The rapid emergence of bitcoin and digital asset reserve legislation at the state level marks a fundamental shift in the government’s view of cryptocurrencies as speculative assets and potential strategic reserves.

Author: Michael Tabone, CoinTelegraph

Compiled by: Deng Tong, Golden Finance

On February 4, the new cryptocurrency czar David Sacks said at a press conference that the bicameral cryptocurrency working group is studying the Strategic Bitcoin Reserve (SBR) and emphasized that “the concept of sovereign wealth funds is a bit different.”

In fact, sovereign wealth funds (SWFs) have always been widely understood by the cryptocurrency community and are often mistaken for a tool that can naturally contain Bitcoin or other digital assets. SWF is a government-owned investment fund that manages national savings and is usually built from surplus income such as oil profits or trade gains.

Their main goals are long-term growth and wealth protection and ensuring economic stability for future generations. Unlike central banks, which focus on managing money and monetary policy, sovereign wealth funds take a more strategic approach, investing in real estate, stocks, infrastructure and local companies.

In essence, they prioritize stable growth over risky investments, making them an important tool for countries seeking to ensure financial security beyond immediate needs.

The definition of a sovereign wealth fund is why Sacks quickly pointed out that sovereign wealth funds and SBR should not be confused. The scope of sovereign wealth funds may be used for broader purposes than specific reserves, including supporting domestic companies and market infrastructure.

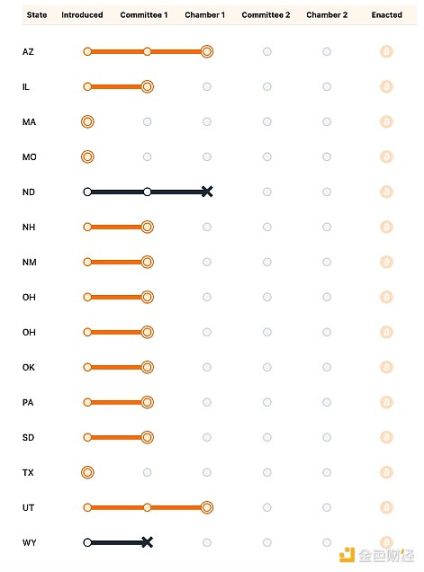

Twenty-three states have introduced bitcoin and digital asset legislation. Source: Bitcoin Laws

Bill Hughes, senior legal counsel for blockchain software company Consisys, pointed out that the concept of a sovereign wealth fund was created on February 3 by U.S. President Donald Trump and could serve as “a second option if cryptocurrency-only strategic reserves fail.”

As these initiatives gain momentum, they raise important questions about the role of cryptocurrencies in national-level investment strategies and what this means for the broader digital asset industry in 2025 and beyond.

The United States has established state-level sovereign wealth funds and bitcoin reserve programs

A few states already have sovereign wealth funds that meet this traditional definition of the United States. The Alaska Permanent Fund was established in 1976 to bring oil revenue into a diversified portfolio to support the state budget and annual dividends to residents.

The Texas Permanent Schools Fund uses oil and gas revenue to fund public education while ensuring financial stability. Similarly, the Wyoming Permanent Minerals Trust and the North Dakota Heritage Fund invest in oil, gas and mineral extraction proceeds to smooth budget fluctuations and preserve wealth for future generations.

New Mexico’s Resource Tax Permanent Fund uses a similar model, reinventing resource tax revenue from resource extraction to support the state’s fiscal health. Although these funds serve different purposes, they share a common goal: to transform temporary resource booms into lasting financial security.

That number would increase if analysts included state-managed funds that set aside surpluses, such as emergency funds or stabilization funds. Some of these funds invest, sometimes in diversified portfolios.

That leaves as many as 23 states with some form of such investment vehicles. However, their mandate and structure may differ from the “classic” sovereign wealth fund model.

Fifteen states have separate bitcoin and digital asset reserve bills. Source: Bitcoin Laws

On the positive side, 15 states currently have at least bitcoin and digital asset legislation. In these states ‘current races, Arizona and Utah are tied for the lead at the legislative voting level.

The Arizona bill proposes establishing a strategic bitcoin reserve fund with a cap of 10% of public funds, but only if the U.S. government establishes its own SBR. It is consistent with Senator Lummis’s Bitcoin bill, which aims to enable states to participate in federally managed plans.

Utah’s bill would allow 10% of several major state funds to be invested in digital assets, protect self-custody rights and ensure nodes are not classified as senders. Utah’s bill, which defines “digital assets” broadly and does not directly mention Bitcoin, takes a comprehensive approach to integrating cryptocurrencies into state investment strategies.

Both the North Dakota bill (HB1184) and the Wyoming bill (HB201) failed their respective state procedures.

This is a matter of time, not whether it will occur

The rapid emergence of bitcoin and digital asset reserve legislation at the state level marks a fundamental shift in the government’s view of cryptocurrencies as speculative assets and potential strategic reserves.

Whether these efforts translate into actual Bitcoin holdings or remain symbolic gestures will depend on political will, regulatory transparency and market conditions. However, what is certain is that these attempts have transcended theory.

As states experiment with digital asset reserves and the federal government formulates its own sovereign wealth strategy, Bitcoin’s role in public finances is no longer a question of “if” but of “when” and “how.”