Author: The Kobeissi Letter

Compiled by: zhouzhou, BlockBeats

Editor’s note:This article analyzes the recent decline in the crypto market. The reasons are complex, including multiple factors such as the Bybit hacking incident, the weakness of Ethereum, and the return of stock market volatility. Especially with reduced liquidity, the cryptocurrency market has lost some of its momentum. Despite the market correction, this does not mean a long-term bear market. The technical correction is healthy and the crypto market still needs liquidity to continue to prosper.

The following is the original content (the original content has been compiled for ease of reading and understanding):

Has the liquidity of cryptocurrencies suddenly disappeared? Since last Friday morning, the crypto market has lost $325 billion in market value.

At 5 p.m. Eastern Time today, the market lost $100 billion in an hour without any major news events.

What happened to the crypto market?

In the past 24 hours alone, we have seen approximately $150 billion in funds being cleared from the crypto market. The sell-off spread, with almost all crypto assets falling sharply. Even the memecoin market seems to have lost a considerable part of its liquidity.

It all seems to have started in Solana, which has fallen 22% since last Friday. During the memecoin craze, Solana showed strong relative strength. However, as memecoin gradually declined, Solana also began to fall back. For some time, Solana’s sell-off was mostly relatively independent of Bitcoin’s movements.

However, as the S & P 500 index began to fall on Friday, Bitcoin began to follow suit. As shown below, the decline in the Standard & Poor’s 500 accelerated the selling of Bitcoin. Now, Bitcoin has lost its relative strength after falling below $98,000 support today.

This is a strange incident, and it comes just after Citadel made a major shift in its stance on cryptocurrencies. Today, Bloomberg reported that Citadel Securities, with a market value of US$65 billion, is seeking to become a liquidity provider for bitcoin and cryptocurrencies, a news that the market regarded as a “news selling” event.

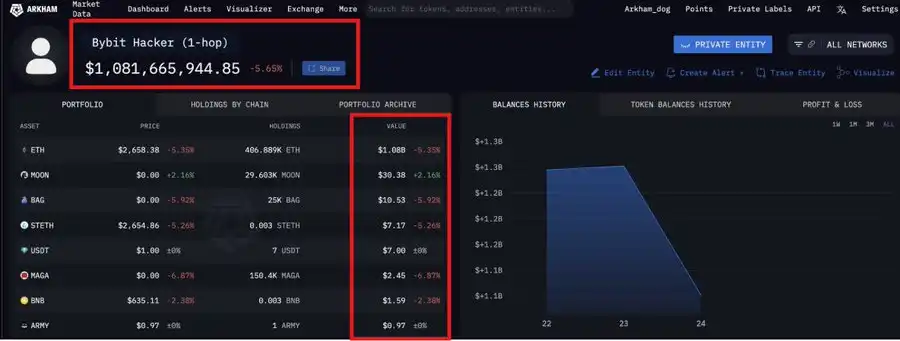

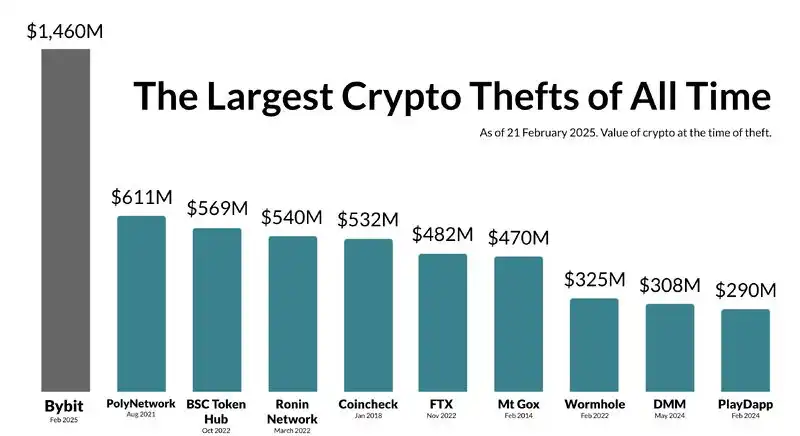

It seems that the Bybit hack on February 21 also hit market sentiment, with Arkham Intelligence calling the hack “the largest financial theft in history.” The closest competitor was the theft of the Central Bank of Iraq in March 2003, which cost US$1 billion.

In fact, Bybit’s hacking incident cost more than twice the second-largest hacking incident in crypto history. In August 2021, PolyNetwork’s $611 million theft was once the largest cryptocurrency hacking incident. The weakness of Ethereum has also brought greater pressure on the entire encryption market, while hacking incidents have weakened market confidence.

The technical side also seems to have lost momentum, but this does not mean that the crypto market is about to enter a long-term bear market. In this bull market, we have seen countless bitcoin corrections of more than 10%, and the technical correction is healthy.

To make matters worse, Sam Bankman-Fried returned to Platform X, and as the crypto market plunged, SBF said he had “full sympathy for government employees.” This comes as DOGE and Elon Musk prepare for more massive layoffs in the federal government.

Finally, as stock market volatility returns, risky assets such as Bitcoin have experienced a correction. We see historic levels of risk appetite in 2024 and into 2025. A correction in risk appetite means less liquidity in the crypto market, which has definitely happened before.

In general, there is no single factor driving cryptocurrencies down, but the combined effect of multiple factors has led to a reduction in liquidity, which the crypto market needs to prosper.

“Original link”