Original title: Uniswap Foundation votes on a massive $165.5m USD funding.

Original author: Ignas, DeFi researcher

Compiled by: Tim, PANews

The Uniswap Foundation voted to approve a huge $165.5 million investment plan. Why?

Because the performance of Uniswap v4 and Unichain after their release fell far short of market expectations.

In more than a month:

· Uni v4’s total lock-in value (TVL) is only $85 million

· Unichain’s TVL is only $8.2 million

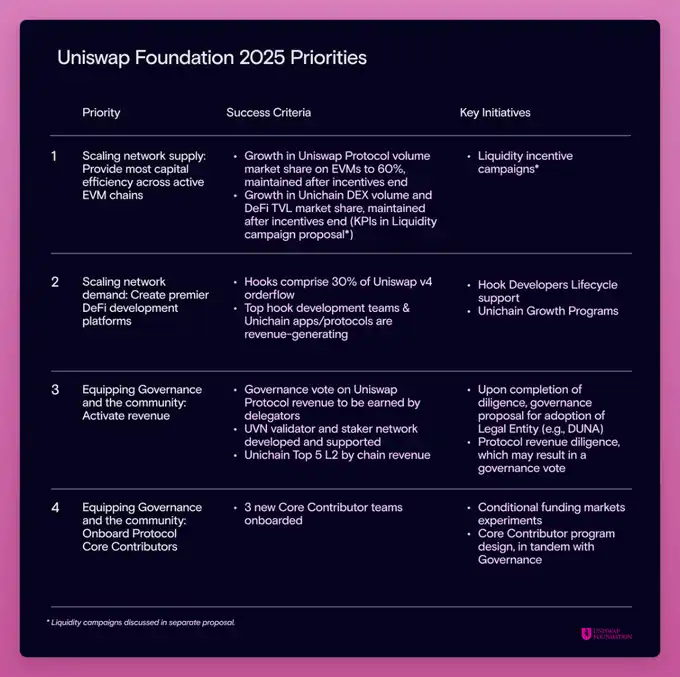

To promote growth, the Uniswap Foundation proposes to allocate US$165.5 million to the following:

·US$95.4 million for funding (developer programs, core contributors, verifiers);

·US$25.1 million for operations (team expansion, governance tool development);

·$45 million for liquidity incentives.

As you can see, Uni v4 is not only a DEX, it is also a mobility platform, and Hooks is the application built on it.

Hooks should promote the ecological growth of Uni v4, so funding plans need to accelerate this process.

Detailed allocation explanation of the funding budget:

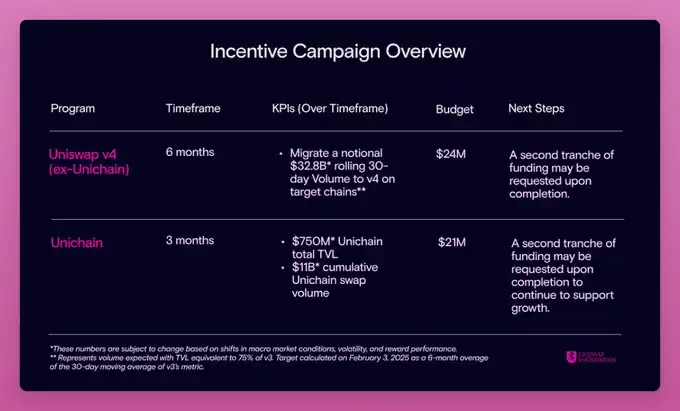

The $45 million in liquidity provider (LP) incentives will be used for the following:

·US$24 million (distributed over 6 months):Used to encourage mobility to migrate from other platforms to Univ4;

·US$21 million (distributed over three months):Promote Unichain’s total lock-in value (TVL) growth from the current US$8.2 million to US$750 million.

In comparison, Aerodrome mints approximately $40 million to $50 million worth of AERO tokens per month for liquidity provider (LP) incentives.

The proposal has passed the temperature check stage, but still faces some criticism:

·As the industry landscape changes, Aave proposes to repurchase US$1 million in AAVE tokens every week, and Maker plans to repurchase US$30 million a month. However, UNI holders are like “cows” that are about to be squeezed out of value, and their token value has never been captured.

· UNI tokens do not have fee sharing mechanisms enabled, and Uniswap Labs has earned $171 million through front-end fees over two years.

The key to the entire system lies in the organizational design of Uniswap:

· Uniswap Labs:Focus on protocol technology development;

· Uniswap Foundation:Promote ecological growth, governance and funding plans (e.g., funding allocations, liquidity incentives).

What a smart legal team.

Aave and Maker have established a closer interest-binding relationship with token holders, and I don’t understand why Uniswap’s front-end fees cannot be shared with UNI holders.

In short, other criticisms focus on three aspects: high salaries for the core team, Gauntlet’s responsibility for liquidity incentive enforcement, and the establishment of a new centralized DAO legal architecture (DUNA).

As a small governance representative for Uniswap, I voted in favor of the proposal, but still have major concerns about the future of UNI holders: the incentive mechanism is not aligned with the interests of the holders.

However, I am a big fan of Uniswap and highly recognize its driving role in the DeFi space. The current growth trend of Uni v4 and Unichain is very bleak, and they need to introduce incentives to promote development.

The next Uni DAO vote should focus on the value capture mechanism of UNI tokens.

original link