Wen| Wired Insight, author| Dou Wenxue, Editor| midnight

The big model startup Zhipu raised another 1 billion yuan from Hangzhou.

On March 3, Intelligent Intelligence AI issued an announcement stating that it had completed a new strategic financing with an amount of more than 1 billion yuan. Participating investors included Hangzhou Urban Investment Industry Fund, Shangcheng Capital, etc.

Tuyuan Zhipu Official Weixin Official Accounts

In the past half of the year, the financing pace of Zhipu has been very tight.

Its last financing occurred three months ago in December 2024, with a financing amount of 3 billion yuan.

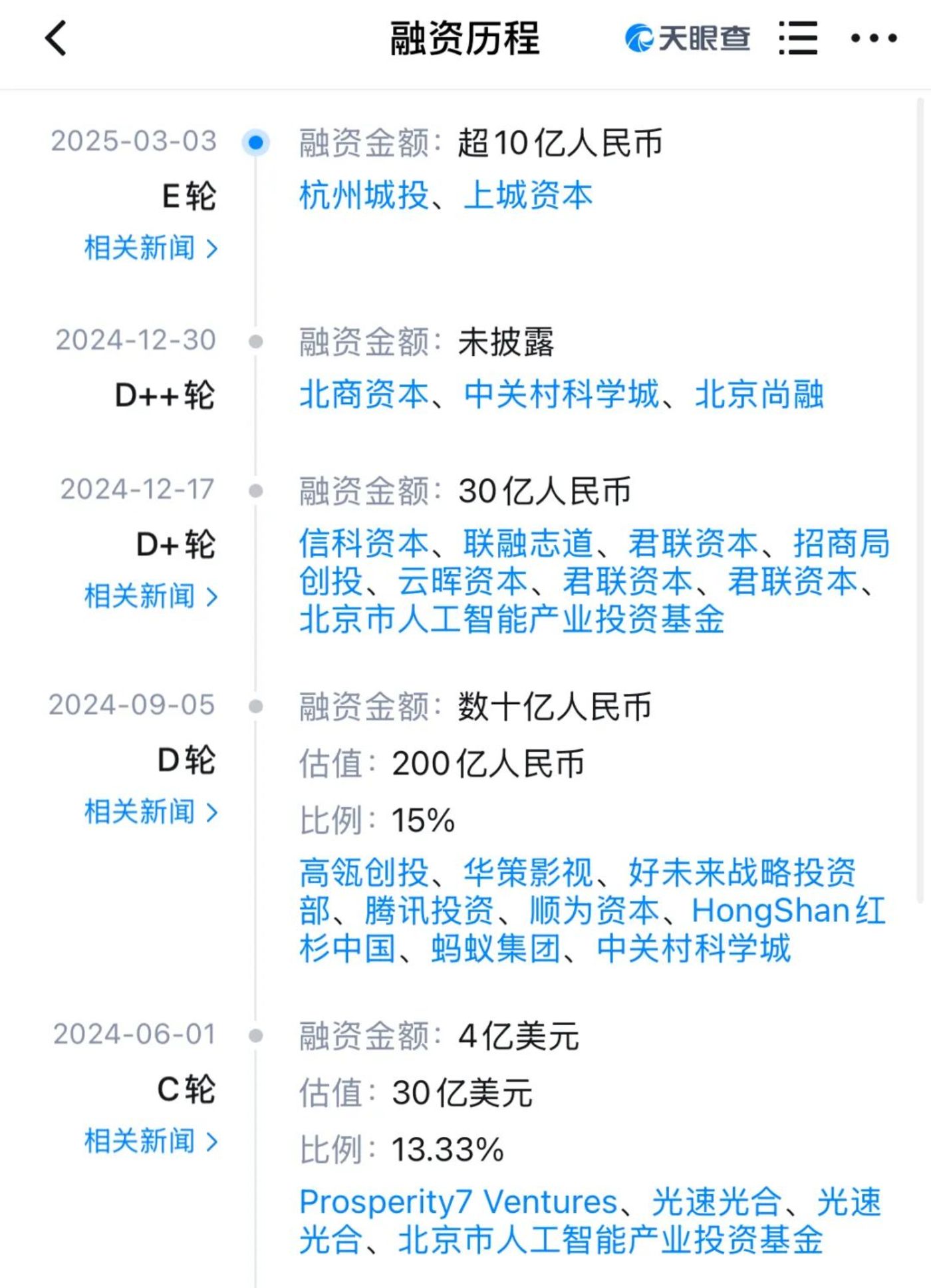

According to Tianyan information, in 2024 alone, Zhipu has completed 4 financings, of which 2 financing amounts exceeded 1 billion yuan. As of the end of 2024, the valuation of Smart Spectrum has reached 20 billion yuan.

Frequent financing may be due to the rush to go public. According to Photon Planet, from the fourth quarter of last year to the beginning of this year, Smart Spectrum has been making every effort to go public.

In the environment where Deepseek has emerged and a group of peers are accelerating, there is a lot of pressure on Smart Spectrum. It requires more capital investment and produces more convincing results.

This new model can be said to bring the capabilities of intelligence spectrum under new scrutiny.

In addition to technical achievements, commercialization is also the focus. Zhipu disclosed the company’s commercialization report card in December last year. Judging from its disclosure, Smart Spectrum’s commercial revenue, average daily Tokens consumption, and number of customers have all achieved significant year-on-year growth.

According to “Smart Emergence”, Smart Music recently won overseas orders from a certain Belt and Road country worth tens of millions of US dollars.“” At the same time, with the signing of big orders such as Samsung, its revenue has exceeded 100 million yuan in less than a month after the Smart Music Festival.

2025 is the first year of open source known as the big model. As more and more big model products are implemented, the industry’s big waves have also begun. Can Smart Spectrum break through in the open source battle and successfully rush to the market?

1. Raising another 1 billion yuan from Hangzhou. Why does Zhipu raise funds frequently?

The financing process of opening Sky Eye Chasing Zhongshu can be described as gorgeous.

This company, which was born one year before OpenAI released the GPT-3 language model, received angel round financing from China Control Technology Transfer, Zhongke Chuangxing, etc. in the year of its establishment.

In the following years, Smart Spectrum frequently raised funds and frequently iterated large models.

In 2021, Zhipu proposed its own model algorithm GLM and released the 10 billion model GLM-10B; in the same year, it trained the 10 billion model enlightenment of the MOE architecture.

This year, Zhipu, which had not received financing for a whole year, completed Series A financing and received more than 100 million yuan in investments from Changfengheng Venture Capital, Lingyunguang, Xinglian Capital, etc.

In 2022, Zhipu, which received financing, increased its investment in large models and trained the country’s first 100 billion open source model, GLM-130B. In September of this year, Smart Vision completed a Series B financing amount of 200 million yuan, with a valuation of 2.58 billion yuan.

In 2023, Smart Vision began to receive widespread attention from capital. It completed the Series B financing in multiple stages throughout the year. The strategic investors are Meituan (300 million yuan Series B+) and the Social Security Fund Zhongguancun Independent Innovation Fund (Junlian Capital Management), with investors including Ant Group, Alibaba, Tencent, Xiaomi, Sequoia, Hillhouse, etc., with a financing amount of more than 2.5 billion yuan.

Also this year, China’s big model market broke out. Big manufacturers such as Baidu, Byte, Tencent, and Huawei launched their own big model products. Smart Spectrum launched the online available China ChatGPT ChatGLM, and also open-source ChatGLM3 – 6B and multimodal model CogAgent-18B. It has not fallen behind in research and development.

In 2024, Intelligent Spectrum released a new generation of language model GLM-4 in January of that year. It is said that the overall performance of GLM-4 has been significantly improved by 60% compared with the previous generation, making it comparable to GPT-4. Subsequently, the GLM-4- 9B and GLM-4V-9B models, as well as the video generation model CogVideoX, were successively opened.

In the second half of the year, Intelligent Spectrum successively launched the base model GLM-4-Plus, the Agent model AutoGLM, and the inference model GLM-Zero.

Intelligent Spectrum’s circle of friends has further expanded, completing Series C financing of US$400 million in June 2024; and at the end of the same year, it completed Series D financing in three times, of which the amount of Series D+ financing was 3 billion yuan., and in September of that year, Intelligent Spectrum’s valuation had reached 20 billion yuan.

Since 2024, not counting the amount of financing that has not been disclosed, Smart Spectrum has attracted at least 6.9 billion yuan.

Part of the financing process of Zhipu, the source is checked by Sky Eye

Of course, Smart Spectrum can win the favor of management. The technical results released regularly are one aspect, and Smart Spectrum’s technical route against Open AI is another aspect.

The technical route of Intelligent Spectrum AI is large model + small model. Through pre-training and fine-tuning of large models, it can adapt to the needs of different scenarios and tasks. This technical route can improve the generalization ability and application scope of the model.

Intelligent Spectrum’s GLM pre-training architecture is a relatively independent R & D system that does not rely on any open source model. Its technology is autonomous and controllable, and its iteration route is clear. This framework particularly emphasizes multimodal integration and bilingual processing capabilities. Compared with OpenAI’s GPT, GLM can better meet the complex conditions of the domestic market.

In addition, Intelligent Spectrum has a complete model and product line from base models to code, multimodal, reasoning, Agents, etc., which is also rare in the country.

However, this technical route of Intelligent Spectrum also has problems such as high model complexity, large calculation amount, and long training time. This is also one of the reasons why Zhipu needs financing, and the amount of each financing is very high.

But the industry is heading towards a price war. Therefore, Smart Spectrum must reduce reasoning costs through technical means, so that prices can be reduced.

According to the official information released by Intelligent Spectrum, the call price of the GLM-3Turbo model will be adjusted from 5 yuan/million tokens to 1 yuan/million tokens starting from May 11, 2024.

In addition, the company is about to launch the GLM-3 Turbo Batch Processing API (Asynchronous Task Processing), which is suitable for scenarios that do not require real-time response, including effect evaluation, data batch processing and other tasks. The price is 1 yuan/2 million tokens.

Entering 2025, with the emergence of DeepSeek, the industry has also entered a new open source battle. Therefore, Smart Spectrum also stated that 2025 will be Smart Spectrum’s open source year.

For this war, Intelligent Spectrum Preparation requires more ammunition, so it is understandable that frequent financing is carried out.

2. In the battle for commercialization, wisdom cannot lose

For large model startups, how to commercialize their products has always been one of the important dilemmas they face.

In this case, each company chooses different commercialization routes.

Among the six domestic AI tigers, companies such as MiniMax and Dark Side of the Moon that already have C-end star products have begun to shrink their B-end layout and concentrate resources on C-end products.

On the other hand, Intelligent Spectrum and Step Stars focus on the B-end market, betting on multimodal and Agents.

In order to cope with the diverse needs of different B-end users, Smart Spectrum adopts different service models for various types of customers.

The first is the charging model for API calls, which is mainly suitable for customers who have relatively small demand for model usage and want to quickly try and integrate large model capabilities. Enterprises and developers can call the APIs of various models through Smart Spectrum’s MaaS open platform bigmodel.cn and pay fees based on usage.

The price war for the big model mentioned above also revolves around this charging model. With the improvement of the capabilities of the Smart Spectrum model and the reduction of the price, Smart Spectrum’s API services have now attracted many users.

According to data disclosed by Intelligent Spectrum, in 2024, the company’s annual API revenue will increase by more than 30 times year-on-year, and the average daily Tokens consumption will increase by 150 times. The MaaS platform already has more than 700,000 enterprise and developer users.

Secondly, there are two privatization models: cloud privatization and local privatization, which are aimed at enterprises with requirements for data security and privacy.

Among them, cloud privatization is aimed at enterprises with certain requirements for data security and privacy. Smart Spectrum provides a model zone based on cloud computing power, so that customers ‘data when calling models can be relatively isolated from other customers.

For central state-owned enterprises and other industries with higher requirements for confidentiality, Smart Spectrum provides a local privatization model, which means deploying large models within the enterprise and developing applications through the enterprise’s own computing power and technology platform.

It is reported that Zhipu has established cooperative relationships with companies in many industries such as smart cars, manufacturing, mass consumption, finance, government services, medical and health, games and entertainment, and cultural tourism on the B-side.

For example, it provides AI technical support for smart cabins of car companies such as Xiaopeng; cooperates with banks and financial institutions such as Postal Savings Bank and China Merchants Bank to use them for business scenarios such as intelligent customer service and risk assessment.

In 2024, Zhipu frequently won the bid. According to statistics from smart hyperparameters, 32 smart spectrum models will be won in 2024, with a disclosure amount of approximately 130 million yuan, second only to iFlytek and Baidu.

In addition, Smart Spectrum is still deploying overseas markets. Previously, it established cooperation with Samsung. In October 2024, the Agent product AutoGLM jointly released by the two parties can realize AI real-time voice and video calls, as well as visual understanding and intelligent system function calls.

According to Intelligent Emergence, Intelligent Spectrum has also recently won overseas orders from a certain Belt and Road country, worth tens of millions of US dollars.

The report also said that with the signing of big orders such as Samsung, its revenue has exceeded 100 million yuan in less than a month after the Smart Music Festival.

Although its main focus is on the B-end, Smart Spectrum has not given up its layout in the C-end market.

Zhipu Qingyan APP, the main carrier in its C-end market, is expected to have annual revenue of more than 10 million yuan and more than 25 million users since the payment function was launched in the third quarter of 2024.

According to Intelligent Spectrum, the company’s commercial revenue growth in 2024 will exceed 100%.

But even so, intelligence is not completely dominant.

The current big model industry is being chased by DeepSeek, a catfish, and is caught in the whirlpool of price wars. Although Smart Spectrum has been benchmarking OpenAI, there is still a certain gap between its products and OpenAI. Customers will only pay for the effect. Intelligence cannot only rely on low prices, but also rely on strength.

At the same time, although the multimodal and Agent paths it has chosen have a lot of room for development, and there are no players in the industry who have fully mastered these technologies, this also means that Smart Spectrum will have to invest more costs in research and development in the future. Cost control will become its eternal proposition.

3. The battle between talent and speed is under great pressure on intelligence

In the fast-growing field of artificial intelligence, companies are also striving for talent absorption capabilities while striving for technology iteration speed.

In terms of technical iteration speed, the average iteration speed of the intelligent spectrum base large model once every 3-4 months is not slow, but the technical strength after completing the iteration still needs to be improved.

Intelligent Spectrum has always claimed that its benchmark is OpenAI. For example, its new generation language model GLM-4 released in January 2024 is benchmark GPT-4, but its capabilities can only reach about 90% of GPT-4.

Over the past year, many domestic manufacturers have also been monitoring the speed of technology iteration.

For example, in the first three quarters of 2023, Baidu Wenxin Model will be able to achieve an average of 45 days. In the fourth quarter, its update cycle has been shortened to 22 days.

In addition to application updates, companies such as Baidu, Byte, and Ali are also trying to accelerate the penetration of large models into various application scenarios such as language generation, knowledge question and answer, image generation, and video generation.

In terms of the layout of multiple scenes, although the speed of intelligence is not slow, it is not outstanding either.

Take the release of large video models as an example. In May last year, cut and screen launched the AI creation platform, Dream; in February last year, Ali launched the audio and video diffusion model EMO.

Intelligent Spectrum released its AI video product Qingying in July last year.

Therefore, in this battle for speed in technology research and development, wisdom still cannot relax.

Talent is an important resource that large model manufacturers are scrambling for. Many large model startups have frequently reported news of personnel changes recently.

In January this year, a wave of personnel changes was also exposed to Zhipu.

According to Venture Capital Daily, Wang Yueting, former vice president of Midjourney Asia, joined Smart Spectrum, mainly responsible for multimodal products and markets; Zhang Kuo, chief strategy officer of Smart Spectrum, and Qu Teng, vice president, recently left.

In such a situation, Zhipu has to endure the pain of brain drain and spare no effort to recruit people.At the end of last year, Zhipu recruited Hu Yunhua, a former researcher at Microsoft Research Asia, a senior technical expert at Aridamo, and chief data officer of Alipay China, and made him the person in charge of Zhipu Qingyan.

In addition, in January this year, Intelligent Spectrum was also included in the U.S. entity list, becoming the first domestic large model enterprise to be included in the entity list.

Although this means to some extent that the technical level of Smart Spectrum has been recognized, it also hinders the expansion of Smart Spectrum in the U.S. market.

2025 is not only a critical year for the commercialization of large models, but also a critical year for the industry to reshuffle. The wisdom of obtaining financing at the beginning of the year cannot be relaxed. It must withstand pressure, control costs, and improve the speed and quality of technology iteration., seek growth in the industry’s price war.