Who can debut in the C position of women’s clothing on e-commerce?

The hidden king of e-commerce women’s clothing, the “Four King Kong” holds tens of millions of middle-class girls ‘wallets

author| Temperature Ji Jiangwang

While you are still deterred from the prices of so-called old-money brands such as Maxmara, The Row, Loro Piana, and LEMAIR, and while you are waiting for classic brands such as Theory, ICICLE, Uma Wang, and Editon to sell at a discount, a group of domestic black horses hidden on e-commerce platforms have quietly invaded the wardrobes of middle-class girls in Beijing, Shanghai and Guangzhou.

In 2024, fans dubbed the four major kings of e-commerce women’s clothing, CHICJOC, KEIGAN, UNICA, and MARIUS (the last one may be replaced by CEST M), have won sales of more than 5 billion yuan throughout the year, with unit prices ranging from several hundred to tens of thousands of customers. Behind this is the madness of countless girls who are just new.

Instead of looking for celebrity endorsements or co-branding gimmicks, they started out as an obscure e-commerce company, using versions and fabrics as selling points, shouting the slogan of a thousand yuan versus a ten thousand yuan, and going from online to offline and even overseas, allowing High-end shopping centers such as Nanjing Deji, Shanghai Henglong, and Chengdu IFS are opening their arms to women’s e-commerce brands that were once at the bottom of the chain of contempt.

It is a consensus that e-commerce women’s clothing is not easy to do, but the rising phenomenon of the four major families has brought shock to the women’s clothing market. However, this quality-to-price revolution also has hidden flaws: when imitators reproduce the same models at half price, when popular designs become assembly line operations, can the simple luxury upstarts killed from e-commerce truly shake the contempt chain of traditional luxury goods? The answer may be hidden in your shopping cart tomorrow.

Women’s clothing, a new force in the Red Sea

In a live broadcast, the turnover was 62.4 million yuan, with 1 single product exceeding 10 million yuan, 3 single products exceeding 5 million yuan, 12 single products exceeding 1 million yuan, and the average price of a single product being 6000 yuan. Although few people outside the circle know about it, looking back at China’s women’s clothing market in 2024, we have to mention these amazing numbers.

During last year’s Double 11 period, CHICJOC teamed up with Taobao’s “Super Fashion Release” to create a clothing live broadcast called Intelligent Wardrobe, which overtook the top live broadcast rooms such as Li Jiaqi and all girls ‘wardrobes to top the Taobao list. 1.

The live broadcast transaction volume of CHICJOC’s single store that night not only created a single-day transaction peak in the 11 years since its store opened, but also set a record high in single-day store transaction volume in the Taobao apparel industry.

Live results of the CHICJOC Super Conference

Later, Kaijian Keigan, which is also one of the four major shopping stores in the Amoy department, created a live broadcast of a fashion art exhibition with the theme of “Free Singing” and achieved a turnover of 40 million yuan, which also broke the brand’s store live broadcast transaction history. Record, the growth of on-site visitors and fans also set a new record for the brand’s own broadcast, and 13 million-dollar items were also born.

Seeing how lively Taobao live broadcast was, Douyin E-commerce couldn’t sit still and hurriedly moved the show to the clothing live broadcast room.

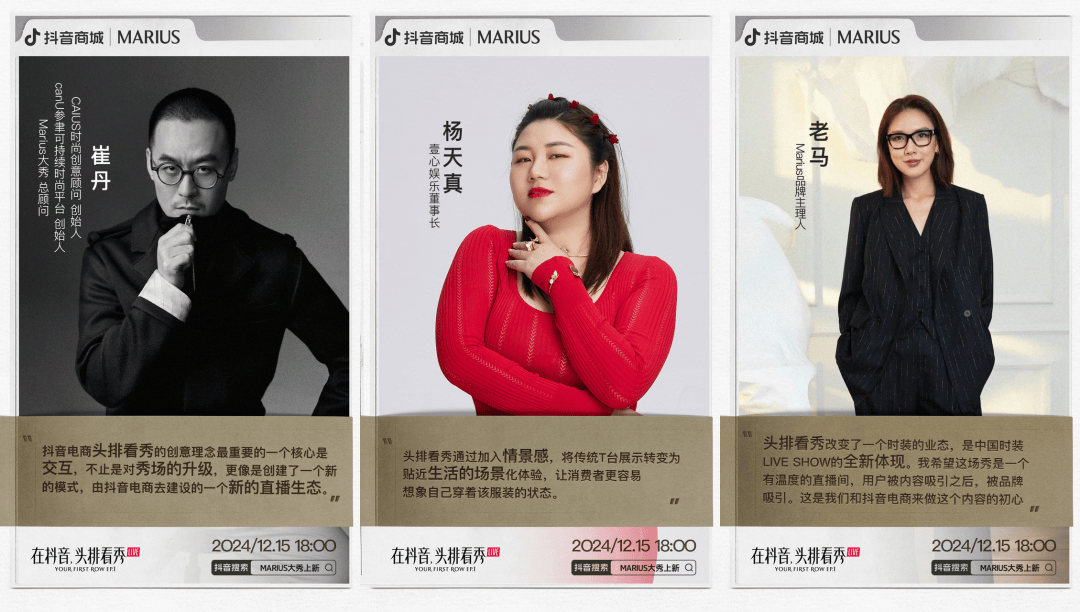

Through Douyin’s “Front Row Show” project, MARIUS not only shocked the audience with an “immersive theater” live show, but also took Yang Tianzhen, Lao Ma and the company’s employee No. 002 and the old tailor to chat about women’s power and entrepreneurship during the live broadcast, constantly creating topics and creating popularity.

In the end, the total number of viewers in the live broadcast room on the day of the big show reached 1.14 million, with a month-on-month increase of 543%, and a single increase of 41,000 new fans; the search PV exceeded 57,000, with a burst factor of 921%. During the event, the brand paid GMV 50 million +.

“The four major kings have their own layouts and activities on Taobao and Douyin

Behind this string of numbers, it is not difficult to find that in the soil of e-commerce and live broadcast rooms, a group of brands have emerged that do not follow the route of large price, hawking and shouting, and are both fashionable and tonality.

The four major golfers of Amoy women’s clothing, led by CHICJOC, are the best among these brands. In just a few years, they have developed from small stores to large merchants with a size of more than one billion. They position their style as minimalist and light luxury, with their main selling points being fabrics and tailoring, serving high-priced and unaffordable people who pursue high quality and comfort; their common user portrait is that of focusing on high quality, pursuing a sense of fashion, and having a relatively high economic level. High-level high-tech women and professional elites.

At present, on the Taobao platform, in addition to the young MARUIS, who has 65.2W fans, the fans of Keigan and UNICA are both around 200W. The most popular CHICJOC has close to 300W fans. There is also CEST M, which has a high popularity recently, which also has more than 45W fans.

Every store displays suits, coats, coats, windbreakers, shirts, skirts, trousers, T-shirts, vests and other basic style items that meet the needs of urban women. Every detail page is full of design ideas, fabric introductions, process details, etc. From time to time, you can also see imported goods customs declarations from the customs, as well as quality inspection reports on various fabrics, to prove the authenticity of their origin and quality.

Source: CHICJOC Taobao Store

“120S wool OTW Japan seamless, Peru’s top 100% alpaca albaca alpaca alpaca wool, top yak wool loop yarn… The copy on the details page is full of introductions to the source, optimization, and craftsmanship of the fabric. It is not so much in the clothing store as in the Fabric Grand View Garden. Especially in autumn and winter, it is a paradise for all kinds of expensive fabrics such as cashmere, alpaca wool, and even fur.

Those girls born in the 1980s and 1990s who once accompanied Taobao’s women’s clothing have long reached the age of financial independence. They bid farewell to the early Taobao women’s clothing that came out of Hangzhou Sijiqing, such as the early Internet celebrities, Zhang Dayi, and Sydney. They have also begun to have a new high-quality brand.

Compared with the scene where big brands sell polyester fiber at sky-high prices, JOCs do seem to have a high-quality price ratio. Therefore, even if the price band spans a large range of hundreds to tens of thousands, and the average price is several thousand yuan, customers who love them still call it a luxury brand parity.

The size of China’s clothing market is about 2 trillion yuan, with Taobao and Douyin accounting for 60%. There are only more than 20 Taobao women’s clothing stores with a GMV of more than 1 billion yuan a year. The C position of women’s clothing brands always turns, but at least for now, it is the world where middle-class girls hold the four kings.

How did the Four Great Kings of Women become popular?

“Consumption more than 20 W in the room a year.& rdquo;

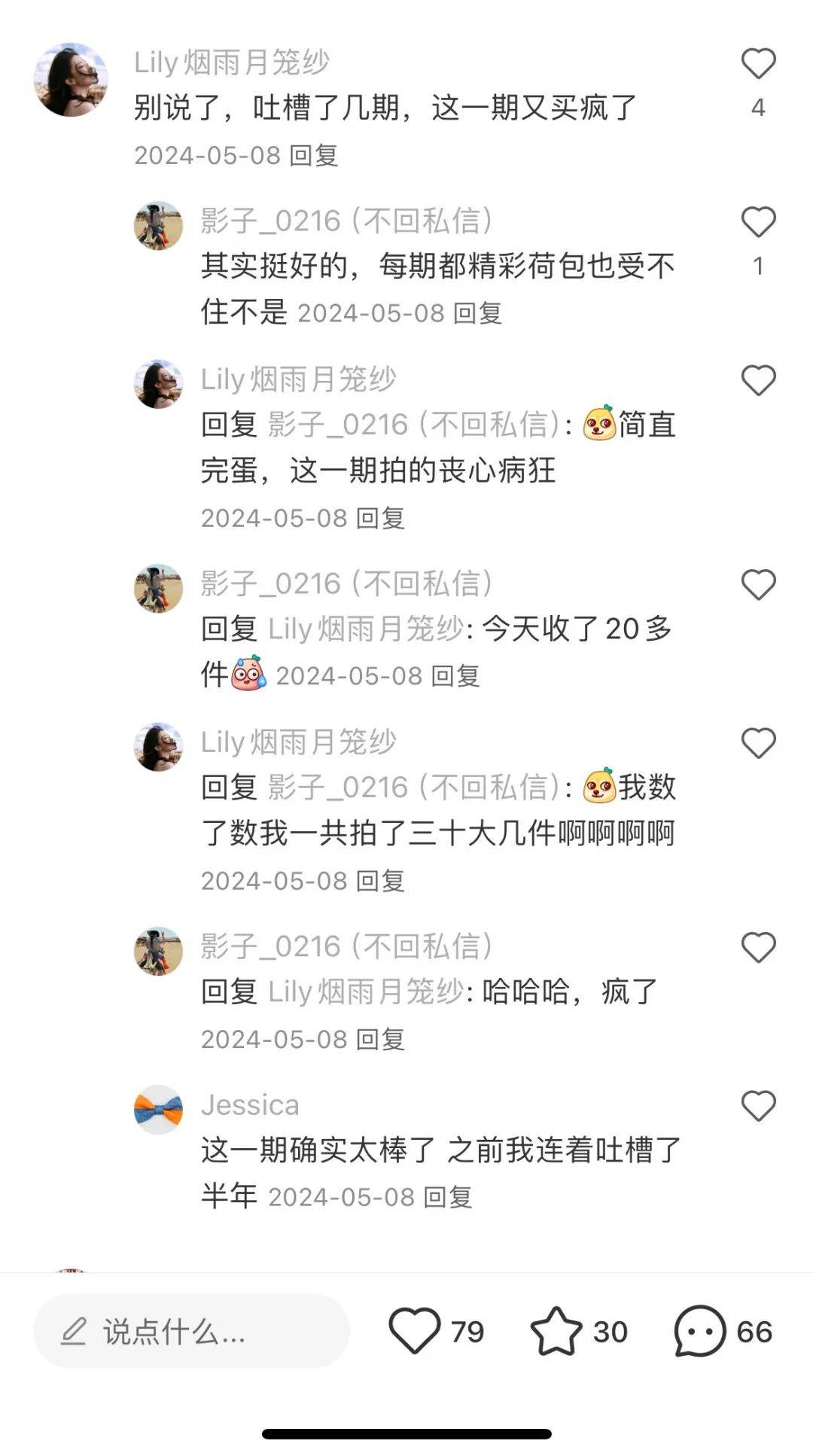

“I complained about several issues, but this issue went crazy again. Today, I took several 30s.& rdquo;

“MARIUS, I bought 15W in 5 months, and I am generally satisfied.& rdquo;

“JOC entered the pit at the end of 2016, and spent 100,000 yuan a year in 2017.& rdquo;

On Xiaohongshu, you can see true love fans of brands such as CHICJOC, KEIGAN, UNICA, MARIUS, and CEST M everywhere. There are many customers who buy dozens of new models and spend hundreds of thousands of pieces a year. The consumption power of its customer base is amazing.& ldquo; The key reason why the four major families have attracted so many hardcore fans is that they have captured the consumer psychology of the target audience and utilized the platform traffic that has the largest intersection with their users.

Many female fans must buy every new item

“Quality awakening is one of the most significant consumption trends at the moment. Under the baptism of fierce market competition from e-commerce for years, a large number of consumers are reluctant to pay for excessive brand premiums. At the same time, more and more rational and pragmatic consumers are no longer simply pursuing cost performance, even if they have strong purchasing power. High-end people are also more interested in the quality price ratio, which is why the four major families were able to break out of many Taobao stores in the first place.

Lou Chen, founder of CHICJOC, once said in an interview that CHICJOC uses the best raw materials, with the greatest sincerity and the lowest rate, and is selling the same quality as luxury goods at an equal price.

In the apparel industry, multiplier refers to the extent of the difference between retail price and cost price. According to industry insiders, the price increase rate of fast fashion brands such as Uniqlo on the market is usually about 2-3 times, and the price increase rate of mass apparel brands is about 2-5 times; the price increase rate of high-end luxury brands is generally relatively high, which can reach 10-20 times or even higher. In the early days, CHICJOC’s clothing mark-up factor was about 2.5. Generally, the lower the factor, the higher the quality-to-price ratio of the product.

In short, luxury quality and price parity are the current core competitiveness of JOCs. MARIUS Lao Ma also revealed in an interview: Many of our fabrics are homologous fabrics of LV, Chanel, Dior and other brands, and international face accessories account for nearly half.& rdquo;

In addition to working hard on product competitiveness such as fabrics, layouts, and prices, the rise of the four major families is also positively related to their efforts in content marketing on social platforms.

For example, Zhou Dudu, founder of Kaijian KEIGAN, and Lao Ma, founder of MARIUS, are all famous people. They operate personal accounts on social media platforms such as Douyin, Xiaohongshu, and Weibo, and continue to convey popularity and momentum to the brand. In addition to traditional e-commerce platform operations, they also pay great attention to social channels. Before various new and live broadcast activities, they conduct targeted private domain operations and conversions between fan groups and regular customers to attract precise customers to return to the live broadcast room.

At present, on Xiaohongshu, which has the most concentrated target audience, the number of page views on topics with the CHICJOC tag has exceeded 140 million, the number of page views on topics with the Keigan tag has exceeded 84 million, and the number of page views on topics with the UNICA tag has nearly 80 million. Marius, which has the shortest debut time, also has nearly 30 million data. The content of the notes mainly includes wearing sharing, unpacking of new products and evaluation content. In addition to consumers ‘spontaneous sharing, a large number of grass planting promotion is hidden.

Xiao Hongshu has many full-time bloggers who are dressed as the Four Great Kings

Bloggers are responsible for releasing a comprehensive review of new products after each brand is launched, analyzing them from the perspectives of fabric, layout, design, etc. to strengthen consumer trust; KOCs will combine the current season’s popularity and use new products to create various styling guidelines for various scenarios to further stimulate consumers ‘desire to buy.

But in addition to the overwhelming grass planting content, there are also endless discussions on the four major kings on social platforms.

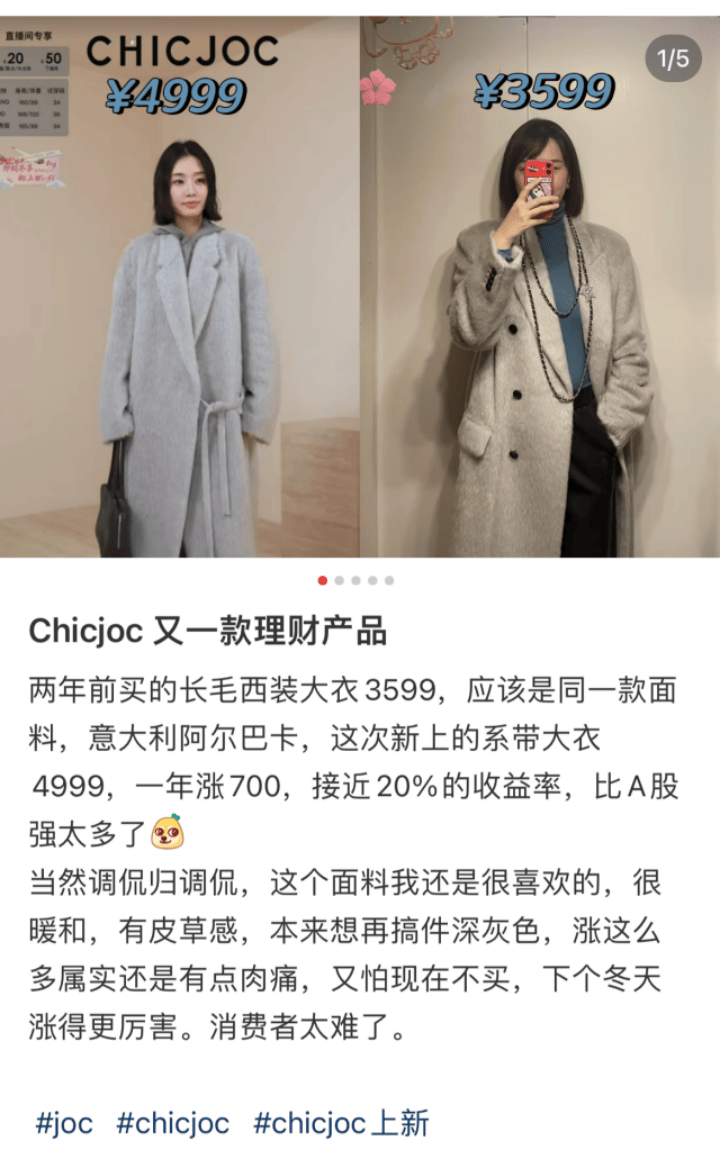

Xiaohongshu netizens complain about price increases

The most common criticism is originality. With the titles of The Row, Loro Piana, Toteme, Maxmara, MiuMiu and other international luxury brands, the Four King Kong have really attracted many loyal fans, but long-term product homogenization has made consumers feel visually tired, and the overly neutral and Oversize version also limits their customer base.

Two stores launched similar windbreakers at the same time, both from an international brand

After CHIC JOC entered the offline market, many consumers compared it on the spot and believed that there was still a gap between the quality of its products and the mid-to-high-end women’s clothing brands in the mall, and that the fabrics and tailoring were not as high-quality as its copywriting advertised.

E-commerce brands that rely on the ratio of quality to price are not irreplaceable. If they lose their fundamental advantages, it will only be a matter of time before they are abandoned by consumers.

Is large-scale expansion a new way out?

Faced with such a sense of crisis, CHICJOC is trying to break away from its identity as an Taobao brand and enhance its brand power through offline store expansion and overseas exploration.

In May 2022, CHICJOC opened the world’s first brand flagship store in Nanjing Deji Plaza. Since then, it has successively opened offline stores in high-end shopping malls in Wuhan, Hangzhou, Shanghai, Beijing and other cities. So far, there are more than 40 in total. Offline stores.

During this period, fast fashion brands such as Uniqlo and ZARA are gradually reducing the number of offline stores, and store closures in the entire clothing market are still the mainstream. However, through two years of omni-channel expansion, CHICJOC has widened the gap with its previous competitors and firmly ranked first among the four major kings.

On November 15, 2024, CHICJOC’s first overseas offline direct store grandly opened at the Beverly Center, a famous fashion landmark in Los Angeles, USA. Soon after, it entered Fashion Island, a high-end shopping mall in California.

CHICJOC store in Newport Beach, California, USA

In fact, overseas fans of CHIC JOC had contributed 3% of sales even before going to sea, but these users needed to purchase products through transfer stations. In the same year, CHICJOC opened an independent overseas website, achieving global distribution service coverage, making it easier for overseas fans to purchase products. In order to open up brand awareness, CHIC JOC also opened accounts on social media websites such as Insgram to serve as a traffic window for brand marketing promotion, demonstrating its determination to expand its global footprint.

In overseas markets, the price of CHICJOC ranges from US$130 to US$1200, slightly higher than the domestic market. In China, relying on a specific consumer environment that seeks to replace big brands, despite its lack of brand core and original capabilities, CHIC JOC can still rely on integration capabilities and scale effects to win with high-quality fabrics and affordable prices. However, in completely different overseas markets, the development of brands without recognition is undoubtedly difficult. Whether this consumption logic will work is unknown.

Coincidentally, MARIUS, which also followed Taobao to sea, also announced that it would open its first offline store in Nanjing Deji, and would later deploy in cities such as Wuxi and Shanghai. Founder Ma Rui will create China’s own LV vision as his own goal.

conclusion

In the future, what lies ahead of these brands will still be how to build their core values in addition to the quality-price ratio?

The short-term advantages gained by relying on imported fabrics and replica replicas of classic models are not irreplaceable; the original design is insufficient and the product is seriously homogenized, and it is difficult to defend against the impact of latecomers. Once a fresher imitator appears, consumers will quickly shift their goals.

And like CHOICJOC, from online to offline, from domestic to global, first expand large-scale to seize the market, and then go back to increase popularity, gradually adjust and reduce losses. This curved form of saving the country is a good way, but consumers are increasingly dissatisfied with price increases, which shows that this is also a path full of unknowns.

But no matter what, these are the only ways for brand development, and everything will be discussed first at the table.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.