From home appliances and cars to robots, Japan has encountered similar problems.

Why are Japanese robots no longer working?

Wen| Deep sounding forest cypress

Get up early and catch up with the evening collection.& ldquo; Japan, the robot kingdom, seems to have become an outsider to this robot feast.

Not long ago, Morgan Stanley announced the Humanoid 100 (Humanoid Robot 100: Combing the Global Value Chain), but Japan did not have a separate name. It was only included in other Asia-Pacific regions with South Korea and others. There are only 18 companies on the list in the region, about half of the number of companies in China (35).

This is not an intentional target of Morgan Stanley. It can only be blamed for the fact that Japan’s humanoid robot industry has been too disappointing in recent years: Softbank and Honda have successively suspended their projects, and the four traditional robot families have lingered outside the field. Japan has not seen eye-catching products and companies for a long time.

In sharp contrast, the Chinese and American robot industries, where hot money is surging and flowers are blooming.

In China, not only have popular hotcakes like Yushu Technology emerged, but upstream and downstream affiliated companies are also bullish. As of the end of February, the stock prices of more than a dozen companies including Changsheng Bearing, Folai New Materials, and Junchuang Technology rose by more than 80% during the year, among which Changsheng Shaft, which had the highest increase, surged by more than 250%. Big factories that have always been keen to compete for popularity are not idle. Ant Group recently established a subsidiary, Ant Lingbo, to enter the field of embodied intelligent humanoid robots. Ali has invested heavily in Yuanluo Technology, and Xiaomi’s Tieda has also been rumored to be in March-April this year. Important progress was ushered in.

In the United States, fueled by Silicon Valley giants and Wall Street giants, the primary market has set off an investment boom, and the valuations of a large number of unicorns have soared: Figure AI, which has been established less than three years ago, has a valuation of US$39.5 billion, firmly ranking the world’s number one robot unicorn throne; Apptronik, which just completed a US$350 million Series A financing in mid-February this year, has a valuation of nearly US$2.5 billion; Physical Intelligence, which completed a US$400 million financing at the end of last year, has a valuation of US$2.4 billion……

As a country that has long ranked first in the world in market share and proposed many creative technologies, the process of Japan’s robot industry from rise, explosion to decline is regrettable.

From the four major families to dominating the world, the glorious era of the robot kingdom

The earliest germination of the Japanese robot industry can be traced back to the 1960s and 1970s. In 1968, Kawasaki Heavy Industries signed a licensing agreement with the American robot company Unimation and introduced corresponding technology. The following year, it developed the first industrial robot product Unimate in its self-built production workshop. This was a key transition for the Japanese industrial robot industry from introduction to independent research and development.

In its infancy, Japan did not produce many top products or technologies, but it had one significance that cannot be ignored: it established the positioning of robots mainly serving manufacturing and industry, and in the next few decades, the entire industry has been moving towards the main line of industrial robots. This was largely due to the fact that Japan’s economy began to recover at that time, the average annual growth rate of economic output reached double digits, and the demand for labor in the industrial and manufacturing industries was tight, and companies turned their attention to the robot field.

In the 1960s, Kawasaki Heavy Industries launched the exploration of Japan’s robot industry. Source: Kawasaki Heavy Industries official website

Coincidentally, the rise of shipbuilding, another industry that Japan is proud of, is also closely related to Kawasaki Heavy Industries. In 1878, Kawasaki Heavy Industries ‘predecessor, the Legendary Foundation Shipyard, built Japan’s first modern cargo ship, the Iyu Maru, and promoted the vigorous development of the domestic shipbuilding industry.

I just didn’t expect that nearly a century later, similar stories were still repeating itself.

Kawasaki Heavy Industries achieved zero breakthroughs in the field of industrial robots, which has undoubtedly boosted the confidence of domestic counterparts. Japan’s industrial robot industry has ushered in one heavy player after another: Fanuc, which started with CNC systems, developed the first industrial robot in 1974, mechanical tool maker Fujikoshi and electrical industry giant Yaskawa Electric have also entered the game. ldquo; The four major families successfully met at the industrial robot track and worked together to create the golden twenty years of Japanese industrial robots from the 1970s to 1990s.

The economy is booming and demand is exploding, which is the fuel for Japan’s industrial robot industry to soar.

In 1974, affected by the energy crisis, Japan’s economy experienced negative growth for the first time after the war, but it also made the government determined to upgrade the economic structure and transform into high-end manufacturing. In the late 1970s, high-end industries represented by automobiles, home appliances, and precision machinery rose, and Japan became the world’s largest automobile producer in 1980. In order to reduce labor costs and improve production efficiency, low value-added work at the end of the assembly line was thus handed over to industrial robots.

The four major families have also fulfilled their mission and developed many landmark classic products: In 1973, Fujikoshi developed the world’s first motor-driven 6-axis robot Famulus; in 1978, Yasukawa Electric launched Japan’s first all-electric industrial robot, promoting the industry to fully enter the electrification era; Kawasaki Heavy Industries launched the E series of large universal robots in 1983, further expanding the application scope of robots to heavy industries……

Source of the four famous Japanese industrial robot families: company official website

Data shows that Japan was the world’s largest producer of industrial robots in the 1980s, accounting for more than 70% of the global market at its peak; from the 1970s to the 1980s, its industrial robot output grew at an average annual rate of 30%. At this time, Japan is indeed worthy of the title of the robot kingdom. However, such an exaggerated growth rate cannot continue forever. Twenty years after bidding farewell to gold, the Japanese robot industry entered a period of stability in the 1990s.

In fact, a slowdown in domestic growth in Japan is already foreseeable. Official data shows that as of the mid-1980s, Japan’s possession of advanced industrial robots reached more than 100,000 units, accounting for more than 50% of the global market, more than four times that of the United States, and the penetration rate is close to the ceiling.

On the other hand, Japan’s domestic industrial upgrading is still continuing, and the manufacturing and industrial sectors have been successively shifted to China, South Korea, Southeast Asia and other regions, weakening the production needs of domestic companies. According to statistics from Mizuho Bank of Japan, since 1991, Japan’s domestic demand for industrial robots has dropped three times in a row.

Faced with the background of peaking penetration and slowing demand, the Japanese robot industry maintains competitive vitality through two strategies. The first is to develop more new application scenarios in China and are no longer limited to the industrial and manufacturing fields. For example, in response to the medical, housekeeping, and age-friendly service outlets created by population aging, Japan’s Ricoh Company took the lead in launching a humanoid robot RIBA-II for home service scenarios in 1997. Sony and other companies also quickly followed suit.

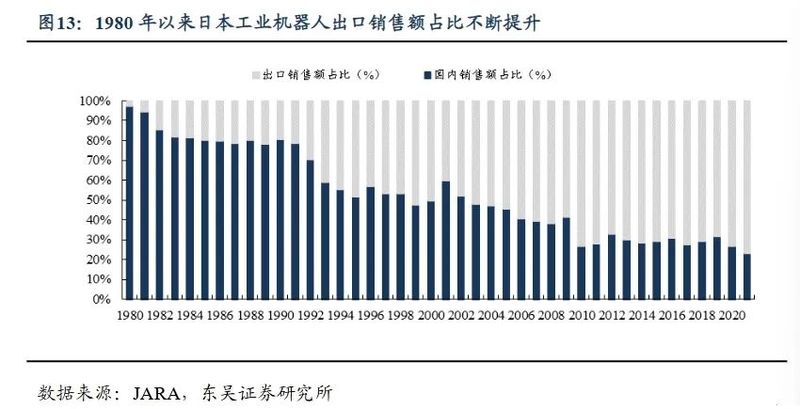

The second was to actively expand overseas, especially in East Asia and Europe, which were in a period of rapid economic expansion at that time. In the process of going to sea, the four major families still played the vanguard role. In 1990, Yasukawa Electric subsidiaries settled in China and Canada, and Fanuc also established a Beijing subsidiary a few years later. At the beginning of the new century, along with the emergence of a series of trends such as economic globalization and China’s official accession to the WTO, the four major families continued to exert their efforts. In the late 2000s, the domestic demand to export ratio of Japanese industrial robots fell below 50%, marking that overseas markets have replaced the domestic market and become a source of growth.

Source: Dongwu Securities Research Institute

However, in the process of continuing to increase overseas markets, the challenges of the Japanese robot industry have gradually emerged: the domestic R & D team is too far away from the market and cannot capture changes in technical trends and market demand as soon as possible; the industrial chain is too long, raising the cost of production, transportation, after-sales and other aspects, and losing its advantage in terms of cost performance. In the 2010s, with the explosion of power in the robot industries in China and the United States, Japan ‘s status as a robot kingdom was severely challenged and entered a period of turmoil.

During this period, the performance of the four major families, which relied too much on the industrial/manufacturing scene and overseas markets, became unstable. According to Bloomberg statistics, during the period from 2010 to 2020, Fanuc’s annual net profit experienced negative growth four times, and Yaskawa Electric once experienced a three-day decline in net profit between 2014 and 2016. At the same time, with the help of a strong domestic demand market and an increasingly mature industrial chain, China’s robot industry has risen strongly and gradually eroded the market share of Japanese companies.

In 2010, China’s industrial robots began to be used on a large scale in the fields of high-precision cutting and high-risk operations. This is also a critical period for China’s manufacturing industry to transform towards high-end and intelligent. With the explosion of markets such as automobiles, digital 3C, and smart home appliances, Midea acquired KUKA and cooperated with Yaskawa Electric to establish subsidiaries. Large factories such as Gree and Haier also started building robots, boosting China’s 2013 Officially surpassed Japan and became the world’s largest sales country in industrial robots.

At this stage, Japan had to give up its center position on the stage and become a supporting role in the drama between China and the United States. The peak of the robot kingdom seems to have stopped in the not-so-distant 2010s.

Behind the frustration: thinking limitations, capital chaos and economic stagnation

Japan is certainly not reconciled. The focus of the robot industry has slowly shifted from industrial robots to humanoid robots over the years, and Japan also hopes to seize this opportunity to return to its peak. However, all kinds of decision-making mistakes and thinking limitations on the road to transformation have not only made Japan farther and farther away from its former throne, but also increasingly made the outside world confirm that it is not surprising or wronged that the development of Japan’s robot industry has been blocked. Everything is a trace. Follow.

First of all, the limitations of Japanese thinking are undoubtedly revealed in the development of humanoid robots.

It is not too late for Japan’s humanoid robot industry to start. The WABOT developed by Waseda University in 1973 is recognized as the world’s first humanoid robot in the industry. Honda began to develop humanoid robots in the 1980s and released the famous ASIMO robot in 2000. Kawasaki Heavy Industries also joined the ranks of R & D in the 1990s and soon developed the classic HRP series.

However, Honda and Kawasaki Heavy Industries soon discovered that although their products had good technology, they were difficult to gain market recognition because they were too expensive. The cost of an ASIMO robot reaches US$2.5 million. Kawasaki Heavy Industries ‘HRP series is mainly aimed at scientific research scenarios and does not consider the cost of large-scale production. From this perspective, despite spending huge sums of money on research and development, Japanese manufacturers do not seem to believe that humanoid robots can be commercialized on a large scale, but only use them as a tool to showcase technology.

In contrast, China humanoid robot manufacturers rely on cost performance to achieve success.

Ubisoft launched the Walker series humanoid robot prototype in 2016. It is the first company in the world to reduce the cost of a bipedal human-sized size humanoid robot to less than US$100,000. With its excellent price/performance ratio, Ubisoft has successively won orders from companies such as Krypton, BYD, and Foxconn. The Walker S series is expected to achieve large-scale delivery in the second quarter of 2025. Wang Xingxing, founder of Yushu Technology, which is now popular, began to experiment with the technical route of high-performance pure electric drives as early as 2013 while he was in graduate school. The newly launched G1 series starts at a price of only 99,000, making it a price butcher in the humanoid robot world.

Ubisoft Walker S series humanoid robots are about to start large-scale delivery Source: Ubisoft official website

There is no denying that ASIMO and HRP have made many breakthroughs in technology. For example, the former’s bipedal sports ability, mechanical structure, intelligent interaction and environmental perception are widely recognized in the industry. However, facts have shown that without commercialization and large-scale application, no matter how sophisticated technology is, it is like a castle in the air, exquisite but suspended, unable to withstand wind and rain. In 2018, Honda announced that it would discontinue production of the ASIMO series, marking the official end of this 18-year expensive test.

What is sad is that Japan has similar experiences in the fields of automobiles and home appliances: Toyota is betting on hydrogen energy vehicles during the new energy transformation stage, and Panasonic has chosen plasma technology routes in the era of flat-panel TVs because it places too much emphasis on the advancement of technology and ignores market demand and costs. Behind this, it reflects the thinking limitations of Japanese companies who are too superstitious about untested technologies and past successful experiences. No company can always lead the trend, and when necessary, it has to put down its stance and cater to the market.

From cars and home appliances to robots, Japanese companies make similar mistakes Source: company official website

Secondly, capital intervention has indeed brought solid financial support and a fanatical atmosphere, but it has also brought a style of eager for quick success and instant benefit, disrupting the pace of the market.

Except for Kawasaki Heavy Industries, the other three families have little enthusiasm for humanoid robots and have always focused on the field of industrial robots. Without the leadership of the four major families, Japan’s humanoid robot industry is in a leaderless state. In addition to cross-border players such as Honda and Sony, there are also more capital forces squeezing in to share a piece of the pie, such as Softbank.

In 2012, SoftBank acquired French robot company Aldebaran Robotics, and two years later launched Pepper, the world’s first humanoid robot with human emotions; in 2017, it acquired Boston Dynamics for a sky-high price of US$921 million. In those years, Softbank brought acceleration that is rare in the Japanese robot industry: Pepper announced mass production after its launch in 2014, began to sell it to C-terminals in 2015, and went overseas in 2018. All plans were pressed. Accelerate button.

According to SoftBank’s vision, humanoid robots will be widely used in the tertiary industry, such as cultural tourism, medical care, etc. In order to seize the market as soon as possible, SoftBank even adopted a radical profit-for-scale approach to sell at a price lower than cost.

I have to say that SoftBank is doing robot projects with standard capital thinking, but everyone knows that burning money for growth is unsustainable. Data shows that SoftBank’s robot business lost as much as US$1 billion in 2017, and it is in a state of losing more and more losses as it sells. Since mass production, Pepper’s total production in two years has only been 27,000 units, and there has been a serious inventory backlog, which is far from SoftBank’s original vision.

The Pepper robot, which has been highly expected, has developed far less than expected. Source: Softbank Robot official website

At this time, SoftBank showed its decisive side. In 2020, news of layoffs came from Pepper’s French R & D headquarters, and shortly afterwards it officially announced that production was suspended; not long after, SoftBank sold 80% of Boston Dynamics’s equity to South Korea’s Hyundai Group for a price of about US$800 million. At this time, it was only two years before the completion of the acquisition. During this period, Boston Dynamics only sold less than 400 robots.

After Softbank’s operation, it was basically nothing: there was no way to talk about a technological breakthrough. Although small-scale mass production and commercial sales were achieved, it was at the expense of a loss. In the final analysis, the nature of capital is profit-seeking, pursuing low risks and maximizing short-term benefits is contrary to the long-term stable development trajectory of the Japanese robot industry, and it is difficult to persist in the long term.

However, Softbank and Honda’s plans were blocked. In addition to their own mistakes, they were also restricted by objective factors: Japan’s turbulent economic environment was neither able to create demand nor provide policy and financial support.

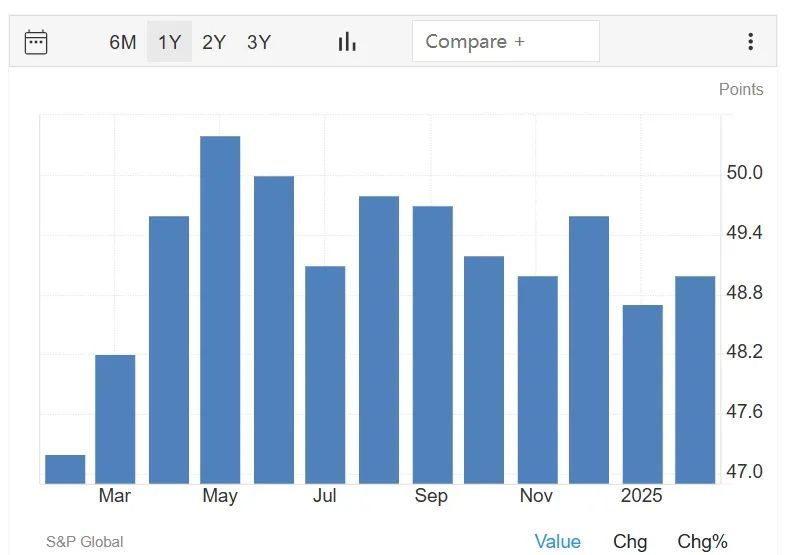

As mentioned earlier, the rise of industrial robots in Japan and the explosion of industries such as automobiles and home appliances complement each other. The latter creates demand for the former, and the former improves efficiency and reduces costs for the latter. But now, after a lost decade, the bubble economy, the ice age and multiple rounds of global financial crises, Japan’s economy is no longer what it was. In particular, the two pillars of manufacturing and industry have performed very unstable: according to World Bank statistics, Japan’s manufacturing added value has experienced negative growth six times in the past ten years, and the manufacturing PMI index as of February 2025 is still lower than 50. line of prosperity and decline.

The robot industries of China and the United States are catching up, and they are also largely due to the growth of related industries, especially the new energy vehicle industry. Industrial development has always been prosperous. I can only sigh with emotion that Japan’s ambitious humanoid robot industry failed to catch up with the good times after all.

Japan’s manufacturing PMI has long been hovering below the 50th line in recent years. Source: TRADING ECONOMICS

It is a pity to miss out on the popularity of humanoid robots, but the Japanese robot industry does not have to be completely discouraged, because there will be other opportunities in the future. Of course, China and the United States are also keeping an eye on these popularity, and competition is inevitable.

On the one hand, the integration of robots and AI is deepening, and the improvement of intelligent interaction, deep reasoning and learning capabilities will greatly improve the efficiency of robots and create more new demands. China has obvious advantages in the intelligent industrial chain. For example, it has a large amount of AI data accumulation and motion control algorithms, and the localized replacement rate of precision devices such as reducers and sensors is also increasing.

On the other hand, the application scenarios of robots are constantly refined, and it is difficult for a winner-take-all situation. As long as you identify the right advantages and avoid weaknesses, you will have the opportunity to build barriers. For example, the status of high-end industrial robots from the four major families has become increasingly stable. Taking the China market as an example, MIR statistics show that Fanuc, Yaskawa Electric, and Fuji will all increase their market share in China in 2021. Among them, Fanuc firmly ranks first with a 14.4% share. The main increase comes from high-end manufacturing industries such as automobiles and digital 3C.

Robotics is a constantly changing and developing industry and will never lack opportunities.& ldquo; Japan, the robot kingdom, is fading, but it is still waiting for an opportunity to act. China and the United States, which are temporarily leading the world, cannot be careless. There will always be other variables in the future.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.