① Huawei’s concept stock Bee Assistant’s share price increased by 180% during the year. In addition, Changsheng Bearing and Daily Interactive’s cumulative maximum increase during the year exceeded three times;

② Sort out the number of institutional surveys received during the period from 2.5 to 2.28, the list of the top ten stocks received by institutional visits (attached table), and the latest institutional surveys on bullish stocks in the most recent month.

Cailian News, March 1 (Editor’s Square)According to Choice statistics, as of press time, the three stock markets in Shanghai, Shenzhen and BeijingIn February (2.5-2.28), a total of 632 listed companies accepted institutional surveys。Specifically, the listed company with the largest number of receptions received by reception agencies was Amperongda 15 times; Huichuan Technology ranked second, with 10 receptions; Huaxi Testing followed closely, with 9 receptions. See the following figure for details:

According to the statistics of institutional visits, Huichuan Technology, Folai Xincai, Lianying Medical, Digital Zhengtong, Beifang Beijing, Chuanyin Holdings, Yuxin Technology, Anbiping, Bee Assistant and Crystal Optoelectronics rank among the top ten in terms of receptions. The top three Huichuan Technology, Folai New Materials and Lianying Medical Institutions received 487, 343 and 342 visits respectively. See the following figure for details:

According to the graphical bull and bear stock data compiled by the Financial Union every week, it is found that among the many bull stocks that ran out that month,Folai New Materials, Bee Assistant, Changsheng Bearing, Capital Online, Youkede-W, Daily Interactive, Hanwei Technology, Baotong Technology, Gugao Technology, Shenhao Technology, AnkaiweiDuring the same period, the number of visits received by institutions was 343, 171, 150, 129, 76, 52, 47, 46, 29, 22, and 10 respectively.

Domestic leading enterprise in advertising inkjet printing materialsFoley New Materials has accumulated the largest increase since its January low of 244%。Foley Xincai stated in its investor relations activity record form on February 7 and February 18 thatThe flexible sensor project is the cutting-edge research direction of the company’s early planning, and made a number of patent layouts in different technical routes. As of now,The company’s research on humanoid robot flexible sensorsWe are in contact with many dexterous hand and ontology robot companies to simultaneously promote customized research and development, sample delivery, and technical exchanges.The main body of the flexible sensor pilot line has been installed, currently debugging functions and process parameters is progressing smoothly. In a change announcement issued on February 21, Folai Xincai said that the company has noticed that the market has paid high attention to the company’s flexible sensors recently.The company is building a pilot test line for flexible sensors, has not yet received orders for robotic electronic skins.

Main Internet digital virtual goods comprehensive servicesBee helpers have accumulated the largest increase since January lows of 180%。Bee Assistant stated in the investor relations activity record form on February 12 that as far as the cloud terminal sector is concerned,The cooperation between the company and Company H originated in 2019。The company took the lead in investing in the research and development of cloud terminal core technologies and products.Currently, it has accumulated cloud terminal computing power scheduling and 5G core application technologies, mainly including “terminal virtualization, cloud-native OS, end-cloud collaboration engine, intelligent computing resource scheduling engine”, etc. In 2021, Company H and the company reached a cooperation,Cloud terminal technology is applied in H Cloud’s ARM-architecture Kunpeng server, H Cloud provides cloud terminal products and services to operators, governments, etc. What distinguishes the company from other partners of Company H is that the company focuses on the application level of cloud terminal technology. On top of Company H’s hardware and basic systems, that is, on Company H’s IaaS system,Company provides PaaS and SaaS products,Form a complete product for end users and sell it externally by Company H.

Domestic leading self-lubricating bearing enterpriseChangsheng Bearing has accumulated the largest increase of 317% since its January low。Changsheng Bearing said in an institutional survey on February 18 thatThe cooperation between the company and Yushu Technology is advancing in an orderly manner, and a cooperation agreement has been signed and orders have been obtained.。The cooperative products are mainly self-lubricating bearings used in robot joints,This type of product has been produced and sold in small batches, accounts for a low proportion of main business income (less than 1%). In the research announcement on February 11, Changsheng Bearing stated thatThe company’s screw products include ball screws, T-screws and planetary roller screws。Some of the company’s lead screw products used in the automotive field have been mass-produced, mainly used in automotive braking, steering, parking systems and gearboxes. The company’s lead screw products used in the robot field are still in the process of sample delivery and research and development, mainly used in linear actuators of robots.

Also,Hanwei Technology, Baotong Technology, Gugao Technology, and Shenhao Technology all belong to robot concept stocks, the largest cumulative increases since January lows are190%, 147%, 133% and 100%。Hanwei Technology said on a conference call on February 16 that judging from the current stage of cooperation with the robot factory, the progress is relatively smooth.The company has carried out different forms of cooperation with nearly 20 robot factories, such as sample delivery, personalized solution customization, small batch supply, etc. Baotong Technology, which specializes in industrial Internet and mobile Internet, said in a research announcement on February 25 thatThrough recent communication with YushuThe needs and goals of both parties are the same, which is to promote the innovation and implementation of industrial robot technology and assist industrial intelligent transformation.

Gu High-Tech, whose motion control technology and products have reached the international advanced level, said in an institutional survey on February 27 thatAt present, the company’s related components and system products have certain revenue in the robotics field, mainly from industrial and logistics robot customers. Specific to the current humanoid robots and quadruped robots, the company is cooperating with host customers to build systems and actively explore and explore commercial implementation scenarios. When Shenhao Technology accepted an institutional survey on February 14, it said that the company has been paying attention to the development trend of humanoid robots and is exploring the application development of humanoid robots by using the company’s accumulated technology and understanding of the industry over the years.

A global Internet data center service providerCapital Online has accumulated the largest increase since January low of 231%。Capital Online disclosed its investor relations activity record form on February 9, saying thatThe company and DeepSeek are still in the process of communicationAs a large model, DeepSeek is essentially software that needs to be combined with hardware to provide services. It has its own computing power requirements. The company hopes to have closer cooperation with excellent model manufacturers like DeepSeek. On the same day, Capital Online issued a change announcement stating that the company had noticed that relevant platforms had included the company’s shares in the DeepSeek concept stocks.The company has recently carried out a full range of model adaptation work for DeepSeek, and launched the DeepSeek-R1 model. There are uncertainties in the relevant business effects and impact on the company’s future performance.

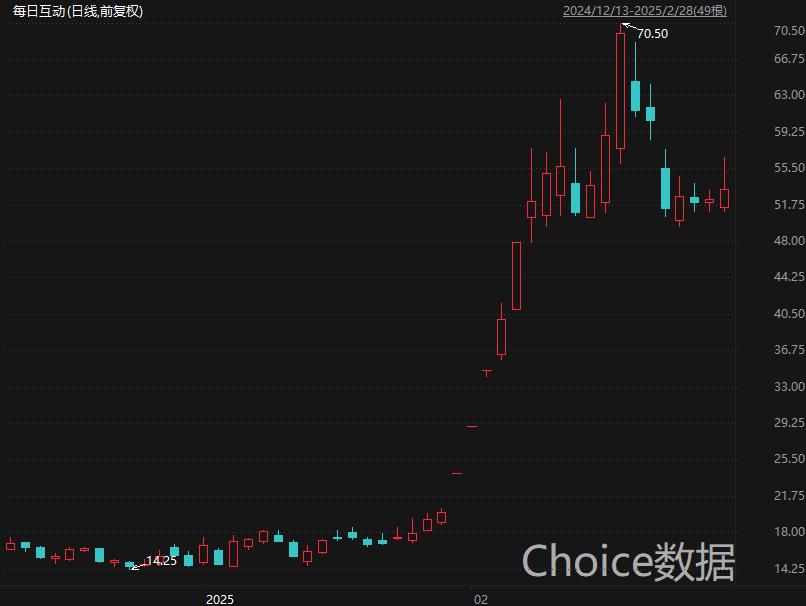

andUcede and Daily Interaction also have the DeepSeek concept, sinceThe cumulative biggest increases so far from the January lows are 242% and 388%, respectively.A research announcement disclosed by a third-party cloud computing service provider on February 13 stated thatThe company has the ability to publicly provide API services based on the full blood version of the large model, this model has been officially launched and tested with good results and will continue to be open in the future. The company has served many AI customers and has a relatively good understanding of large models, especially reasoning. In the process of serving many large model customers, I have accumulated a lot of valuable experience in handling practical problems. Ucede announced on February 14 thatThe company has also recently conducted a full range of model adaptation work with DeepSeek, currently has no material impact on the company’s business development.

When a professional data intelligence service provider accepted an institutional survey on February 7, it said that the company currently does not provide corpus data to DeepSeek, and the company mainly uses DeepSeek’s capabilities for its own use. Daily Interactive issued a change announcement on February 5 stating that the company had accessed relevant versions of DeepSeek earlier and completed various aspects of evaluation and used its own computing power to conduct privatization deployment.The company’s digital intelligence products built based on the DeepSeek modelThe impact on future operating results depends on the progress of product research and development and the implementation of industry scenarios.