Concerned that Trump would impose higher tariffs on gold, traders would move gold from London to New York, regional price differences would open, and there would be arbitrage opportunities for cash conversion. Trading funds would push gold prices.

Gold prices hit record highs repeatedly, and gold ETFs showed “fear of heights”

Photo source: Visual China

Blue Whale News, February 11 (Reporter Ao Yulian)Affected by the uncertainty brought by the Trump administration, after a 26% surge in 2024, the price of gold continued to soar during the year, with an increase of more than 11%.

On February 10, local time, Trump announced that import tariffs on steel and aluminum would increase to 25% with no exceptions or exemptions. Affected by this, international gold prices rose sharply. In the morning of February 11, London gold and New York gold prices rose by more than 1%, and Shanghai gold prices rose by more than 2%, both reaching record highs. However, the intraday fell back, and Shanghai gold closed at 684 yuan/gram, up 1.03%. As of press time, the London gold price was US$2905/ounce, and COMEX gold price was US$2930/ounce.

Gold stocks, which are the amplifiers of gold prices, also performed well. On February 11, the market closed down, while the gold jewelry index bucked the trend and rose by 2.77%. Gold concept stocks Laishen Tongling and Caibai shares had a strong daily limit. China gold rose by 9.84%. Well-known gold retail stocks such as Chao Hongji, Zhou Dasheng, and Lao Fengxiang also rose by more than 4%.

At the ETF level, 20 gold-themed ETFs across the market closed up all, with significant volume. The intraday turnover of Hua ‘an Gold ETF was 4.5 billion yuan, compared with 2 billion yuan the previous day; the turnover of Yongying Gold Stock ETF was 200 million yuan, which was twofold compared with the previous day.

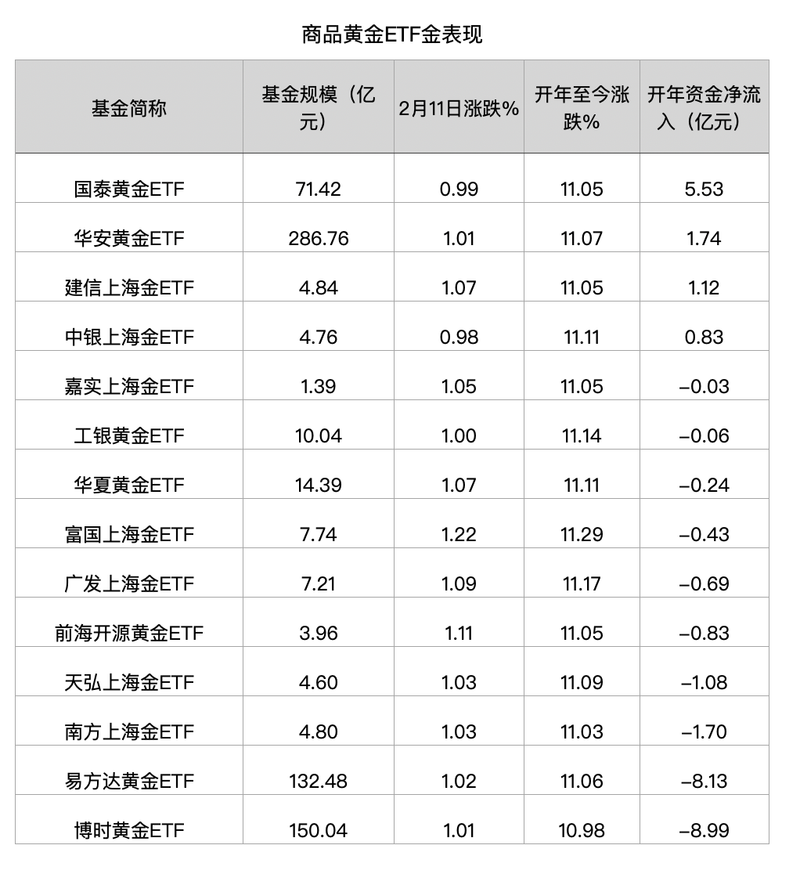

Since the beginning of the year, gold has risen fiercely, hitting new highs eight times, and has risen by more than 11%. There are 14 commodity gold ETFs in the market, and the increase during the year is also around 11%.

However, while the net value was booming, funds began to stop profits and showed a net outflow. Wind data shows that the total size of 14 commodity gold ETFs is 70.4 billion yuan, with a net outflow of funds of 12.95 yuan during the year, with a net outflow rate of 2%. Among them, Boshi Gold ETF and E Fund Gold ETF ranked among the top two in net outflows, with net outflows of 899 million yuan and 813 million yuan respectively.

Performance of commodity gold ETFs during the year, Cartography: Blue Whale News

Hoarding gold in troubled times. Although the Trump administration did not mention imposing tariffs on gold, the market has always had such concerns. To this end, traders have moved gold from London (the global spot gold trading center) to New York (the global futures gold trading center).

According to data from the London Bullion Market Association, the amount of gold stored in London gold warehouses fell by 139 tons in January, the largest monthly decline since records began in 2016. During the same period, gold inventories on the New York Mercantile Exchange increased by 292.85 tons, a month-on-month increase of 42.99%.

At present, futures trading prices are US$25 higher than spot prices, regional spreads are open, and there are arbitrage opportunities for futures to cash, attracting capital transactions and thus promoting gold prices.

After Trump was elected, uncertainty caused by tariffs was permeated, coupled with rising expectations of the Federal Reserve to cut interest rates, and the popularity of global investment in gold also increased.

In November 2024, the month Trump was elected, China’s central bank restarted purchasing 160,000 ounces of gold, purchased 330,000 ounces in December, and continued to purchase 160,000 ounces in January 2025. According to the World Gold Council, driven by central banks and investors, gold demand hit a new high in 2024, and central banks purchased more than 1000 tons for three consecutive years.

Recently, 10 insurance companies have received the request of the State Administration of Financial Supervision and will carry out investment in gold business. According to the analysis of Yongying Fund, the incremental capital may reach 200 billion yuan, which is close to the total purchase amount of the central bank of China from 2022 to 2024. Moreover, this part of explicit demand is expected to leverage institutions outside the pilot to allocate gold. The demand side of gold and gold stocks will be significantly positive.

Although gold prices continue to rise and are at historical highs, some institutions are still bullish.

First, global central bank purchases are a long-term trend. Take the People’s Bank of China as an example. At the end of 2024, gold accounted for 5.5% of the People’s Bank of China’s international reserve assets, which is lower than the world average of 15%, and there is still huge room for improvement.

Second, judging from the recent policies released by Trump, global geopolitical and economic uncertainties will increase in the future, and risk aversion may further rise.

Third, economic data in Europe and the United States is weak. Loose global monetary policy will drive global real interest rates down. The deficit ratios of various countries will have a further upward trend. The inflow of gold investors is expected to form a synergy with the central bank.