Enjoy important bond market announcements, seize opportunities, and effectively lightning protection.

[Hongda debt refund: The resale amount is 91.65 million yuan. Due to insufficient working capital of the company, the principal and interest of the resale cannot be paid]

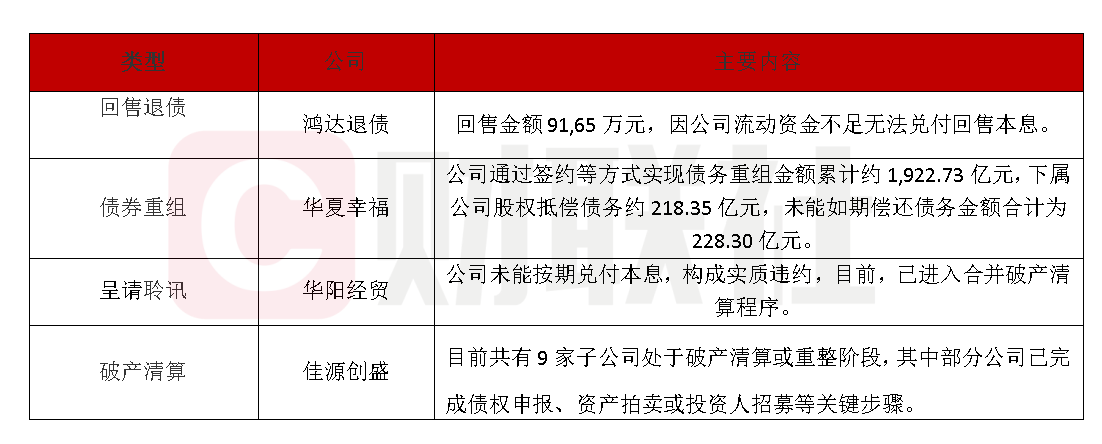

Hongda Industrial Co., Ltd. issued an announcement on the results of the resale of “Hongda Debt Refund”. The number of applications for this resale is 908,306, and the resale amount is 91.65 million yuan (including current interest and tax). Due to insufficient working capital of the company, it was unable to pay the principal and interest of the resale. The company will apply to terminate this resale business and lift the bond custody freeze. Relevant rights holders can safeguard their rights and interests through judicial channels.

Hongda Xingye’s surviving bonds are the above-mentioned convertible bonds, with a stock size of 337 million yuan.

[Huaxia Happiness: The progress of debt restructuring and the cumulative amount of debt failure to repay as scheduled total 22.830 billion yuan]

Huaxia Happiness Foundation Co., Ltd. released an announcement on the progress of debt restructuring as of January 31, 2025, showing that the total amount of debt restructuring achieved through contract signing and other methods is approximately 192.273 billion yuan, and at the same time, approximately 21.835 billion yuan of debts are paid off with equity of subsidiary companies. In addition, the company’s cumulative failure to repay debts as scheduled totaled 22.830 billion yuan. During this period, the total amount of new litigation and arbitration involved was 544 million yuan, and relevant cases are still in progress.

Huaxia Happiness has 14 existing bonds, with a bond stock of 28.553 billion yuan, of which 6 bonds have defaulted, with a bond default amount of 14.8 billion yuan.

[14 Huayang Economic and Trade MTN001, 15 Huayang Economic and Trade MTN001 Progress in Default: Physical asset evaluation and auction are being promoted]

The “14 Huayang Economic and Trade MTN001” and “15 Huayang Economic and Trade MTN001” issued by China Huayang Economic and Trade Group Co., Ltd. failed to pay the principal and interest on schedule, constituting a material breach of contract (the amount of default was 1.6 billion yuan). At present, the company has entered the consolidated bankruptcy liquidation process. In January 2025, the manager is promoting the evaluation and auction of physical assets, and has filed a case to resolve the equity holding dispute. At the same time, relevant criminal cases are in the review and prosecution stage.

Huayang Economic and Trade has 7 defaulted bonds, with a defaulted amount of 6.766 billion yuan.

[Jiayuan Chuangsheng Holding Group: 9 subsidiaries are in the stage of bankruptcy liquidation or reorganization]

Jiayuan Chuangsheng Holding Group issued an announcement on the progress of the bankruptcy of its subsidiaries. As of February 18, 2025, Cangnan Guoyuan Real Estate Development Co., Ltd. has entered bankruptcy liquidation procedures. Currently, a total of 9 subsidiaries are in the bankruptcy liquidation or reorganization stage, and some of them have completed key steps such as creditor’s rights declaration, asset auction or investor recruitment.

Jiayuan Chuangsheng Holding Group Co., Ltd. previously announced on January 9 that due to the company’s liquidity constraints and debt risks, some financial institutions and partners have filed lawsuits against the company and its subsidiaries. The company has recently added a new defendant and the amount involved exceeds RMB 50 million in major litigation matters, as well as due to issues such as failure to disclose important information and failure to disclose annual reports on time, The company and relevant responsible personnel were taken by the Zhejiang Regulatory Bureau of the China Securities Regulatory Commission to issue a warning letter.

Jiayuan Chuangsheng has 4 existing bonds, with a bond stock of 591 million yuan.