The Bitcoin Reserve Act is still in the exploratory stage at the state level.

Written by KarenZ, Foresight News

On the evening of March 2, Trump elaborated on his ambitious vision: “Ensure that the United States becomes the world’s cryptocurrency capital.” We are making America great again and advancing our crypto strategic reserves including BTC, ETH, XRP, SOL and ADA.” This move not only signals firm support for cryptocurrencies at the federal level, but may also ignite legislative enthusiasm among U.S. states in the field of digital asset reserves.

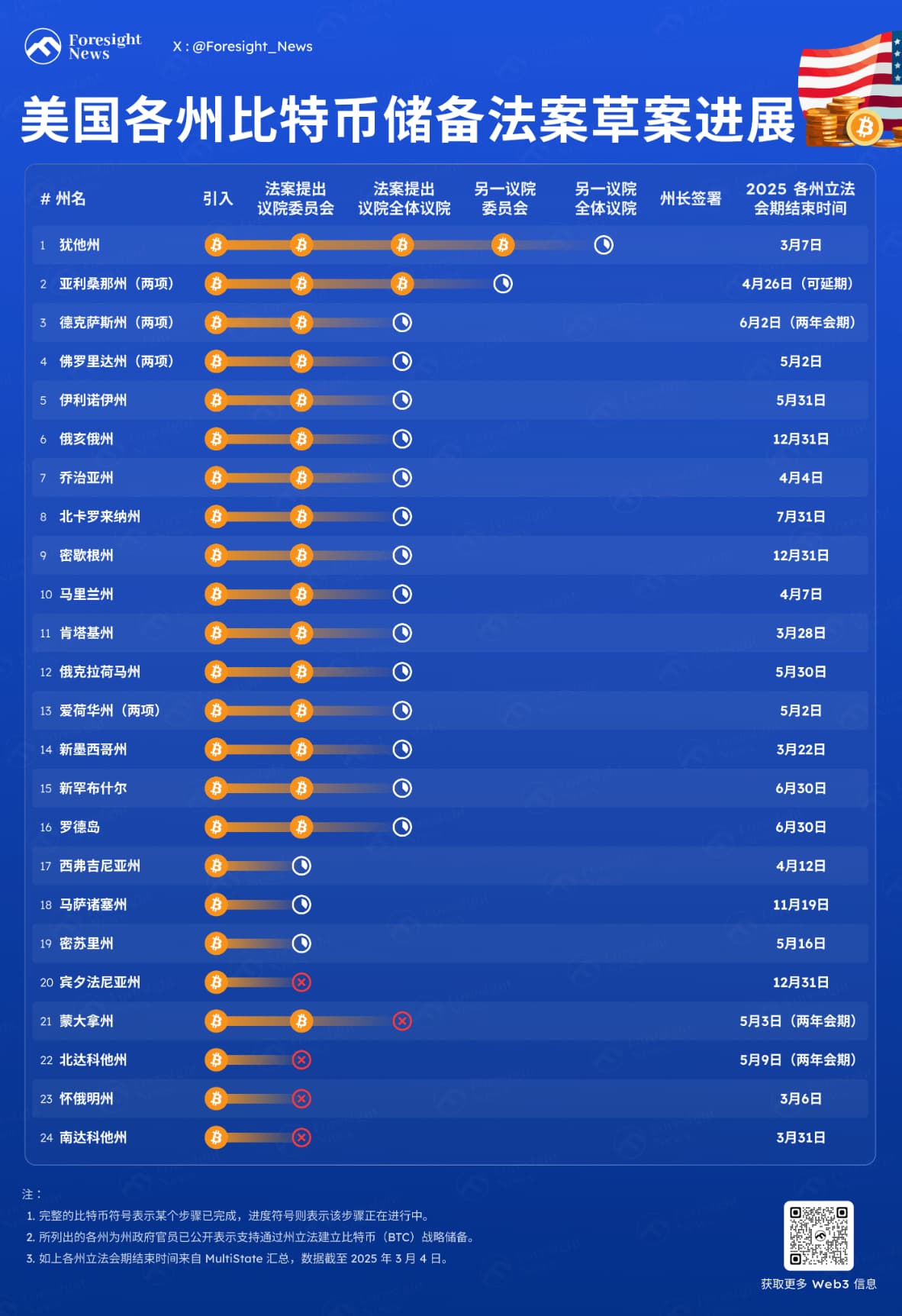

Faced with the reality that inflation erodes the purchasing power of traditional assets, although state governments cannot directly intervene in monetary policy, they can explore the possibility of incorporating Bitcoin and other cryptocurrencies into public finances through legislation. As of March 4, 2025, 24 states have proposed draft crypto reserve bills in an attempt to implement Trump’s grand blueprint to the local level. These efforts are both a response to national strategies and a reflection of states ‘proactive actions in fiscal innovation and economic resilience.

This article will review the U.S. state legislative process and detail the content and progress of bitcoin reserve proposals in 24 states.

U.S. state legislative periods and processes

The Legislative Session of each state in the United States refers to the period of time during which state legislatures (including the House and Senate) formally meet to discuss and pass bills during the year. Due to different state constitutions and practices, the schedule and length vary significantly.

Most states hold regular legislative sessions every year, usually in the spring (such as January to May). The duration of the sessions ranges from a few months to half a year, and the specific time is determined by each state. A few states (such as Montana, Nevada, North Dakota and Texas) meet every two years (in odd-numbered years) and have a slower pace of legislation.

The legislative process of each state in the United States usually has some nuanced differences from state to state, but most states follow a similar basic framework. Each state has its own constitution and legislative body, and a bicameral legislative body usually composed of the state House and the state Senate is responsible for making laws. The following is a typical state-level draft process into law, taking most bicameral states as an example:

1. Proposal: A congressman or state senator submits a draft bill. After submission, the bill will be assigned a number,”HB” for a House bill and “SB” for a Senate bill.

2. Committee review: After the bill is submitted in writing, it is assigned to relevant committees for review. The committee may hold public hearings and invite experts, stakeholders and the public to express their opinions. Committee members discuss and amend the bill and vote on whether to refer it to the full house for review.

3. Initiate deliberation in the House: second reading (members debate and propose amendments) and third reading (final voting).

4. Deliberation by the other house: The bill goes through similar committee review and house review in another member (such as the House of Representatives submitting it to the Senate, or vice versa).

5. If the versions of the two houses are inconsistent, coordination is needed.

5. Governor’s approval: Sign, veto or take no action.

6. Entry into force: The bill usually takes effect immediately after being signed, or on a specific date specified in the bill. Some states stipulate that failure to sign within a certain period of time will automatically take effect or expire.

Draft bill related to bitcoin reserves in U.S. states

So far, a total of 24 states in the United States have submitted draft bills related to Bitcoin reserves, of which some states including Arizona, Texas, and Florida have submitted two related bills.

Progress of proposal reviewOn the one hand, most states ‘bills are still in the draft or presentation stage of deliberation in the House, a few states are making rapid progress (such as Utah), while relevant bills in five states (Pennsylvania, Montana, North Dakota, Wyoming, and South Dakota) have been rejected. The reasons for the veto were concerns about the risks and volatility associated with digital assets, concerns about taxpayer funds, the high energy consumption of cryptocurrency mining, and the possibility that digital currency could be used for illegal activities. It’s worth emphasizing that cryptocurrency-friendly Senator Cynthia Lummis belongs to Wyoming. Cynthia Lummis introduced a bill in 2024 to allow states to voluntarily store bitcoins in reserves, and also created a “Bitcoin Purchase Program” to purchase no more than 200,000 bitcoins per year for five years, for a total of 1 million bitcoins.

In Utah, the fastest-moving state, a draft bill involving investing some public funds in Bitcoin has been reviewed by the House plenary session and Senate committees. It still needs to complete the second, third readings, voting and signature by the governor in the Senate. Since the Utah Legislative Session is fixed for 45 calendar days, if the bill is passed by the Senate and signed by the governor before March 7, 2025, it will take effect on May 7; otherwise, the bill will expire due to the end of the session.

ininvestment scopeOn the other hand, most state bills focus on bitcoin and stablecoins, or ensure that only bitcoin qualifies by setting a market cap threshold (typically $500 billion or $750 billion). Even if some bills allow other currencies to be included in reserves, they are mostly limited to being obtained through donations. A few states have expanded their investment to a wider range of digital assets, such as NFT and other cryptocurrencies.

investment ratioOn the one hand, most states have set clear caps: most limit them to 10% of public or prescribed funds (such as Arizona, Florida, Michigan), and a few states limit them to 5%(such as Utah, New Mexico). Wyoming had proposed a 3% limit, but the relevant bill was rejected.

forasset safetyMost states require holding Bitcoin through a secure escrow solution, qualified custodian, or exchange-traded product (ETP), such as Georgia, New Mexico, Oklahoma, etc. In addition, some states (such as Arizona, Michigan, and Rhode Island) allow lending of Bitcoin or digital assets to obtain additional benefits without increasing financial risk, reflecting a certain degree of innovative attempts. Most states have also established strict security measures and standards for Bitcoin escrow solutions, ensuring multi-party governance, encrypted private key storage, and disaster recovery protocols.

Utah

Utah Congressman Blockchain and Digital Innovation Amendment HB0230 was introduced on January 28, 2025, authorizing the state Treasury Secretary to invest some public funds in eligible digital assets (digital assets with an average market value of more than US$500 billion in the past 12 months, currently only Bitcoin meets this criterion) or stablecoins, with an investment cap of 5% of designated accounts. Under certain conditions, the draft supports the pledge and lending of these digital assets. HB0230 also stipulates that state or local governments must not prohibit accepting digital asset payments or using self-managed/hardware wallets to hold assets, and that money transfer licenses are not required to run nodes, develop software, transfer assets, and participate in pledges (if legal tender is not involved). If HB0230 is passed, the effective date will be May 7, 2025.

Progress: HB0230 has passed the review of relevant House committees, the full House of Representatives, and relevant Senate committees. Currently, the second and third readings of the Senate need to be completed, voted on and signed by the governor.

Arizona

Arizona currently has two draft strategic bitcoin reserves, SB1025 and SB1373, both proposed by Senate members.

Among them, SB1025 authorizes public funds to invest no more than 10% of public funds under their control (state treasuries and retirement systems) in virtual currencies. In addition, if the U.S. Treasury Secretary establishes a strategic Bitcoin reserve to store government Bitcoin holdings, public funds can store the virtual currency they hold in a secure isolated account within the strategic Bitcoin reserve.

Draft SB1373 proposes the establishment of a digital asset strategic reserve fund, which will consist of legislative appropriations and digital assets seized by the state. State fiscal officials should deposit confiscated digital assets into the fund through a secure custody solution provided by a qualified custodian or in the form of exchange-traded products issued by an investment company registered in the state. State finance officials are not allowed to invest more than 10% of the fund’s total deposits in any fiscal year. If the loan does not increase any financial risk to the state, digital assets can be lent from the fund to generate additional returns. The digital assets specified in the draft include Bitcoin, stablecoins, NFT, virtual currencies, etc.

Progress: Both drafts have passed the third reading of the Senate and have been submitted to the House of Representatives for consideration.

Texas

Texas currently has two strategic bitcoin reserve drafts, SB21 and SB778, both proposed by Senator Charles Schwertner. Although the two drafts have similar goals, they differ significantly in detail, scope and execution methods.

Among them, the purpose of SB21 is to emphasize enhancing state fiscal resilience and hedging against inflation by investing in cryptocurrencies, supplemented by accepting donations, involving the establishment and management of the Texas Strategic Bitcoin Reserve Fund for investing in cryptocurrencies, and the granting of public accounts auditor general (in the state, state chief financial officer) investment rights in the reserve fund and certain other state funds. The scope is not limited to Bitcoin, but also includes other cryptocurrencies (such as assets acquired through “forking” or “airdrops”). However, there is also a rule. Bitcoin and other cryptocurrencies that use reserve funds to purchase or receive donations must have an average market value of at least US$500 billion in the past 12 months.

Draft SB778 focuses more on Bitcoin, proposing to establish a strategic Bitcoin reserve for the purposes of: the state owns and holds Bitcoin as a financial asset, and individuals, including state residents, donate Bitcoin to the state and deposit it in the reserve to promote the state’s financial future. Co-ownership and community investment. The draft does not involve active investment in other assets.

Progress: SB21 is currently being voted on by the relevant Senate committee. SB778 has entered the review stage of the State Finance Board. Both drafts finally state that if the draft is approved by two-thirds of all elected members of each house, it will take effect immediately. If this draft does not receive the votes required for immediate entry into force, this draft will enter into force on September 1, 2025.

Florida

Florida currently has two bitcoin reserve bills (House Draft 487 and Senate Draft 550) entering committee consideration. Both drafts, introduced in February 2025, provide for state chief financial officers to maintain flexibility in certain investment decisions and authorize investments in Bitcoin and other digital assets from certain public funds to hedge against inflation risks. The investment limit is no more than 10% of the total funds in any account.

Proposal progress or voting result: Committee review stage.

Illinois

Illinois Strategic Bitcoin Reserve Draft HB1844 authorizes the establishment of a “Strategic Bitcoin Reserve Fund” as a special fund in state finances, designed to hold Bitcoin as a financial asset, and stipulates that state finance officials can accept Bitcoin gifts, grants, and donations from Illinois residents and government entities in the fund. State finance officials should hold all bitcoins deposited into the fund for at least 5 years, after which time they can transfer, sell, allocate funds, or convert any bitcoins in the fund to another cryptocurrency.

Progress: HB1844 has been submitted to the House Rules Committee for consideration.

Ohio

Ohio currently has two bitcoin or cryptocurrency reserve drafts in the House HB18 and Senate SB57. Among them, draft HB18, called the Ohio Strategic Cryptocurrency Reserve Act, allows state finance ministers to invest certain temporary funds (from the general income fund, the budget stabilization fund, and the Deferred Prizes Trust Fund, a trust fund established specifically to defer payment of lottery prizes) in digital assets, with an investment cap of no more than 10% of the fund’s balance. Although judging from the name and regulations of the HB18 draft, the digital assets covered may be wider, the draft also stipulates that digital assets eligible for investment need to have an average market value of more than US$750 billion in the past 12 months. This means that only Bitcoin meets this rule.

Draft SB57, called the Ohio Bitcoin Reserve Act, authorizes state funds to invest in Bitcoin and requires government entities to accept cryptocurrency payments. State finance ministers can invest in Bitcoin using temporary state funds and designated donations, and must hold Bitcoin for at least five years after purchase before any transfers, sales or conversions can be made.

Progress: HB18 was submitted to the House Technology and Innovation Committee on January 28. SB57 was submitted to the Senate Financial Institutions, Insurance and Technology Committee on January 29.

Georgia

Georgia submitted its first Bitcoin Reserve Senate Draft SB178 on February 13, which aims to amend the draft of Title 50, Chapter 17, Section 3 of the Georgia Code of Notes, authorizing the State Deposits Committee to allow state fiscal officials to invest in Bitcoin, stipulating that state fiscal officials invest no more than 5% of public funds in Bitcoin. In addition, the proposal stipulates that any digital assets acquired under this chapter should be held in the following manner:

1. Directly by using secure hosting solutions;

2. Held by a qualified custodian on behalf of the state;

3. Hold it in the form of exchange-traded products issued by registered investment companies.

In addition, the committee could allow state finance ministers to lend digital assets, provided that such borrowing does not increase the state’s financial risk.

On February 21, Georgia proposed its second Bitcoin Reserve Draft SB228, which aims to amend the draft of Title 50, Chapter 17, Section 3 of the Georgia Code of Notes, authorizing the State Deposits Committee to allow state fiscal officials to invest in Bitcoin; Require state fiscal officials to develop policies and procedures for accepting, storing and trading Bitcoin. In addition, the proposal removes SB178’s investment restrictions on Bitcoin (no more than 5%) and the last rule above that digital assets can be lent out.

Proposal progress: SB178 and SB228 are both in the Senate review stage.

North Carolina

North Carolina Digital Asset Investment Draft H92 authorizes state Treasury secretaries to invest public funds in digital asset exchange-traded products, digital assets (with an average market value of at least $750 billion in the first 12 months), with an investment cap of 10%. These public funds include general funds, highway funds, and highway trust funds, as well as special fund investments authorized to be held by state finance officials (teachers and state employee retirement systems, consolidated judicial retirement systems, local government employee retirement systems, inheritance funds, state education aid agencies, state property fire insurance funds, etc.).

Progress: H92 has been submitted to the House Business and Economic Development Committee.

Michigan

Michigan HB4087 authorizes state finance ministers to invest in cryptocurrencies from general funds and the Countercyclical Budget and Economic Stability Fund, with an investment cap of 10%. In addition, state finance ministers can also lend cryptocurrency without increasing the state’s financial risk in return. The draft defines cryptocurrency broadly: a digital currency that uses cryptotechnology to regulate the generation of monetary units and verify the transfer of funds, and operates independently of the central bank.

Progress: HB4087 has been submitted to the House Communications and Technology Committee.

Maryland

Maryland Strategic Bitcoin Reserve Draft HB1389 authorizes the establishment of the Maryland Bitcoin Reserve Fund to invest in Bitcoin as the state’s reserve asset and authorizes the state Treasury Secretary to invest in Bitcoin funds confiscated from the fight against gambling violations.

Progress: HB1389 is still in committee review in the House of Representatives, with the Judiciary Committee responsible for the main review (March 11 hearing), and the Appropriations Committees may also participate (as it was allocated to two committees when it was first submitted).

Kentucky

Kentucky HB376 authorizes the State Investment Committee to invest in certain digital assets and precious metals, prohibits investment in Central Bank digital currency, authorizes state agencies to accept digital assets and precious metals as payment methods, prohibits accepting Central Bank digital currency as payment methods, requires the Department of Taxation to accept digital assets and gold and silver as payment methods, and requires the State Treasury Secretary to transfer certain digital asset deposits to the Budget Reserve Trust Fund. In terms of digital asset investment, we support investing in digital assets with a market value of more than US$750 billion (the average market value of the past fiscal year) and obtaining approval from U.S. or state regulatory agencies. In terms of investment limits, the total investment in digital assets, stablecoins and precious metals must not exceed 10% of the total excess cash investments of state finances under paragraph (9).

Progress: HB376 has been submitted to the House Banking and Insurance Committee.

in Oklahoma

The latest draft revision to Oklahoma’s Strategic Bitcoin Reserve Draft (HB1203) authorizes state fiscal officials to invest public funds in Bitcoin or any digital asset with an average market value of more than $500 billion in the previous calendar year, as well as stablecoins, from the following funds: state general funds; revenue stabilization funds; constitutional reserve funds. The draft also supports the use of third-party solutions to pledge digital assets. If the draft is passed, this draft will take effect on November 1, 2025. Any state pension fund can hold digital assets directly by using a secure custody solution, store digital assets with a qualified custodian, or invest digital assets in exchange-traded products that are formally registered with the U.S. Securities and Exchange Commission or the Commodity Futures Trading Commission.

Progress: It passed the review of the State House Government Oversight Committee on February 25.

the Iowa

Iowa currently has two drafts, SF403 and HF246, submitted by senators and House members respectively.

Both drafts allow state finance officials to use public funds from any of the following funds to invest in precious metals, digital assets with an average market value of more than $750 billion in the previous calendar year, and stablecoins: state general funds, cash reserve funds, and Iowa Economic Emergency Fund. The investment shall not exceed 5% of the total public funds of the fund.

Progress: SF403 and HF246 are currently pending review by the Senate State Government Committee.

new Mexico

New Mexico SB275 authorizes the state Treasury Secretary and Investment Committee to invest bitcoin from the following funds: the Land Granting Permanent Fund, the Resource Tax Permanent Fund, the Tobacco Reconciliation Permanent Fund; and any other state fund the state Investment Committee deems appropriate. The investment cap is 5%. The draft also supports lending assets without increasing the state’s financial risk. The effective date of this draft clause is July 1, 2025.

Progress: SB275 is currently pending before the State Senate Taxation, Commerce and Transportation Committee.

new Hampshire

Draft HB302 in New Hampshire allows the state’s finance minister to invest through public funds in precious metals, digital assets (digital assets with an average market value of more than $500 billion in the previous calendar year), and stablecoins. This draft will enter into force 60 days after the date of adoption.

Progress: Draft HB302 is still in the review stage of the House Commerce and Consumer Affairs Committee and is currently advancing discussions through a subcommittee work session and an upcoming executive session.

Rhode Island

The Rhode Island HB6007 draft seeks to authorize state treasuries, state employee retirement systems, public school employee retirement systems, or any other state retirement systems to allow Bitcoin to be included as a valuable asset to hedge against inflation, thereby protecting the purchasing power of state funds; and allowing flexibility in investment decisions to respond to changing economic conditions and explore emerging opportunities. State finance ministers can use unspent, unrestricted, or uncommitted funds (in general funds, budget stabilization reserve funds, and other investment funds directly managed by state finance ministers) to invest in Bitcoin or digital assets. The digital assets specified in the draft refer to virtual currencies, cryptocurrencies or native electronic assets, including Bitcoin, stablecoins, NFT or other assets that confer economic, ownership or access rights and exist in digital form.

During a calendar year, state finance ministers must not invest more than 10% of the fund’s total deposits at the time of investment, and may also lend bitcoin or digital assets to generate additional benefits without increasing the state’s financial risk.

Progress: HB6007 was submitted to the House Finance Committee on February 28.

Missouri

Missouri lawmakers are currently submitting two draft bills related to Bitcoin reserves, HB1217 and SB614. Among them, HB1217 authorizes the establishment of a Bitcoin Strategic Reserve Fund, allowing state finance ministers to allow some state funds to invest, purchase and hold cryptocurrencies, accept Bitcoin donations and hold them for at least five years before possible sale, transfer or redemption. SB614 authorizes state finance ministers to use a portion of state funds to invest in stablecoins or qualified digital assets (digital assets with an average market value of more than $500 billion in the previous 12 months), with an investment cap of 10%.

Progress: Not yet in the committee review stage.

West Virginia

West Virginia draft SB465 allows the state government to invest 10% of public funds and public pension funds in precious metals, stablecoins, and digital assets with market capitalizations of more than $750 billion.

Progress: Not yet in the committee review stage.

Massachusetts

Massachusetts draft SD422 authorizes the establishment of a federal Bitcoin strategic reserve that allows widespread investment in Bitcoin or other digital assets. During a fiscal year, state treasury ministers must not invest more than 10% of the total federal stability fund deposits allocated by the Legislature in Bitcoin or digital assets. The Treasury Secretary may also deposit any Bitcoin or other digital assets confiscated by the Federation into the fund. In addition, lend Bitcoin or other digital assets to generate additional revenue without increasing the federal financial risk.

Progress: Not yet in the committee review stage.

The following draft bills were rejected

Pennsylvania

The Pennsylvania House Strategic Bitcoin Reserve Draft HB2664 was introduced in November 2024, allowing the state treasurer to invest 10% of Pennsylvania’s general funds, emergency funds, and state investment funds in Bitcoin and cryptocurrency-based ETPs.

Progress: Rejected at committee stage. A previous petition opposing the draft mentioned reasons including damage to taxpayers ‘money, high energy consumption in cryptocurrency mining, and frequent use in illegal activities.

Montana

House Draft No. 429 in Montana, USA, was introduced on February 7, 2025, proposing to create an inflation protection bill state special income account to invest in precious metals and digital assets. Under the proposal, the Investments Committee has the authority to invest funds from the draft inflation protection state special income account in precious metals, stablecoins, and digital assets with a market value of more than $750 billion (based on an average of the previous calendar year), and authorizes the transfer of up to $50 million from the general fund to the account by July 15, 2025. It is worth noting that currently Bitcoin is the only digital asset that meets this market value criterion.

Digital assets are defined in the proposal as virtual currencies, cryptocurrencies, native electronic assets (including stablecoins and non-homogeneous tokens), and other assets that exist only in digital form and confer economic, ownership or access rights.

Progress of the proposal or voting result: The House voted twice and failed to pass, and the final voting result was 41 (yes) to 59 (no). The reason for the rejection was that some lawmakers were worried about the fluctuations in digital assets and their impact on taxpayers ‘currencies, and were unwilling to put public funds in high-risk digital investments.

North Dakota

North Dakota Draft HB1184 was proposed on January 31, 2025, and involves investment in digital assets and precious metals. It stipulates that up to 10% of “funds managed by the University and School Land Commission” and “public funds managed by the North Dakota Investment Commission” should be invested in precious metals, digital assets or stablecoins with an average market value of more than US$500 billion in the previous year, Digital assets must be held directly by the Commission/State Office of Retirement and Investment through a secure custody solution, or on behalf of the state through a qualified custodian or exchange-traded product.

In addition, the draft supports the use of third-party solutions for pledge (provided that the state retains legal ownership of the digital assets) and also supports the lending of digital assets (provided that lending of digital assets increases the return on investment and does not increase the state’s financial risk).

Progress: The House rejected HB1184 on its second reading with a vote of 32 to 57.

Wyoming

In January 2025, several Wyoming lawmakers proposed a draft HB0201 to authorize state public funds to invest in Bitcoin, specifically authorizing state finance ministers to invest the following funds in Bitcoin:

1. General funds: The proportion of general funds invested in Bitcoin at any time shall not exceed 3%;

2. Wyoming Permanent Minerals Trust Fund: The investment ratio must not exceed 3% of the fund.

3. Permanent Land Fund. The investment ratio shall not exceed 3% of the fund.

The draft also stipulates that state finance ministers should obtain and hold Bitcoin through one or more of the following methods:

1. Secure hosting solutions;

2. Compliance custodian;

3. By holding or owning exchange-traded products issued by investment companies or managers registered under the Federal Investment Advisors Act of 1940.

It is worth mentioning that if the investment assets appreciate, the state finance minister does not need to sell or reduce the investment to comply with the rules; if the investment assets are impaired and fall below the prescribed investment ratio, investment in Bitcoin can be resumed.

Progress: Failed to pass the Wyoming House Committee’s Minerals, Commerce and Economic Development Committee vote, and later failed to obtain the necessary report or advance before the full committee deadline.

South Dakota

South Dakota Draft HB1202 was proposed on February 3 to authorize state public funds to invest in Bitcoin, and the investment should not exceed 10% of state funds available for investment. Holding methods include holding directly by the State Investment Board through a secure custody solution, holding by a qualified custodian on behalf of the State Investment Board, or holding in the form of an exchange-traded product issued by a registered investment company.

Progress: The South Dakota House Commerce and Energy Committee voted on February 24 to defer consideration of draft HB1202 until the 41st Legislative Day. Since the state’s legislative session lasts up to 40 days, the decision effectively vetoes the draft.

summary

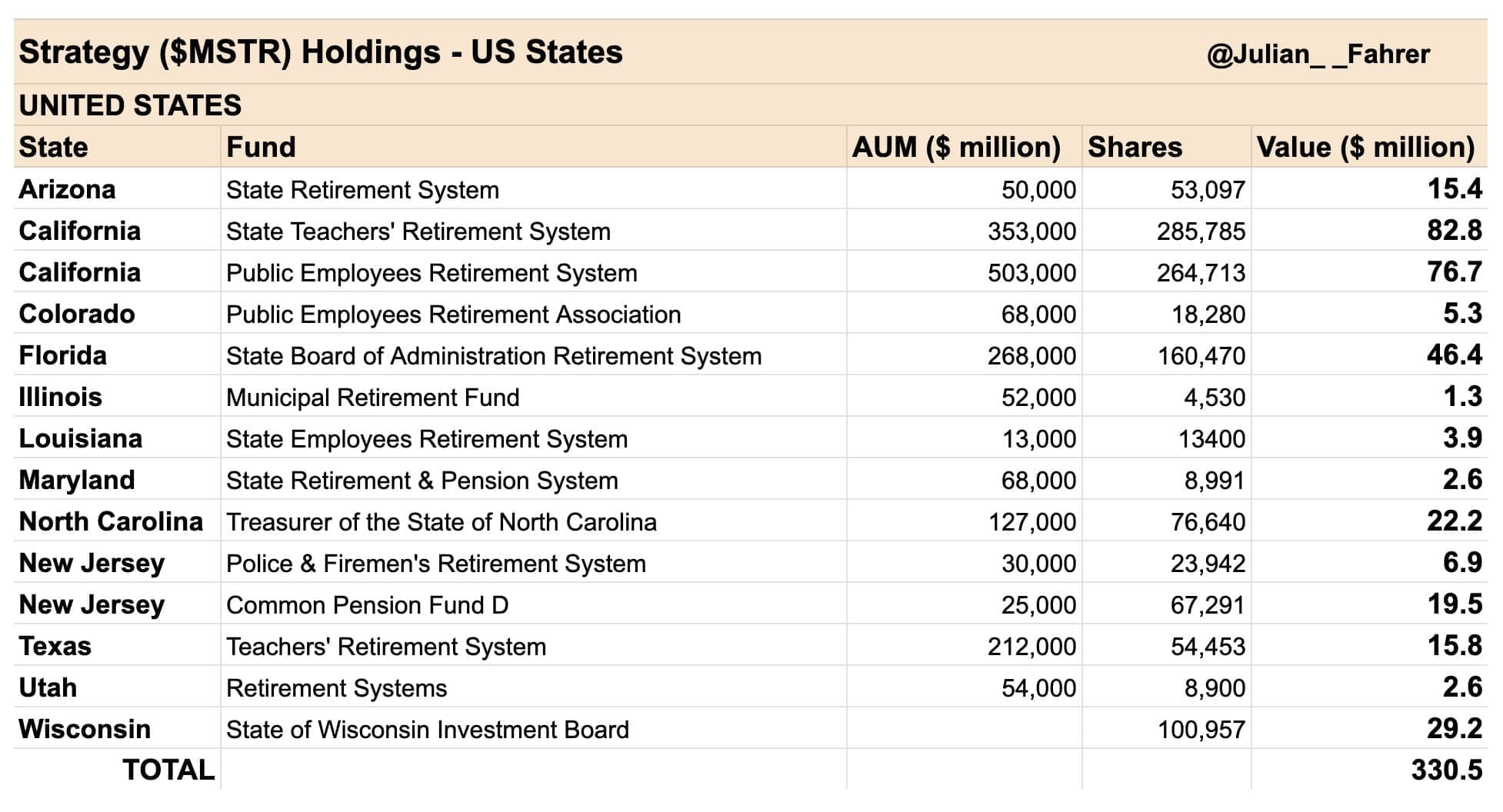

According to analyst Julian Fahrer, in the first quarter of 2025, 12 U.S. states reported holding a total of US$330 million in MicroStrategy shares. These investments were mainly held indirectly through pension funds or treasury bills. Since MicroStrategy is one of the important holders of Bitcoin, this suggests that some states have begun to invest in Bitcoin indirectly.

Source: Julian Fahrer

At the same time, the crypto reserve bill promoted by U.S. states is becoming a concrete implementation of Trump’s vision of “building the world’s cryptocurrency capital” at the local level.

But overall, due to legislative procedures, risk concerns and veto precedents, most bills are less likely to be passed. 2025 may be a turning point in the encryption strategy, but it is more likely to be a situation where a few states test the waters rather than a comprehensive roll-out. The final result depends on legislative advancement in the next few months and the Trump administration’s specific policy direction.

According to Grok’s analysis, the Bitcoin Reserve Act is still in the exploratory stage at the state level, and the adoption rate is generally low. In the short term (1-2 years), the probability of passage in most states is no more than 30%. However, if breakthroughs are made at the federal level (such as the Bitcoin Strategic Reserve Act promoted by Senator Lummis), or if bitcoin prices stabilize and gain more institutional recognition, state legislation may gradually accelerate over the next 3-5 years.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern