AI Agents are weak, celebrity coin issuance is equivalent to fraud, and major narratives are suspended.

Since the beginning of this year, the biggest feature of the currency circle has been the poor sustainability of growth, which is not only reflected in the exchange of altcoins, but even the on-chain currencies that performed well in 2024 Q4 are also facing a sharp decline.

The following are the prices and declines of the main currencies of AI Agent in 2025:

- Virtual:-79.2%

- Ai16z:-85.5%

- AIXBT:-68%

- Griffain:-80.3%

- Buzz:-72.4%

- Fartcoin:-67.5%

- ARC:-62%

- Swarms:-45%

It can be found that in less than three months, the top events of the popular narrative fell by 80%. Although it is currently impossible to directly judge that the track is fake, the loss of attention is an objective fact and cannot be recovered in a short time.

Let’s take a look at the celebrity coin narrative. Trump fired the first shot, and then other celebrities and even countries followed suit.

The following are the main currencies of celebrity coins, which have fallen back from their highs:

- Trump:-77.1%

- Melania:-91%

- Vine:-92.7%

- jailstool:-93.5%

- Jellyjelly:-98%

- CAR:-98.5%

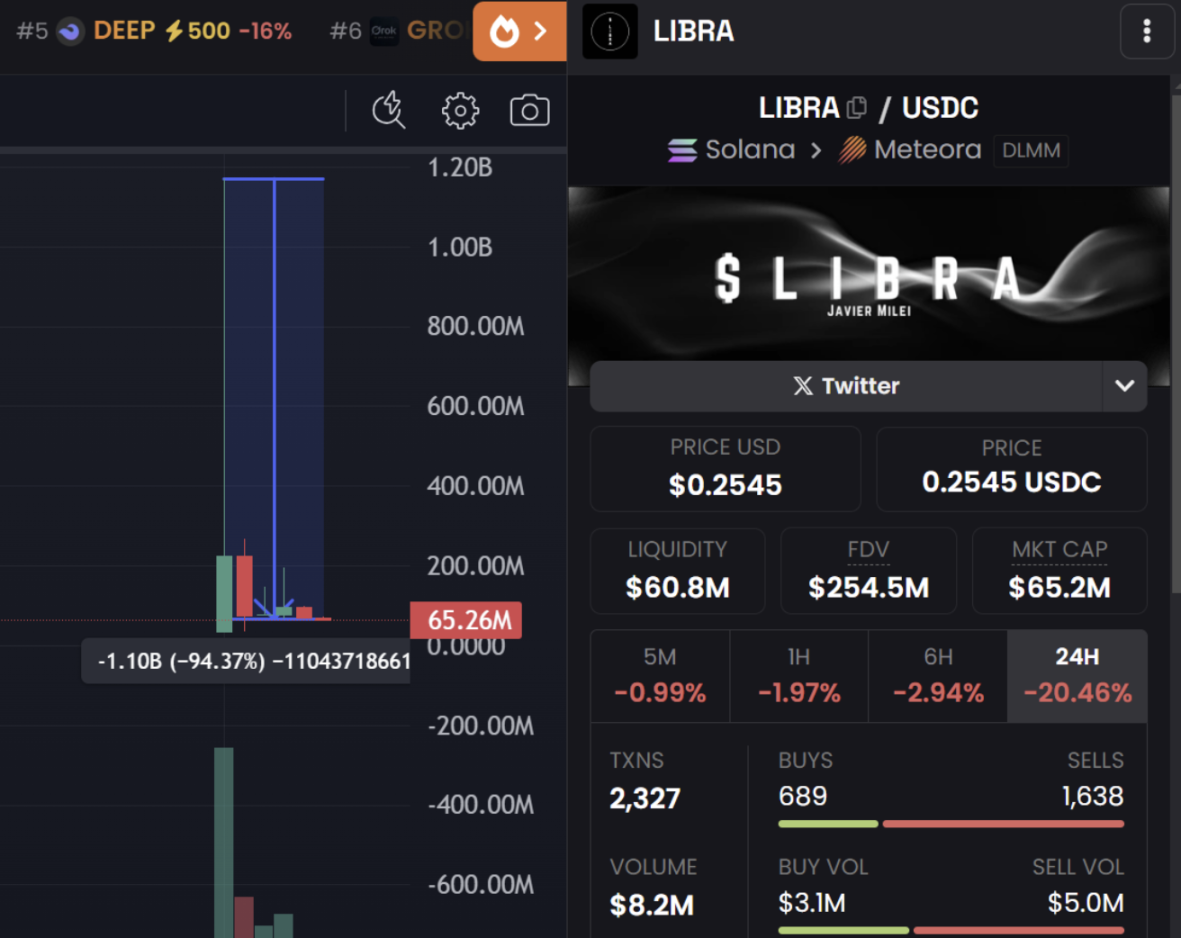

- Libra:-94.3%

There is a saying in the currency circle called speculating on the new rather than the old, which means that funds are willing to choose a newer narrative to hype. However, compared with AI Agent, it is obvious that the celebrity coin track is more bloodthirsty and ferocious. What are the current problems with these two tracks? At a time when new narratives are scarce in the currency circle, is there any breakthrough?

Reference: dexscreener

Current narrative dilemma: pure conceptual hype is prevalent

In terms of the AI Agent track, many projects are still at the stage of “concept demonstration” and “future blueprint”, lacking products that are actually available and can be promoted on a large scale. Even if a number of operable services are indeed launched on the market, there are still problems such as complex interfaces and poor user experience, which makes it impossible for ordinary investors to truly stick to them. What’s worse is that in order to meet investors ‘expectations for “AI + blockchain”, project parties often use exaggerated narratives to raise prices, but actual implementation applications are repeatedly skipped. Over time, funds lost patience and attention began to shift, causing the price of relevant tokens to fall sharply.

In the celebrity coin section, although Trump is a full beginning of the topic, when the token circle encounters the “celebrity end effect”, the problem is also quite obvious: there is probably no public figure in the world who can surpass Trump in topic and influence. Although subsequent political figures, Internet celebrities and celebrities from various countries tried to follow up, they were unable to replicate the initial funding boom and market sentiment. As market follow-up becomes weaker and weaker, the celebrity coin track also shows a “flash in the pan” phenomenon of moving and leaving quickly. Investor confidence is rapidly lost, and prices naturally follow suit.

However, the deeper problem behind the reason why these tracks fall into large fluctuations is that many projects remain at the level of “speculation concept” and lack a real and sustainable revenue model. Whether it is AI Agents or celebrity coins, their core narratives rely on capital and heat to enter quickly, but lack incentives for users to participate in the long term. When the fever recedes, prices become difficult to support, let alone attract new funds to enter again.

Looking for real revenue projects

The key to standing out in the current market with tired narratives is to find products that have “real benefits” and are “willing to share with users.” The so-called “real income” is not only to earn the rising bubble when the exchange is listed, but to continuously generate feedback through actual business models and trading behaviors, and feedback to token holders or ecosystem participants.

Among them, Hyperliquid conforms to the regulatory model and has the same business as a centralized exchange. Most of its revenue source is contract transaction fees. However, Hyperliquid will repurchase Hype tokens at a 100% fee, and the transaction fees are determined by the transaction volume. Therefore, Hyperliquid firmly bundles the currency price with the product.

According to DefiLlama, Hyperliquid handles approximately 45% of the total 24-hour trading volume of all Perps DEXs. Currently, it is $3.78B per day, and its daily revenue is about US$1 million. It remains extremely active despite the current market downturn. As a result, the price of Hype currency remains strong in the cold winter of altcoins in the past month.

No matter how hot the narrative is, it will pass, and it will still be a project with PMF, high user stickiness and real benefits that can remain in the crypto market for a long time.