Banxia hasn’t been made a strong replacement yet.

Anta’s dream under the banana was not achieved

Wen| Source Sight Anran

The Internet’s half-sister brands, Banana-Nei and Banana-Xia, are folded on the same outdoor dream.

2024 is a year that is fully swept by outdoor storms.

Against the background of the overall weakness of the apparel industry, outdoor sports brands are making great achievements in the ice and snow. For example, Anta’s Desante and Kelon; Amafen’s Archaeopteryx and Salomon have seen their performance rise.

The craze began in 2022, known as the first year of outdoor activity. At that time, amid repeated epidemics and obstruction of long-distance travel, outdoor activities such as camping and Frisbee were popular. Outdoor craze gradually emerged and new air outlets gradually took shape.

Many chasing the wind brands followed the trend, including Jiaonei, which started with underwear, and Jiaonei, which made their mark with sunscreen products.

In 2023, Jiaonai launched a new product of oxygen assault jackets for the first time, and launched the second generation of this series in September 2024, using the concept of urban assault jackets to highlight scene differences in an attempt to break through.

In the same year, Jiaoxia, which embarked on the path of lightweight outdoor, launched outdoor products such as airliner jackets; in the winter of 2024, spokespersons Jay Chou and Yang Mi joined forces in an attempt to use national popularity to help airliner ski suits break through.

Left: Jiaonei City Compartment| Right: Under-charred velvet jacket

However, the two brands, which are also well aware of the logic of Internet hot goods and have achieved rapid growth through concepts first and strong marketing, have not been able to taste the benefits in the field of outdoor clothing that requires a certain professional threshold.

On the 2024 Tmall Double 11 Sports Outdoor Sales List, in addition to the old outdoor heads, Camel, Bosch, Kelon, Decathlon, etc. have been on the list, while Shuangbanao has no name on the list.

The main prices of these brands or products are close to those of Shuangjiao, or they are positioned in the same fashion and outdoor lifestyle, or they specialize in cultivating sporting goods but have a more affordable and wider coverage, which has dealt a blow to the Shuangjiao enclosure, which has been halfway home.

In January this year, Jiaonei Beijing Sanlitun store closed. Although the official explanation was due to the expiration of the lease, the evacuation of important sites in Landing Plan 2.0 may indicate that store operations have not met expectations.

The situation under Jiaxia is even more severe. In the second half of 2024, Jiaoxia was exposed to the abolition of its brand department, and the brand CMO also resigned under structural adjustment; the previous two submissions to the Hong Kong Stock Exchange have gradually disappeared, and the IPO is nowhere to be seen.

At the same time, competition in the underwear category and sunscreen track where Shuangjiao occupies is becoming increasingly fierce, and many sports brands have also entered the game.

After failing to take off under the wind, perhaps returning to the comfort zone to cultivate products and build a solid moat is the long-term solution to let Shuangjiao go further.

A marketing expert who stepped on the short

Banouchi and Banouxia, who are deeply imprinted with the Internet’s genes, are veritable marketing experts.

The first is to put the concept first, and the concepts such as unlabeled sun protection is anti-aging are innovative and innovative, arousing consumer interest and making the underwear inside and under the banana stand out from their peers.

Then, through overwhelming and strong marketing methods, especially inviting celebrities and celebrities from all walks of life to endorse and promote, it increased the volume and broke the circle and became a hit in the industry.

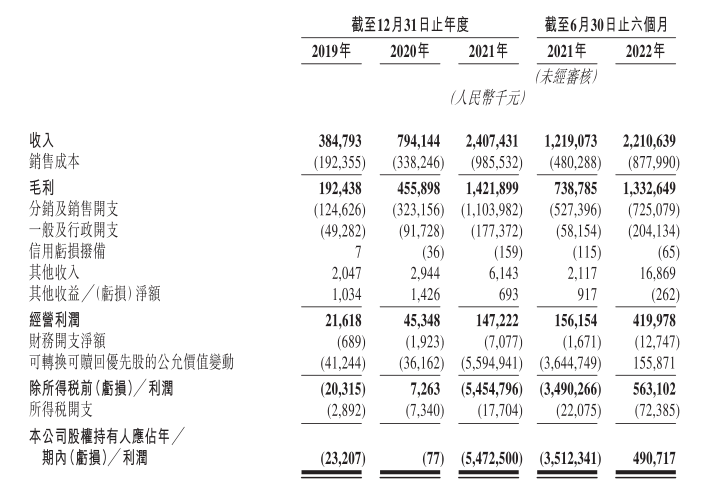

According to multiple media reports, from 2017 to 2021, sales in Banana completed a huge leap from 50 million yuan to 1.9 billion yuan; the prospectus shows that in the first half of 2019-2022, revenue under Banana achieved a transformation from 385 million yuan to 2.211 billion yuan, reaching 2.407 billion yuan at the peak in 2021, more than six times that in 2019.

Intensive external promotion requires considerable marketing expenses, and celebrity endorsements alone are enough to make the brand bleed.

According to Spicy news from Chopping Pepper, a person familiar with the matter revealed that top-level celebrities such as Liu Yifei are quoted at around 15 million yuan in the market, and the endorsement fees for artists with similar national and favorable feelings are not low.

In addition to the celebrity’s endorsement fee, the accompanying media promotion accounts for at least 60% of the total fee. Therefore, some industry insiders revealed that if 15 million yuan is hired for a spokesperson, it will even have to be matched with a budget of about 100 million yuan.” rdquo;

Judging from the current celebrity echelons of Jiaoxia and Jiaonai such as Jay Chou, Yang Mi, Zhou Dongyu, Wang Yibo, Zhao Lusi and other spokespersons, endorsement promotion expenses alone are a heavy burden for two new consumer brands with known revenue of no more than 2.5 billion yuan.

According to the data disclosed in Jiaoxia’s prospectus, from 2019 to 2021, Jiaoxia’s marketing expenses were 125 million yuan, 323 million yuan and 1.104 billion yuan respectively, accounting for 32%, 41% and 46% of revenue for the same period respectively.

The screenshot comes from the Jiaoxia prospectus

In the same period, although the gross profit margin of Banxia could reach 50%, 57%, and 59% respectively, the profit was-23 billion yuan, basically the same at-5.473 billion yuan. Although the company explained that the losses mainly came from losses caused by changes in the fair value of convertible redeemable preferred shares, high marketing fees are still a major drag on the company.

Therefore, expanding categories and seeking new additions has become an inevitable choice. Just at the right time, the outdoor heat allows people under the banana trees to see opportunities.

However, Jiaowai and Jiaowai seem to be betting in the wrong direction.

Beauty is a kind of competitiveness, but it is difficult to become a core competitiveness, especially for outdoor sports apparel. ldquo; Shuangjiao puts more skills on fashion sense, but ignores the most important basic performance guarantee of outdoor products.

On social platforms such as Xiaohongshu, there are many comments that the combos inside the banana are not warm in winter and breathable in summer, have poor waterproof performance, and have threadless cuffs or cannot be adjusted. Consumers call them outsiders.

In the previously disclosed data, Jiaoxia has been questioned about emphasizing marketing over research and development. 2019-2021 In 2001, its R & D expenses accounted for 5.3%, 4.6%, and 3% of revenue respectively, far lower than the proportion of sales expenses, and declined year by year.

In November 2024, in order to cater to the winter ice and snow craze, Jiaoxia launched a blockbuster advertising campaign for ski wear. However, the skiing equipment, shoe board matching, etc. appearing in the spokesperson’s poster made many sports enthusiasts see the problem and further questioned the professionalism of the brand’s outdoor wear.

Winter has passed, but the layout of Shuangjiao’s outdoor clothes has not warmed up. As of 9:00 on February 24, Shuangjiao ‘s products are still nowhere to be found.

Unique skills per capita

If you play fake in the field of outdoor sports, you will inevitably risk stepping on the empty.

After all, every brand that stands out on this track has its own unique skills.

Kelong also emphasizes the fashion of sportswear, pursues outdoor lifestyle, and takes a light outdoor route. While distinguishing high-performance outdoor routes such as Archaeopteryx, Beibu, and Colombia, it does not abandon basic equipment performance, but achieves two-pronged.

Backed by Anta Group, Kelong enjoys high-end outdoor resources in terms of technology and raw material reserves, including top Gore-Tex fabrics such as Archaeopteryx, quick-drying and sun-blocking Seco Shuke fabrics, breathable and wear-resistant Banboo Fiber bamboo fiber materials, etc.

Although there are also big-name celebrities endorsed by Hu Ge and Liu Shishi, and the brand has always targeted the core business district for trend and creative marketing, in addition to fashion aesthetics, Kelong has not given up strengthening its professional image, thereby winning more consumers.

From January to September 2024, Kelong’s revenue growth will reach 50%; for the whole year of 2024, all other brand divisions of Anta Group, including Kelong, recorded positive growth in retail sales of 40%-45% year-on-year, and annual sales may exceed 10 billion yuan.

The prices of the main products are close, but they can rank at the forefront of the industry’s sales list. Camel, Boscihe, Decathlon and other brands also have their own unique advantages.

According to source Sight, the price of the jacket in Jiaowai is between 300- 1,000 yuan, mainly concentrated in the range of 300-500 yuan. The price of the hottest jacket in Tmall Official Flag is around 400 yuan; the price of the jacket in Jiaowai is between 299- 1,299 yuan, the sales of each model are relatively balanced, and the price of the most popular model is around 900 yuan. ldquo; Shuangjiao’s main products are basically concentrated in the range below 1000 yuan.

Take Camel as an example. The original price of its jacket product is about 300- 5,100 yuan. However, due to the large online discounts, the actual selling price is basically about 80- 3,700 yuan, with the main force concentrated in 200-600 yuan, which is also in the same range below 1000 yuan.

Compared with other brands at the same price point, Camel’s outstanding advantage lies in the supply chain.

According to late LatePost, Camel founder Wan Jingang once said that he had done nothing else in 2022 and was building a factory.” rdquo;

In 2022, Wan Jingang built 5 assault clothing production factories, 2 shoe factories, and 1 tent factory. In two years, Camel has built more than 500,000 square meters of production and research centers in Huanggang, Shaoxing, Foshan, Qingyuan and other places. At that time, Shuangjiao had not yet launched its assault suit business.

Liu Haoyu, head of Camel’s outdoor equipment, said that almost all of camel’s major products are now self-produced, and self-produced camel assault jackets can reduce the cost by about 10%.

In contrast, for example, the OEM and OEM model used for Jiaoxia products reduces production costs through production outsourcing, but it is difficult to guarantee product quality and risks unstable quality control.

In addition, foundries can also undertake OEMs from other brands, and can create other so-called white-label products with the same or homogeneous model under Banana for sale at a lower price, which will impact the sales of the original brand products.

Another example is Decathlon. In itself, Decathlon is a more professional and well-known sporting goods brand than Shuangjiao, but in addition, Decathlon also has the advantage of being more affordable and wider coverage.

Source Sight learned that the price of its jacket is basically around 70- 1,500 yuan, and the exploration space is lower than that of Shuangjiao.

At Tmall’s official flagship store, the historical transaction volume of a single piece of Decathlon fleece worth 70 yuan has exceeded 200,000 units, and there are not a few other hot-selling jackets with sales exceeding 100,000 units.

In contrast, the sales volume of the highest-traded jacket item in Banana was only more than 30,000 units, while the highest sales volume under Banana was only more than 10,000 units.

Data from the National Bureau of Statistics shows that CPI will increase by 0.2% year-on-year in 2024. During the year, the per capita consumption expenditure of residents nationwide was 28227 yuan, a nominal increase of 5.3% over the previous year. After deducting price factors, the actual increase was 5.1%. Among them, per capita clothing consumption expenditure was 1521 yuan, an increase of 2.8%, accounting for 5.4% of per capita consumption expenditure.

Against the background of rising prices and increasing consumer spending across the country, affordable clothing is obviously very attractive. For consumers, while taking into account certain professional performance, Decathlon is so simple and unpretentious compared with Shuangbanos, whose prices are slightly inflated, so it is more popular.

Comfort zone recovery

Losing one place does not mean losing the entire game.

In fact, Shuangjiao has so far been operating well in its main business areas, and under the wave of the Xinjiang Cotton Incident and the rise of the national tide, as a new local force, it has had a certain impact on international brands.

In the field of underwear, according to statistics from Zhiyi Technology, in the 2024 Tmall Home Wear/Underwear Store Double Eleven Sales Ranking, Jiaonai won second place with sales of 425 million yuan, ranking before Uniqlo, Fenteng and other home wear/underwear brands.

Top 10 sales list of Tmall Double Eleven underwear stores in 2024

Data shows that four hours after the 2024 Jingdong Double 11 event started, the overall turnover of head underwear brands increased by more than 12 times year-on-year, and the turnover of brands such as Jiaonei and ubras doubled year-on-year.

In the field of sunscreen clothing, in the 2024 618 event, the live broadcast sales of all categories of Jiaoxia exceeded 100 million for the first time. The main hot product was the owner of Huadan Ice Silk Cool Sunscreen Clothing.

According to data released by Taobao Live Broadcast, the full-cycle live broadcast transaction of Jiaoxia 618 ranks among the top 1 live broadcast in the apparel industry. The transaction of single products increased by 220% month-on-month, the transaction between live broadcasts increased by 124% month-on-month, and the transaction conversion rate increased by 112% month-on-month.

In contrast, the development of giants in China has become increasingly conservative and sluggish.

In the first fiscal year of 2025, Uniqlo’s parent company Fast Retailing achieved double profit growth, but the growth mainly comes from the local, European, American, and Southeast Asian markets. Fast Retailing said that the the mainland of China market recorded a decline in revenue and a significant decrease in profits due to the failure of its commodity mix to fully respond to warm winter demand and the lack of elastic adjustment to different local needs.

However, in the first three quarters of 2024, 22.1% of the company’s revenue contributed by Uniqlo Greater China region has dropped by 15.7% year-on-year to 522.469 billion yen, and same-store sales and operating profit have both shrunk.

In addition, in October last year, Oysho, an underwear brand owned by Zara’s parent company Inditex Group, said that due to the company’s business adjustments, the brand closed its Tmall flagship store on November 17. As a result, Oysho withdrew from all online channels in China; its offline stores were also closed from more than 80 stores at its peak to 4.

However, returning to the comfort zone does not mean that it will be done once and for all.

The confrontation between old and new underwear brands has become increasingly fierce and frequent. Even as the PVH Group of the United States is about to take CK away, Banauchi still cannot breathe a sigh of relief.

On the one hand, Ubras, who was born in the same period, became popular with non-sized underwear with similar routes. They pursued Bannei closely on the sales list, and even surpassed Bannei in key sales points. For example, they occupied store sales in the above-mentioned Tmall Double Eleven promotion. Top of the list.

In addition, in terms of the performance of the 2024 Double Eleven full-cycle, Cat People, who also flaunt technological underwear, have also won the TOP 1 underwear brand on multiple e-commerce platforms such as Douyin and Jingdong, ranking among the top brands of big clothing.

On the other hand, dark horses are still emerging. For example, Kazuko Ono mainly promotes products such as shark pants and bare-leg artifacts that meet women’s body shaping needs and can be worn externally, which are loved by many female consumers.

In February 2024, actor Ma Li announced that the bare-legged artifact worn during the Spring Festival Gala came from Kazuko Ono. Jingdong data shows that on February 18, the transaction volume of related categories such as bare-leg artifacts and tights increased by 121% year-on-year, and search keywords such as Ono and Zimali bare-leg artifacts increased by 20 times year-on-year.

In the hard-to-sun arena, the disruptors and forces are even greater.

Data from iiMedia Research shows that my country’s sunscreen apparel market will reach 74.2 billion yuan in 2023, and it is predicted that it will be close to 95.8 billion yuan by 2026, and the market scale will move towards 100 billion yuan.

As a result, sports brands including Anta and Li Ning have also turned their attention to this red sea.

Last summer, Anta Tmall Official Banner put on shelves nearly 40 sunscreen garments, and many of them sold more than 10,000 per month. Its popular Juejue Purple series of sunscreen garments have all been upgraded in fabrics and styles to cover children’s categories.

While Anta adopts ice coating technology, Li Ning has also developed COOLSHELL cooling technology; Peak Sports launched Extreme Speed 1.0, equipped with quick-drying technology, with an evaporation rate of greater than 0.18 g/h; Hongxing Erke launched the Cloud Ice T, which claims to achieve a maximum cooling temperature of 12 degrees in 5 minutes, and lasts for up to 60 minutes……

With rookies emerging in large numbers and giants coming off the field, even if they return to their comfort zone, Shuangjiao still has many problems and needs to catch up. nbsp;

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.