1. Trump’s tariff stick hit the U.S. stock market hard, with the Nasdaq Composite Index falling 2.78%, and Nvidia falling more than 8%. 2. The bearish sentiment of U.S. retail investors suddenly jumped;3. Amazon released the quantum computing chip Ocelot;4. Musk’s “free” satellite delivery chain is intended to snatch large government orders.

Cailian News, February 28 (Editor Shi Zhengcheng)Last night and this morning, just as investors believed they had weathered the test of Nvidia’s earnings report safely, US President Trump’s erratic remarks triggered a new round of selling in the US stock market.

As of Thursday’s close, the Standard & Poor’s 500 Index fell 1.59% to 5,861.57 points; the Nasdaq Composite Index fell 2.78% to 18,544.42 points; and the Dow Jones Industrial Average fell 0.45% to 43,239.5 points.

(Daily chart of the Nasdaq Index, source: TradingView)

Affected by this,The “Big Seven” symbolizing the bull market in U.S. stocks collectively plunged, and the overall market value evaporated by nearly US$550 billion (approximately RMB 4 trillion)。whereinNVIDIA rose 2% from the opening to the closing down more than 8%, the market value evaporated by more than US$270 billion.

(Source: Wind)

In the chip giant’s latest earnings report, revenue and profit exceeded expectations in the fourth quarter, and a strong performance guidance was also released, reflecting that the artificial intelligence race continues to drive demand for AI chips. If you want to find fault, the decline in gross profit margin this quarter may be a problem. At the same time, as data center revenue has increased tenfold in two years, revenue has exceeded expectations by the least in recent years, which is not enough to ignite market sentiment.

James t, chief investment officer of Main Street Research, lamented thatNvidia’s performance is actually excellent, but it comes at a time of extreme market turmoil.

In addition to Trump’s tariff statement, Thursday’s jobless claims data also deepened market concerns about the prospects of the U.S. economy under Trump. The Labor Department’s report showed that the number of jobless claims for the week ended February 22 was 242,000, an increase of 22,000 from the previous week’s revised figure.

Similar to the fact that U.S. consumers ‘confidence in the U.S. economy continues to be clouded, only five weeks after Trump returned to the White House, the mentality of individual U.S. stocks has suddenly changed.

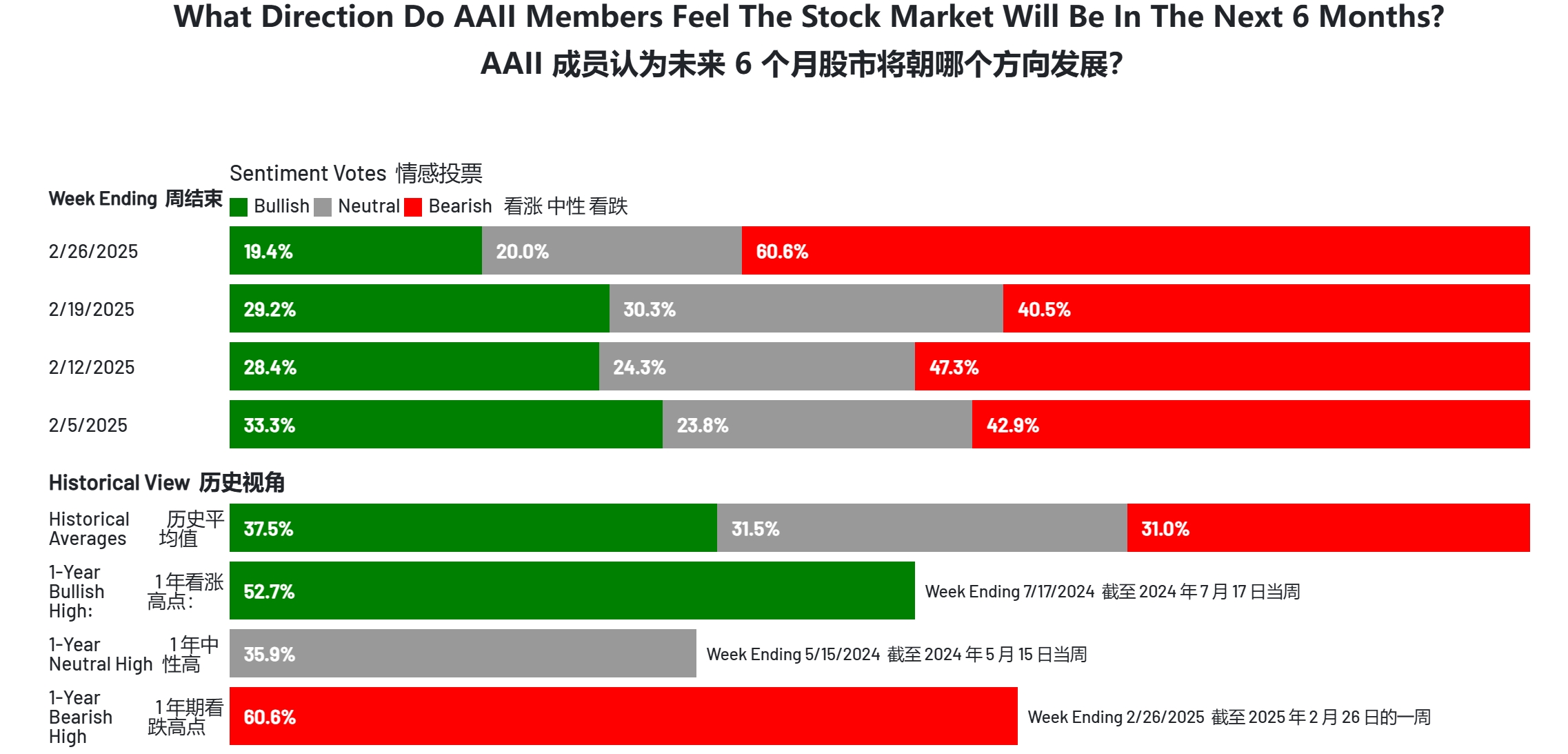

According to the latest sentiment survey by the American Association of Individual Investors,More than 60% of respondents believe that U.S. stocks will fall in the next six months, a sharp increase of 20% from the previous week.

Generally speaking, pessimism among retail investors often means a better place to buy. The problem is that the S & P 500 only hit a record high last Wednesday.With U.S. stocks near historical highs, it is unprecedented for retail investors to be so pessimistic.

(Daily chart of the S & P 500 Index, source: TradingView)

Dan Ivasian, chief investment officer of Pacific Investment Management Corporation (PIMCO), explained that there is not only uncertainty here in the United States, but also in terms of relations with other countries and impact on the market. This not only caused a large number of local fluctuations, but also triggered fluctuations across countries, industries, and yield curves. This is also a huge opportunity.

ian saidThis year’s key theme is maintaining “healthy humility” about uncertainty–Recognize the uncertainty of markets and then focus on taking advantage of all opportunities in global markets.

For the U.S. stock market, there is also PCE data on Friday,”the Fed’s most concerned inflation indicator”. Current economists forecast that the PCE annual rate may slow down in January.

Performance of hot stocks

As of Thursday’s close, US technology giants fell across the board. Apple fell 1.27%, Microsoft fell 1.8%, Amazon fell 2.62%, Nvidia fell 8.48%, Google-A fell 2.45%, Tesla fell 3.04%, Meta fell 2.29%, and Ultramicro Semiconductor fell 4.99%.

Chinese stocks were also dragged down and weakened, but their condition was significantly better than the U.S. stock market. The Nasdaq China Golden Dragon Index closed down 0.93%.

As of the close, Alibaba fell 1.82%, Jingdong rose 0.02%, Baidu fell 1.01%, Dianduo fell 0.91%, Beilai fell 2.27%, NIO rose 1.48%, Netease fell 0.81%, Ideal Car fell 3.02%, Xiaopeng Automobile rose 1.23%, Gaotu rose 3.61%, and Baiji Shenzhou rose 7.48%. Driven by the China Securities Regulatory Commission’s approval of the IPO registration of Yingshi Innovation and Technology Innovation Board, the company’s shareholder Xunlei shares surged 29.66%.

company news

[Amazon releases quantum computing chip Ocelot]

Amazon’s cloud computing division AWS launched a new quantum computing chip,”Ocelot,” on Thursday, claiming that Ocelot can reduce the cost of implementing quantum error correction by up to 90% compared to current methods.

[Musk’s “free” star delivery chain is intended to snatch big government orders]

Media reports on Thursday said Musk’s Star Chain equipment had been installed in a Federal Aviation Administration (FAA) facility, paving the way to take over Verizon’s existing $2.4 billion upgrade contract. Musk also publicly stated on Thursday that Star Link terminals are being provided to taxpayers for free in emergencies to restore the air traffic control network.

[Tesla applied for an online ride-hailing service in California but it was not driverless]

Reports emerged on Thursday that Tesla had applied for a permit to operate an online ride-hailing service in California, but would use human drivers instead of the driverless taxis Musk had previously promised. Musk has said Tesla will launch a driverless online ride-hailing service in Austin in June and plans to offer the service in California by the end of this year, but did not provide specific details.

[Meta discusses US$35 billion in financing for data centers with asset managers]

According to people familiar with the matter, asset management giant Apollo Global Management is negotiating to take the lead in providing Meta with US$35 billion in financing, and KKR is also one of the potential investors. It is reported that the financing scale will reach US$35 billion to develop data centers in the United States.