① In February, the ex-factory prices of industrial producers nationwide fell by 2.2% year-on-year and 0.1% month-on-month;

②2 Lianban Guomai Technology announced that AI agent-related technological achievements have not yet generated commercial income;

③ Non-agricultural employment in the United States increased by 151,000 in February, which fell short of market expectations.

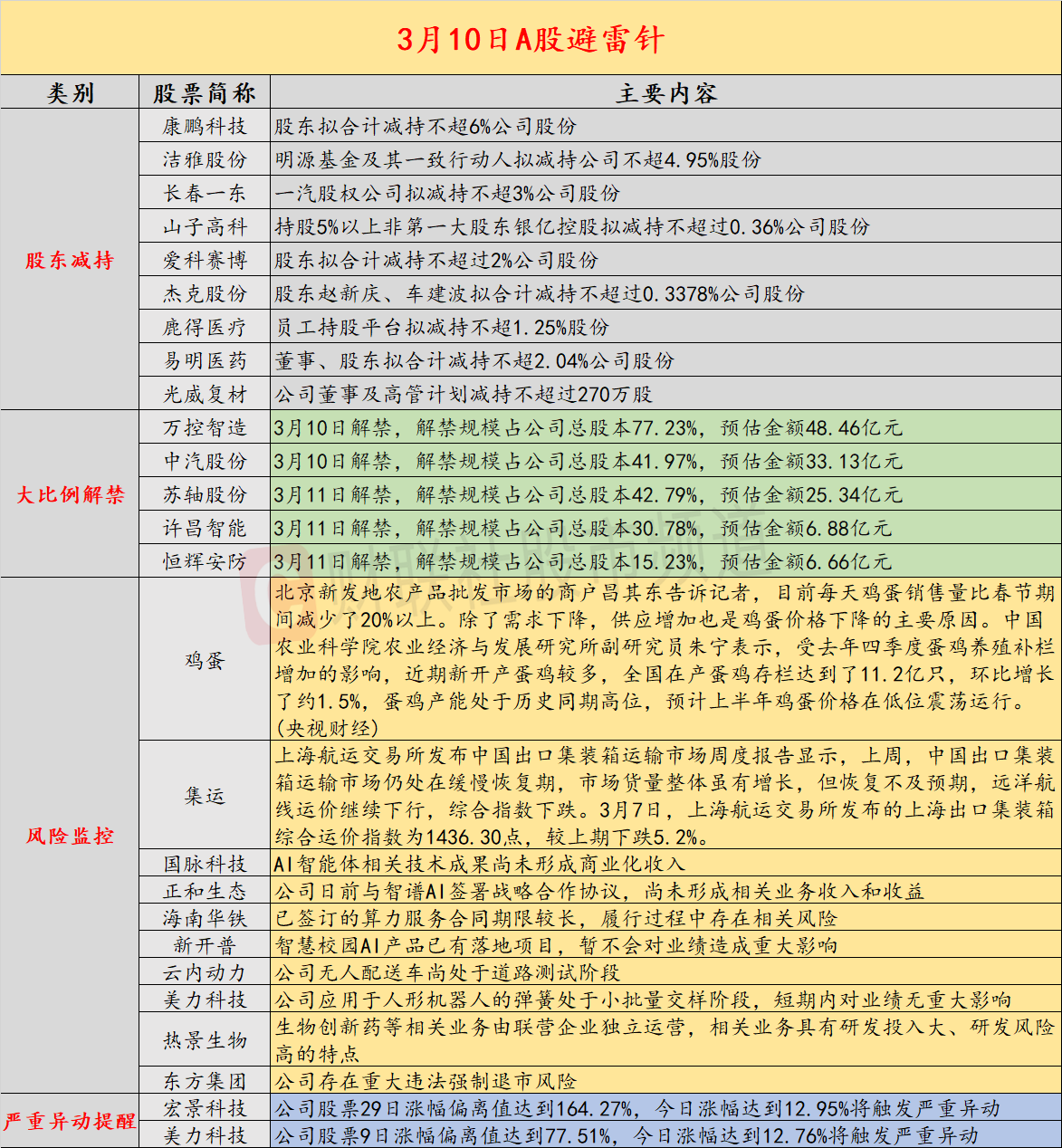

Introduction:Cailian invested in the lightning rod on March 10. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) In February, the ex-factory prices of industrial producers nationwide fell by 2.2% year-on-year and 0.1% month-on-month;2) Demand decreased and supply increased, and the national egg prices showed a downward trend; the company’s key concerns include: 1) 2 Lianban Guomai Technology announced that technological achievements related to AI agents have not yet generated commercial income; 2) 2 Lianban Zhenghe Ecology said that the company recently signed a strategic cooperation agreement with Smart Vision AI, but has not yet formed relevant business income and income; key concerns in overseas markets include: 1) The number of non-agricultural employment in the United States increased by 151,000 in February, which was less than market expectations;2) Federal Reserve Chairman Powell said that the Federal Reserve does not need to rush to adjust interest rates.

economic information

1. Data released by the National Bureau of Statistics shows that in February 2025, the ex-factory prices of industrial producers nationwide fell by 2.2% year-on-year and 0.1% month-on-month, and the decline narrowed by 0.1 percentage points from the previous month; the purchase prices of industrial producers fell by 2.3%, a month-on-month decrease of 0.2%. 1-2 On average, the ex-factory price of industrial producers fell by 2.2% compared with the same period last year, and the purchase price of industrial producers fell by 2.3%.

According to data released by the National Bureau of Statistics, in February 2025, national consumer prices fell by 0.7% year-on-year. In February, the prices of food, tobacco and alcohol fell by 1.9% year-on-year, affecting the CPI (Consumer Price Index) drop by about 0.54 percentage points.

2. Chang Qidong, a merchant at Beijing Xinfadi Agricultural Products Wholesale Market, told reporters that the current daily egg sales volume has decreased by more than 20% compared with during the Spring Festival. In addition to falling demand, increased supply is also the main reason for the decline in egg prices. Zhu Ning, an associate researcher at the Institute of Agricultural Economics and Development of China Academy of Agricultural Sciences, said that due to the increase in the number of laying hens breeding in the fourth quarter of last year, more new laying hens have been laid recently. The number of laying hens in the country has reached 1.12 billion, a month-on-month increase of about 1.5%. The production capacity of laying hens is at a historical high in the same period, and egg prices are expected to fluctuate at a low level in the first half of the year. (CCTV Finance)

3. The weekly report on China’s export container transportation market released by the Shanghai Shipping Exchange shows that last week, China’s export container transportation market was still in a period of slow recovery. Although the overall market volume increased, the recovery fell short of expectations. Freight rates on ocean routes continued to decline, and the composite index fell. On March 7, the Shanghai Export Container Composite Freight Index released by the Shanghai Shipping Exchange was 1,436.30 points, down 5.2% from the previous period.

Company warning

1.2 Lianban Guomai Technology: AI agent-related technological achievements have not yet generated commercial income.

2. 2 Lianban Zhenghe Ecology: The company recently signed a strategic cooperation agreement with Intelligent Spectrum AI, but has not yet formed relevant business income and income.

3. Kangpeng Technology: Shareholders plan to reduce their shares in the company by no more than 6%.

4. Jieya Shares: Mingyuan Fund and its concerted actions plan to reduce their shares in the company by no more than 4.95%.

5. Changchun Yidong: FAW Equity Company plans to reduce its shares by no more than 3%.

6. Shanzi High-tech: Yinyi Holdings, the non-largest shareholder holding more than 5% of the shares, plans to reduce its shareholding by no more than 0.36%.

7. Aikesaibo: Shareholders plan to reduce their shares in the company by no more than 2% in total.

8. Jack Shares: Shareholders Zhao Xinqing and Che Jianbo plan to reduce their shares in the company by no more than 0.3378%.

9. Lude Medical: The employee stock ownership platform plans to reduce its shares by no more than 1.25%.

10. Yiming Pharmaceutical: Directors and shareholders plan to reduce their shares in the company by no more than 2.04% in total.

11. Guangwei Composite Materials: The company’s directors and senior executives plan to reduce their holdings by no more than 2.7 million shares.

12. Changlian Shares: Net profit in 2024 will be 131 million yuan, a year-on-year decrease of 14.51%.

13. Aerospace Electromechanical: The net loss in 2024 will be 71.1649 million yuan.

14. Zhejiang Dongri: Net profit in 2024 will decrease by 34.94% year-on-year.

15. High-tech development: Net profit in 2024 will decrease by 83.75% year-on-year.

16. 3 Hainan Huatie: The signed computing power service contract has a long term and there are related risks during the performance process.

17. 20CM2 Connected Board New Cape: Smart campus AI products have been implemented and will not have a significant impact on performance for the time being.

18.2 Connected Board Cloud Power: The company’s unmanned delivery vehicles are still in the road testing stage.

19. Meili Technology: The company’s springs used in humanoid robots are in the stage of small batch submission and will have no significant impact on performance in the short term.

20. Hot View Bio: Related businesses such as bioinnovative drugs are independently operated by joint ventures. Related businesses are characterized by large R & D investment and high R & D risks.

21. Orient Group: The company has a major risk of forced delisting in violation of laws and regulations.

Overseas warning

1. Non-agricultural employment in the United States increased by 151,000 in February, which is estimated to increase by 160,000. The previous value was revised from an increase of 143,000 to 125,000. In the United States, private sector jobs increased by 140,000 in February, with an estimated increase of 142,000; in the United States, manufacturing jobs increased by 10,000 in February, with an estimated increase of 5,000; in the United States, federal government employees decreased by 10,000 month-on-month in February; The average weekly working hours in the United States in February were 34.1 hours, and it is estimated to be 34.2 hours.

2. U.S. President Trump said that in view of Russia’s current “fierce attack” on Ukraine on the battlefield, he strongly considers imposing large-scale sanctions and tariff increases on Russia until a ceasefire and a final peace agreement are reached. He urged Russia and Ukraine to “sit at the negotiating table.” As of now, Russia has not responded to Trump’s remarks.

3. Federal Reserve Chairman Powell said that the Federal Reserve does not need to rush to adjust interest rates. The Fed does not need to rush and can wait for the situation to become clearer. Uncertainty about the impact of the Trump administration’s policies remains high, with some recent surveys of inflation expectations and market indicators rising due to tariffs. Inflation is expected to continue to be bumpy towards 2% and will not overreact to one or two economic data that exceed expectations.

4. On the morning of March 8, China announced the results of its anti-discrimination investigation against Canada and announced that it would impose additional tariffs on Canada. This means that the results of the first anti-discrimination investigation initiated by China are released. Six major associations, including China Minmetals and Chemicals Import and Export Chamber of Commerce, China Automobile Manufacturers Association, China Chamber of Commerce for Import and Export of Mechanical and Electrical Products, China Nonferrous Metals Industry Association, China Chamber of Commerce for Import and Export of Food, Native Animals, and China Iron and Steel Industry Association, immediately voiced their firm support for the Ministry of Commerce’s anti-discrimination investigation and ruling in Canada.