① A total of 97 investment and financing incidents occurred within domestic statistics this week (2.15-2.21), a month-on-month increase of 3.19%; the total amount of financing disclosed was approximately 4.850 billion yuan, a month-on-month increase of 48.05%.

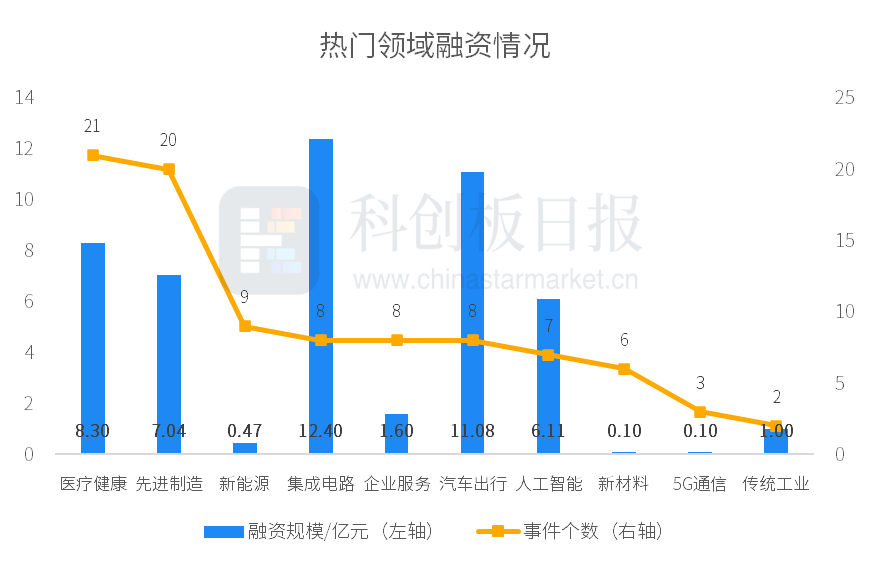

② Medical health, advanced manufacturing and other fields are among the most active, with integrated circuits disclosing the largest total financing.

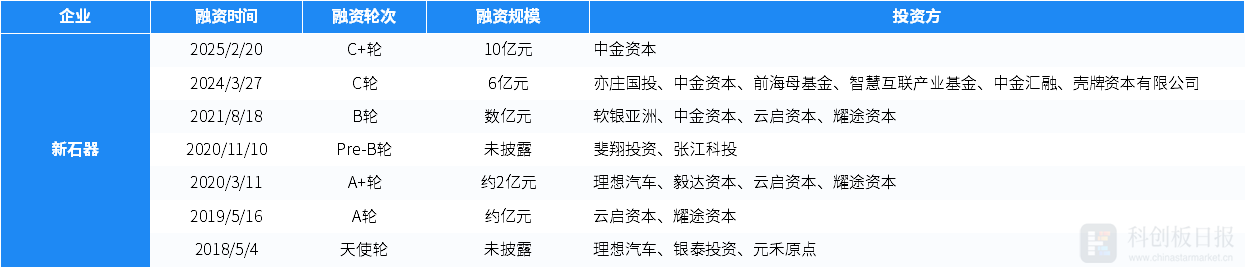

③ Neolithic completed a 1 billion yuan Series C+ financing, which was the largest investment event disclosed this week.

“Science and Technology Innovation Board Daily” February 22 According to data from Cailian Venture Capital, a total of 97 investment and financing incidents occurred in domestic statistics this week (2.15-2.21), an increase of 3.19% from 94 incidents last week; the total amount of financing disclosed was approximately 4.850 billion yuan, an increase of 48.05% from 3.276 billion yuan last week.

hot areas

Judging from the number of investment events, medical health, advanced manufacturing, new energy, integrated circuits, corporate services, automobile travel, artificial intelligence and other fields are relatively active this week; judging from the total financing amount, integrated circuits disclosed the largest total financing amount, about 1.24 billion yuan.NeolithicThe completion of a 1 billion yuan Series C+ financing involving multiple logistics giants and financial investors such as CICC Capital was the largest investment event disclosed this week.

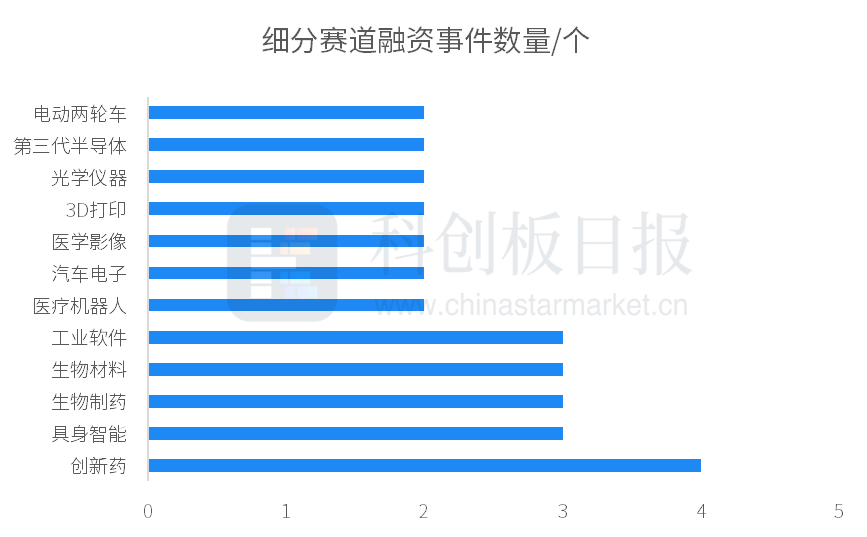

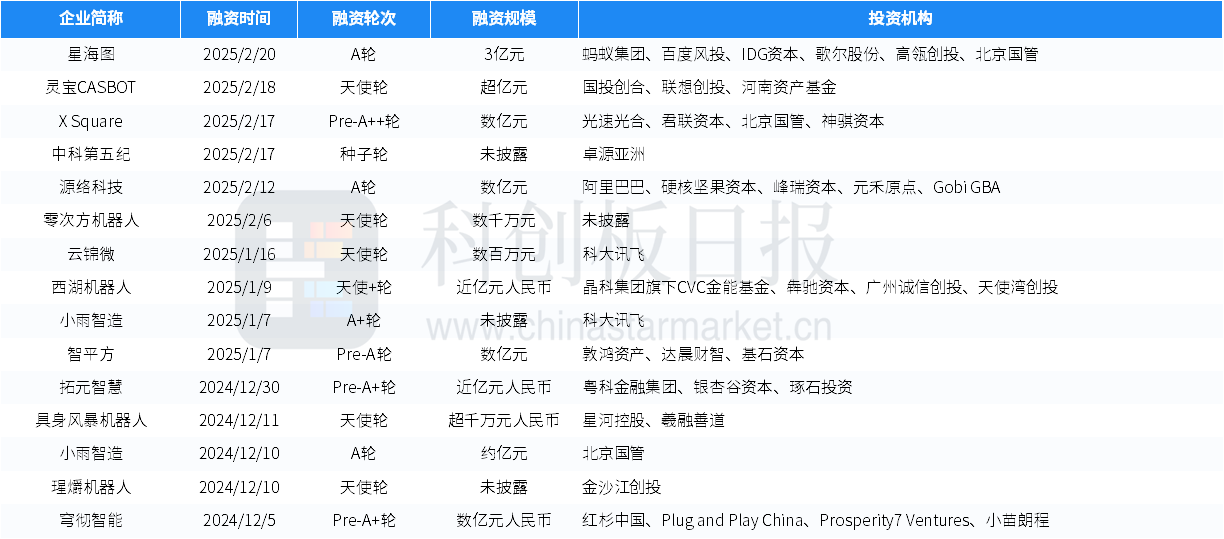

On the segmented track, the ones that are more popular among investors this week are innovative drugs, embodied intelligence, biopharmaceuticals, biomaterials, industrial software, medical robots, etc.

As a comparison, the performance of the secondary market for innovative drugs, humanoid robots, and new materials this week is shown in the following table.

Hot investment rounds

From the perspective of investment rounds, except for equity financing, the number of Series A financing events this week was the largest, with 27 incidents, accounting for about 28%; followed by the Seed Angel Round, with 20 incidents, accounting for about 21%. Judging from the amount of investment received in each round, the total financing disclosed in Series A was the highest, about 1.768 billion yuan, followed by Series C and beyond, about 1.3 billion yuan.

Active investment and financing areas

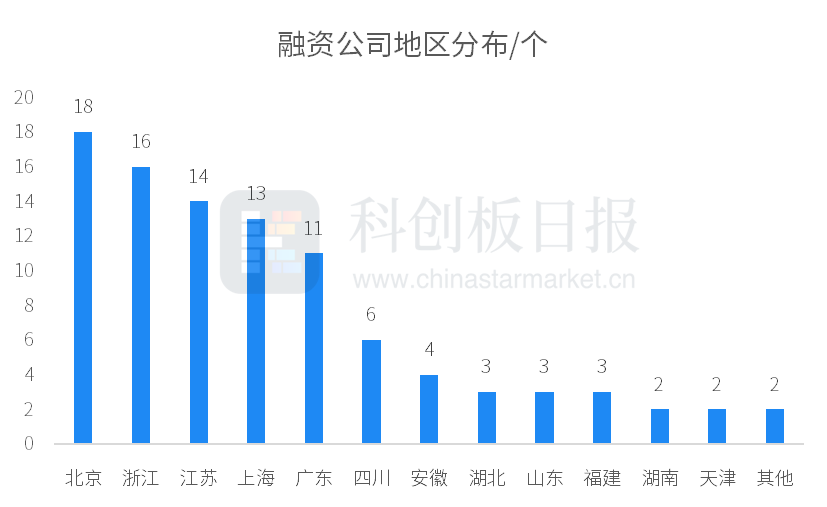

From a regional perspective, companies in Beijing, Zhejiang, Jiangsu, Shanghai, Guangdong and other places are more popular this week, with more than 10 financing incidents; Beijing ranks first with 18 financing activity incidents. In terms of individual cities, Beijing ranked first with 18 companies invested; Shanghai followed closely with 13 companies invested.

Active investment institutions

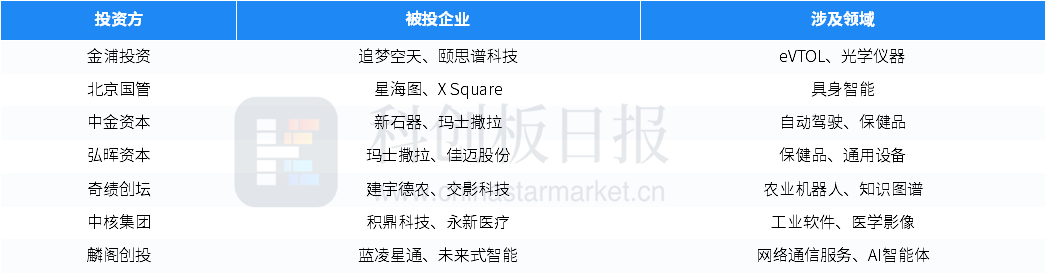

Investors this week include Hillhouse Ventures, IDG Capital, Lightspeed Photosynthetic, Gimpo Investment, Jinsha River United Capital, Lanchi Venture Capital, Qiji Chuangtan, Weihao Chuangxin, CICC Capital, Zhongke Chuangxing, SMIC Juyuan, Zhuoyuan Asia and other well-known investment institutions;

As well as industry-related investors such as Ant Group, Baidu Venture Capital, Lenovo Venture Capital, Tongge Venture Capital, China National Nuclear Corporation, Jingtai Technology, Aimei, Jiu ‘an Medical, Jiangfeng Electronics, Yahong Pharmaceutical, and Yihang Intelligent;

It also includes Shenzhen Venture Capital, Beijing Guoguan, Yizhuang SDIC, Pudong Science Investment, Xi Venture Capital, Optics Valley Industrial Investment, Yuanhe Holdings, Hefei Innovation Investment, Nanjing Venture Capital, Xiangjiang SDIC, China Guoxin, SDIC Chuanghe, Shanghai Biomedicine Fund, Ningbo Tongshang Fund and other state-owned investment platforms and government-guided funds.

Some active investors this week are listed as follows:

Investment events worthy of attention

Neolithic completes a 1 billion yuan C+ round of financing

Founded in 2018, Neolithic is a smart city unmanned logistics vehicle provider. With more than ten years of experience in building intelligent hardware in the logistics industry, the company integrates vehicle-level productization capabilities, uses L4-level unmanned vehicles as the carrier, and leverages the power of the Internet of Vehicles to have the commercialization and large-scale delivery capabilities of L4-level unmanned vehicle products.

The Enterprise Innovation Evaluation Laboratory shows that Neolithic’s global science and technology innovation capabilities in the fields of Internet, cloud computing, and big data services are rated as A-level. A national-level specialized and innovative small giant enterprise currently has more than 850 public patent applications, including invention applications. The proportion exceeds 60%, mainly focusing on technical fields such as unmanned vehicles, autonomous driving, driverless driving, electronic equipment, and graphical user interfaces.

Recently, the company announced the completion of a 1 billion yuan C+ round of financing, which was jointly supported by a number of logistics giants and financial investors such as CICC Capital.

According to Cailian Venture Capital Connect-Implementation Data, with February 2025 as the forecast benchmark time, the financing forecast probability for Neolithic in the next two years is 94.43%.

Venture Capital Data shows that in the past year, some cases of investment in the domestic autonomous driving field are as follows.

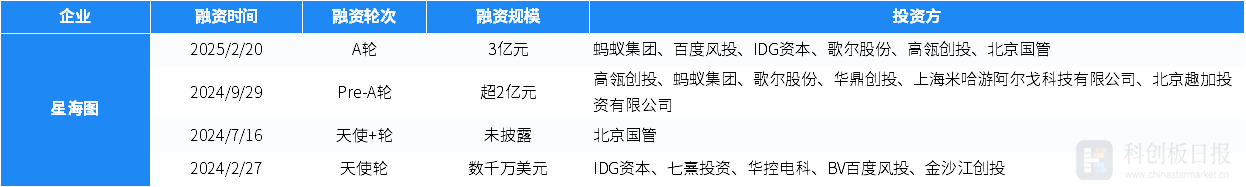

Xinghaitu completed nearly 300 million yuan in Series A financing

Xinghaitu was established in 2023 and focuses on building “one brain with multiple types” embodied intelligent robots. The company adheres to the development idea of collaborative research and development of AI algorithms and ontologies, sets the ontology form based on needs, independently designs and manufactures ontologies, and explores Scaling Law with specific intelligence based on each generation of agent products. Ultra-light force-controlled robotic arms and humanoid robot R1 series products have been released.

The Enterprise Innovation Evaluation Laboratory shows that Xinghaitu’s global scientific innovation capabilities in the field of artificial intelligence are rated CCC. There are currently 2 public invention patent applications, mainly focusing on map construction, semantic information, robots, relative poses, and semantic grids. and other technical areas.

Recently, the company announced that it has completed nearly 300 million yuan in Series A financing. This round of financing was exclusively led by Ant Group, and a number of old shareholders such as Hillhouse Ventures, IDG Capital, Beijing Robot Industry Fund, Baidu Ventures, and Tongge Ventures continued to increase their investment. The funds will be mainly used to accelerate the research and development and verification of specific basic models, and further drive the iterative upgrade of Xinghai Map’s trinity of ontology, intelligence and commercialization.

According to Cailian Venture Capital Connect-Implementation Data, with February 2025 as the forecast benchmark time, Xinghai Tu’s financing forecast probability in the next two years is 85.37%.

Venture Capital Data shows that in the past year, some of the domestic investment cases in the field of specific intelligence are as follows.

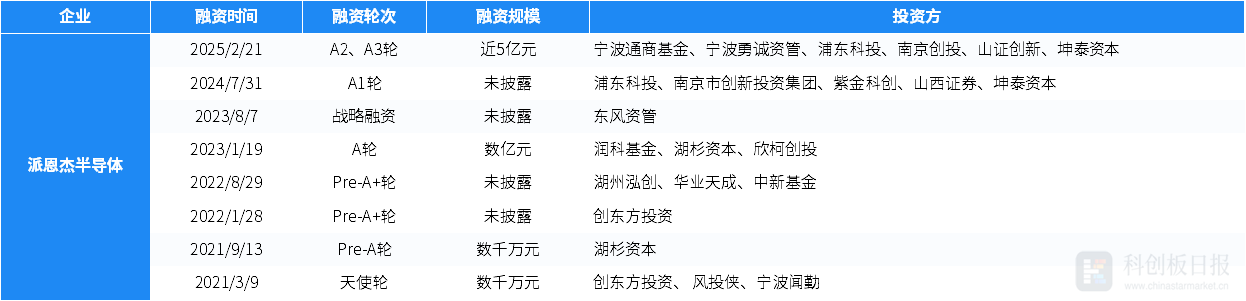

Pinjie Semiconductor completed nearly 500 million yuan in A2 and A3 rounds of financing

Founded in 2018, Pinger Semiconductor is a third-generation semiconductor power device designer and developer. It is committed to the development and industrialization of silicon carbide and gallium nitride power devices. It mainly specializes in silicon carbide MOSFETs, silicon carbide SBD and gallium nitride HEMT. and other power device products. Products are widely used in the fields of servers, communication base station power supplies, new energy vehicles and electric vehicle charging piles.

The Enterprise Innovation Evaluation Laboratory shows that Pinger Semiconductor’s global scientific and technological innovation capabilities in the smart grid industry are rated BBB. A national-level specialized and innovative small giant enterprise currently has more than 100 public patent applications, of which invention applications account for more than 48%, mainly focusing on power devices, silicon carbide, semiconductors, silicon carbide substrates, epitaxial layers and other technical fields.

Recently, the company announced that it has completed consecutive rounds of A2 and A3 financing totaling nearly 500 million yuan. The main investors include Ningbo Tongshang Fund, Ningbo Yongcheng Asset Management, Shanghai Semiconductor Equipment and Materials Industry Investment Fund, Nanjing Venture Capital, Shanzheng Innovation, Kuntai Capital, etc.

According to Cailian Venture-China Data, with February 2025 as the forecast benchmark time, Pinjie Semiconductor’s financing forecast probability in the next two years is 85.16%.

Venture Capital Data shows that in the past year, some investment cases in the domestic power device field are as follows.

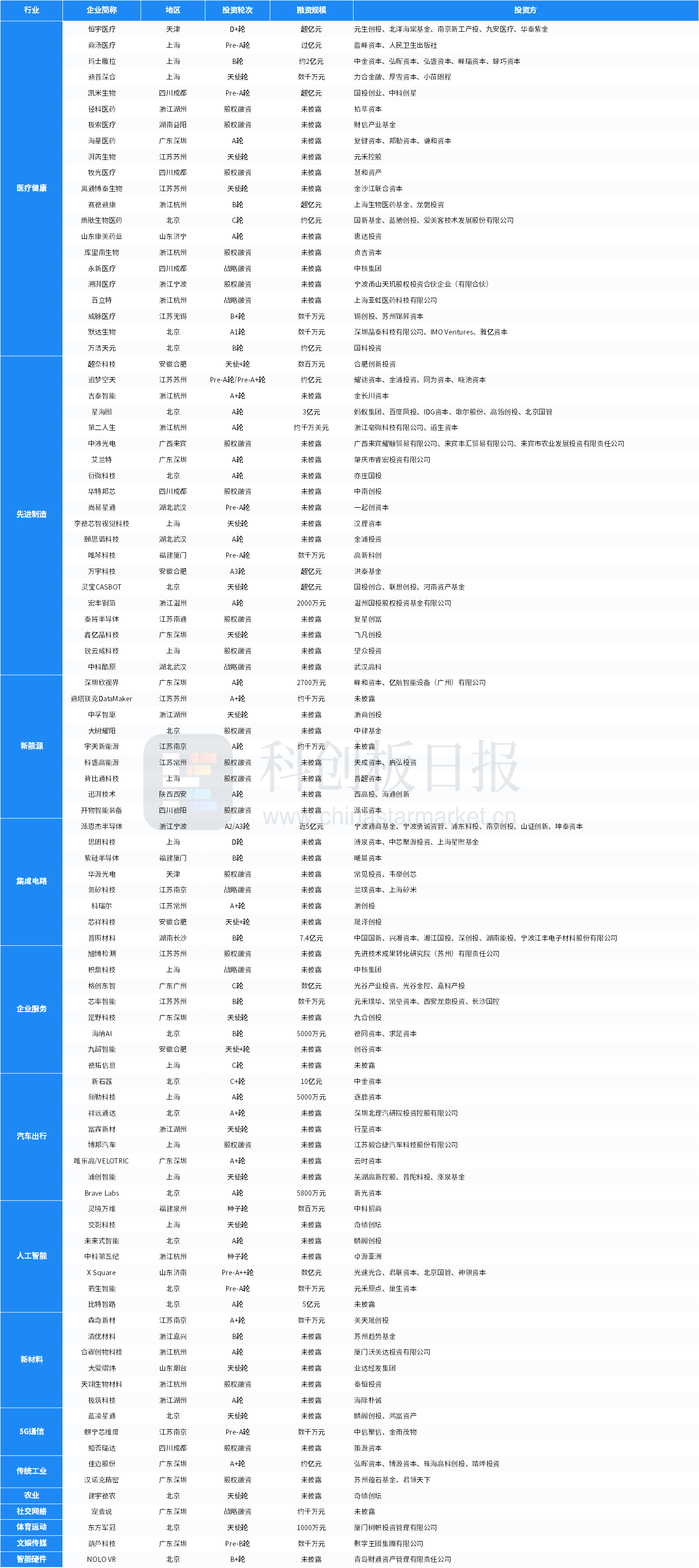

List of investment and financing events this week

Venture Capital: The primary market service platform under Cailian and Science and Technology Innovation Board Daily will be listed on the Shanghai Data Exchange in April 2022. Through star mining data, primary market investment and financing data, enterprise innovation evaluation laboratory, innovative company database, self-selection of unlisted companies, early knowledge of companies to be listed, and industry investment research, it provides innovative companies and venture capital institutions with data from products to solutions.