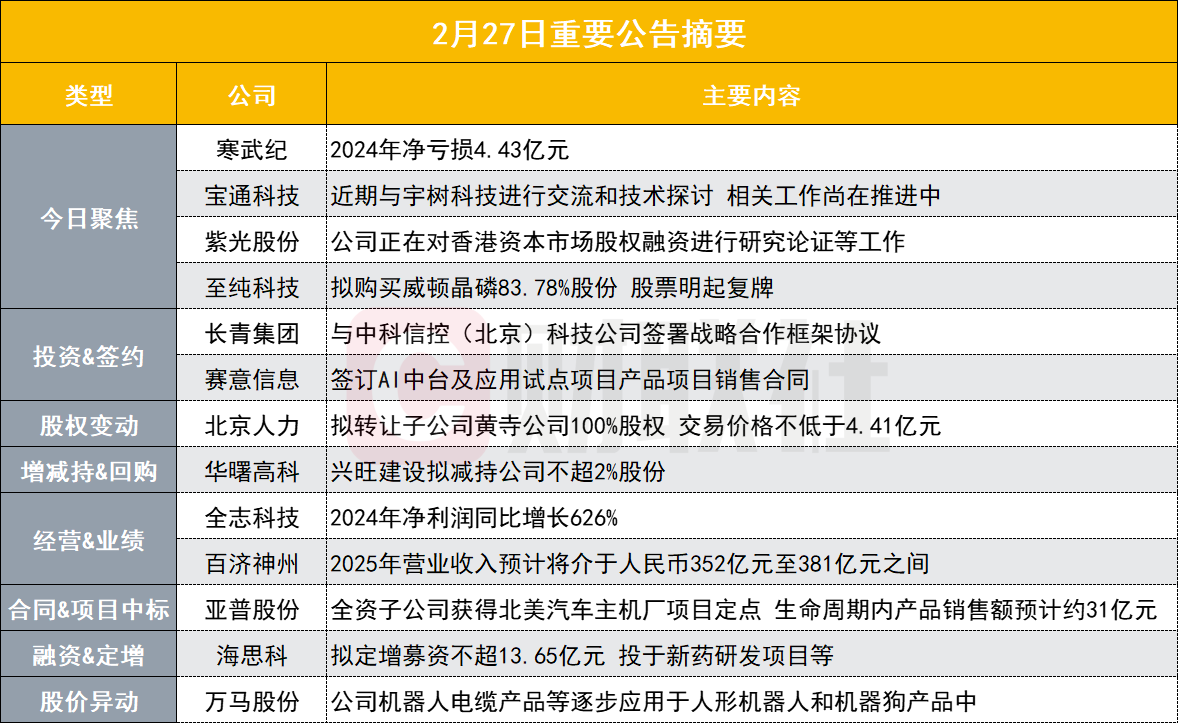

Cambrian: Net loss of 443 million yuan in 2024

today’s focus

[2 Lianban Wanma Co., Ltd.: The company’s robot cable products are gradually applied to humanoid robots and robot dog products]

Wanma Co., Ltd.(002276.SZ) announced that the company is concerned that the market has paid high attention to robot-related concepts in the recent market. The company’s robot cable products in the equipment cable sector and Wanma robot Zhilian CCa system can be applied to robot-related products. Such products are now mainly used in the field of industrial robots, and are also gradually being used in humanoid robots and robot dog products. Combined with the company’s recent operating conditions and the analysis of internal and external operating environment, the company’s fundamentals have not changed significantly in the near future. Investors are kindly requested to invest rationally and pay attention to investment risks.

[Cambrian: Net loss of 443 million yuan in 2024]

Cambrian (688256.SH) released a performance report, achieving operating income of 1.174 billion yuan in 2024, a year-on-year increase of 65.56%, and net profit attributable to owners of the parent company was-443 million yuan. The main reason was the significant increase in operating income during the reporting period compared with the same period of last year and the reversal of credit impairment losses.

[Baotong Technology: Recent exchanges and technical discussions with Yushu Technology are still in progress]

Baotong Technology (300031.SZ) announced abnormal fluctuations in stock trading. As a leading provider of industrial material transportation solutions in China, the company recently conducted exchanges and technical discussions with Hangzhou Yushu Technology Co., Ltd. to explore the innovative application and implementation of industrial robot technology in mining, metal smelting, cement building materials, terminal transfer and other scenarios, and related work is still in progress. At the same time, the company is also concerned that some media platforms have reported related matters, and investors are advised to pay attention to investment risks.

[Ziguang Co., Ltd.: The company is conducting research and demonstration on equity financing in Hong Kong capital market]

Ziguang (000938.SZ) announced that in order to deepen the company’s global strategic layout, accelerate the development of overseas business, enhance the company’s overseas financing capabilities, and further enhance the company’s international brand image, the company is conducting research and demonstration on equity financing in the Hong Kong capital market. As of now, the company has not yet determined a specific timetable or a specific plan. There are still significant uncertainties as to whether the company will implement the above-mentioned matters, as well as the specific implementation plan and implementation time.

[Zhichun Technology: Plans to purchase 83.78% shares of Witton Crystal Phosphorus and resumes trading tomorrow]

Zhichun Technology (603690.SH) announced that the company plans to purchase 83.78% of the shares of Witton Crystal Phosphorus held by 24 counterparties including Beijing Witton International Trading Co., Ltd. and raise matching funds through share issuance and cash payment. After the completion of this transaction, Witton Crystal Phosphorus will become a holding subsidiary of the company. Trading in the company’s shares will resume when the market opens on February 28, 2025. Witton Crystal Phosphorus is a national-level specialized and new “little giant” company mainly engaged in the research and development, production and sales of high-purity electronic materials in the pan-semiconductor fields such as integrated circuits and photovoltaics. This acquisition will help promote the company’s introduction to the high-purity electronic materials business in the field of semiconductors, further improving the company’s business landscape.

[Quanzhi Technology: Net profit in 2024 will increase by 626% year-on-year]

Quanzhi Technology (300458.SZ) released a performance report. In 2024, total operating income will be 2.288 billion yuan, a year-on-year increase of 36.76%, and net profit attributable to shareholders of listed companies will be 167 million yuan, a year-on-year increase of 625.82%. During the reporting period, the company actively seized the opportunity of picking up demand in the downstream market, improved its product matrix, and vigorously expanded the business of vehicle-mounted, industrial, consumer and other product lines. Representative by business lines such as floor sweeping robots, intelligent projection, and pan-security, shipments increased significantly., resulting in a year-on-year increase in operating income of 36.76%, a record high.

[Wall Nuclear Materials: Net profit in 2024 will increase by 22.7% year-on-year]

Wall Nuclear Materials (002130.SZ) released a performance report, achieving total operating income of 6.931 billion yuan in 2024, a year-on-year increase of 21.11%; and achieving net profit attributable to shareholders of listed companies of 860 million yuan, a year-on-year increase of 22.70%. By increasing R & D and market development efforts, as well as improving automation levels and improving production efficiency, the company has achieved an increase in operating income from electronic products, power products, wire products and new energy vehicle business-related products.

[Saiyi Information: Signed a product sales contract for AI China and application pilot projects]

Saiyi Information (300687.SZ) announced that the company recently signed a product project sales contract with customers for AI mid-stage and application pilot projects, with a total contract amount of 48.4692 million yuan including tax. The contract is a daily operating contract of the company and does not meet the disclosure standards. It is voluntary disclosure. The services and products provided by the company to customers focus on AI application scenarios such as intelligent networking development and product design. The content includes end-to-end capabilities such as data processing, large model training and fine-tuning, and AI application development based on AI tool chains, and has access to DeepSeek. The ability to large model.

[Baiji Shenzhou: Operating income in 2025 is expected to be between RMB 35.2 billion and RMB 38.1 billion]

Baiji Shenzhou (688235.SH) announced that its operating income in 2025 is expected to be between RMB 35.2 billion and 38.1 billion yuan. The expectation of strong revenue growth is mainly due to Baiyuze ®’s leading position in the United States and its continued expansion in other important markets in Europe and the world; At the same time, based on the improvement of the company’s product portfolio and production efficiency, the gross profit margin in 2025 is expected to be in the median range of 80% to 90%. It is estimated that the total R & D expenses, sales and management expenses in 2025 will range from RMB 29.5 billion to RMB 31.9 billion.

[7 Days 4 Board Chengbang Shares: Its holding subsidiary, Xincun Electronics, is mainly engaged in the R & D and design of semiconductor memory, etc. The current business scale is relatively small]

Chengbang Shares (603316.SH) issued a stock trading risk warning announcement stating that the company’s stock rose and fell for three consecutive trading days from February 24 to 26, 2025, with a cumulative deviation of 20%, which is an abnormal fluctuation in stock trading. The company expects to achieve operating income of about 360 million yuan in 2024, net profit of about-86 million yuan, and non-net profit of about-89 million yuan, which is still a loss. Dongguan city Xincun Chengbang Technology Co., Ltd.(referred to as Xincun Electronics), a subsidiary of the company, is mainly engaged in the research and development, design, production and sales of semiconductor memories. The current business scale is small. Due to fierce competition in the storage industry, the gross profit margin has been at a low level in the past two years. In 2024, Xincun Electronics expects to contribute operating income and net profit to be about 122 million yuan and 1.02 million yuan respectively, which is in a state of low profit.

[2 Lianban Longxi Co., Ltd.: The company’s fundamentals have not changed. The main business is plain bearings, tapered roller bearings, etc.]

Longxi shares announced abnormal fluctuations in stock trading, saying that the company’s main business is the research and development, production and sales of joint bearings, tapered roller bearings, and gears/gearboxes. The company’s fundamentals have not changed, but since the beginning of this year, facing many difficulties and challenges such as increasingly fierce market competition, rising labor costs and additional tariffs on product exports, the company will proactively take measures to maintain stability in its main business and operating results.

[Zhongwei Company: Net profit in 2024 will be 1.626 billion yuan, down 8.93% year-on-year]

Zhongwei Company released a performance report. In 2024, operating income will be approximately 9.065 billion yuan, a year-on-year increase of 44.73%; net profit will be 1.626 billion yuan, a year-on-year decrease of 8.93%. Among them, the revenue from etching equipment is approximately 7.277 billion yuan, a year-on-year increase of 54.73%; the sales revenue of LPCVD equipment in 2024 is approximately 156 million yuan. In 2024, the company’s R & D investment will be approximately 2.452 billion yuan, a year-on-year increase of 94.31%, accounting for approximately 27.05% of operating income.

[Shengyi Technology: Net profit in 2024 will be 1.744 billion yuan, a year-on-year increase of 49.81%]

Shengyi Technology released its 2024 annual performance report, with total operating income of 20.388 billion yuan, a year-on-year increase of 22.92%; net profit attributable to shareholders of listed companies of 1.744 billion yuan, a year-on-year increase of 49.81%. During the reporting period, the company’s copper clad laminate production and sales increased year-on-year, optimizing the sales structure, resulting in a year-on-year increase in revenue and gross profit margin of copper clad laminate products, driving an increase in profits. Shengyi Electronics Co., Ltd., a subsidiary, achieved a net profit turning around as the market demand for high-level, high-precision, high-density and high-reliability multi-layer printed circuit boards grows.

[Jinshan Office: Net profit in 2024 will be 1.645 billion yuan, a year-on-year increase of 24.84%]

Jinshan Office announced that it will achieve operating income of 5.121 billion yuan in 2024, a year-on-year increase of 12.40%; net profit attributable to owners of the parent company will be 1.645 billion yuan, a year-on-year increase of 24.84%. Focusing on the core strategic direction of “multi-screen, cloud, content, collaboration, AI”, the company continues to increase investment in research and development in the fields of collaboration and AI, promote product iteration and upgrades, and enhance market competitiveness and industry influence.

[Yuncong Technology: Net loss in 2024 is 637 million yuan]

Yuncong Technology released a performance report. In 2024, the company achieved total operating income of 398 million yuan, a year-on-year decrease of 36.60%; the net loss attributable to owners of the parent company was 637 million yuan, compared with a net loss of 643 million yuan in the same period last year. Mainly due to the company’s initiative to promote strategic adjustments in product portfolio and customer structure, the scale of newly signed orders has shrunk in stages. At the same time, in order to strengthen the demonstration effect of some projects, the company took the initiative to transfer the gross profit margin of some projects, dragging down the overall gross profit margin level year-on-year decline. In addition, the depreciation expenses incurred by the company’s purchase of a large number of computing power servers increased year-on-year, increasing the financial burden. Although the expenses during the period decreased year-on-year, under the comprehensive impact, the company’s loss scale was basically the same as that of the previous period.

[Yuntian Lifei: Net loss in 2024 is 573 million yuan]

Yuntian Lifei released a performance report, with total operating income of 918 million yuan in 2024, an increase of 81.42% over the same period last year; a net loss of 573 million yuan. During the reporting period, the company’s main business operations remained stable, and the company increased investment in technology research and development, market expansion, etc. At the same time, in order to seize the development opportunities of the industry and consolidate the competitive advantages of the company’s core technologies, the company continued to increase investment in high-end talents and underlying technologies. During the reporting period, the company’s R & D investment remained at a high level, so the company’s operating gross profit did not cover R & D, etc. Investment, showing a loss. In addition, the company stated that the increase in total operating income in 2024 is mainly due to the increase in sales revenue from smart computing operations and smart hardware products. The income from smart hardware products is mainly due to the newly added controlling grandson company Shenzhen Qiancheng Technology Co., Ltd. in this period.

operating results

[China Micro Semiconductor: Net profit in 2024 will be 135 million yuan, turning losses into profits]

China Micro Semiconductor released a performance report, achieving a total operating income of 911 million yuan in 2024, a year-on-year increase of 27.72%. The net profit attributable to owners of the parent company was 135 million yuan, turning losses into profits. The company stated that the company has effectively strengthened the solution development and service capabilities of brushless motor control and drive chips, improved customer satisfaction, continued to increase new customers and new projects, achieved breakthroughs in the application of artificial intelligence servers and robots, and brushless motor control and drive chip revenue nearly doubled year-on-year.

[Wealth Trend: Net profit in 2024 will be 305 million yuan, a year-on-year decrease of 1.83%]

The Wealth Trend announcement stated that total operating income in 2024 will be 388 million yuan, a year-on-year decrease of 10.71%; net profit attributable to owners of the parent company will be 305 million yuan, a year-on-year decrease of 1.83%. Mainly affected by changes in the macroeconomic environment and reduced demand from institutional customers in the securities market, software and hardware sales revenue and contract amount for this year have been adjusted compared with the previous period, which has a certain impact on the company’s revenue and net profit. The 40% increase in share capital compared with the beginning of the period was due to the company’s conversion of capital reserve to share capital during the reporting period.

[Lianying Medical: Net profit in 2024 will be 1.262 billion yuan, a year-on-year decrease of 36.08%]

Lianying Medical announced that in 2024, it will achieve total operating income of 10.3 billion yuan, a year-on-year decrease of 9.73%; net profit attributable to owners of the parent company will be 1.262 billion yuan, a year-on-year decrease of 36.08%; net profit attributable to owners of the parent company after deducting non-recurring gains and losses will be 1.010 billion yuan, a year-on-year decrease of 39.32%. Mainly affected by the pace of implementation of domestic equipment renewal policies, the overall scale of the industry has shrunk significantly compared with the same period last year. Although the company’s domestic market share remains at a leading level, domestic revenue has still declined compared with the same period last year. At the same time, the company continues to strengthen overseas market development and the introduction of innovative products to achieve sustained and rapid growth in overseas revenue.

[Obi Zhongguang: The net loss for 2024 is 59.9877 million yuan]

Obi Zhongguang released a performance report. The total operating income in 2024 was 562 million yuan, an increase of 56.16% over the same period last year; the net profit attributable to owners of the parent company was-59.9877 million yuan, and the net profit for the same period last year was-276 million yuan. During the reporting period, the company accelerated the promotion of emerging scenarios and continued to enrich and optimize its product structure, achieving rapid scale growth in AIOT and other fields. With the continuous expansion of the downstream market and the smooth commissioning of the company’s 3D visual perception industry intelligent manufacturing base, the company’s production capacity scale and mass production planning pace will continue to improve and optimize.

[Jingke Energy: Net profit in 2024 is 90.5409 million yuan, a year-on-year decrease of 98.78%]

Jingke Energy announced that in 2024, the company achieved total operating income of 92.621 billion yuan, a year-on-year decrease of 21.96%; net profit attributable to owners of the parent company was 90.5409 million yuan, a year-on-year decrease of 98.78%. The main reason was the decline in the price of photovoltaic products, which led to a decline in profit from the main business.

[Junshi Biotech: Net loss in 2024 is 1.282 billion yuan]

Junshi Biotech released a performance report. In 2024, the company achieved total operating income of 1.948 billion yuan, a year-on-year increase of 29.67%; the net loss attributable to owners of the parent company was 1.282 billion yuan, compared with a net loss of 2.283 billion yuan in the same period last year. During the reporting period, operating profit, total profit, net profit attributable to owners of the parent company, net profit attributable to owners of the parent company after deducting non-recurring gains and losses, basic earnings per share, and weighted average return on net assets decreased compared with the loss for the same period last year. This is mainly due to the company’s active implementation of the action plan of “improving quality, efficiency and emphasizing return”, continuing to strengthen various expense control, reducing unit production costs, improving sales efficiency, and focusing resources on more potential R & D projects.

[China Resources Micro: Net profit in 2024 will be 776 million yuan, down 47.55% year-on-year]

China Resources Micro released its performance report, achieving total operating income of 10.119 billion yuan in 2024, a year-on-year increase of 2.2%; net profit of 776 million yuan, a year-on-year decrease of 47.55%; and basic earnings per share of 0.59 yuan. During the reporting period, due to the cumulative effect of production capacity release and industry destocking, product price competition was fierce. At the same time, major company-level projects, such as packaging base projects and 12-inch production line projects in Chongqing and Shenzhen, were in the climbing stage and construction stage respectively. During the period, the depreciation impact of heavy asset investment in the previous period has caused certain pressure on the company’s profit indicators.

[Baiji Shenzhou: Net loss in 2024 will be 4.978 billion yuan]

Baiji Shenzhou (688235.SH) released a performance report, achieving total operating income of 27.214 billion yuan in 2024, a year-on-year increase of 56.2%; net profit loss of 4.978 billion yuan, compared with a loss of 6.716 billion yuan in the same period last year. During the reporting period, the company’s operating profit, total profit and net profit attributable to owners of the parent company excluding non-recurring gains and losses decreased compared with the same period last year, mainly due to the significant increase in product revenue and the improvement of operating efficiency driven by expense management.

[Trina Solar: Net loss in 2024 will be 3.455 billion yuan]

Trina Solar (688599.SH) released a performance report, achieving total operating income of 80.334 billion yuan in 2024, a year-on-year decrease of 29.15%; net profit attributable to owners of the parent company lost 3.455 billion yuan, compared with net profit of 5.531 billion yuan in the same period last year, turning into a loss year-on-year. During the reporting period, the company’s operating profit, total profit, net profit attributable to owners of the parent company, and net profit attributable to owners of the parent company after deducting non-recurring gains and losses decreased by 154.15%, 156.43%, 162.46% and 190.35% respectively. This was mainly due to the year-on-year decline in the selling price of photovoltaic module-related products due to the impact of supply and demand in the photovoltaic industry chain during the reporting period, and the profitability of photovoltaic products declined.

[Daquan Energy: Net profit loss in 2024 will be 2.718 billion yuan]

Daquan Energy (688303.SH) announced that it will achieve operating income of 7.411 billion yuan in 2024, a year-on-year decrease of 54.62%; net profit attributable to shareholders of listed companies will be-2.718 billion yuan. Mainly affected by the decline in polysilicon prices, the company’s performance declined compared with the same period last year.

[Baili Tianheng: Net profit in 2024 will be 3.658 billion yuan, turning losses into profits year-on-year]

Baili Tianheng announced that its total operating income in 2024 will be 5.823 billion yuan, a year-on-year increase of 936.31%; its net profit attributable to owners of the parent company will be 3.658 billion yuan, turning a loss into a profit year-on-year. The main reason is that the company received an irrevocable and non-deductible down payment of US$800 million from Bristol-Myers Squibb, an overseas partner of the core product BL-B01D1, based on the cooperation agreement.

[Baiwei Storage: Net profit in 2024 is 176 million yuan, turning losses into profits year-on-year]

Baiwei Storage (688525.SH) announced that it will achieve operating income of 6.704 billion yuan in 2024, a year-on-year increase of 86.71%; net profit attributable to owners of the parent company will be 176 million yuan, turning a loss into a profit year-on-year. The storage industry is recovering and the company’s business has grown significantly. The company’s representative storage products such as ePOP have performed well and have entered the supply chain system of well-known domestic and foreign AI/AR glasses manufacturers such as Meta, Rokid, Thunderbird Innovation, and Flash, as well as well-known domestic and foreign smart wear manufacturers such as Google, Xiaotiancai, and Xiaomi. With the increase in volume of AI glasses in 2025, the company’s cooperation with key customers such as Meta will continue to deepen, which will promote the continued growth of the company’s smart wearable storage business.

[Lexin Technology: Net profit in 2024 will increase by 150% year-on-year]

Lexin Technology (688018.SH) released a performance report. Total operating income in 2024 will be 2.007 billion yuan, a year-on-year increase of 40.04%; net profit attributable to owners of the parent company will be 340 million yuan, a year-on-year increase of 149.54%. From the application side, core application markets such as smart home, smart lighting, and consumer electronics have achieved a total growth of more than 30%, while emerging application markets such as energy management, tools and equipment, and big health have become more prominent, all showing rapid growth.

stock price change

[Yokogawa Precision: The company is not involved in the humanoid robot business]

Yokogawa Precision (300539.SZ) announced an abnormal fluctuation in stock trading, saying that the company is concerned that the market has paid high attention to concepts related to humanoid robots in the near future. The reducer/actuator products produced by the company are mainly used in home appliances and automobiles, and do not involve humanoid robot business.

[Huapei Power: The wholly-owned robot subsidiary has not yet been established and the relevant business is still in the research and development stage]

Huapei Power (603121.SH) issued an announcement on abnormal fluctuations in stock trading, stating that the company’s stock’s daily closing price increase exceeded the deviation value of more than 20% for three consecutive trading days on February 25, February 26, and February 27, 2025, which belongs to abnormal fluctuations in stock trading. After self-inspection by the company, the company’s overall production and operation conditions are normal, there have been no major adjustments to the internal and external operating environment, and no major changes have occurred in its main business. In addition, the company’s wholly-owned robot subsidiary has not yet been established, and the related business is still in the research and development stage. No sales revenue has been generated and will not have a significant impact on the company’s performance.

[Hangzhou Steel Co., Ltd. in 17 days and 13 boards: The stock price is seriously deviated from fundamentals and there is a high risk of speculation]

Hangzhou iron and steel Co.(600126.SH) issued an announcement on serious abnormal fluctuations and risk warnings in stock trading, saying that since January 22, 2025, the cumulative increase in stocks has reached 217.24%. As of the close of February 27, 2025, the company’s share price was 14.72 yuan, which has been seriously divorced from the company’s fundamentals. The average turnover rate in the last three trading days is 17.48%, which is a high turnover rate, and market sentiment is overheated. There is a high risk of speculation and a risk of short-term stock price decline. The company’s main business is the production and sales of steel and its rolled products, with a very small proportion of computing power business. The company expects to achieve a net profit attributable to owners of the parent company in 2024 of about-630 million yuan, and there will be a loss. The company has no material information that should be disclosed but has not disclosed.

[Tianji Technology: The company has no business cooperation with DeepSeek]

Tianji Technology (300245.SZ) announced that the company focuses on information technology services, mainly including IT solutions and services such as IT support and maintenance services, IT outsourcing services, and IT professional services. The company’s current business activities are normal. There have been no major changes in the company’s business and internal and external operating environment. The company has no business cooperation with DeepSeek.

[5-board large-position technology: The company’s business has not undergone major changes, mainly engaged in IDC business]

Dawei Technology (600589.SH) issued a risk warning announcement stating that the company is an Internet integrated service provider mainly engaged in IDC business, providing customers with cabinet rental services, network transmission and value-added services, and related operation and maintenance services. After self-inspection, the company’s current operating conditions are normal, its main business has not undergone major changes, and the external market environment and industry policies have not undergone major changes. Investors are kindly advised to pay attention to investment risks, make rational decisions, and invest prudently.

Fixed increase financing repurchase

[Haisike: It plans to raise no more than 1.365 billion yuan to invest in new drug research and development projects, etc.]

Haisco announced its plan to issue A shares to specific targets in 2025. The number of shares issued to specific targets this time will not exceed 70,000,000 shares (including the number of shares). Based on the current total share capital of the company, it will not exceed the total share capital before this issuance. 30% of the total share capital. The total amount of funds raised from this issue of shares to specific targets will not exceed 1.365 billion yuan (including the amount). The net amount after deducting issuance expenses is planned to be 965 million yuan for investment in new drug research and development projects, and 400 million yuan will be used to supplement working capital.

[Li Yuanheng: Plans to buy back the company’s shares for 30 million to 40 million yuan for employee stock ownership plans or equity incentives]

Li Yuanheng (688499.SH) announced that Zhou Junxiong, the company’s actual controller, chairman and president, proposed to use his own funds and/or self-raised funds to repurchase the company’s issued shares through a centralized bidding transaction through the Shanghai Stock Exchange trading system. Some RMB ordinary shares (A shares) stocks, and the repurchased company shares are intended to be used for employee stock ownership plans or equity incentives. The total amount of repurchase funds shall not be less than RMB 30 million (inclusive) and shall not exceed RMB 40 million (inclusive), and the upper limit of repurchase price shall not exceed RMB 36.60 per share. The repurchase period shall be 12 months from the date when the board of directors reviewed and approved the share repurchase plan.

Winning the bid was approved

[Fosun Pharma: Holding subsidiary obtained drug clinical trial approval]

Fosun Pharma announced that its holding subsidiary Jiangsu Xingsheng Xinhui Pharmaceutical Co., Ltd. received approval from the State Food and Drug Administration for the use of XS-03 tablets in combination with FOLFOX or FOLFIRI and bevacizumab in the treatment of RAS mutant metastatic colorectal cancer. Approval of clinical trials. Xingsheng Xinhui plans to conduct Phase Ib/II clinical trials of this treatment regimen in China when conditions are met. XS-03 is a small-molecule oral PLK1 inhibitor independently developed by Fosun Pharma. It mainly inhibits cell cycle regulatory factors and induces mitotic arrest, achieving anti-tumor effects of inhibiting tumor cell proliferation and promoting tumor cell apoptosis. As of the date of this announcement, XS-03 as a single agent for the treatment of advanced solid tumors with RAS mutations is in phase I clinical trial in China.

[General Design Institute: The company and its subsidiaries recently won the bid for a total of 656 million yuan in projects]

The General Design Institute (603357.SH) announced that recently, the company and its subsidiaries have received bidding notices for multiple projects, with a total winning bid amount of 656 million yuan.

[Huakang Medical: Won the bid for the construction project of Shanghai Jiao Tong University’s third-level animal biosafety laboratory]

Huakang Medical (301235.SZ) announced that the consortium formed by the company and Bofeite Environmental Technology Co., Ltd. received the “Notice of Acceptance” issued by the bidding agency Shanghai Shenkang Health Infrastructure Management Co., Ltd., confirming the consortium as “Shanghai Jiao Tong University Animal Biosafety Level III Laboratory Construction Project” The winning supplier of the project. The winning bid price is 107.505,452 million yuan. As the leader of the consortium, the company’s estimated share is no less than 100 million yuan. The performance of this project is expected to have a positive impact on the company’s net profit in future years.

[Jianyou Co., Ltd.: The subsidiary obtained FDA approval for the transfer of the production site of Norepinephrine Bitartrate Injection]

Jianyou Co., Ltd.(603707.SH) announced that the company’s subsidiary Meitheal Pharmaceuticals, Inc. received an approval letter issued by the U.S. FDA for the transfer of the production site of norepinephrine bitartrate injection, approving production at the site of the company’s subsidiary Jianjin Pharmaceutical Co., Ltd. The drug is used to treat severe acute hypotension in adults, and there are currently 12 generic drugs on sale in the United States. The company has invested approximately RMB 586,300 in research and development expenses on this project. The newly approved products will be arranged for sale in the United States in the near future, which is expected to have a positive impact on the company’s operating results.

Reduce holdings

[Huashu High-Tech: Xingwang Construction plans to reduce its shareholding by no more than 2%]

Huashu High-Tech (688433.SH) announced that Hunan Xingwang Construction Co., Ltd.(referred to as “Xingwang Construction”), a shareholder holding 21.94% of the shares, plans to reduce its shares in the company through block transactions within 3 months after 15 trading days. More than 8.2834 million shares (accounting for 2% of the company’s total share capital).

[Tanaka Seiki: Rose Capital plans to reduce its shareholding in the company by no more than 1.34%]

Tanaka Seiki (300461.SZ) announced that shareholder Rose Capital Co., Ltd. holds 6.34% of the company’s shares. It plans to reduce its shares in the company it acquired through agreement transfer through block transactions and centralized bidding. It is expected that the reduction of shares will not exceed 2.0805 million shares (accounting for 1.34% of the company’s total share capital).

Transfer and acquisition of investments

[Yapu Co., Ltd.: The wholly-owned subsidiary obtained the designated product sales of the North American automobile main engine factory project are expected to be approximately 3.1 billion yuan during the life cycle]

Yapu announced that its wholly-owned subsidiary Yapu American Automotive Systems Co., Ltd. has received a project designated notice from a North American automobile main engine factory and will provide customers with more than 2 million sets of high-pressure fuel tank systems. The sales volume is expected to be approximately 3.1 billion yuan. This target point demonstrates customers ‘full recognition of the company’s technical capabilities, cost and quality control, and will have a positive impact on the company’s future development in North America. However, the designated notice does not reflect the customer’s final actual purchase quantity, and is based on the order settlement amount.

[Beijing Human Resources: The transaction price of 100% equity of the proposed subsidiary Huangsi Company shall not be less than 441 million yuan]

Beijing Human Resources (600861.SH) announced that the company plans to transfer 100% equity of a wholly-owned subsidiary Beijing Urban and Rural Huangsi Commercial Building Co., Ltd. to a related party Beijing Jingguoguan Real Estate Investment Co., Ltd. through an agreement transfer, at a transfer price of no less than 440.7115 million yuan. Real Estate Investment is a wholly-owned subsidiary of Beijing State-owned Capital Operation and Management Co., Ltd., the company’s controlling shareholder. This transaction constitutes a connected transaction.

[Changqing Group: Signed a strategic cooperation framework agreement with Zhongke Credit Control (Beijing) Technology Company]

Changqing Group (002616.SZ) announced that the company and Zhongke Credit Control (Beijing) Technology Co., Ltd. signed the “Strategic Cooperation Framework Agreement” on February 26. The two sides hope to jointly promote digital transformation and intelligent upgrading of their industries through cooperation, empower the sustainable development of the industry, and extend to areas in need. The two parties to the transaction also made it clear in the framework agreement that both parties agreed that the company would transfer a 49% stake in Beijing Zhongke Credit Control Big Data Co., Ltd.

[Huaxin New Materials: The subsidiary plans to invest 80 million yuan to build a functional membrane material project with an annual output of 5000 tons]

Huaxin New Materials announced that Huaxin High-tech, a wholly-owned subsidiary of the company, plans to invest 80 million yuan to build a “5000-ton functional membrane material project with an annual output”, and the project construction cycle is expected to be 18 months. The main body of the project is Huaxin High-tech, and the construction site is located in the east factory area of Zhujiang Road Company in Xiyi High-tech Zone, Xinyi City, Jiangsu Province. The project funding source is Huaxin High-tech’s own funds or self-raised funds. The project aims to optimize and adjust the product structure, expand business scale, and enhance the company’s core competitiveness and sustainable development capabilities.

other

[Delisting Zhuolang: Termination of listing of company shares]

Delisting Zhuolang (600225.SH) announced that the company’s shares will enter the delisting consolidation period on February 7, 2025. As of February 27, 2025, the transaction has been completed for 15 trading days, and the delisting consolidation period has ended. The Shanghai Stock Exchange will delist the company’s shares on March 6, 2025, and the company’s shares will be terminated. The company will be transferred to the National Small and Medium-sized Enterprise Share Transfer System and the two network companies and delisted companies that were established and managed by the original securities company agency share transfer system for listing and transfer. The host brokerage company is Tianfeng Securities Co., Ltd.

[BOE A: Holding subsidiary BOE Energy has been approved for listing on the New Third Board]

BOE A(000725.SZ) announced that the company’s controlling subsidiary, BOE Energy Technology Co., Ltd.(referred to as “BOE Energy”), recently received the “Letter on Agree to the Public Transfer of Shares of BOE Energy Technology Co., Ltd. and Listing in the National Stock Transfer System” from the National Stock Transfer Company. After BOE Energy was listed on the New Third Board, it remains a controlling subsidiary within the scope of the company’s consolidated statements.