① The retirement and licensing transformation of large-scale collection products are a foregone conclusion. As the expiration approaches, the asset management scale of securities firms may gradually shrink.

② Expanding their business into the field of public funds has become an inevitable choice for securities firms to improve their competitiveness and strength.

③ If securities firms want to gain advantages in competition, asset management needs to further leverage their professional advantages in the capital market and strengthen coordination and linkage with other business sectors.

Financial Union, February 22 (Researcher Li Xiang)Driven by intensified capital market volatility, downward interest rates and escalating residents ‘wealth management needs, the brokerage asset management business is becoming the core battlefield for the transformation of the securities industry.

In 2024, the asset management business of securities firms will grow against the trend, and the differentiation between leading institutions and small and medium-sized securities firms will intensify. After entering 2025, the transformation of asset management of securities firms will accelerate under strict supervision, and the asset management business of securities firms will gradually move forward in the deepening of structural adjustment.

With the transformation of securities firms ‘asset management, what is the “destiny” of large-scale products heading? In the eyes of many industry insiders, the retirement and licensing transformation of large-scale products are a foregone conclusion. As the expiration approaches, the scale of asset management by securities firms may gradually shrink.

How to transform and break through? Give full play to its own product and investment research advantages to form synergy in the business sector, or the key to brokerage institutions gaining advantages in the competition on the asset management track.

The asset management business of securities firms is divided, and many securities firms have launched fixed income + products.

Against the background of continued pressure on brokerage and investment banking businesses last year, the brokerage asset management business performed relatively well. Against the background of both stocks and bonds strengthening in the second half of last year, some securities firms ‘asset management made a lot of gains in the equity and bond markets.

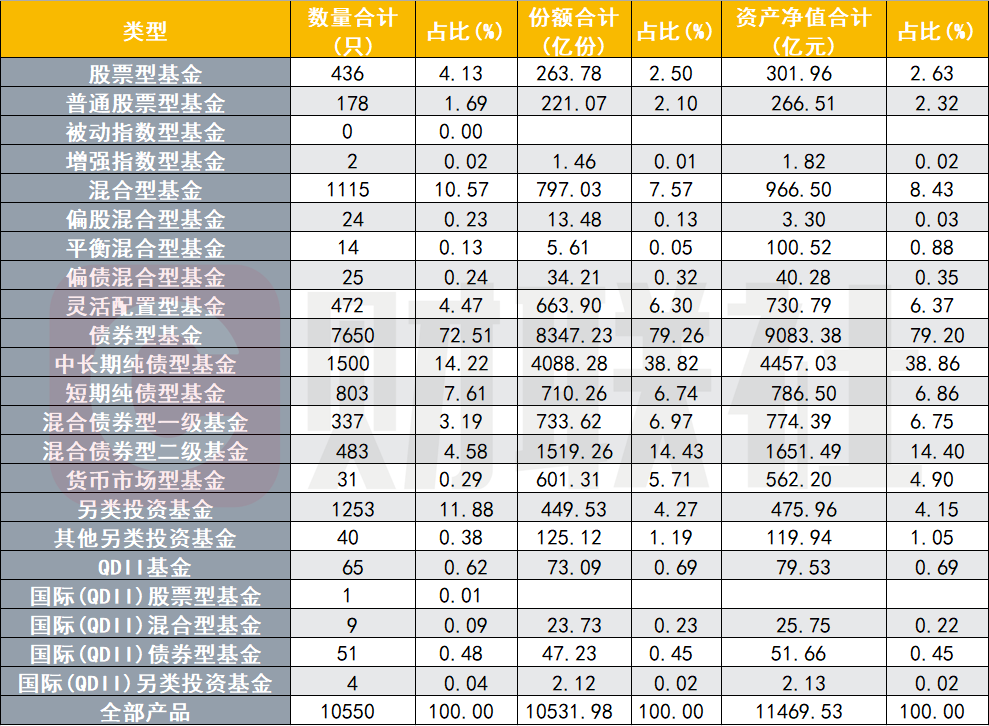

Figure: Overview of the quantity, share, net asset value, etc. of various products that exist at the end of 2024

Data source: Wind, compiled by Financial Union

In terms of revenue, according to Choice data, as of the end of last year, the average revenue of asset management products of securities firms that have been established for one year reached 4.70%. In terms of types, the average return of stock-based asset management products is relatively leading, with 7.78%;FOF asset management products are closely behind (6.39%), with the largest number of bond-based asset management products. The average return of asset management products in 2024 is 4.57%, and the median return is 4.54%. The number of hybrid products and FOF products is more than 300, and the average revenue in 2024 will be 4.06% and 6.39% respectively.

After entering 2025, in the context of low interest rate fluctuations, many brokerage asset management products will still maintain steady growth. Fixed income products are the basics of securities asset management, and some hybrid asset management products that allocate assets such as convertible bonds perform more well. For example,”First Venture Convertible Bonds Flexible Allocation No. 1″, as a bond-type collective product, enhances returns through flexible allocation of convertible bonds and stocks. As of February 20, the return rate this year has reached 15.28%.

In the eyes of many institutional people, against the background of falling interest rates and narrowing of pure debt income space, it is basically the consensus in the industry to broaden the boundary of capabilities and increase income sources through “fixed income +” and multiple assets. At the same time, against the background of continued pressure on brokerage and investment banking businesses last year, the asset management business has emerged as a ballast for brokerage performance with its steadily growing management scale.

Data disclosed by China Securities Investment Fund Association shows that as of the end of 2024, the scale of private equity management products of securities firms reached 5.47 trillion yuan, an increase of 3.04% over the same period last year. At the same time, the scale of new private equity management products established by securities firms in 2024 will increase by 19.85% year-on-year.

Cai Enze, chief analyst of Jingsu Media, said that with the improvement of residents ‘income levels and the maturity of financial management concepts, the public’s demand for asset preservation and appreciation is no longer satisfied with traditional savings and a single investment channel. At the same time, in terms of product innovation, the asset management business has also shown full vitality. With its rich product lines, asset management institutions can provide diversified investment portfolios covering stocks, bonds, funds, alternative investments, etc. to meet the needs of customers with different risk preferences.

Although the scale of securities firms ‘asset management business is growing steadily, the overall head effect of the industry is still relatively obvious. Data shows that the top 10 securities firms account for more than 60% of the entire market. Among them, CITIC, CICC, Guotai Junan, etc. rely on full licenses and The collaborative advantages of investment and research dominate the market, while small and medium-sized institutions such as Zhongtai Asset Management use the “boutique” model to break through the “boutique” model, and Capital Securities has obvious income-increasing effects around the “multi-asset and multi-strategy” transformation layout.

According to the latest annual report data disclosed by Capital Securities, the company’s net profit in 2024 was 980 million yuan, a year-on-year increase of 40.14%. The main reason for the change was also the significant increase in income from proprietary investment business and asset management business compared with the previous year.

In the eyes of many industry insiders, with the development of the asset management industry, expanding their business into the public fund field has become an inevitable choice for securities firms to enhance their competitiveness and strength. It is also a key strategy to achieve differentiated business development. As of the end of 2024, 15 securities companies and their asset management companies have obtained public offering business management qualifications. However, since Xingzheng Asset Management was approved for public offering fund qualifications at the end of 2023, there have been no new institutions, including Guangfa Asset Management and Everbright Asset Management, Anxin Asset Management, and Guojin Asset Management are still queuing to apply for public offering fund qualifications.

Securities firms ‘collective products are facing liquidation, forcing securities firms’ asset management to compete around public fundraising, differentiation, and technology.

At present, the asset management business types of securities companies are mainly divided into collective asset management plans, targeted asset management plans, and special asset management plans. Generally speaking, brokerage asset management products generally refer to securities firms ‘collective asset management plans. Broker pooled asset management plans can be divided into stock type, bond type, hybrid type, FOF, QDII, money market type, alternative investment, etc. according to the investment target (as shown in the above chart).

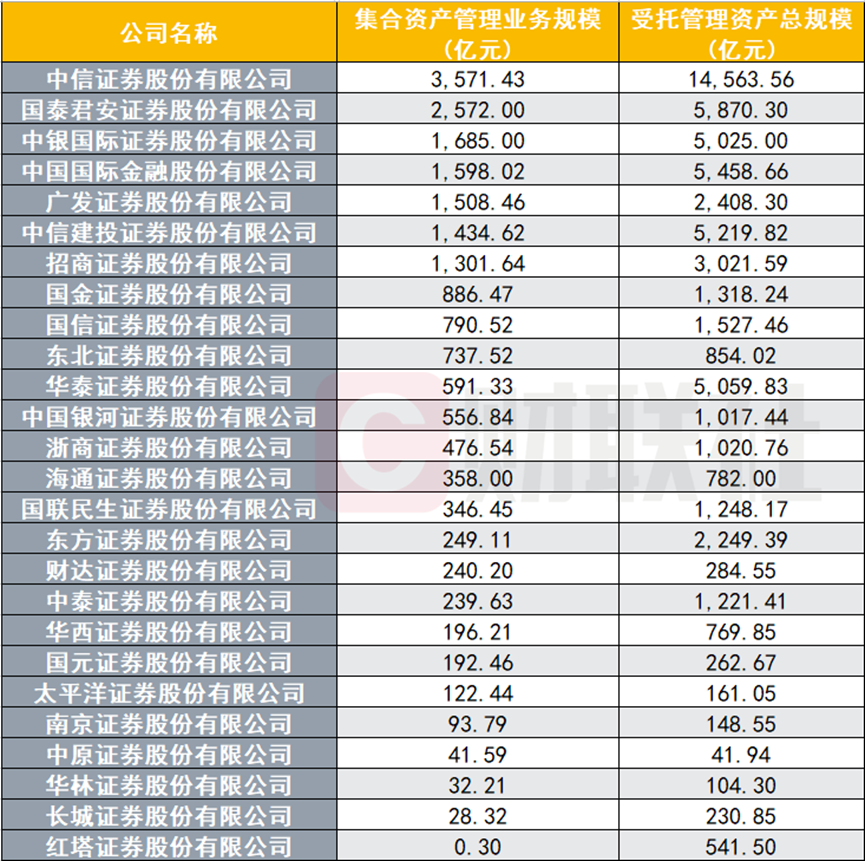

Wind data shows that as of the end of last year, there were 9068 asset management products (pooled asset management plans) in the entire market, with a total product scale of approximately 3.0517 billion yuan. Among them, there are 21 securities firms with a collective asset management scale exceeding 10 billion yuan. CITIC Securities temporarily ranks first with a management scale of 357.143 billion yuan, and the entrusted management scale also ranks first, reaching nearly 1.5 trillion yuan, which is almost equivalent to the sum of two, three and four.

Data source: Wind, compiled by Financial Union

It is worth noting that, according to the requirements of the China Securities Regulatory Commission, securities firms participating in the public congress collection products need to be gradually transformed or liquidated after completing the public fundraising transformation. In the last month of 2024 alone, as many as 51 products, including CICC’s Anxin Return Flexible Configuration Hybrid Collective Asset Management and China Merchants Asset Management Intelligent Growth Flexible Configuration Hybrid Collective Asset Management Plan, have announced extensions of their duration.

According to the incomplete review of the Financial Union, leading large-scale brokerage institutions and small and medium-sized institutions treat the transformation of public assembly products differently. Among them, leading large-scale brokerage institutions may use their capital and resource advantages to speed up the application for public offering licenses to avoid product liquidation due. For example, by establishing or using public offering subsidiaries to achieve qualification coverage, or relying on investment research capabilities and customer base to convert expired products into public offering funds or private equity active management products to continue the income of asset management business, or extend the duration of some high-quality assets, or optimize the product structure through internal resource allocation (such as introducing strategic investors).

Due to the high cost and long cycle of obtaining licenses, small and medium-sized securities firms prefer to liquidate at maturity. Especially for products with smaller scale and high operating costs, the main focus is liquidation. Some middle and lower securities firms also choose to cooperate with public offering institutions to transfer product management rights to licensed parties, retaining only some customer resources and channel shares, or shrinking business lines, focusing on advantageous areas (such as regional services or segmented strategic products), and reducing the layout of large collections of products to avoid compliance risks.

For example, Pacific Securities’s only public collection product,”Pacific Securities’s 30-Day Rolling Bond-Type Collective Asset Management Plan”, public information shows that the scale of this bond-type asset management product is 603 million yuan. If it is not changed to a public offering fund as of April 1, 2025, there is no need to convene a collective plan share holder meeting, and this collective plan will enter the liquidation process.

According to industry insiders, it is currently difficult to extend large-scale products that participate in public transformation. If there is a phenomenon of stuck public offering licenses, the product will need to face liquidation or change of manager after it expires.

“The retirement of large collections of products and the transformation of licensing are a foregone conclusion. As the expiration date approaches, the scale of asset management by securities firms may gradually shrink. Especially for products with smaller scale of public reform, in 2025, asset management by securities firms will focus on public fundraising, differentiation, and technology to compete.” A securities firm asset manager pointed out that leading institutions rely on their license and investment research advantages to consolidate their position, while small and medium-sized institutions need to break through segmentation strategies.

According to incomplete statistics from Wind, a total of 642 collective products are facing expiration of their survival period from the end of this year, with a total scale of 9.782 billion yuan. However, the number of valid subscriptions is below 200. Large collective products with more than 200 people have not yet been disclosed. Specific remaining survival period.

How to manage securities assets in 2025? Focus on business collaboration

In terms of the development of brokerage asset management companies, each securities firm has different focuses on deepening its asset management capabilities. Many leading institutions have built an “investment bank + asset management + investment research” ecological chain, such as participating in Pre-IPO corporate financing, mergers and acquisitions and restructuring supporting asset management plans to move the income chain forward, while newly approved subsidiaries such as Guoxin Asset Management plan to layout subjective long positions + fixed income + strategies to strengthen absolute income capabilities.

Market analysts said that the competition for asset management of securities firms in 2025 is essentially the product effect of “asset acquisition capabilities × customer service capabilities × risk management capabilities.” Leading institutions need to break down business silos and build ecological barriers through technology + licensing + globalization, while small and medium-sized institutions need to establish “cognitive gaps” in segmented tracks, such as regionalized non-standard asset conversion, ESG investment in specific industries, etc. It is expected that The asset management industry will shift from scale dividends to capabilities dividends, ultimately forming a new pattern of symbiosis between “big but comprehensive” and “small but beautiful”.

Regarding the development strategy of brokerage asset management in 2025, the relevant person in charge of Guoxin asset management said that the bond market may still remain relatively positive in 2025, but it is expected to fluctuate significantly, and bond market investment may seek opportunities amid fluctuations.

Guangzheng Asset Management believes that after the New Year’s Eve, the driving force of profit holding in the profit-making market and the allocation pressure in the allocation market are combined. Interest rates are expected to fluctuate. If the RRR cut and interest rate cuts are implemented, it may lead to a good market. However, in the medium term, adjustments or buying opportunities. Throughout the year, the asset shortage may turn into a revenue shortage. Under the background of debt conversion, the supply of interest-rate bonds may be large, and the supply of coupon assets may continue to shrink. It is expected that the market may pursue coupons and compress interest spreads. Continue to evolve.

At the same time, with the rise of asset management business, various financial institutions such as banks, insurance, and public funds have made efforts in the asset management field to seize market share, and industry competition has become increasingly fierce.

Industry insiders pointed out that if securities firms want to gain advantages in competition, asset management needs to further leverage their professional advantages in the capital market and need to strengthen coordination and linkage with other business sectors. For example, we use investment banks ‘project resources to provide high-quality assets for asset management products, expand customer resources through brokerage business channels, etc., create a comprehensive financial service platform, enhance customer service experience and comprehensive competitiveness, and lead the brokerage industry to become more diversified and stable. The road to development.