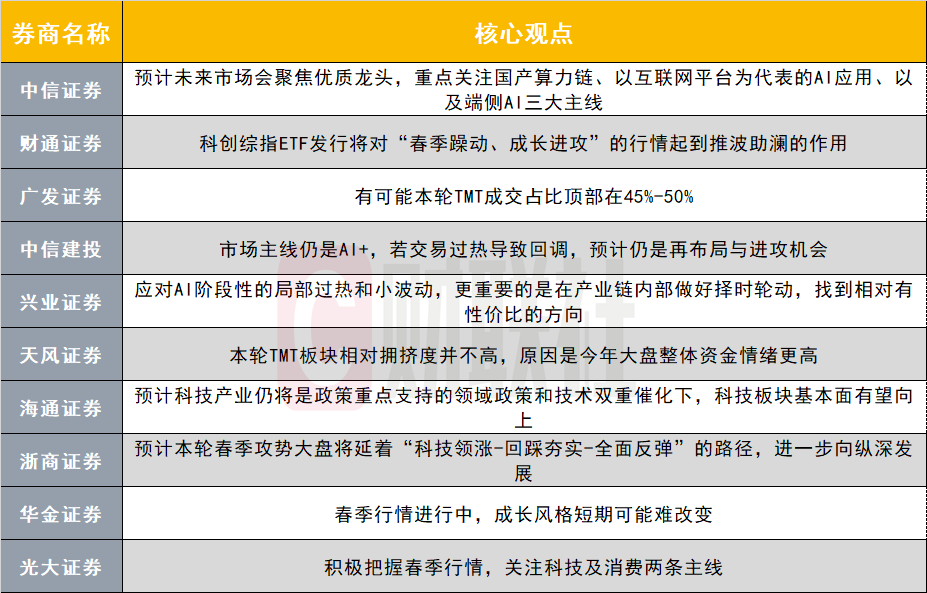

① CITIC Securities: It is expected that the market will focus on high-quality leaders in the future, focusing on the three main lines.

② GF Securities: It is possible that the top proportion of TMT transactions in this round will be 45%-50%.

③ Tianfeng Securities: The relative congestion of the TMT sector in this round is not high, because the overall funding sentiment of the market is higher this year.

Financial Union reported on February 23 that the market continued to rebound this week. The technology sector represented by humanoid robots and cloud computing continued to be sought after by the market. As transactions in the TMT sector entered a crowded range, institutions had doubts about whether the sector’s subsequent market could continue. There were some differences in the trend, but overall, in this week’s brokerage strategy, the TMT sector was still the “best interest” for institutions. It is worth mentioning that this week’s top ten brokerage strategies basically focused on TMT’s follow-up market performance, and technology stocks once again became the focus of attention this weekend.

CITIC Securities: It is expected that the market will focus on high-quality leaders in the future and focus on the three main lines

The future sustainability of the pure theme sector, which relies heavily on capital relay, is limited. It is expected that the market will focus more on clear industrial logic. The “elephant dance” market since the beginning of the year is just the beginning of the revaluation of core assets. First of all, from the perspective of sentiment and positions, the excess turnover rate and transaction ratio of popular topics are both at extremely high levels in history. Active capital positions have risen to the highest level in the past five years. It is expected that the market will rely purely on capital relay in the future. The sustainability of the market is limited. Secondly, from the perspective of industrial logic, the large-scale deployment and application of DeepSeek and Alibaba’s CAPEX significantly exceeding market expectations mean that domestic AI has moved from the mapping and theme stage to a real industrial trend. The high profit elasticity of large-cap companies will make the appeal of pure theme receipts that lack performance has been greatly reduced. It is expected that the market will focus on high-quality leaders and abandon pure game hype in the future.

From a configuration perspective, it is recommended in the technology sector to focus on the three main lines of domestic computing power chains, AI applications represented by Internet platforms, and end-side AI; in traditional core assets, the imagination space is large enough, the low time is long enough, and institutional positions are relatively clear. Lithium batteries and innovative drugs are also worthy of attention.

Caitong Securities: The ETF issuance of the Science and Technology Innovation Composite Index will add fuel to the “spring agitation and growth attack” market

The transformation of the domestic technology industry has pushed China’s assets to welcome the spring. The US dollar index has continued to fall since February 3, creating a good overseas environment. Funds have poured into the core assets of China’s technological growth, and valuations have been significantly restored. Domestic high-frequency economic data is still relatively prosperous. Private economic symposiums have boosted social confidence. At the same time, the technology industry has catalyzed spillover and diffusion effects. All sub-industries have been driven by prosperity expectations and have begun to reassess valuations. The issuance of the Science and Technology Innovation Composite Index ETF will also add fuel to the market of “spring agitation, growth attack”. The subscription time for the first batch of Science and Technology Innovation Composite ETF is only 5 days on average (the first batch of A500 is 10 days, and the second batch is average 8 days). Day), the 12 Science and Technology Innovation Board comprehensive ETF funds in this round (with a raised ceiling of 24 billion yuan) may flow into the market at a faster pace.

At the configuration level, continue to recommend securities firms and technology (Hengke + Science and Technology Innovation +AI core assets, etc.): 1) The external macro environment is conducive to emerging markets, and the core assets of Hong Kong stocks represented by Hengke are reassessed;2) The pace of capital inflow into the market in this round of science and technology innovation comprehensive ETF may be faster than the A500 market, pay attention to potential benefit combinations; 3) The core AI assets of China are rising, the capital expenditures of domestic major manufacturers exceed expectations, the overseas OpenAI GPT-4.5/5 is approaching the launch or form a new catalyst, the congestion is digested, attention is paid to the rotation to the low-level application side, and the hardware side is concerned about whether Nvidia’s earnings report next week will cause disturbance;4) The low-level economy (complete& machine parts/infrastructure/operators) is low-level, and there may be poor policy expectations during the window of the two sessions.

GF Securities: It is possible that the top proportion of TMT transactions in this round will be 45%-50%

Since the outbreak of the AI industry, TMT transaction congestion in the past two years has always attracted market attention. Because, in the past two years, as long as TMT transactions accounted for close to the 40% upper limit, the sector’s excess returns will appear to be stepped back. Around the Spring Festival of 25 years, TMT turnover exceeded 40% and continued to run at a high level. The invisible constraint of 40% seemed to have lapsed in this round.

In every round of large-scale technology industry cycle, the center of TMT turnover will experience a significant increase. This is due to the increase in the number of constituent stocks and market value, and the improvement of investors ‘expectations for fundamentals. The current TMT turnover accounts for 44%. Judging from past experience and the United States, it is possible that this round of turnover accounts for 45%-50%.

Technology is still the main line, and subsequent ideas for participation in the technology industry can be carried out along two clues: “low-level growth branch” and “25 years of performance to be fulfilled”. First of all, low-level growth can focus on military industry, cultural sailing, satellites, medical equipment, AI education, etc. Secondly, look for technology fields where 25H1 has a high probability of immediate fundamentals cashing. Currently, the main focus is on end-side hardware, robots/smart driving, inference-side computing power, etc.

CITIC Construction Investment: The main line of the market is still AI+. If overheated transactions lead to a correction, it is expected that it will still be an opportunity for re-layout and attack.

This week’s surge in the A-share market was mainly due to Alibaba’s capital expenditure plan. Capital expenditures exceeding expectations have strengthened the market’s confidence in the technology sector. The market may not be able to continue to have strong catalysis in the short term. However, the evolution of the industrial boom in the medium term is the general trend. Even if there is a brief technical correction in the technology sector, the strong willingness of funds to participate may still contribute to the market. Provide support.

Continue to focus on poor policy expectations and the resonance direction of industrial trends. Industries: Internet, communications, electronics, computers, media, nonferrous metals, etc. Theme and direction: AI domestic computing power chain, domestic substitution (semiconductor equipment/materials), robots, low-altitude economy.

Industrial Securities: To deal with the periodic local overheating and small fluctuations of AI, it is more important to choose the timing within the industrial chain to find a relatively cost-effective direction

AI is the most focused main line direction in the current market. Although the rise in the proportion of short-term transactions to a high level may lead to periodic shock adjustments in the sector, it usually will not lead to the systematic end of the market. Under major industrial trends, we should deal with periodic local overheating and small fluctuations, and more importantly, we should choose the timing within the industrial chain to find a relatively cost-effective direction.

In the medium and long term, under the current background of continuous catalysis in all links of the AI industry chain, continuous renewal of the industrial narrative, and many positive catalysis and verifications in the future, the AI sector may be active repeatedly, and its main line status is expected to be further consolidated. Supported by the industry logic and policy environment, AI may continue to pass through short-term transaction congestion and continue to become the main line of the market’s medium and long-term focus.

Combined with medium-term industry trends and short-term relative cost performance, among the current 50 segments of the AI industry chain, we can focus on optical modules, servers, AI chips, PCBs, operators and other links.

Tianfeng Securities: The relative congestion of the TMT sector in this round is not high, because the overall funding sentiment of the market is higher this year

The high congestion in the TMT sector, which the market is currently paying close attention to, refers to absolute congestion. However, in fact, the sentiment of all A’s has improved after 924, and the relative congestion level (the ratio of TMT turnover rate to all A’s turnover rate) is still far from being achieved.

Since January 24, 2025, the proportion of turnover in this round of TMT sector has continued to exceed 40%. The turnover rate of this round of TMT sector is also much higher than that in 23 years, and the absolute congestion level is higher than that in 23 years; The ratio of TMT turnover rate to total turnover rate in this round of market is higher than the highest level in 23 years, that is, the relative congestion is not high, because the overall financial sentiment of the market this year is higher.

Industry allocation suggestions: The third phase of Match Point 2.0 is tough, and the social financing pulse has rebounded. After the Spring Festival, we will further observe the improvement of fundamentals. Hang Seng has taken the lead, and the response of A-shares lags behind. Based on economic recovery and market liquidity, the investment line can be downgraded into three directions: (1) Deepseek breakthrough and open-source led technology AI+,(2) valuation restoration of consumer stocks and gradual recovery of consumption stratification, and (3) Undervalued dividends continue to rise.

Haitong Securities: Under the dual catalysis of policies and technology, the fundamentals of the technology sector are expected to rise

The recent emergence of Deepseek has brought about the restructuring of the AI landscape. Tencent, Alibaba, Baidu and other technology companies have announced access to Deepseek, and market attention continues to heat up. This breakthrough progress reflects the strong momentum of scientific and technological innovation in China, which is inseparable from the support of my country’s science and technology innovation policies. The recent symposium for private entrepreneurs also reflects the great importance that decision-makers attach to scientific and technological innovation. Combined with last year’s Central Economic Work Conference and the industrial policy signals of this year’s local two sessions, we believe that future industrial policies will further focus on scientific and technological innovation and promote the cultivation of new productive forces.

Industrial policies play an important role in guiding the allocation of factor resources, and are also an important support and vane for my country’s economic development. In recent years, the policy level has placed scientific and technological innovation in an important position. Judging from the recent statements of decision-making levels, the Central Economic Work Conference, and the local two sessions, scientific and technological innovation may have become one of the focuses of my country’s current industrial policy.

It is expected that the science and technology industry will remain an area supported by key policies. Under the dual catalysis of policies and technology, the fundamentals of the science and technology sector are expected to improve. On one hand, technology may focus on consumer electronics, humanoid robots, autonomous driving, etc. on the application side of AI technology. On the other hand, the fiscal sector is expected to make positive efforts in the past 25 years, and scientific and technological fields such as digital infrastructure, information innovation, and semiconductors are also receiving key financial support.

Zheshang Securities: It is expected that this round of spring offensive will follow the path of “technology-leading the gains-stepping back and consolidating-comprehensive rebound” and further develop in depth

This week, the market continued to rise, the growth index strengthened significantly, and the weight index followed suit. Looking forward to the market outlook, it is expected that this round of spring offensive will follow the path of “technology-leading the gains-stepping back and consolidating-comprehensive rebound” and further develop in depth. Of course, some over-selling industries, sectors, and individual bonds should still pay attention to possible two-way fluctuations.

In terms of allocation, based on the judgment that the mid-line market is steadily improving and the volatility of some industry sectors is increasing, investors are advised to maintain existing positions before the end of the spring offensive and continue to increase allocations when a “golden right foot” appears. In terms of the industry sector, it is recommended to make certain adjustments to some of the over-inflated technology sectors, find targets within the sector to “cut high and low”, or switch some positions to large financial sectors with lagging gains in the previous period, so that they can not only participate in making up for the gains, but also Properly smooth the net worth curve. In addition, for the pharmaceutical sector, which has continued to decline in the past few years, we can focus on stocks that have experienced large declines, stabilized fundamentals, and increased shareholders ‘holdings.

Huajin Securities: The spring market is in progress, and the growth style may be difficult to change in the short term

Currently, external events are relatively positive and liquidity is loose, and the growth style may be difficult to change in the short term. (1) Short-term external events are positive. First, domestic policy easing has a high probability of continuing in the short term. Second, external risks may decline further: first, risks such as the Russia-Ukraine conflict may drop significantly; second, overseas constraints on domestic easing may decline. Third, the trend of the science and technology industry continues to rise. (2) Fundamentals continue to be weak and repaired: First, the absolute value of real estate sales after the holiday remains relatively low; second, corporate profits continue to be in a trend of recovery at a low level. (3) Domestic liquidity may remain loose in the short term. First, the RRR may still be lowered in the short term. Second, the first quarter is the traditional peak credit season.

Industry allocation direction: Focus on short-term growth to make up for growth. (1) Short-term technology and consumption may configure the main line. First, historically, there was a gap in performance when liquidity was loose, and industries with policy orientation and high prosperity were relatively dominant. Second, at present, the direction of policy orientation is science and technology and consumption, and the continuous upward trend of industrial trends leads to high prosperity is science and technology. (2) In the short term, we can focus on industries such as big finance, consumption, and non-TMT growth that make up for the increase. First, in terms of historical experience, industries that make up for gains in the middle and late stages of the spring market are relatively dominant: industries ranked in the bottom 5 in the early stage may improve in the middle and late stages. Second, at present, attention can be paid to major financial, electricity and new industries, pharmaceuticals, consumer and other industries that make up for the increase. (3) Short-term suggestions to continue to allocate bargain-hunting: first, electronics (semiconductors, consumer electronics), communications (computing power), media (AI applications), machinery (robots), and computers (autonomous driving, data elements) with upward policies and industrial trends; second, electricity, pharmaceuticals, and securities firms whose fundamentals may improve and make up for increases.

Everbright Securities: Actively grasp the spring market and pay attention to the two main lines of technology and consumption

Continued policy support and capital inflows brought by the money-making effect are expected to further enhance market valuations. The current valuation of the A-share market is near the average since 2010. With the active efforts of policies, medium-and long-term funds and incremental funds brought by the early money-making effect may accelerate their flow into the market, which is expected to further enhance the A-share market. valuation.

In terms of configuration direction, we focus on the two main lines of technological growth and consumption. The science and technology growth sector focuses on industries such as TMT, machinery and equipment, and power equipment where policies have a mapping in the capital market; the consumer sector focuses on trade-in and service consumption, such as home appliances, consumer electronics, social services, and commercial retail.