Yimeng stated that the company will correct the issues mentioned in the decision on administrative supervision measures in strict accordance with relevant laws, administrative regulations and regulatory requirements.

Tencent’s Yimeng shares were named by regulators: insufficient compliance management and risk control mechanisms

(Photo source: Visual China)

Blue Whale News, March 1 (Reporter Wang Wanying)Recently, the Shanghai Securities Regulatory Bureau decided to issue a warning letter to Yimeng Co., Ltd.(hereinafter referred to as Yimeng Co., Ltd.).

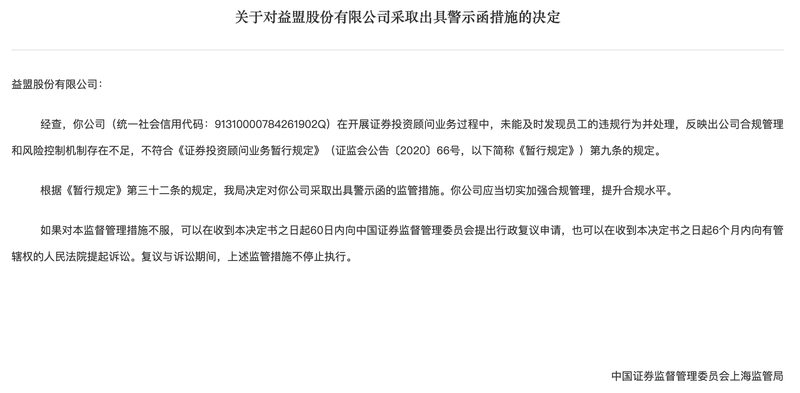

After investigation, Yimeng Co., Ltd.(Unified Social Credit Code: 91310000784261902Q) failed to discover and deal with employee violations in a timely manner during the process of conducting securities investment advisory business, reflecting that the company’s compliance management and risk control mechanisms were insufficient and did not comply with the provisions of Article 9 of the Interim Provisions on Securities Investment Advisory Business (CSRC Announcement [2020] No. 66, hereinafter referred to as the “Interim Provisions”).

(Photo source: Shanghai Securities Regulatory Bureau)

According to the provisions of Article 32 of the Interim Provisions, the Shanghai Securities Regulatory Bureau has taken regulatory measures to issue a warning letter against Yimeng Shares, requiring the company to effectively strengthen compliance management and improve compliance levels.

At the same time, employee Huang Fei was also issued a warning letter. After investigation, during his tenure at Yimeng, Huang Fei did not register as a securities investment consultant with the Securities Industry Association of China but provided investment advice to investors during the process of engaging in investment consulting services.

Yimeng stated that the company will correct the issues mentioned in the decision on administrative supervision measures in strict accordance with relevant laws, administrative regulations and regulatory requirements.

In April last year, Yimeng shares were also subject to regulatory measures by the Shanghai Securities Regulatory Bureau. Information released by the Shanghai Securities Regulatory Bureau shows that Yimeng has arranged some personnel to carry out marketing activities in different places and entrusted a third party to conduct on-site management of relevant personnel. The company has deficiencies in personnel management and business control.

According to public information, Yimeng was established in 2005 and was listed on the New Third Board in 2015. The company is mainly engaged in securities information software research and development, sales and system services, providing financial data analysis and securities investment consulting services to investors. Tencent is the company’s second largest shareholder, holding 19.12%.

In the first half of 2024, Yimeng achieved operating income of 212.7547 million yuan, a decrease of 40.75% from the same period last year; the net profit after deducting non-recurring gains and losses attributable to shareholders of the listed company was-16.0582 million yuan, a decrease of 133.12% from the same period last year. (Blue Whale News Wang Wanying wangwanying@lanjinger.com)