OpenSea’s SEA tokens may be the key to the platform’s self-rescue, and may also become the driving force for pushing the NFT market out of the downturn.

Authors: Babywhale, Glendon, Techhub News

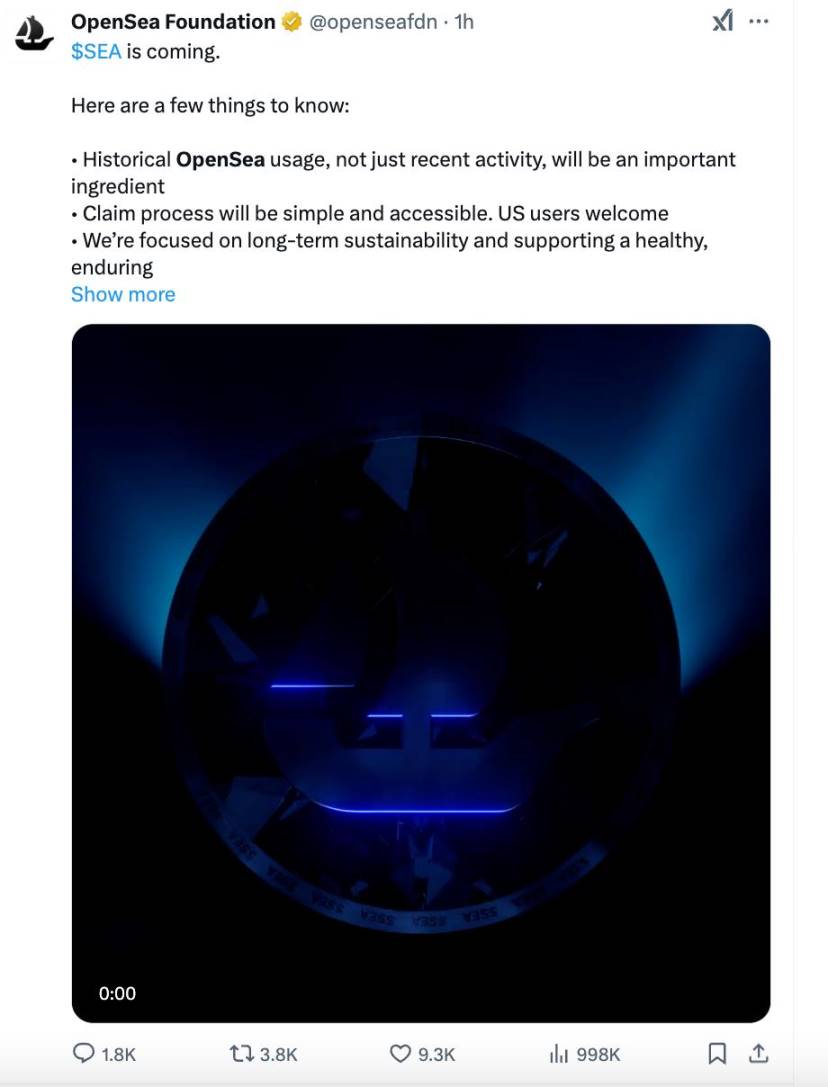

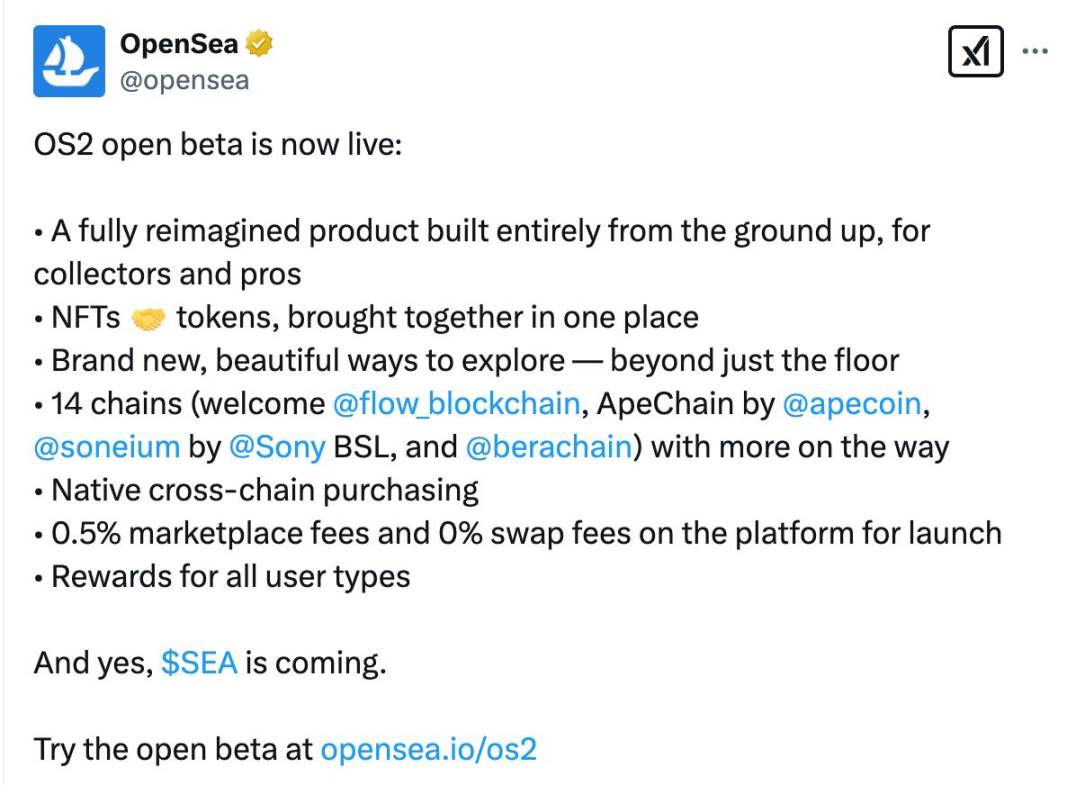

On the evening of February 13, OpenSea announced on X that it would launch a public beta version of OS2, launch the platform token SEA, and hinted that it would airdrop. Although the specific timetable and details have not yet been announced, this announcement has undoubtedly touched the hearts of many veteran players in the currency circle. In just one hour, the number of comments and retweets on this tweet has exceeded a thousand times, and the popularity of community discussions has soared.

Devin Finzer, CEO of OpenSea, also tweeted and emphasized,”The OS2 being launched is not just a new product, and SEA is not just a token, but a new OpenSea built from scratch.” There have also been some rumors that the new version of OpenSea will refer to Blur’s transaction-centered UI.

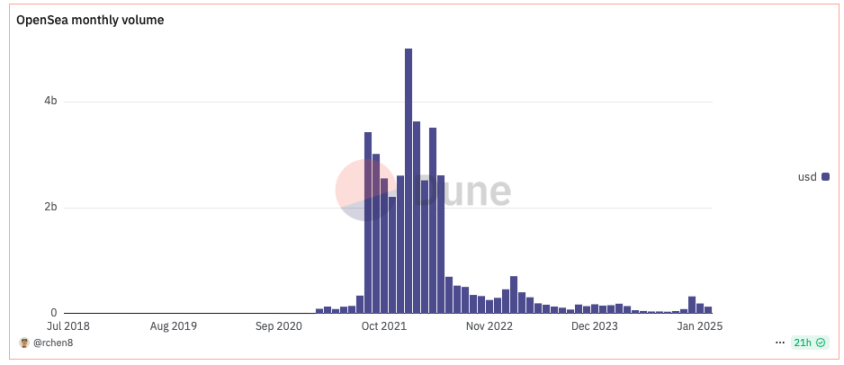

OpenSea is finally about to issue coins. If it were three years ago, this would have definitely been a much-awaited currency circle carnival. However, today’s currency circle is now the world of MemeCoin, and NFT has long been “obsolete”. What is even more regrettable is that even if we limit our focus to the NFT field, OpenSea is no longer glorious. According to Dune data, OpenSea’s trading volume in January was only US$195 million, a 96% drop from its peak of US$5 billion at the beginning of 2022, and annual revenue shrank to approximately US$33.26 million.

According to nftpulse data, as of writing, Opensea’s market share in the past 30 days has dropped sharply from 95% in December 2021 to 29%; on the other hand, OpenSea’s valuation has also dropped from a peak of US$13.3 billion in early 2023 to around US$1.5 billion, and it even once fell to the point of being “sold for sale.”

So, why did OpenSea, once the dominant player in the NFT trading market, reach this situation?

Let’s review the brief history of OpenSea’s development and see how it rose rapidly and how it fell from the throne in the NFT market competition. Finally, let’s talk about what impact OpenSea’s decision to issue coins at this time may have on the entire NFT market landscape?

Initial Creation Period: Hiding and Survival in the NFT Wilderness

Mu Yong questioned that among startups in the Web3 field, OpenSea is undoubtedly a legendary company that started from zero. Especially in the two years from 2021 to 2022, the company jumped from unknown to a valuation of 13.3 billion U.S. dollars at an alarming rate. Super “unicorn” and firmly sits on the top spot in the NFT trading market. However, behind this glory is a dramatic history of market ups and downs. Therefore, the author believes that the rise and fall of OpenSea may also be regarded as a microcosm of the NFT industry’s growth from barbaric to rational competition.

In September 2017, Devin Finzer and Alex Atallah received seed round financing from well-known venture capital incubator Y Combinator for their innovative project “Wificioin”. This project aims to use cryptocurrency to pay for shared WiFi and is not related to the NFT track.

However, in November 2017, Dapper Labs officially launched CryptoKitties, an ethereum-based cryptocat game, which triggered a wave of hype. The fanatical bidding once pushed the price of CryptoKitties ‘NFT collection to 247 ETH pieces, which was approximately US$118,000 at the time.

In the same year, Dieter Shirley, founder and CTO of CryptoKitties, proposed the concept of NFT (Non-Fundible Token) and promoted the launch of EIP-721, which defines the NFT standard. (Techhub News notes that EIP-721 was later discussed and improved, and was officially adopted in 2018, becoming today’s ERC-721 protocol standard.)

It was the proposal of this standard that changed the entrepreneurial direction of Devin Finzer and his wife. They decided to abandon the original “Wificioin” project and created the NFT trading platform Opensea in February 2018.

Devin Finzer said, according to The Generalist: “We see the potential of the NFT market because there is a standard for digital projects that everything that has emerged since CryptoKitties will comply with.”

At that time, it was in the early stages of development of blockchain and cryptocurrency, the NFT concept was not yet popularized, and the entire NFT market was almost a wasteland.

Still, Opensea was not the only NFT trading platform at the time. Released on Product Hunt almost the same day, Rare Bits, which calls itself an “EBA-like zero-fee crypto asset market,” a competitor with an advantage over OpenSea. Interestingly, OpenSea also describes itself as the “Ebay of crypto goods.” (Techhub News notes that Ebay is an online auction and shopping site that allows people around the world to buy and sell items online)

In May 2018, OpenSea raised $2 million from investors including 1confirmation, Founders Fund, Coinbase Ventures and Blockchain Capital. But Rare Bits raised $6 million a month ago, with investors including Spark, First Round and Craft.

From the perspective of VC investment, although OpenSea is at a disadvantage, Richard Chen, a partner at 1confirmation, prefers OpenSea. He believes that “Rare Bits does not have a better understanding of NFT than OpenSea. OpenSea’s team is more capable and more combative. Devin and Alex have also done a good job in discovering new NFT projects and promoting them to launch OpenSea. Moreover, when we invested in April 2018, OpenSea’s transaction volume was already four times that of Rare Bits.”

In addition, the sales strategies of the two companies are also different. OpenSea insists on charging a 1% trading commission (later gradually increasing to 2.5%) to maintain operations through stable revenue. Rare Bits adopted a “zero-fee” strategy in 2018 and promised to refund Gas fees generated by user transactions in an attempt to attract traffic by reducing user costs. This strategy attracted some attention in the early days. It seemed to be more user-friendly, but it was actually not conducive to the long-term development of the platform. The high operating costs also made it difficult for Rare Bits to continue, especially when the “2018 cryptocurrency winter” approaches.

During this period, in order to expand its user base and gain platform transaction volume, Rare Bits also tried to expand its business from NFT to a wider range of virtual commodity transactions. For example, it launched “digital stickers” in cooperation with animation platform Crunchyroll and explored non-NFT asset transactions such as game props.

Unlike Rare Bits’s diversification, OpenSea remains focused and its focus has always been on improving its NFT trading business.

But on the long road before dawn, OpenSea’s life was also difficult. The early trading volume of the platform continued to be sluggish, and early projects were limited to a few NFTs such as CryptoKitties and CryptoPunks.

According to titanium media reports, in March 2020, the team size was only 5 people, and the average monthly transaction volume was about US$1 million. Based on a commission rate of 2.5% at the time, OpenSea’s monthly revenue was only US$28,000. If it weren’t for the US$2.1 million in “life-saving funds” injected by strategic investors such as Animoca Brands at the end of 2019, the start-up might have long disappeared into the industry’s winter. As for Rare Bits, it was in jeopardy as early as 2019, and until 2020, the platform was completely withdrawn from the market.

In hindsight, OpenSea’s rise and become the king of the NFT field is inseparable from its operational decisions to focus on core businesses and streamline operations. Devin Finzer once said in an interview,”We are willing to develop in this area for the long term, regardless of the current growth trajectory. We want to create a decentralized market for NFT and hope it will last for 3-4 years.”

Time is soon approaching the second half of 2020, and dawn is approaching. This year can be said to be a watershed in OpenSea’s destiny. As the Crypto market gradually recovered in the second half of the year, OpenSea took the lead in receiving dividends by relying on its advantage as a pioneer in the NFT market, and its platform transaction volume began to rise rapidly. Dune data shows that in October 2020, OpenSea’s monthly transaction volume reached approximately US$4.18 million, an increase of approximately 66% from US$2.46 million in September.

In order to allow the platform to have more types of NFT assets and attract a wider range of liquidity, OpenSea began to fully implement the “open market” product strategy.

In December 2020, OpenSea launched a new feature “Collection Manager”, which allows users to cast NFT without handling fees (Gas fees are borne by the buyer). Officials also call this feature “Lazy Minting”, which separates on-chain distribution from metadata. Users can upload metadata of products to OpenSea for free, and only when products are sold for the first time will they be cast as on-chain ERC-1155 NFT.

This feature significantly lowers the threshold for creators, and based on the fact that OpenSea NFT does not require censorship, every user can directly create and publish NFT on OpenSea. Despite this advantage, OpenSea also covers the widest range of transactions among its kind platforms, including digital avatars, music, domain names, virtual worlds, transaction cards, art and other NFT collections. Its strategy maximizes the expansion of creators. The supply of works has attracted more and more users in the primary and secondary markets.

Objectively speaking, the potential of the NFT market has contributed to OpenSea’s subsequent success, but the rapid outbreak of this field is definitely due to OpenSea’s contribution.

In 2021, the Crypto market has ushered in a comprehensive “bull market”, and OpenSea, which has been dormant for two years, has begun to truly show its edge.

NFT exploded at a phenomenal level, and OpenSea reached the throne with billions of dollars in monthly trading volume

According to Dune data, in February 2021, OpenSea’s data experienced explosive growth for the first time. On February 2, OpenSea’s single-day trading volume exceeded US$5 million, while OpenSea’s monthly trading volume in January only slightly exceeded US$7.5 million. In the end, OpenSea’s monthly transaction volume in February was close to US$95 million, a month-on-month increase of more than 10 times.

Also starting from the beginning of 2021, a large number of commemorative NFTs have been released on OpenSea. Bands, entertainment stars, sports stars, and well-known artists have begun to launch their own NFTs. A large number of well-known brands have also begun to launch commemorative NFTs or use NFTs to launch user loyalty activities. It can be said that the NFT, which started with CryptoKitties, brought together Web3 and traditional industries for the first time, and also brought many people who did not understand Crypto into contact with a new “species” for the first time.

Budweiser launched NFT series

As the largest NFT trading platform, OpenSea has finally waited for the arrival of the wind. Data shows that in March 2021, transaction volume on OpenSea exceeded the US$100 million mark for the first time, exceeding US$300 million in July, and in August, the figure increased more than 10 times month-on-month to US$3.44 billion. It was also in March that OpenSea completed a US$23 million round of financing led by a16z. Many angel investors, including Mark Cuban, also participated in this round of investment.

Although NFT has actually started to develop rapidly since the beginning of 2021, the floor price of the CryptoPunks series NFT has also increased from single digits ETH at the beginning of the year to more than ten to twenty ETH in the middle of the year. However, the main narrative of the market in the first half of 2021 still revolves around DeFi. At that time, everyone’s attention had not yet completely shifted to NFT. The reason is that in addition to the rising popularity of DeFi, there are no targets or concepts that can be hyped up in the NFT field.

After entering the second half of the year, the launch of a series of PFP’s represented by BAYC completely ignited the passion of the market. NFT is also considered to be another phenomenal concept after DeFi. As the popularity of NFT trading has increased, the monthly trading volume on OpenSea has remained at a high level of billions of dollars. In January 2022, this figure even exceeded 5 billion dollars. Nate Chastain, product leader of OpenSea, tweeted at the end of August 21 that the company had only 37 people. In that month, OpenSea’s fee income alone exceeded US$80 million. The per capita contribution of more than US$2 million was an extremely terrifying existence in any industry.

Before the end of 2021, OpenSea will spend most of its time accelerating without interruption. During this period, apart from the just-mentioned Nate Chastain’s departure due to the insider trading scandal, OpenSea has almost no other negative news. Even if other NFT trading platforms have obtained large amounts of financing, there is no way to shake OpenSea’s position. Even almost all NFT trading platform products refer to OpenSea more or less.

Challengers are eyeing, but OpenSea “betrays” Web3 and plans to go public?

In a prosperous era, a turning point has quietly arrived, and it all starts with the rumors of OpenSea’s listing.……

In early December 2021, Bloomberg reported that Brian Roberts, CFO of American ride-hailing company Lyft, would join OpenSea as CFO. At the same time, Roberts said he was planning an IPO plan for OpenSea. This was originally a common news, but it triggered some discussions in the Web3 industry. Many people believed that OpenSea should issue tokens to reward OpenSea users, and this is what the Web3 project should do.

Perhaps feeling some pressure, two days later, Brian Roberts personally stepped forward and clarified that there were no IPO plans at present, and said,”There is a big gap between thinking about what an IPO will ultimately look like and actively planning an IPO. We have no plans to conduct an IPO, and if we have it, we will seek community participation.”

This slightly ambiguous statement not only did not dispel the community’s concerns, but also strengthened everyone’s choice of eventually listing OpenSea, because he did not mention issuing coins at all.

If OpenSea had decided to issue coins at that time, there might not have been a wonderful story on the track of the NFT trading platform. Instead, it was the “selfish” decision to choose an IPO that tore open the originally unbreakable wall.

At that time, OpenSea accounted for more than 90% of the NFT trading market on Ethereum. After its attitude of not issuing coins spread, some entrepreneurs found opportunities and quickly launched an NFT trading platform for issuing coins. LooksRare is one of them. Although it was not the first project to launch a “vampire attack” on OpenSea, it obviously had a lot of influence after OpenSea was ready to go public.

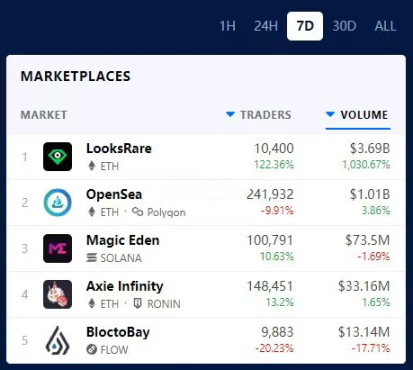

On January 10, 2022, LooksRare was officially launched. The team said that only users with a transaction volume of more than or equal to 3 ETH on OpenSea can get airdrops by placing an NFT on LooksRare. In addition, users can pledge the LOOKS airdrops they receive to share all transaction fees on the platform. Two days after its launch, LooksRare’s single-day trading volume exceeded OpenSea, and in terms of the 7-day trading volume data ending January 19, 2022, LooksRare was more than three times that of OpenSea.

When the crack was torn open and the market realized that OpenSea was not completely invincible, everyone began to show their own abilities. X2Y2, which will be launched in February 2022, Element focusing on BNB Chain, NFT focusing on art, Zora, which takes the high-end route, and Magic Eden, which focuses on the Solana NFT market, are all constantly encroaching on OpenSea’s existing markets and markets that may expand. Perhaps arrogance is a bit excessive, but at least not taking precautions at its peak was indeed a major strategic mistake for OpenSea.

Despite this, OpenSea’s market influence remains difficult to shake. As we enter the second quarter of 2022, on the one hand, Yuga Labs is about to issue APE tokens. On the other hand, transactions such as Moonbirds and Doodles are still active. As the most liquid NFT trading market, OpenSea still holds the lifeblood of the NFT market.

The person responsible for changing the entire NFT track or the NFT crash was quietly born at this time. Its emergence fundamentally changed everyone’s stereotypes of what the NFT market should look like.

Blur was born, and the NFT market’s “first list” changed owner

At the end of March 2022, Blur announced that it had completed a financing of US$11 million. At that time, I believe many people would wonder why a new NFT trading platform came out. However, after Blur was officially launched at the end of October, it gave everyone a head start.

A completely different UI clarifies that there will be airdrops for pending orders, Bid, and sales, and the airdrops are just a “treasure chest” with no idea how many tokens will be issued. With a UI designed purely for transactions and clear but unclear airdrops, Blur has achieved the ultimate in product and gameplay design. Although many people used Blur’s UI to be very difficult to use at first, after getting used to it, everyone found that this design was indeed much easier to use than OpenSea in terms of buying and selling. To make an analogy, if OpenSea is NFT’s e-commerce platform, then Blur is NFT’s exchange.

Prices are listed from low to high, and real-time transactions and the distribution of transaction prices are displayed on the right. This UI design for convenient transactions and the expectation of airdrops, a large amount of money began to rush into Blur. Previously, many NFT trading platforms relied on tokens to attract traffic in the short term, but OpenSea’s market share in transaction volume was not challenged in monthly or quarterly data. However, the emergence of Blur made OpenSea’s transaction volume account until a week ago. The proportion returned to more than 50%.

But it was precisely because of this that big funds gained the ability to control the market and bought and sold crazily. At that time, the Crypto market had entered a deep bear market. Seeing that big funds had to airdrop regardless of cost, a large number of NFT prices were almost destroyed. Retail investors lost interest in NFT. After Bitcoin had dropped to around US$20,000, the “last goalkeeper” of crypto assets also left the market sadly. With the collapse of the NFT market and the accession of the new king Blur, OpenSea became cannon fodder.

At the beginning of 2022, it also completed a US$300 million Series C financing at a valuation of US$13.3 billion. Two years later, in early 2024, OpenSea CEO has admitted that it is considering being acquired. In this round of Bitcoin’s “one-person bull market”, in addition to Puggy Penguins, who had airdrop expectations, the floor prices of a large number of former blue-chip NFT have fallen to a terrible level. For OpenSea, if they don’t make changes, they may end up giving away years of hard work. This is definitely not what they want to see.

Therefore, OpenSea’s decision to launch the platform token SEA is on the one hand a self-rescue move to cope with the continued decline of the platform business; on the other hand, this former king may also have a little unwillingness and ambition to return to the peak. So the question arises. Will OpenSea’s coin issuance change the competitive landscape of the NFT market?

With the recent surge in transaction volume, OpenSea is expected to reshape the competitive landscape in the NFT market?

There is no doubt that Blur is most likely to be affected by OpenSea’s coin issuance and the launch of the public beta version of OS2. As a strong rival in subverting OpenSea’s status, Blur has also shown a decline in the future with the downward trend of the Crypto market. As of writing, its trading market share in the past 30 days still exceeds 44%, firmly ranking first in the NFT market.

In addition to the unique product UI and gameplay design mentioned above, Blur also attracted a large number of users with its Bid Airdrop and zero-fee model. It conducted airdrops many times in 2023 to gain market share. You can see from the data:

On February 15, 2023, Blur conducted an airdrop of 360 million BLURs in the first quarter. Airdrop tokens accounted for 12% of the initial total supply and were released immediately. According to Glassnode, Blur’s market share surged after the airdrop of BLUR tokens, with its market share of NFT trading volume jumping from 48% to 78%, while OpenSea’s market share fell by 21%.

On February 23, 2023, Blur launched the second season of 300 million BLUR airdrops. This airdrop directly pushed Blur’s transaction volume to significantly surpass OpenSea. DappRadar data shows that on February 22, 2023, BLUR’s transaction volume reached approximately US$108 million, while OpenSea’s volume was only US$19.27 million during the same period.

To a certain extent, Blur’s two large token airdrops were instrumental in breaking OpenSea’s “moat”. As the saying goes, do another’s own thing. At a time when the NFT market has not yet recovered, if OpenSea’s SEA tokens attract users through airdrops or pledge rewards, it is likely to replicate this strategy, and even follow the example of “OpenSea killers” such as LooksRare and x2y2 that year launched a “vampire attack” on Blur to compete for its core users.

In fact, since OpenSea confirmed that it would carry out an airdrop, it has aroused expectations and heated discussions among many Twitter users. Many people believe that this will be one of the largest airdrops this year.

In addition, in terms of handling fees, OpenSea’s recently launched beta version of OS2 reduces the market fee to 0.5%, and the transaction fee to 0%. This directly compares Blur’s zero-handling model. By the time SEA is launched, OS2 will rely on the combination of “low handling fee + token incentive”, which is very likely to build a very flexible competitive strategy.

Objectively speaking, most users are essentially profit-seeking. If the reward mechanism of SEA tokens is more attractive, and some of Blur’s existing users are originally from OpenSea, it may not cause these users to return to OpenSea. However, Blur’s “moat” is that its transaction speed is faster than OpenSea, Gas is more efficient, and it still has technical advantages in the short term.

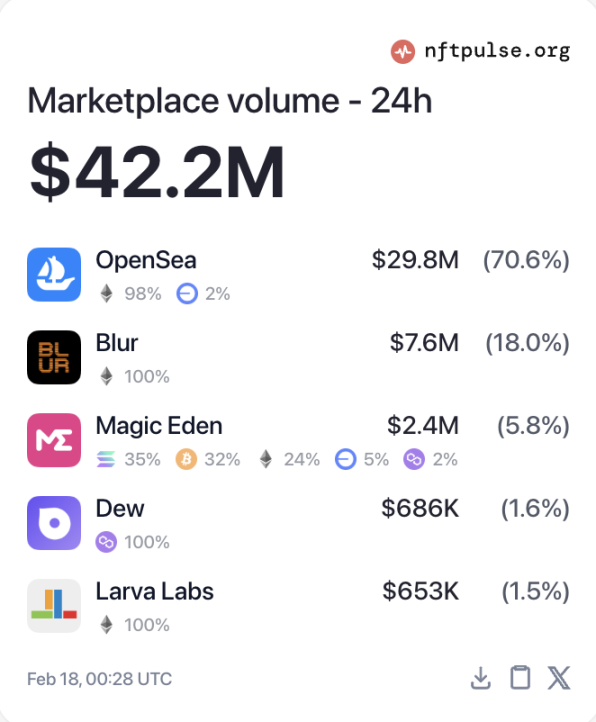

Affected by the news of the coin issue, the market has already reacted. According to nftpulse data, as of writing, OpenSea’s single-day trading volume has reached approximately US$29.8 million, and the trading proportion has soared to 70.6% of the total single-day trading volume.

For the entire NFT market, OpenSea’s launch of SEA tokens is undoubtedly a good thing. In addition to stimulating a significant increase in NFT transaction volume in the short term, OpenSea also tweeted that OS2 already supports cross-chain transactions of 14 chains including Flow, ApeChain, and Soneium. So, can SEA tokens become a common token for the multi-chain NFT ecosystem, thus promoting the development of the NFT market in Ethereum external chains (such as Solana)? This is worth looking forward to.

However, from another perspective, the upcoming fierce competition between OpenSea and Blur will once again squeeze the living space of second-tier platforms such as LooksRare and X2Y2. Blur will probably not sit back and watch its former rivals make a comeback. Blur may launch more token application scenarios, or token rewards, further stimulate user loyalty. In addition, Magic Eden, which is also a late-stage star, cannot be underestimated. With its dominant dominance in the Bitcoin and Solana chains, the transaction volume of the entire platform market in the past year once reached US$3.2 billion, accounting for more than 30%, second only to Blur’s US$3.8 billion (accounting for about 36%), while OpenSea’s transaction volume in the past year was only US$1.2 billion, accounting for less than 12%.

In short, the author believes that OpenSea’s SEA tokens are not only the key to self-rescue for the platform, but may also become the driving force for pushing the NFT market out of the downturn. In the long run, the competition between OpenSea and Blur will also promote the NFT field to move towards a more complex development. Financialization and multi-chain development. As for whether OpenSea can regain its dominant position, whether the future pattern will be a confrontation between the two powers or whether Blur will continue to be king will depend on the performance of the SEA token after it is launched. Let’s let the bullets fly for a while!

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern