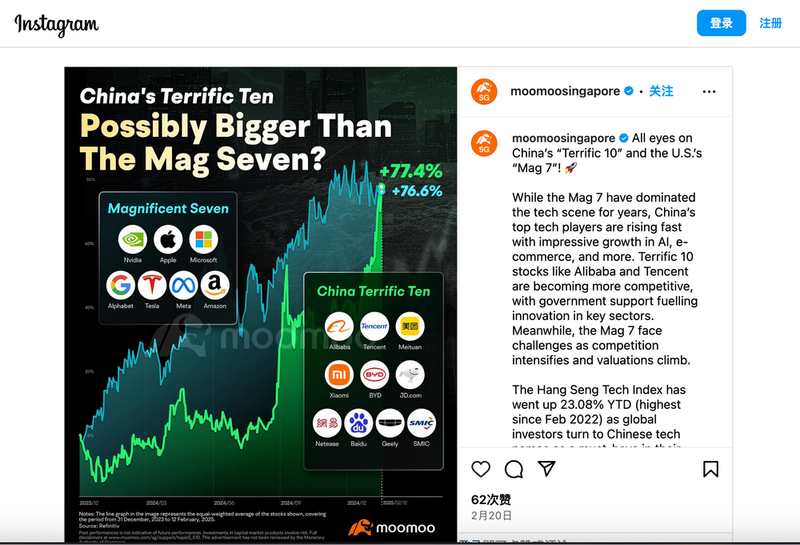

China’s technology has also become the protagonist of research reports by foreign investment banks: Deutsche Bank released a research report on “China Swallows the World”, Morgan Stanley upgraded China’s industrial technology to overallocation, and Jeff Weniger, director of strategy at WisdomTree Investments Securities, proposed the concept of Terrific 10 (China’s Top Ten Technology Talents: Alibaba, Tencent, Meituan, Xiaomi, BYD, Jingdong, Netease, Baidu, Geely, SMIC). China’s Top Ten Technology Talents pose a challenge to the seven U.S. stock giants.

Looking around the world, technology stocks are experiencing a downward trend. Since 2025, the Hang Seng Technology Index has increased by 29%, while the Nasdaq Technology Index has fallen by 6%.

In response, Yan Taw, head of Asia at Lubemai, published an article in March “Forget the Top Seven: Welcoming the Top Ten.” He believes that China’s technology industry may be in its own OpenAI moment. Western models are not popular in China. Alibaba and others have announced increased investment in AI. DeepSeek’s breakthrough may trigger productivity growth in other industries, including health care, retail and manufacturing.

In addition, Yan Taw believes that, on the one hand, the private enterprise symposium in mid-February will release technological benefits. On the other hand, the technology ecosystems of the West and China have been decoupled, and the impact of U.S. chip restrictions is actually limited. At present, the valuations of China’s top ten are far lower than those of the top seven in the United States. The difference in valuation between the two will attract long-term investors to intervene in China’s technology investment.

China’s Top Ten Science and Technology Leaders Get Attention