① The United States will grant a one-month tariff exemption to cars imported through the US-Mexico-Canada Agreement;

② Chinese stocks generally rose, with the Nasdaq China Golden Dragon Index closing up 6.4%;

③ Google tests new AI search models to deal with complex queries;

④ The Federal Reserve’s Beige Book: Economic activity increased slightly, and consumer spending fell overall.

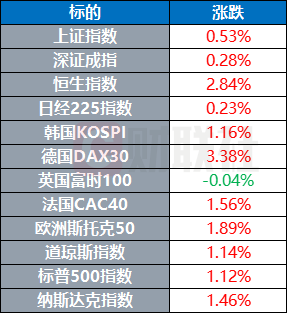

Overnight stock market

On Wednesday, the three major U.S. stock indexes closed up collectively, with the Dow rising 1.14%, the Nasdaq rising 1.46%, and the S & P 500 index rising 1.12%. Large technology stocks generally rose. Microsoft rose more than 3%. Tesla, Amazon, Meta, Broadcom rose more than 2%.

Chinese stocks generally rose. The Nasdaq China Golden Dragon Index closed up 6.4%, setting a new closing high since October last year. Alibaba rose nearly 8.6%, Jingdong rose 6.8%, Mangang rose 13.8%, Dianduo rose 6%, and Baidu and Beili rose more than 5%.

Major European stock indexes closed generally higher, with Germany’s DAX30 index rising 3.38%, France’s CAC40 index rising 1.56%, and the European Stoxx 50 index rising 1.89%.

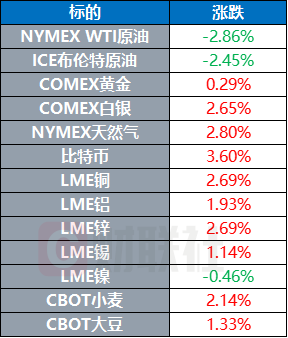

commodity market

COMEX gold futures closed up 0.29% at US$2929/ounce;COMEX silver futures closed up 2.65% at US$33.24/ounce.

The settlement price of WTI crude oil futures fell 2.86% to US$66.31/barrel. Brent crude oil futures settled down 2.45% to US$69.30/barrel.

Rebecca Babin, senior energy trader at CIBC, said: “The market is repricing the downside risks to crude oil, and the $65 floor for U.S. oil has shifted closer to $60. The focus has shifted entirely from supply risks to demand concerns, which could signal that we are approaching the bottom.”

market news

[The United States will grant a one-month tariff exemption to cars imported through the U.S. -Mexico Agreement]

White House Press Secretary Levitt said that the United States will grant a one-month tariff exemption to any car imported through the US-Mexico-Canada Agreement. On March 3, local time, U.S. President Trump said that the United States will impose a 25% additional tariff on Mexican and Canadian goods that will take effect on March 4. In a speech at a joint session of Congress on the 4th, Trump reiterated that reciprocal tariffs would begin to be levied on April 2.

[Goldman Sachs raised its target price for the emerging markets index and predicted that China stock market will rise further]

Goldman Sachs raised its 12-month target for the MSCI Emerging Markets Index from 1,190 to 1,220 to reflect the positive impact of artificial intelligence adoption on corporate profits in China. New forecasts suggest the index has 12% room to rise from Tuesday’s close. Strategists such as Sunil Koul expect China stocks to rise further as stimulus measures are expected to stabilize economic growth.

[White House: U.S. is reconsidering funding for Ukraine]

US White House Press Secretary Carolyn Levitt said on March 5 local time that US Presidential National Security Assistant Waltz has been talking with his Ukraine counterparts. The U.S. National Security Council told Levitt it was reconsidering funding for Ukraine.

[French President Macron: Refusing to sign a fragile Russia-Ukraine ceasefire agreement]

French President Macron delivered a public speech on the evening of March 5 local time on the eve of the EU special summit. Macron said that Europe’s ally, the United States, has changed its stance in this conflict, reduced its support for Ukraine, adding more uncertainty to Europe’s future security and prosperity. He believed that the road to peace could not be achieved by abandoning Ukraine, and therefore refused to sign a fragile Russia-Ukraine ceasefire agreement. At the same time, he said that once a peace agreement is signed, Europe may need to deploy troops in Ukraine to ensure that all parties respect the agreement.

[Czech government will increase the proportion of defense spending]

The Czech government decided on March 5 that by 2030, the Czech Republic will increase its defense spending to 3% of its gross domestic product (GDP). The Czech government held a cabinet meeting that day. Czech Defense Minister Chernokhova posted on social media after the meeting, saying that the government has approved an increase in defense spending as a proportion of GDP to 2.2% in 2026, and will gradually increase it by 0.2 percentage points every year in the future until it reaches 3% goal in 2030. She said: “We must pay more attention to our own safety. We need to invest more in national defense and be responsible, efficient and rational.” Czech Prime Minister Fiala said on social media on the same day that the government’s decision to increase the proportion of defense spending is not only crucial to ensuring national security, but also brings opportunities for the country’s economic and scientific research development.

[Panamanian President: Trump’s remarks that “the canal is being taken back” are lies]

Panamanian President Mulino took to social media to refute U.S. President Trump’s remarks that “the United States is taking back the Panama Canal”, calling them a “lie.” Mulino said that Panama has not and cannot discuss this with U.S. Secretary of State Rubio or other U.S. representatives, rejected Trump’s insults to the facts and Panamanian national dignity, and reiterated that the sovereignty of the Panama Canal always belongs to Panama. Trump said in a speech to the Senate and House of Representatives on the 4th:”In order to further strengthen our national security, my administration will take back the Panama Canal, and we have already begun to do so.” He once again criticized Carter for signing a treaty with the Panamanian government during his tenure as U.S. president to return the Panama Canal to Panama.

[Federal Reserve’s Beige Book: Economic activity rose slightly, consumer spending fell overall]

The Federal Reserve released a survey report on the national economic situation. This report is compiled based on the latest survey results from the 12 regional reserve banks (i.e., 12 jurisdictions) affiliated to the Federal Reserve. It is also known as the “Beige Book”. The report showed that overall economic activity has increased slightly since mid-January. Six regions reported no change, four regions showed moderate or moderate growth, and two regions reported slight contractions. Consumer spending fell overall, with reports showing strong consumer demand for essential items but increased price sensitivity to non-essential items, especially among low-income consumers. Banking activity increased slightly overall. The residential real estate market is showing a mixed trend, with reports pointing to continued tight inventories. Construction activity in both residential and non-residential units declined slightly. Some people in the industry have also expressed concerns about the impact of potential tariffs on the prices of wood and other materials. Agricultural conditions have deteriorated. Overall expectations for economic activity in the coming months are slightly optimistic.

[Britain abandons antitrust investigation into the “Microsoft-OpenAI” combination]

On Wednesday local time, British antitrust regulators said that Microsoft’s $13 billion investment in OpenAI did not lead to “gaining control” and there were no problems that could hinder competition in the industry, so no subsequent intervention measures would be taken. CMA said in a statement: “CMA found that although Microsoft had had a significant impact on OpenAI in 2019, Microsoft has not changed or gained control of OpenAI.” Joel Bamford, CMA’s executive director for mergers and acquisitions, pointed out that the complexity of the two companies ‘cooperation, the ever-changing relationship and continuous communication with the company have resulted in an “unusually long review period.”

[Google tests new AI search model to deal with complex queries]

Google will begin testing a new artificial intelligence search model that allows users to ask questions that consist of multiple parts. Robby Stein, vice president of search products at Google, said the new feature, called “AI Mode”, can run multiple related searches simultaneously in the background, guess which subtopics users will be interested in next, and then give a comprehensive answer that summarizes multiple questions. This feature will run in a separate tab and is suitable for handling more complex queries. Early testing showed that query times in AI Mode were twice as long as normal searches. Stein said the feature allows users to access information on the web and all of Google’s new information systems. AI Mode can process text, pictures and videos and runs on Google’s latest flagship AI model, Gemini 2.0. AI Mode will first be available to users who pay for a Google artificial intelligence subscription plan.