Participants either turn to building/investing in physical businesses or pray for a comeback in crypto casinos.

Author: Noah

Compiled by: Shenchao TechFlow

TL;DR

Not many new faces, not much unimportant marketing spending, and a shift to pragmatism. There are still some legacy issues in the past (such as infrastructure projects coming to an end in 2018, or a newly overfunded VC scam is burning money in marketing), but this is less common than in previous years.

Set the stage background

Industries are generally divided into two categories: crypto native groups and new entrants. I will further divide these two groups into two sub-groups.

-

Encrypt Native Americans/Mercenaries

-

Crypto Native Technology Expert

-

Low-quality new entrants

-

High-quality new entrants

Encrypt Aboriginal people

There are technical experts (venture capitalists/investors, venture capital projects) who are mainly focused on seizing huge market opportunities and creating real products. This accounted for two-thirds of the crypto native people participating in the event, mainly focusing on AI/DePIN and financial technology.

There are fewer mercenaries than ever before. I think this is because 1. The market on the chain is cold 2. Future growth prospects are biased towards institutions 3. Most mercenaries are either bankrupt or rich. Not many people choose to play games fiercely.

new entrants

New entrants can often be segmented based on talent quality. Low-quality talent often works in soft skills-related jobs (business development, growth, ecosystems, etc.) in closed L1/L2 and other capital-overcrowded companies. These people may be crypto enthusiasts, or they may just enjoy the relatively high salaries and work output of the industry.

High-quality new entrants can be divided into mercenaries and technicians:

These technicians are either from TradFi, engaged in the construction of on-chain finance and stablecoins, or infrastructure experts from AI, DePIN, security, etc. are usually a large potential market with emerging technologies/capital formation.

Mercenaries are often young founders aged 18-25 who have seen the financial success of their peers in 2021 and want to replicate it. They are charming, intelligent and even a little anti-social. They are a relatively small group, but they capture a large proportion of attention.

So why are our token prices falling sharply when we face mass adoption of blockchain technology? Why are some people optimistic and some are pessimistic?

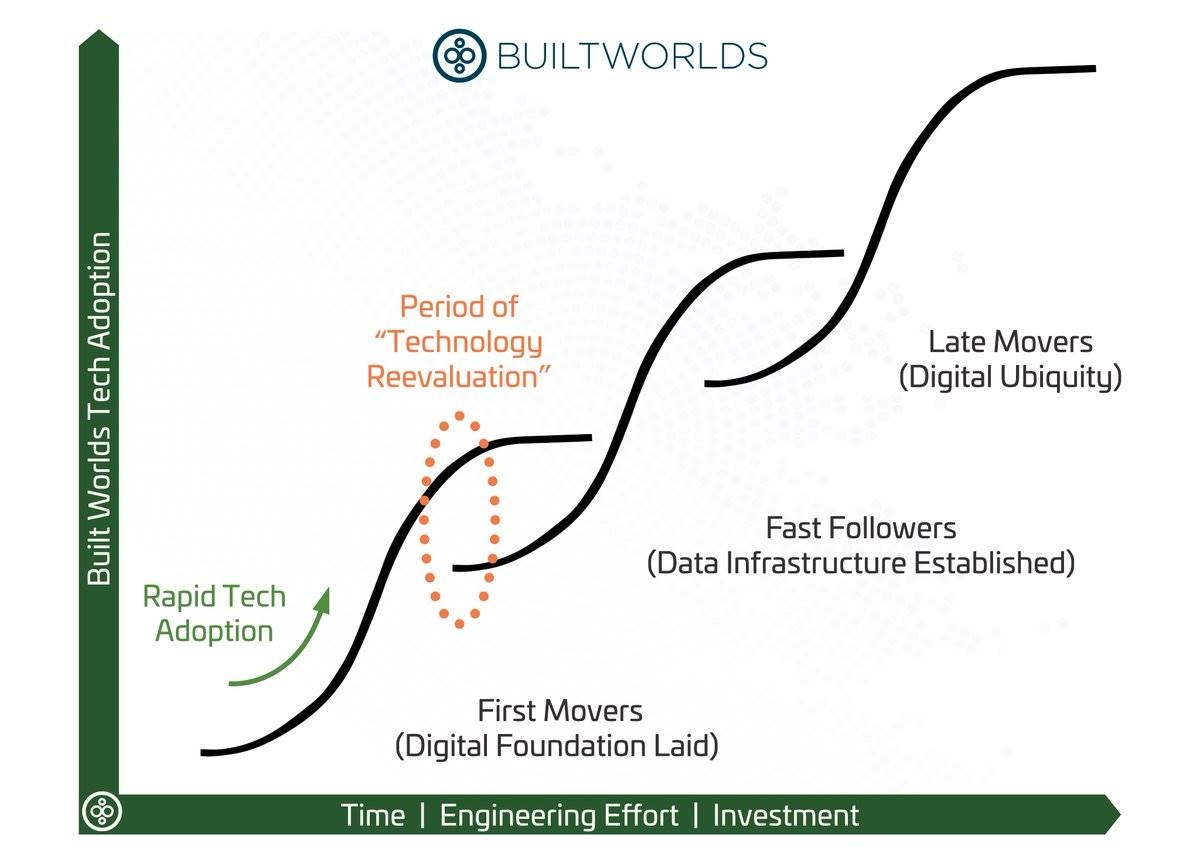

The answer is simple. We are at the end of one S-curve and the beginning of another S-curve.

A brief review of the past history of the encryption industry

2009-2011: The era of edge technologists

2011-2016: Dark Web/Gambling Era

2017-2019: Normies first round (ordinary participants in the cryptocurrency boom who entered the industry but lacked a deep technical or cultural background)

2020-2021: DeFi summer, Normies ‘first/second cycle

2022-2024: Opportunists/Vultures, Normies ‘Second/Third Cycle

This is a very general statement, but I think it is accurate.

Early entrants are either

1. those skilled

2. criminals

3. The right time, the right place and the right people.

Most people who entered the cryptocurrency space before 2017 were either

1. Rich people and retirees

2. Consider cryptocurrency as a way of life

3. Can’t make money.

After the summer of DeFi, a large number of people have begun to enter the cryptocurrency space, indicating that the post-2020 group is more similar to the general population.

Many people became rich, but the extraordinary wealth in these groups was much less, and participants were either

1. Rich people and retirees (ethnic minorities)

2. Moderately wealthy and selective

3. He was rich and disappointed in this field.

After 2024: All industries will face challenges,Only those who discover business opportunities and are highly capable can survive.We may see many executives with extensive Tradfi or Web2 experience.

Looking at the ranks of crypto industry participants, it is clear that only one remaining is

-

Pre-rich early players before the industry became rich and pre-2022 entrants: Failure to take advantage of opportunities in the past 5-10 years and in many cases disappointed with the field

-

After-rich players and hard-core crypto aborigines (pseudo-religions: ETH Maxis, Link Marines, etc.)

-

New entrants seek business opportunities

Most bearish/pessimistic people fall into the first category. They envy the wealth they have created and chase it, but realize that the wealth has been created mainly through luck or crime.

The second group of people still believe that ETH is money and cannot reason with others. They are pretentious; speak on podcasts or work at fund companies, but have not devoted themselves to work for years and are out of touch with the market.

The third group was more optimistic because they were not troubled by past experiences and were able to focus on what they believed in. We are finally seeing regulatory clarity, stablecoins are being adopted on a large scale, and financial markets are accepting tokenization.

Where is the industry going?

I think we as an industry share the same vision for the next few years, but also think that participants who have not benefited from this reality choose not to recognize it.

Looking to the future, marginal consumers exposed to cryptocurrencies will focus on how cryptocurrencies provide tangible value to their lives. We may see significant developments in financial applications on the chain, using cryptographic primitives to ensure security or reduce back office costs, etc.

We may not see much growth in the pure cryptocurrency market, but I don’t think that’s surprising to many people. This may have a negative impact on token fund inflows and may cause problems in the liquidity market.

We are in a transition period where regulation is uncertain but imminent. Liquidity may have access to an increasing number of publicly registered stocks that can directly replace its token allocation. We may see many on-chain financial products requiring KYC to attract large institutional customers, dividing the on-chain financial market into gray/black market and regulated markets. Uncertainty is risk, and while deviations in results are good for our industry, they may not be good for many of our products.

ETH Denver and the price trend it triggered have sounded alarm for the industry.This decision becomes increasingly obvious as actual business results are produced and the opportunities offered by crypto casinos are relatively reduced.

Many industry participants (companies, traders, funds) have been dying for years, but they don’t have to accept death due to lengthy feedback cycles or excess capital. The shift to rationality began with the Bitcoin ETF in 2024 and will be fully realized in 2025 with Trump’s inauguration.

Maybe ordinary people can continue to deliberately turn a blind eye to Ponzi casinos after the first or second cycle, but the first major hype cycle was eight years ago, and many people have accepted that the VC-TGE-Cashout cycle is a scam that will not change if it remains profitable.

In 2024, the market rebounded due to the wealth effect led by BTC and the memecoin hype cycle, but traders were watching the game they were participating in this time with wide eyes. They only go when they make money and don’t believe any theory.

The free money is gone, the gamblers are gone, and downstream industry participants are assessing the impact on their portfolios.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern