Against the background of dual growth in revenue and profit, AmorePacific Group achieved its first positive growth in many years in 2024.

Amore Pacific’s fiscal year 2024 is “mixed”, with high growth in the Americas and “three consecutive losses” in Greater China

Photo source: Visual China

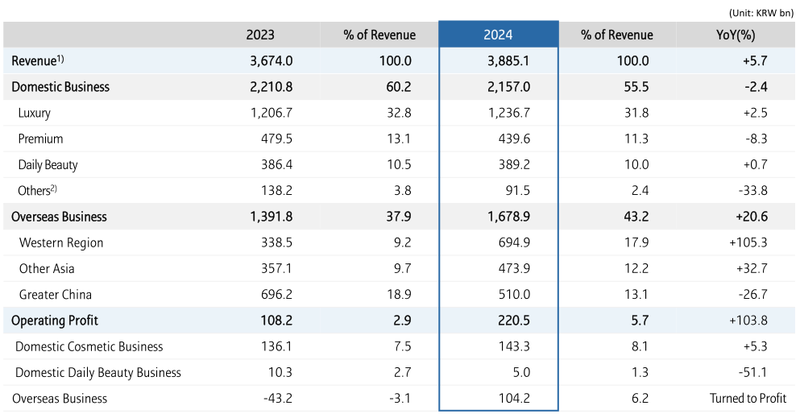

Blue Whale News, February 7 (Reporter Wang Hanyi)On February 6, Amore Pacific Group released its fourth quarter and full year financial report for fiscal year 2024. Data shows that AmorePacific Group’s sales in fiscal year 2024 were 3.89 trillion won (approximately RMB 19.56 billion), a year-on-year increase of 5.7%. Operating profit was 220.5 billion won (approximately RMB 1.108 billion), a year-on-year increase of 103.8%.

Photo source: Intercept from financial report

Against the background of dual growth in revenue and profit, AmorePacific Group achieved its first positive growth in many years in 2024.

From 2020 to 2024, its annual sales were 28.579 billion yuan, 28.153 billion yuan, 24.723 billion yuan, 18.486 billion yuan and 19.56 billion yuan respectively.

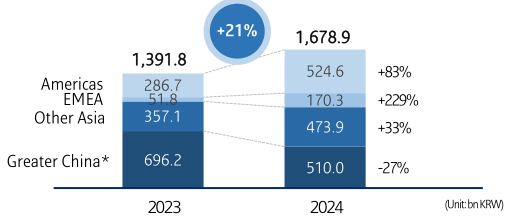

However, in Greater China, Amore Pacific faces greater challenges. In the third quarter of 2024, the region’s revenue fell by 34% year-on-year, becoming the region with the largest decline in the group’s revenue, and has declined for three consecutive quarters.

In the financial report, the main reasons for the decline were attributed to the reduction of inventory in the e-commerce channel, the optimization of offline stores and the adjustment of business structure in the China market. For example, at the beginning of the year, the Lanzhi brand reported that it had withdrawn from offline channels in China, and the group responded that it was optimizing some offline channels.

In fact, it is no longer a matter of time that Korean cosmetics encounter cold weather in the China market. In 2022, affected by the epidemic, Amore Pacific’s revenue in the China market will fall by 30%; in the fourth quarter of 2023, total sales in the China market will drop by 50%.

In order to reverse the situation, AmorePacific has also taken a series of measures. In May 2024, after Park Tae-ho took office as president of China, he promoted new strategies including introducing high-end skin care brand AP Aibin, opening its first store in Shanghai, and providing exclusive beauty services to VIP customers.

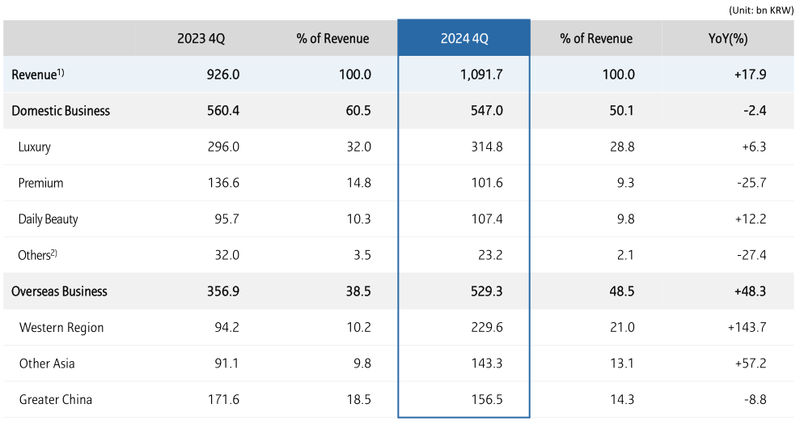

At the same time, AmorePacific’s local Korean market is also facing challenges. In the fourth quarter of fiscal year 2024, South Korea’s domestic revenue fell by 2.4%, and revenue from regions other than South Korea increased significantly by 48.3%, before regaining the game. It is understood that by reshaping the global balance strategy, it has set markets such as the United States, Japan, the United Kingdom, and India as global bases for centralized cultivation.

Photo source: Intercept from financial report

By region, AmorePacific’s sales in the Americas increased by 83%, and sales in the EMEA (Europe, Middle East and Africa) region increased by 229%.

Photo source: Intercept from financial report

In the Americas, Lange has maintained No. 1 position in the lip care category through business integration, while the Bouncy Firm series has driven sales growth of skin care products.“&” In addition, AmorePacific also plans to introduce brands such as Snowflake Show, Lanji and Heyan to duty-free channels in the United States and Europe.

In terms of brand performance, the high-end cosmetics division, including Snow Show, He Yan, etc., saw annual sales increase by 2.5% year-on-year; while the mid-to-high-end cosmetics division, including Lanzhi, Aistelan, etc., saw sales decline by 8.3% year-on-year. The financial report pointed out that the growth of high-end cosmetics was due to the launch of seasonal series products and the strengthening of marketing activities during the holiday season.

Bai Yunhu, a senior management expert in the cosmetics industry, said in an interview with Blue Whale News: From the overall situation, whether it is the European and American departments represented by L’Oréal and others, or the Japanese and Korean departments represented by Amore Pacific, the key to the decline in the China market still comes from the mid-to-low-end market and is gradually replaced by domestic products. rdquo;

“In addition, leading companies represented by Peloreya are also continuing to improve brand value and product quality. rdquo; Bai Yunhu added that the trend of mid-to-high-end brands of domestic products is obvious, and they are gradually beginning to seize some users and markets of international brands.

Although the growth of European and American markets has brought a turning point for AmorePacific, Greater China and South Korea’s domestic markets are still key areas for its development. Therefore, how to improve the performance of these regions will be an important issue facing Amore Pacific in 2025.