Is Ripple creating value or creating faith?

Author: YetaS

Yesterday, the president sent $XRP flying with one sentence, surpassing $ETH and becoming second in the FDV in a short period of time. Although it has long been famous, few people know what it does. Is Ripple a huge scam? If not, then why do we hardly see its real users on a daily basis? What is the scale of Ripple’s business and is it enough to support its current value? If not, what does it rely on?

This article will take you to unravel Ripple’s business logic and face its challenges and controversies, from its cross-border payment innovation to its core XRP bridge role, helping us deeply understand how to turn populism into a game of capital and technology in this industry.

What kind of business is Ripple?

Ripple is in the business of cross-border payments. The traditional cross-border payment process is divided into information flow and capital flow. At the information flow level, SWIFT unifies the standards of various remittance receiving countries; at the capital flow level, clearing and settlement are completed by the originating bank and the receiving bank. If there is no direct relationship between the two, funds need to be transferred through the corresponding bank or the central bank., most fund transfers need to go through multiple intermediate banks. Therefore, there will be: 1. Problems such as long time consuming, 2. high cost, and 3. low transparency.

Crypto is very suitable to solve the transfer and settlement of funds.

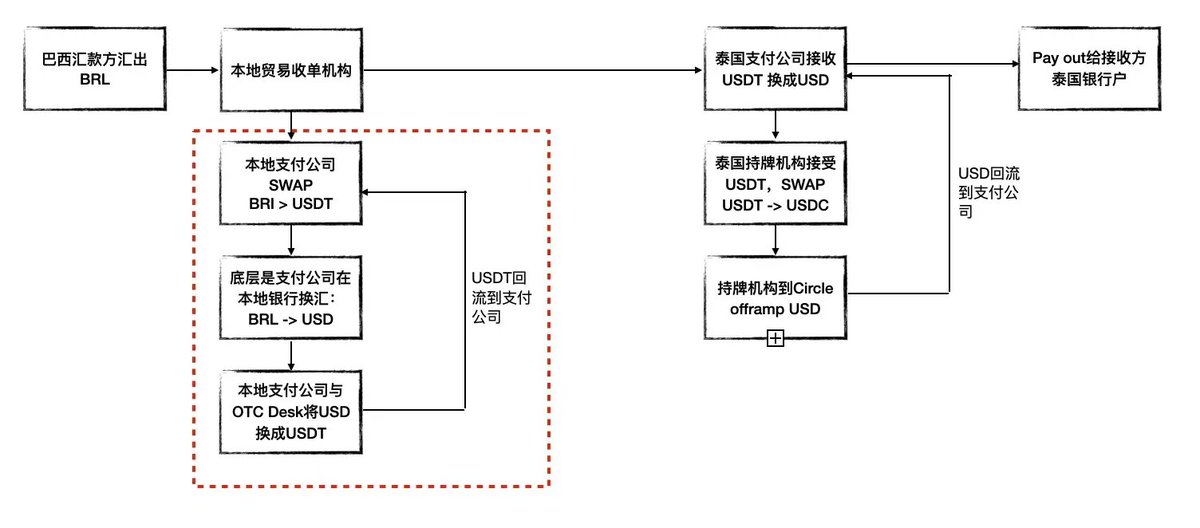

Let’s first talk about the solution under stablecoins: local OTC/payment companies receive foreign exchange and exchange them into USD at the bank. USD needs to be exchanged for USDT by an OTC such as Cumberland, and then the USDT completes the transfer on the chain. At the receiving end, the OTC conversion from USDT to USD is completed again, and then the exchange is exchanged through the bank to local currency. Under this solution, the transfer and settlement of USDT becomes very simple, but the difficulty and moat lie in the entire OTC network. If you go through USDC, this process will be more convenient, because you can complete deposits and withdrawals directly with Circle at the compliance venue.

The following figure is a flow chart taking USDT on one end and USDC on the other end as an example. Actually,The red box in the figure below is the key to the cross-border payment of the entire stablecoin, that is, there are OTC funds that can provide USDT deposits and withdrawals at any time. The amount of funds they occupy is not small. This is the most costly link in cross-border payment. Therefore, it is also the place where Tether has the most moatThis is exactly what I mentioned in “Consensus in the Crack: Tether and the New Global Financial Order”: Tether workers have become Tether workers to help it spread the network around the world.

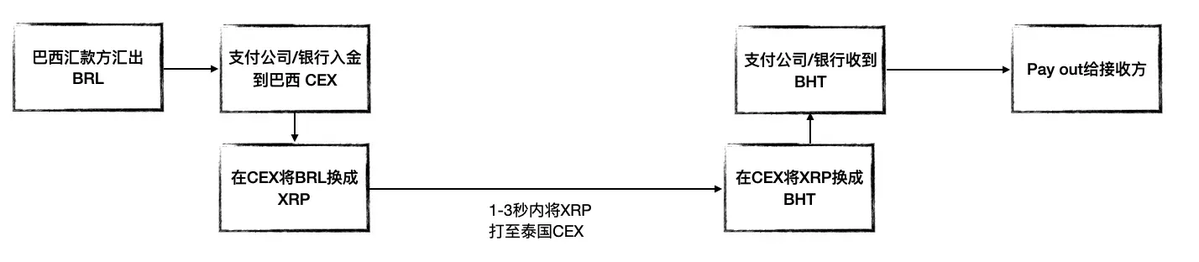

Ripple is actually a simpler solution than a stablecoin. Its process is that foreign currency is exchanged for XRP through a local bank or payment institution, the XRP is transferred to the recipient country CEX, and then the XRP is exchanged for local currency. The figure below takes Brazil to Thailand as an example, and the currency link is BRL-XRP-BHT.In other words, Ripple is recreating a foreign exchange market using XRP as a bridge currency.

Ripple actually provides a very clever and efficient cross-border payment solution. In traditional SWIFT or coin border payment scenarios,Capital appropriation has always been a pain point。Every time a foreign exchange is exchanged, the bank or OTC usually needs to inject enough funds into the account in advance to ensure the smooth completion of the entire payment process. For example, in the stablecoin plan, the bank must have enough USD to exchange, and the OTC trader needs to reserve USDT in advance. This kind of pre-funding is not only cumbersome, but also greatly reduces the efficiency of capital use. But Ripple’s advantage is that it cleverly uses CEX’s liquidity mechanism to avoid this pain point of cash earmarking. By exchanging assets directly at CEX, this is the On-Demand Liquidity it proposes.

What is the key to recreating this foreign exchange market

Ripple is not just running an ordinary business, it is more like promoting a new cross-border remittance model. From a compliance perspective, the policy environment and available trading models vary in different regions, and Ripple, with its own efforts, is trying to push this new market change alone.

There are two key elements in Ripple’s development path:

-

Bank BD: Make banks willing to use XRP as a cross-border payment solution.

-

CEX Market Depth: Ensure that XRP trading markets in various regions have sufficient liquidity to support global currency exchange.

To this end, Ripple has done nothing less.

Let’s start with the first point. Ripple didn’t directly get involved in much currency-related business before 2017. Its original goal was to replace SWIFT and rely on the advantages of the information layer to cooperate with many banks to promote the education process in the market. In this way, Ripple has gradually made major banks in various places its strategic partners. For example, in September 2016, SBI (Strategic Business Innovator) acquired a 10.5% stake in Ripple for 55 million yuan. In the same year, Ripple also received investment from SCB(Siam Commercial Bank). It was not until 2017 that Cuallix became the first financial institution to try to promote XRP as a bridge currency. With the epidemic, businesses using XRP as a bridge currency were rolled out in large numbers.

Here is also an explanation of why it is rare to find true use cases of Ripple, because Ripple’s cross-border payment solutions are not directly exposed to ordinary users or merchants. It mainly operates through bank channels, and merchants or money recipients do not need to know what channels the bank uses to remit money. In fact, as long as banks are willing to branch off a few bits of business to Ripple, it will be enough to support the entire business model.

Let me talk about the second point again. Ripple must establish a global CEX network to ensure the depth of XRP trading, 7*24 hours a day, the slip point is small enough, and deposit and withdrawal are smooth enough. At this end, Ripple has also worked hard. For example, in 2019, Ripple invested in Mexico’s first CEX Bitso and gradually expanded its market influence to Brazil and Argentina. At the same time, Coins.ph, a mainstream exchange in the Philippines, has become an authorized partner of Ripple and the Preferred CEX of its XRP payment, further enhancing Ripple’s market penetration.

Ripple is actually a highly BD driven business. A casual look at Linkedin will reveal that Ripple has a large number of BD and Marketing teams, all of which have high-end consulting and investment banking backgrounds. Ordinary people cannot support this business.

How is Ripple doing in this business?

In 2023, the volume of global cross-border payments will be approximately 190 trillion yuan. In contrast, Ripple has so far reached about 35 million cross-border transactions, with a transaction volume of about 70 billion yuan. This volume is only the size of a sesame seed in terms of the volume of global cross-border payments.

I interviewed a local OTC firm in Latin America. Their cross-border transaction volume is about US$1 to US$1.5 billion a year. This is just an ordinary OTC desk. From this point of view, Ripple’s transaction scale is comparable to the market influence of stablecin payments.

According to industry practice, cross-border payments are usually between 1% and 2%. Based on this calculation, if Ripple relies solely on cross-border payment business income to make profits, it will obviously be a drop in the bucket.

What’s more, in the early days, Ripple had to subsidize heavily in order to allow banks and payment companies to use its solutions. For example, Ripple paid a $15 million subsidy to MoneyGram, once the world’s second largest money transfer company, in one quarter of 2020, to encourage them to use the Ripple network.

What is Ripple’s next step? Expand custody and stablecoins

Unlike Tether, which directly relies on the global liquidity of the US dollar to promote the expansion of US dollar hegemony, Ripple’s ecosystem relies entirely on self-built networks and wooing alliances to maintain it. The bottleneck of this payment business is obvious. Therefore, Ripple also needs to think about how to break through this bottleneck. Based on its own customer advantages on the enterprise side, Ripple has chosen three business lines to expand Payment, Custody, and Stablecoin.

In May 2023, Ripple acquired Swiss custodian Metaco for US$250 million.

In June 2024, Ripple acquired Standard Custody. Standard has nearly 40 currency payment related licenses in the United States, the Major Payment Institution License (MPI) of the Monetary Authority of Singapore (MAS) and the VASP (Virtual Asset Service Provider) registration of the Central Bank of Ireland. Its CEO Jack McDonald serves as the senior vice president of Ripple’s stablecoins, which actually paves the way for Ripple to issue stablecoins.

In December 2024, Ripple officially issued RLUSD stablecoins and obtained approval from the New York Department of Financial Services (NYDFS).

At this point, Ripple can completely treat it as a normal Fintech company, and its three business chains are clearly disassembled.

How Crypto helped Ripple

If we don’t make much money from the business itself, what does Ripple make money? The answer is simple:selling money。

Ripple’s protracted lawsuit with the SEC began over the sale of coins. The SEC accuses Ripple of selling more than $1.3 billion in XRP to 1278 institutions to raise funds for the company. The SEC considers XRP to be unregistered securities, a violation of federal securities laws and requires Ripple to pay fines of up to $2 billion. Finally, in August 2023, the court ruled that Ripple would only have to pay about $125 million, but the judge also mentioned that its On-Demand Liquidity service might cross the line.

Why can Ripple sell coins in such large quantities?

We mentioned earlier that On-Demand Liquidity(ODL) is the core of Ripple’s cross-border payment solution. As long as the liquidity of XRP is ensured and no party needs pre-funding, it can be realized through XRP during exchange. Based on this, ODL provides Ripple with liquidity support for continuous realization. After all, the largest holder of XRP is Ripple itself. Moreover, as a bridge currency for cross-border payments, XRP should obviously not be defined as a security but a currency.

On-Demand Liquidity is actually a very wonderful stone to three birds in Ripple’s business.

Ripple closely binds business needs to the circulation of XRP. The liquidity of XRP in business scenarios not only provides a foundation for Ripple’s narrative, but also makes its operations in the capital market more convenient.

A high-end financial populist experiment

Ripple’s business model has actually gradually shifted from products to capital operations, gradually evolving into a market consensus-driven profit method. This is why we laugh and call Ripple a blue-chip meme, only following favorable policy fluctuations.

In my opinion, Ripple’s business logic is a brilliant experiment in financial populism. It attracts the participation of mainstream financial institutions by packaging cross-border payment pain points, while taking advantage of Crypto retail’s cognitive bias to amplify the strategic significance of its business. This has also allowed Ripple’s business operations to deviate from the simple business-driven profit path of traditional Fintech companies and enter a high-risk and high-yield field that relies more on market narrative and capital logic.

We have no way of knowing what the project party’s original intention is to use capital operation to obtain initial capital to promote industrial progress, or to borrow products with certain value to play the game of capital arbitrage. But what is undeniable is Ripple’s exquisite control of financial populism.

In financial markets, value creation and value perception are often not completely equivalent. Especially in a highly speculative environment such as Crypto, market consensus itself can constitute a business model, and Ripple is a typical example of this model. case. It does not rely entirely on product growth to drive revenue like traditional Fintech, nor does it rely entirely on liquidity bubbles like pure Crypto speculative projects. Instead, it cleverly shuttles between compliant financial systems, using institutional endorsements to shape credibility., while leveraging policy and market sentiment to amplify its narrative.

Is Ripple creating value or creating faith? The core of high-end financial populism often lies in this ambiguous boundary.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern