① 18 billion yuan was withdrawn from the A500. Why did the funds turn?

② Technology diversion, customer redemption and sales guidance are the three main reasons for capital outflow;

③ On the 24th, Cathay Pacific, ICBC and many others reported the A500 enhanced ETF again to welcome the issuance war?

Financial News Agency, February 24 (Reporter Yan Jun)Under the investment style of the technology industry, funds are withdrawing from broad-based ETFs, among which, the 2024 block-based China Securities A500ETF performs the most significantly.

Let’s first look at a set of data. wind shows that as of February 21, the 29 China Securities A500 ETFs have a total outflow of 4.7 billion yuan this year. The funds mainly flowed out after the Spring Festival, with only the net outflow from February 5 to 21. 18 billion yuan. The latest scale of the 29 China Securities A500 ETFs is 267.098 billion yuan.

Since the Spring Festival (February 5 – 24), the China Securities A500 Index has increased by 5.51%, but the capital outflow has exceeded 18 billion yuan. What are the reasons?

After the Spring Festival, 18 billion yuan flowed out of the China Securities A500ETF

Even in the present, the issuance of the China Securities A500ETF is phenomenal, unprecedented and difficult to come after.

Since September 7, 2024, the first batch of 10 China Securities A500 ETFs have appeared on the issuance market. So far, a total of 78 China Securities A500 products have been issued, raising a total of 1.569.093 billion yuan. Including the initial launch scale of China Securities A500 linked funds under Guangfa and E Fund, the initial launch scale of China Securities A500 ETF-linked funds such as Invesco Great Wall, Nanfang, Taikang, and Jiashi exceeded 5 billion yuan. There are also eight companies including China Merchants, ICBC, and Fuguo, which raised more than 3 billion yuan.

The phenomenal level of the A500 is also reflected in the growth in the size of ETFs after listing. In only 7 trading days after listing, the size of the first batch of 10 China Securities A500 ETFs has nearly doubled. The scale of the 10 CSI A500 ETFs reached 39.004 billion yuan, an increase of 98% and 95% respectively compared with the 20 billion yuan at the beginning of listing. Among them, Cathay Pacific China Securities A500ETF became the first 10 billion ETF in the China Securities A series index, an increase of more than 400%.

At the beginning of November 2024, the scale of funds related to the CSI A500 Index was close to 120 billion yuan. On the 25th of the same month, the scale of 21 on-site CSI A500 ETFs exceeded 200 billion yuan, and the number of products of a single 10 billion yuan reached 11. In one fell swoop, it became the second largest broad-based ETF after the Shanghai and Shenzhen 300. By the end of 2024, the total size of the 22 CSI A500 ETFs exceeded 250 billion yuan. By February 2025, the total share of 70 listed A500-related funds exceeds 300 billion.

However, fund companies ‘layout of broad-based products and investors’ enthusiasm for broad-based products were disrupted by the market after the Spring Festival.

As of February 21, 29 China Securities A500 ETFs had a total outflow of 18.07 billion yuan after the Spring Festival. The first batch of China Securities A500 ETFs established were the “hardest hit areas” for capital outflows.

Specifically, the Cathay Pacific China Securities A500 ETF, which has the largest market size, has a large outflow. After the Spring Festival, the net outflow of funds was 3.778 billion yuan, with an outflow of approximately 2.2 billion yuan during the year; followed by the China Merchants China Securities A500 ETF, which has an outflow of 1.44 billion yuan after the Spring Festival. In addition, Bosch and Yinhua also had an outflow of approximately 900 million yuan. Most ETFs have net outflows between 300 million and 600 million.

It is worth noting that China China Securities A500ETF is the only China Securities A500ETF that has maintained its scale after the Spring Festival, with a net capital inflow of approximately 20 million yuan. As of February 21, the latest scale of China China Securities A500ETF is 21.019 billion yuan, ranking fourth in scale, second only to Cathay Pacific, Nanfang and Guangfa China Securities A500 ETFs.

Judging from the recent transaction volume, we can also see China’s efforts in this product. China Securities A500ETF has recently surpassed many giant Shanghai and Shenzhen 300 ETFs in transactions many times, ranking first in A-share ETF turnover. The industry believes that there may be increased market-making.

It is worth noting that judging from the discount and premium situation of the A500ETF on February 24, selling is still continuing.

Three major reasons have led to the diversion of China Securities A500ETF funds

Many market participants have also observed the redemption phenomenon of China Securities A500ETF. It is not difficult to analyze the reasons:

First, the market-making effect is concentrated in the technology sector, especially in artificial intelligence and its application fields such as humanoid robots, cloud computing, games, media, and data. In comparison, the broad-based increase is lagging behind, forming a siphon effect on funds.

Second, with this wave of market repairs, the net value of the China Securities A500ETF has returned to above the water surface, and the willingness to redeem has increased. As of February 24, among the 29 China Securities A500 ETFs on the market, only 8 were below the water surface, that is, the net value was less than 1.

But is redemption always a bad thing? Some fund companies also said that under this wave of market conditions, investors have regained their capital or made money, and choosing to redeem may not necessarily be regarded as a bad thing. The original intention of managing a company is to provide instrumental products to investors, not AUM.

Third, ETFs such as the Science and Technology Innovation Composite Index and artificial intelligence have been newly launched, and the momentum of “redemption of old and buying new” sales has resurfaced. The old disease of Star Fund Manager Times Bank selling proactive products has resurfaced in the sales of ETFs by securities firms.

This phenomenon has already appeared in the previous sales of China Securities A500. At that time, there were sales that guided customers to redeem their funds from the Shanghai and Shenzhen 300 ETFs and subscribed for the China Securities A500 ETFs. The phrase of the “new generation flagship broad-base ETF” was used by many fund companies as a marketing phrase. It is time for this year’s Science and Technology Innovation Composite Index to be issued. Thirteen products were launched together. Under the pressure of sales from securities firms, they guided client funds to withdraw from the Shanghai and Shenzhen 300 ETFs and the China Securities A500 ETFs. It is not uncommon to subscribe for the Science and Technology Innovation Index ETF.

Several companies have reported A500 enhanced ETFs

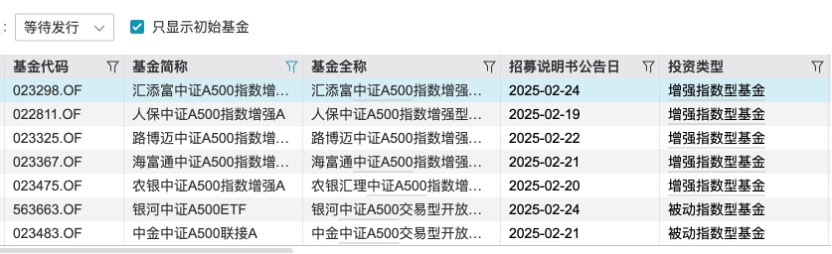

Although the A500ETF already has a leading company, the layout is not over. As of now, 140 China Securities A500 online management funds have been reported across the market, and 15 products have been approved for release or are in the process of release.

Fund companies believe that the theme market does not affect the company’s layout of the broad-based index. Both leading companies and small and medium-sized fund companies have a consensus on this. The difference is that when small and medium-sized fund companies are unable to fund ETFs, they are more inclined to issue and manage index-enhanced products through quantitative and other blessings, in order to gain investors ‘recognition through the demonstration of excess capabilities.

In this regard, wholly foreign-owned public offerings also have advantages. Take BlackRock and Lubemater as examples, relying on the quantitative capabilities of foreign shareholders to provide domestic investors with different products.

The Lubrimai Fund, which is issuing a CSIS A500 index increase, said that Lubrimai has significant advantages in data and technology. In addition to traditional volume-price data, Lubemai also introduced alternative data such as industrial chain data to enrich data sources. At the same time, the company purchased a large number of high-performance GPUs for efficient training and optimization of models, ensuring that models can process massive amounts of data and quickly adapt to market changes.

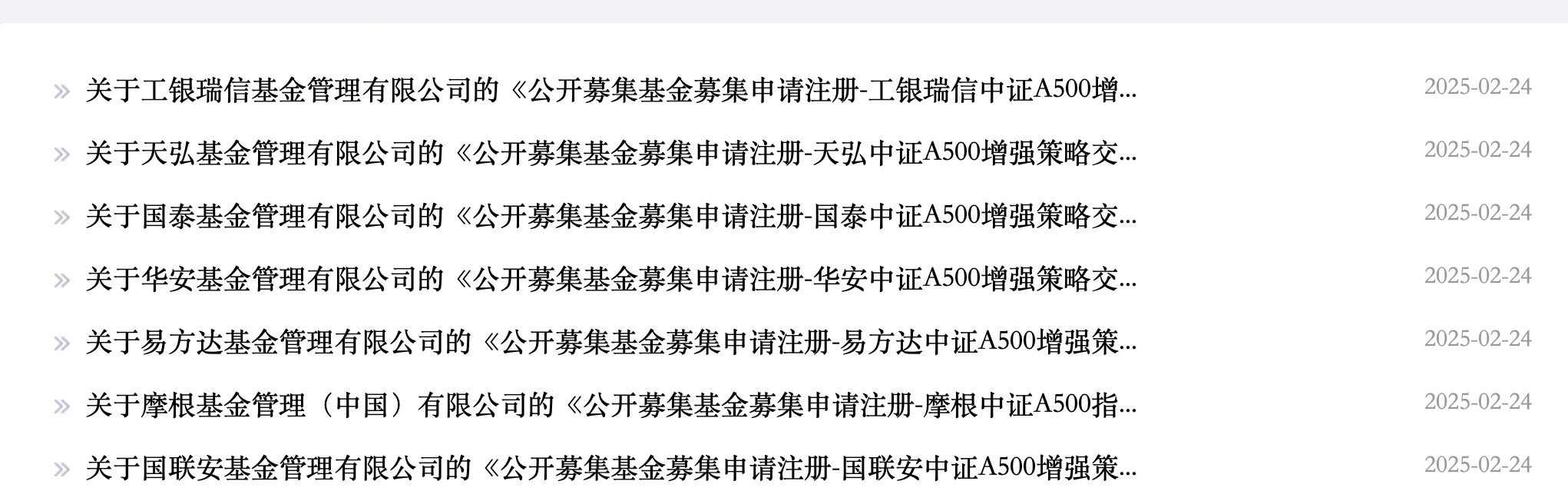

On the other hand, big factories are simple and crude, and ETF and index are strengthened. On February 24, many companies including Cathay Pacific, ICBC, Tianhong, Hua ‘an, Yifangda, Morgan and Guolianan reported the China Securities A500 enhanced strategy ETF.

Cathay Pacific Fund pointed out that the China Securities A500 Index introduced industry balance standards when compiling, and most of its constituent stocks are industry leaders and have strong profitability. Moreover, the volatility and liquidity of this index are relatively moderate, making it more suitable for building a quantitative enhancement strategy. Enhanced ETFs are a type of actively managed ETFs and have the dual advantages of index enhancement and on-site trading.