Time is luck.

Written by: Deep Trend TechFlow

“Whatever he has will be given to him; whatever he does not have, even what he has will be taken away from him. rdquo;

—Gospel of Matthew

On the chain, the Matthew effect of the stronger the stronger never stops.

For example, Pump.fun quietly began to do Raydium’s work: today it secretly launched a self-built AMM pool in an attempt to divide the liquid income that originally belonged to Raydium.

At present, this self-built AMM (http://amm.pump.fun) page is very simple. You can swap any token like other DeFi products.

However, the thinking behind this product may not be simple.

As you all know, Pump.fun has its unique withinouter diskmechanism and memecoin culture Attracted a large number of Degen.

Users ‘transactions are first matched on the internal market of Pump.fun, relying on the liquidity of the platform to complete the transaction; when the internal market is full, the transaction will be routed to the external market, which actually relies on Raydium’s liquidity pool.

In this model, Pump.fun has always been Raydium’s traffic provider, but is therefore subject to Raydium’s rules. Whenever a transaction flows to an outside market, Pump.fun needs to pay a portion of the transaction fees, and this portion of the profits eventually flow to Raydium’s liquidity provider (LP).

Raydium itself is one of the most important AMM platforms in the Solana ecosystem and an important infrastructure for DeFi users to gain mobility. It also provides liquidity pool services for many projects on Solana, and its TVL (Total Locked Volume) has long been at the forefront of Solana.

As Solana’s mobility center, Raydium plays a pivotal role in the ecology. However, Pump.fun’s new actions are challenging this pattern:

Pump.fun is no longer satisfied with being Raydium’s traffic provider, but is trying to become a controller of liquidity.

Self-built AMM poolThe business experience behind it

By building its own AMM, Pump.fun can transfer the liquidity of external markets from Raydium to its own platform, thereby fully controlling the allocation of transaction fees.

If Pump.fun ‘s strategy is successful, Raydium will not only lose part of its liquidity sources, but its revenue model and ecological status will also be affected.

So, how was this account calculated?

-

Raydium’s revenue model: The hidden costs of Pump.fun”

Under the current model, Pump.fun’s external trading relies on Raydium’s liquidity pool, and each transaction will incur a certain handling fee, which will eventually flow to Raydium’s ecosystem.

-

Standard fee for Raydium: Charge per transaction 0.25% fee, including:

-

0.22% Liquidity Provider (LP) assigned to Raydium.

-

0.03% For repurchase and ecological support for $RAY.

-

-

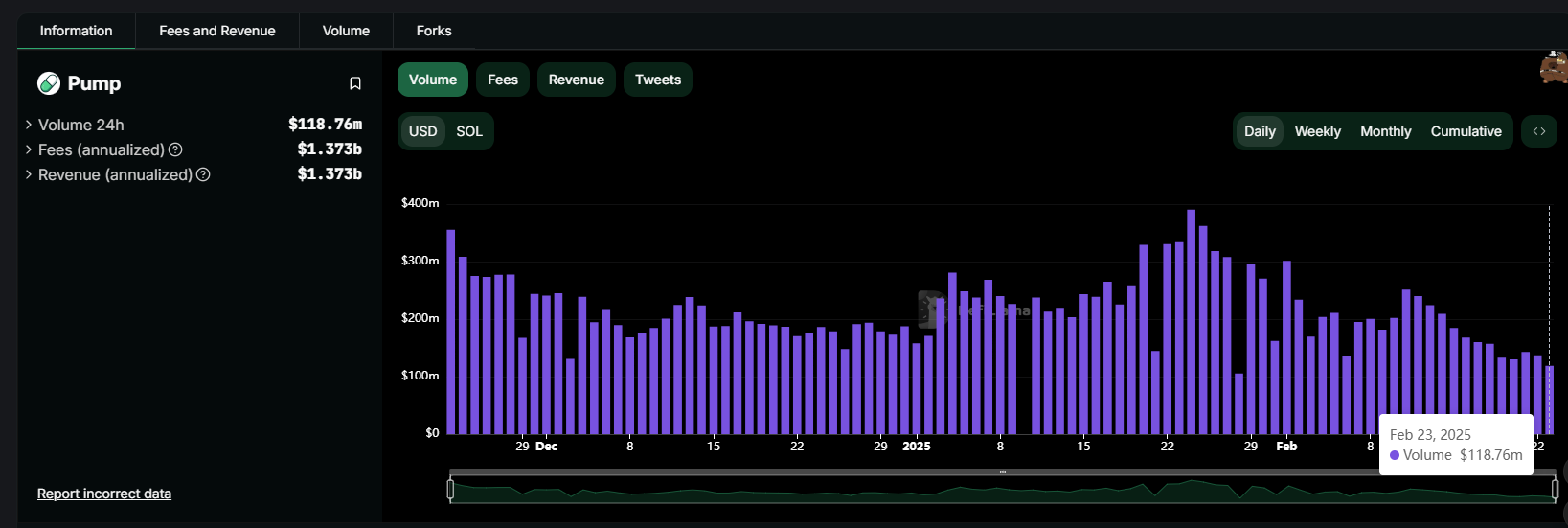

Trading volume at Pump.fun: Suppose that the daily transaction volume of Pump.fun is $100 million, among them 5% trading volume (approximately US$5 million) It is routed to the outer disk of Raydium.

-

Hidden costs of Pump.fun: According to 0.25% For calculation of the handling fee, Pump.fun needs to pay Raydium every day 1.25 million dollars, approximately per year US$4.5625 million。

For a fast-growing platform, although this fee is lower than before, it is still a dependence on external platforms.

-

self-built AMM the potential benefits of

By building its own AMM, Pump.fun can transfer the liquidity of external markets from Raydium to its own platform, thereby fully controlling the allocation of transaction fees. So, how much potential benefit can this move bring?

-

new revenue models0.25%), but all expenses belong to the platform:

-

The daily external trading volume remains at $5 million。

-

accordance with 0.25% handling feeCalculations, available directly daily at Pump.fun 1.25 million dollars income.

-

Cumulative annual income is approximately US$4.5625 million。

-

-

remove LP costs tonet income: If Pump.fun ‘s AMM does not rely on external LPs but is provided by the platform itself, then this revenue will be entirely owned by the platform and will not need to be distributed to other liquidity providers.

-

Besides money, what else does Pump.fun fancy?

Self-built AMM can not only bring direct revenue increase, but also significantly enhance Pump.fun ‘s control over the ecology and lay the foundation for future development.

Under the current model, Pump.fun’s external trading relies on Raydium’s liquidity pool, which means that Raydium controls the user’s trading experience and liquidity stability.

After building AMM, Pump.fun will fully control the rules and fee allocation of the liquidity pool, thereby enhancing its control over users.

After controlling liquidity, Pump.fun can further launch more DeFi products (such as perpetual contracts, loan agreements, etc.) to build a closed-loop ecosystem.

For example, Pump.fun can directly support the publishing and trading of memecoin through its AMM pool, providing more gameplay for its community.

Changes in relevant token prices

After Pump.fun announced the launch of self-built AMM, Raydium’s token $RAY fell, and the daily decline has been already 20%。

This phenomenon may reflect market concerns about its future revenue and status.

Pump.fun ‘s strategy could pose a long-term threat to Raydium, especially in terms of liquidity migration and fee revenue.

But on the other side, Pump.fun built its own AMM pool and used a MEME token to test the liquidity pool.CrackPrices rose rapidly, and the market value reached the highest point $400 m。

CA:

CitRGsrgU7NjaXsxdMFc7sfsxtSnPdtkhHJqbPvhpump

Among the few hot market spots, AMM pool test tokens may still be flying for a while.

The challenge is clear

After building AMM, if it runs smoothly, Pump.fun will fully control the liquidity of the external disk, thereby significantly increasing revenue.

By integrating internal and external liquidity, Pump.fun can build a fully self-consistent online Meme DeFi ecological closed loop.

After an innovative platform has a more user base, it certainly has the opportunity to shake the status of traditional DeFi and the on-chain ecosystem through strategic adjustments.

However, whether Pump.fun can truly shake Raydium’s position in the future will depend on its ability to balance its liquidity strategy and user growth; more importantly, the bull market is still in existence.

Time is luck.

It’s not just the leeks competing in PVP, but the good show of projects competing against each other is also being staged.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern