Even if it has achieved certain results, ANTA’s pace in the North American market is still cautious and slow.

ANTA, which helps Amafen realize its global dream, is still acclimatized to the conditions of North America.

author| A slightly larger reference to Fu Rao

One year after its listing, Amafen hit a record high in revenue and gave back to Anta with a beautiful financial report.

Since the acquisition of Amarfen in 2019, ANTA has spared no effort to deliver funds, talents and resources to Amarfen. In particular, Armafen’s brand Archaeopteryx, under the leadership of Anta, has not only continued to grow in its home base in America and Europe, but also made crazy gold in the China market.

With the help of Anta, the globalization of Amalfen is progressing smoothly. Unfortunately, Anta’s own global dream seems to be far away.

01 New cash cow?

In the year when Archaeopteryx took the lead in running wild, its parent company Amer Sports seemed to have delivered a financial report without shortcomings: turning losses into profits, achieving full-region growth and full-brand growth.

On February 25, U.S. local time, Amalfin released its fourth quarter and full-year 2024 financial results.

In terms of revenue and revenue, Amafen’s revenue in 2024 will increase by 18% year-on-year to US$5.183 billion (approximately RMB 37.6 billion). In terms of operating profit, Amafen turned a profit from the second half of last year, and its full-year profit increased by 56% to US$471 million.

With beautiful market performance, Amalfen not only has the ability to self-produce, but is even becoming another cash cow of ANTA. You know, the Fila brand, known as Anta’s cash cow, had revenue of 25.103 billion yuan during its peak period (fiscal year 2023). In contrast, Amafen has clearly become another powerful growth engine in the Anta ecosystem.

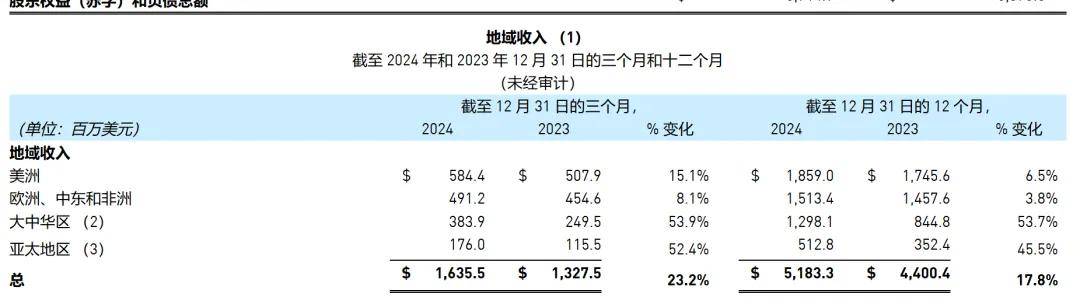

In terms of market performance, Amafen Sports has achieved growth globally.

For example, in North America and EMEA (Europe, Middle East and Africa), Amafen’s annual revenue was US$1.859 billion and US$1.513 billion respectively, an increase of 6.5% and 3.8% respectively. Although such growth results are not impressive, in new markets, Amafen has shown strong growth momentum. In Greater China and Asia Pacific, Amafen’s annual revenue reached US$1.298 billion and US$513 million, a year-on-year increase of 53.7% and 45.5%.

In terms of brand segments, the revenue of Archaeopteryx’s single brand will hit a record high in 2024, reaching US$2 billion; Salomon’s sales of sports shoes alone exceed US$1 billion; Weiersheng won the championship in Zheng Qinwen’s Olympic Games last year. After it broke the circle even more strongly. Especially on China’s social media, the topics #Wilson Tennis Wear and #Wilson Tennis Skirt have been viewed more than 7 million times.

While promoting several outdoor brands to continue to break the circle of social media, Amafen is also working hard on offline marketing.

As clothing brands have become the mainstream trend of closing stores, in the past year, Amafen’s brands have been expanding on a large scale. The number of self-owned stores in the outdoor functional apparel department with Archaeopteryx as the core has reached 223, a year-on-year increase of 19%; There are 229 stores in the mountain outdoor apparel and equipment department with Salomon as the core, a significant increase of 82% year-on-year; there are 53 stores in the ball and racket equipment department with Weisheng as the core, a year-on-year increase of 342%. Among them, Archaeopteryx has a net increase of 33 stores a year, the largest store growth in its brand history.

However, even so, Amalfen is currently unable to give Anta blood transfusion.

As of the end of 2024, although the total non-current liabilities of Amafen decreased by 1.144 billion yuan compared with the end of the previous quarter, and the overall asset-liability ratio dropped to 40.64%, net debt still amounted to US$591 million, and there were US$219 million in interest expenses throughout the year. Profit margins are still squeezed. 02 Make up for market shortcomings?

For Amafen, the China market, the fastest-growing market, was once a vacant piece of its globalization puzzle. Data shows that Amafen, which maintained rapid growth globally in 2010, accounted for only 1% of sales in the China market. By 2018, this figure had only increased to 6%.

Amafen’s success in the China market today is inseparable from the help of ANTA, including its 20 years of deep experience in the China market. Last year, with the comprehensive assistance of ANTA, Amalfen embarked on a larger capital market, raising US$1.571 billion, gathering a considerable amount of funds for the global development of its brand (especially in the China market).

In the past year, Yamafen, which has ANTA genes, has not only paid more and more attention to the development of its brand in the China market, but its brand strategy has also become increasingly closer to ANTA, especially the fastest-growing brand Archaeopteryx.

For example, in the opening strategy of large stores.

In 2024, Archaeopteryx will open 33 new stores, including 6 new stores in China, occupying a favorable geographical location, covering a large area, focusing on service quality and other characteristics, which are exactly the same as ANTA’s high-end super ANTA flagship store.

Among them, in May last year, Archaeopteryx built the global flagship store Archaeopteryx Museum on Nanjing West Road, Shanghai. This purported world’s largest original flagship store covers an area of 2400 square meters and adopts a one-on-one shopping guide system.

Zheng Jie, CEO of Amafen, attaches great importance to and is proud of this store, saying that the flagship store represents the highest level of retail format of the Archaeopteryx brand. At the same time, he remains extremely optimistic about the store, believing that the store’s turnover in its first year will exceed US$20 million (approximately RMB 144 million).

This store opening strategy has indeed helped Archaeopteryx once again consolidate its luxury brand power in the China market.

At the beginning of 2024, Archaeopteryx launched a limited version of the Year of the Snake with an official price of 8200 yuan. The price of this jacket in the secondary market once soared to 20,000 yuan. Even in reports some time ago, even Archaeopteryx tags have become popular in the secondary market. The purchase price of a tag is between 5 yuan and 30 yuan, and the selling price of some limited tags is priced at 300 yuan each.

At the same time, some netizens found that some clothes logos of the Archaeopteryx brand no longer stand out, jokingly calling its low-key style, like clothes specially designed for people within the system.

In the China market, the brand Amalfin is not just Archaeopteryx.

For example, the stores of the mountain outdoor cross-country brand Salomon have gradually expanded in the China market and achieved certain results. Andrew Page, chief financial officer of Amarfin, disclosed in an earnings call that the efficiency of Salomon’s standard stores in China is about four times the industry average. The model will be promoted outside China and new stores will be opened in the Asia-Pacific region, Europe, the Middle East and Africa.

Tennis equipment brand Wilson has also attracted much attention as Zheng Qinwen brought popularity to the sport of tennis. At the same time, the Amafen official revealed that it plans to gradually pour more resources into the China market to help Wilson develop in China.

In addition, Amafen’s emphasis on the China market is also reflected in its series of personnel changes. Amafen management executives recruited star management teams from brands such as Nike, Vans, and lululemon to be responsible for the development of Archaeopteryx’s high-end business line Veilance. At the performance exchange meeting, Amafen management also emphasized this point.

In the past, it can be said that amarfen was only popular in markets such as North America and Europe. Although Amafen’s revenue share in the China market is currently only half of that of the North American market, the gap is narrowing as revenue growth in the China market exceeds 50%.

What is certain is that for Amafen, which is increasingly diverting resources to China and the Asia-Pacific, global business is on the right track.

03 Where has Anta’s globalization gone?

When Anta acquired Amafen, one of its core visions was to place its hopes on relying on Amafen to achieve globalization.

In 2021, ANTA will propose a strategy of single-focus, multi-brand, and globalization, and hopes to use Amafen’s global reputation to help the main brand ANTA become international, enhance its international influence, and achieve complementary advantages.

Now, four years have passed, Amafen has indeed relied on Anta to make up for its performance gap in the China market and take the lead in realizing its vision of globalization. So, where is Anta’s global dream? Has Amafen helped ANTA open up its international influence?

According to previous public reports, in the process of globalization, ANTA implements the strategy of mass positioning, professional breakthroughs, and brand advancement, and focuses the core of globalization on four regional markets: Southeast Asia, Middle East, Europe, and North America.

In these four regional markets, ANTA has adopted two different strategies.

Starting from 2022, ANTA has successively established Southeast Asia branches, Thai subsidiaries and Middle East joint ventures in Southeast Asia and the Middle East, and has opened new single-product stores directly in the core business districts in these two regions to carry out direct retail business. The reason is that these two markets are closer to the China market in terms of geographical location, cultural background and consumption level.

As of the end of 2023, ANTA has approximately 200 stores in countries such as the Philippines, Malaysia and Vietnam. In 2024, Anta’s Disant brand also opened its first store in the Malaysian market.

Photo source: Anta official Weibo

Compared with Southeast Asia and the Middle East, which had early layout, Anta only entered the North American market last year.

The North American market is Amafen’s main battlefield. At the beginning of last year, Amalfen was successfully launched with the help of ANTA. Although Anta says that it can use Aramafen’s international influence to speed up its journey to sea, from the perspective of actions, Anta is still remaking the North American market in its own way.

On the one hand, compared with Amafen’s earlier layout in North America, higher-end brand positioning, and more niche outdoor tracks, Anta wants to do a mass sports brand with high-end price positioning and professional sports fields.

On the other hand, North America is one of the most important markets for sporting goods companies around the world. Even Amafen, which has been deeply involved in the North American market for many years, has slowed down to around 5%. For new players like Anta, Amalfen’s help is indeed limited, and he can only rely on his own.

In the North American market, the sports shoes and apparel field has long been influenced by international brands such as Nike and Adi for many years. Consumers with stronger purchasing power have long had their own brand preferences. Especially in the field of sports brands, its functionality, trend attributes and even brand stories will become factors that determine whether a brand is bought by consumers.

Unlike its strategy of expanding brand influence by opening stores quickly in Southeast Asia, ANTA chose to enter this new market by frequently creating IP products and entering mainstream sales channels.

In March last year, Anta, which signed a contract with well-known NBA star Owen, brought Owen’s signature series of sneakers (ANTA KAI1) to Dallas, the United States, and were sold in trendy boutique shoe stores in 13 cities around the world, including New York, San Francisco, Dubai, Singapore and Manila.

At the end of September, ANTA KAI 1 Speed was launched and was sold offline in more than 60 Foot Locker companies in North America and Europe, and DSG Footwear in the United States. It is worth noting that Foot locker, JD Sports and Dick’s Sporting Goods (DSG) are known as the three largest sporting goods retailers in Europe and the United States, covering a wide area and having a large store size. With the arrival of Anta products this time, it can also be said that Anta has been recognized in the North American market.

Even if it has achieved certain results, ANTA’s pace in the North American market is still cautious and slow. Regarding whether there is a plan to open a store in the North American market, Anta CEO Xu Yang only said that it is possible.

At present, Anta is focusing more on products and wants to borrow more products to open up its brand awareness in the United States. For example, in early November last year, Anta released the NBA Mavericks Thompson signature shoe series KT10, and co-branded shoes with Di Wincinzo are also on the agenda. However, in the process of opening the door to the North American market with its products, Anta also became acclimatized.

Just two days ago, Anta’s newly released Irving’s second-generation ANTA KAI2 sneakers generated polarized evaluations among consumers in the North American market. Many people have given negative comments on the Internet, believing that the design and color matching of this shoe are not good.

However, the sales results and evaluation of a shoe do not determine anything.

At that time, the Japanese brand Onizuka Tiger also tried multiple products to finally create a CORTEZ running shoe that is famous for its cushioning and suitable for American consumers. It was immediately able to shine in the American market and also its parent company, Arthur. The glorious chapter of the marathon shoe collection has kicked off.

At the end of last year, ANTA executive director Lai Shixian revealed that ANTA is still refining its strategic goals and team arrangements for the next five years, including different strategies in several major markets in Europe, America, Southeast Asia and the Middle East. He said that globalization has become a must-win battle for Anta.

If Anta wants to become the world’s Anta and win the North American market, it may be the most critical battle for Anta at present. nbsp;

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.