① The agency pointed out that the new round of mergers and acquisitions focuses on “hard technology” and upstream and downstream integration of the industrial chain.

③ In terms of the secondary market, Longyang Electronics closed up nearly 16% on Friday, and Anning shares recorded two consecutive shares in the intraday session.

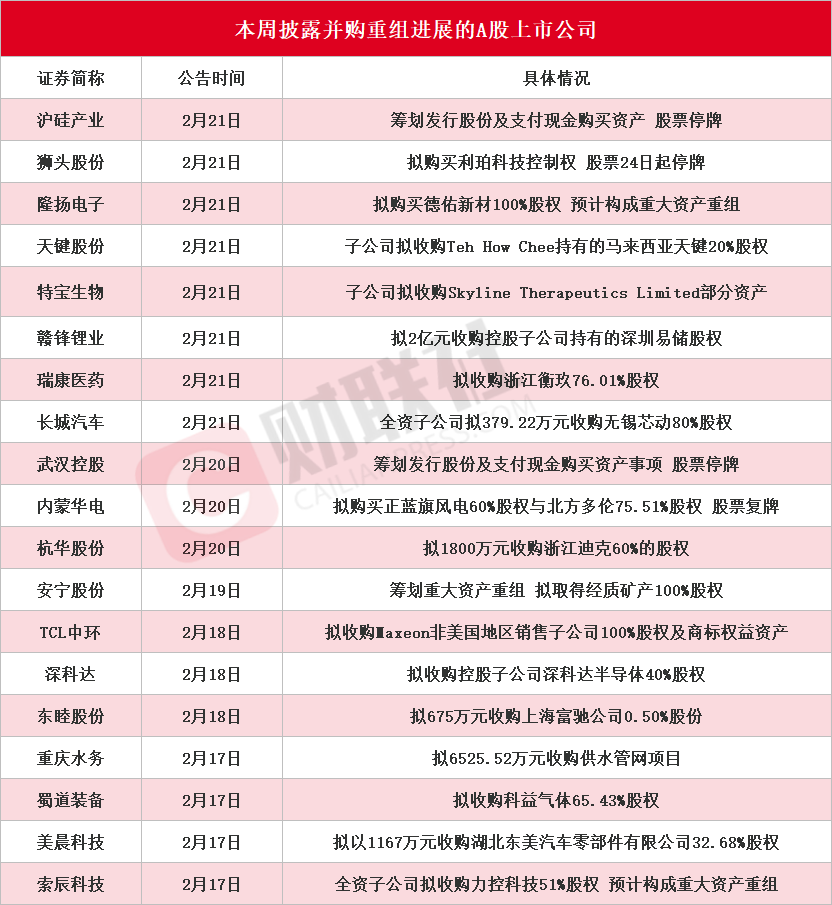

② According to incomplete statistics, as of press time, a total of 19 A-share listed companies have disclosed the progress of mergers and acquisitions this week (attached table).

Cailian News, February 22 (Editor’s Square)The A-share mergers and acquisitions craze continues. Guotai Junan analyst Fang Yi and others pointed out in a research report on February 16 thatThe new round of mergers and acquisitions focuses on “hard technology” and upstream and downstream integration of the industrial chain。The asset reorganization of central enterprise group companies such as China Ordnance Industry Group, China Ordnance Equipment Group, and Dongfeng Motor Group has accelerated.Shanghai, Shenzhen and other places have intensively issued action plans to support mergers and acquisitions。Improved regulatory tolerance for cross-border mergers and acquisitions and acquisitions of unprofitable assets,Mergers and acquisitions are expected to promote the upgrading of the capital market industry structureGuide resources to develop towards “new”.

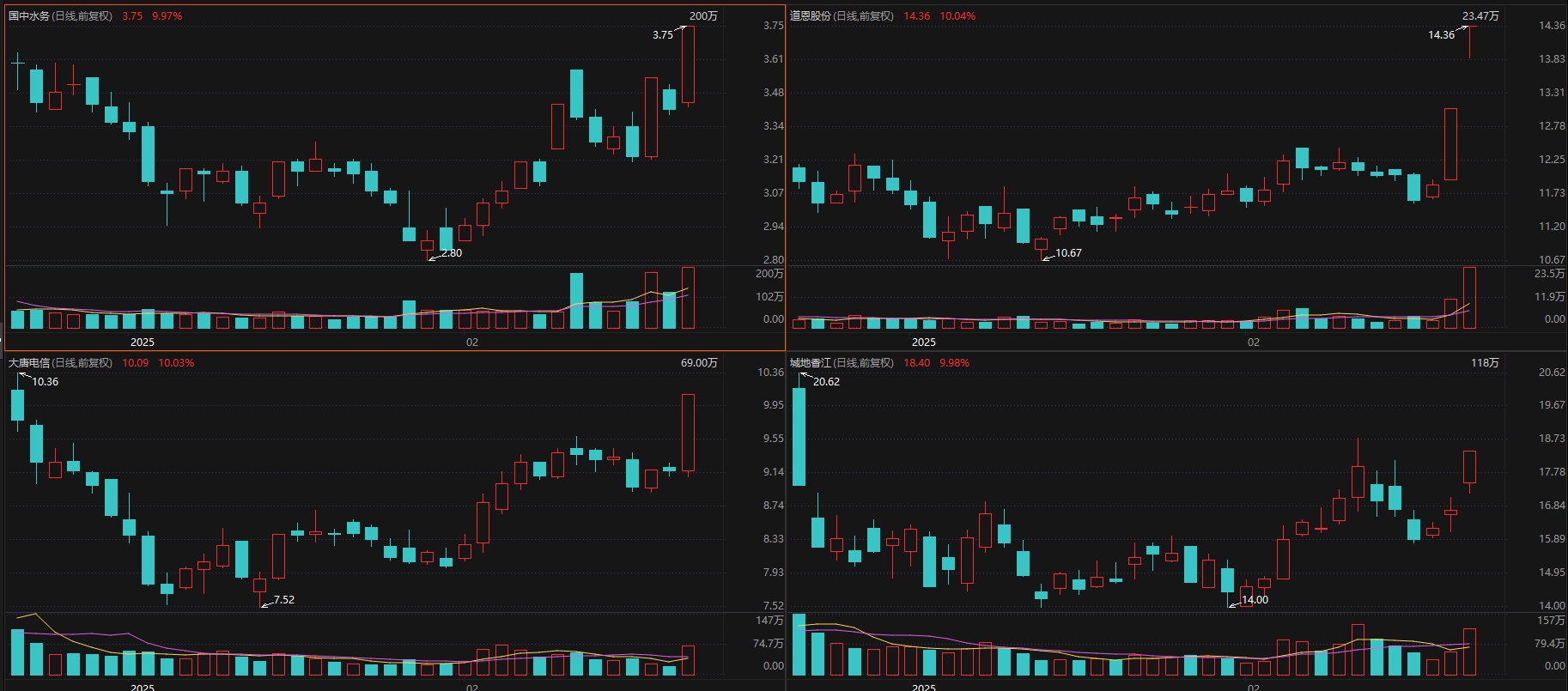

In terms of the secondary market, the company plans to acquire shares in Zhuji WenshenghuiChina-China Water closed on Friday with 2 boards in 3 days, plans to acquire 100% shares of Dawn TitaniumDawn shares recorded 2 consecutive boards。Plan to purchase part of the equity of Datang Microelectronics Technology Co., Ltd.datang telecom, CLP Intelligent Computing plans to become the controlling shareholder of the companyChengdi Xiangjiang closed at daily limit。

According to incomplete statistics from the Financial Union, as of press time,A total of 19 A-share listed companies disclosed the progress of mergers and acquisitions this week, respectivelyShanghai Silicon Industry, Shitou Shares, Longyang Electronics, Tianjian Shares, Tebao Biotech, Ganfeng Lithium Industry, Ruikang Pharmaceutical, Great Wall Motors, Wuhan Holdings, Inner Mongolia Huadian, Hanghua Shares, Anning Shares, TCL Zhonghuan, Shenkeda, Dongmu Shares, Chongqing Water Affairs, Shudao Equipment, Meichen Technology and Suochen Technology, the specific situation is as follows:

According to incomplete statistics from the Financial Union,Trading was suspended this week after disclosing the progress of mergers and acquisitionsListed companies includeShanghai Silicon Industry, Shitou Shares and Wuhan Holdings。Beyond that,Anning, Longyang Electronics and Suochen Technology made it clear that relevant matters are expected to constitute a major asset reorganization。

Semiconductor silicon wafer leader Shanghai silicon industryAnnouncement on February 21 that the company is planning to issue shares and pay cashPurchase minority interests in Xinsheng Jingtou, Xinsheng Jingke and Xinsheng Jingrui, and raise matching funds. The registered capital of Xinsheng Jingtou is 2.91 billion yuan, Xinsheng Jingke is 5.7 billion yuan, and Xinsheng Jingrui is 2.05 billion yuan. Shanghai Silicon Industry stated that the target company is a controlling subsidiary within the scope of the company’s consolidated statements, and this transaction is expected to constitute a connected transaction. As the audit and evaluation work is still in progress,It is not yet certain whether it constitutes a major asset reorganization。The company’s shares will be suspended from February 24, and the suspension period is expected to not exceed 5 trading days.

E-commerce service provider Shitou SharesAnnouncement on February 21 that the company is planning to issue shares and pay cashPurchase control of Hangzhou Lipper Technology Co., Ltd.And raise matching funds.This transaction is expected to constitute a major asset reorganization, but it will not change the actual controller of the company and will not constitute a reorganization and listing.The company’s shares will be suspended from February 24, the suspension period is expected to not exceed 10 trading days. It is worth noting that public information shows thatLipper Technology focuses on machine vision industrial inspection solutions, with the integrated development platform of machine vision algorithms and graphical algorithms as the core technology. In terms of the secondary market,Lion Head shares closed up nearly 8% on Friday, setting a new highOver time,The cumulative largest increase in Shitou’s share price since its July 2024 low is 222%。

Wuhan Holdings, which is mainly engaged in sewage treatment, water engineering construction, and tap water productionIt was announced on February 20 that Wuhan City Investment Group is planning to combine the issuance of shares and payment of part of the cash by Wuhan HoldingsPurchase 100% equity of Wuhan Municipal Council and raise fundsmatters. After the transaction is completed, the company will directly hold 100% equity of Wuhan Municipal Council.The company’s shares will be suspended from the market opening on February 21, the suspension period is expected to not exceed 10 trading days.

Longyang Electronics, a manufacturer of electromagnetic shielding materials in Apple’s supply chainAnnouncement on February 21 that the company plans to pay cashPurchase 100% equity interest in Deyou Xincai。this transactionIt is expected to constitute a major asset reorganization。Deyou Xincai is a high-tech enterprise engaged in the research and development, production and sales of functional coated composite materials. Its products are mainly used in the field of consumer electronics manufacturing. If this transaction is successfully completed, the company will jointly develop more new materials with Deyou Xincai, further expand the company’s product categories, and complete the import substitution of more materials. In the future, it will strengthen and expand the company’s business scope in 3C consumer electronics, automotive electronics and other fields.As a result, the company’s overall business scale and profitability will be further improved。In terms of the secondary market,Longyang Electronics closed up 15.67% on Friday。

Anning shares, which is mainly engaged in the mining, washing and sales of vanadium-titanium magnetite oreAnnouncement on February 19 that the company is planning to pay cashObtained 100% equity in Panzhihua City Jingzhi Minerals, which is expected to constitute a major asset reorganization。The parties involved in the transaction have signed the “Restructuring Investment Intention Agreement.” After the completion of this transaction, Jingzhi Mining, Hongxin Industry and Trade and Liyu Mining will become wholly-owned subsidiaries of the company, and the company’s resource reserves, business scale, market share and profitability will be further improved. In terms of the secondary market,Anning shares once recorded two consecutive boards in intraday trading on Friday。

Suochen Technology, a high-tech enterprise focusing on CAE softwareIt was announced on February 17 that Digital Technology, a wholly-owned subsidiary, plans to transfer equity and/or increase capital by paying cash.Acquisition Obtained 51% equity interest in Beijing Likong Yuantong Technology Co., Ltd., and include it in the scope of consolidated statements as a controlling subsidiary.This transaction is expected to constitute a major asset reorganization。Force Control Technology is an industrial software product developer and solution provider, focusing on production control product development and industry solutions in fields such as intelligent manufacturing.