Enter before others notice and exit before everyone knows.

Author:Foxi (DeFi / AI)

Compiled by: Shenchao TechFlow

Someone has to do this!

I have created the ultimate Sonic guide for everyone (especially those who are not familiar with DeFi Flywheel).

@AndreCronjeTech has been recommending more than 20 projects every day recently, and I have selected some high-quality projects worthy of attention to share with you.

I first came into contact with cryptocurrencies during the 2020 DeFi Summer craze, and now I am very excited to see AC and its chain back!

This article will delve into the latest developments in Sonic like previous tutorials. However, before we start officially, I will introduce newcomers to the possible risks of participating in the DeFi Flywheel ecosystem.

Important reminder: I will not be responsible for your investment losses, but I hope this article will help you understand DeFi Flywheel’s mechanisms.

(If you just want to know about CA, you can just skip to Part 4.)

This article includes the following:

I. Flywheel = Ponzi scheme?When to quit?

II. What is Sonic and why choose Sonic?

III. The new Tokenomics

IV. Select ecosystem opportunities (recommended by Foxi)

I. Flywheel = Ponzi scheme? When to quit?

Among the core mechanisms of many DeFi Flywheel, there is a common phenomenon:There is a mismatch between the investment time of capital and its true value recognized by the market.This phenomenon can be simply summarized as——“Enter before others notice and exit before everyone knows.”

Early liquidity injections often generate potential energy that attracts more users to participate, creating a self-reinforcing growth cycle. Simply put, early participants can gain compound benefits through the accumulation of liquidity and the improvement of system awareness.

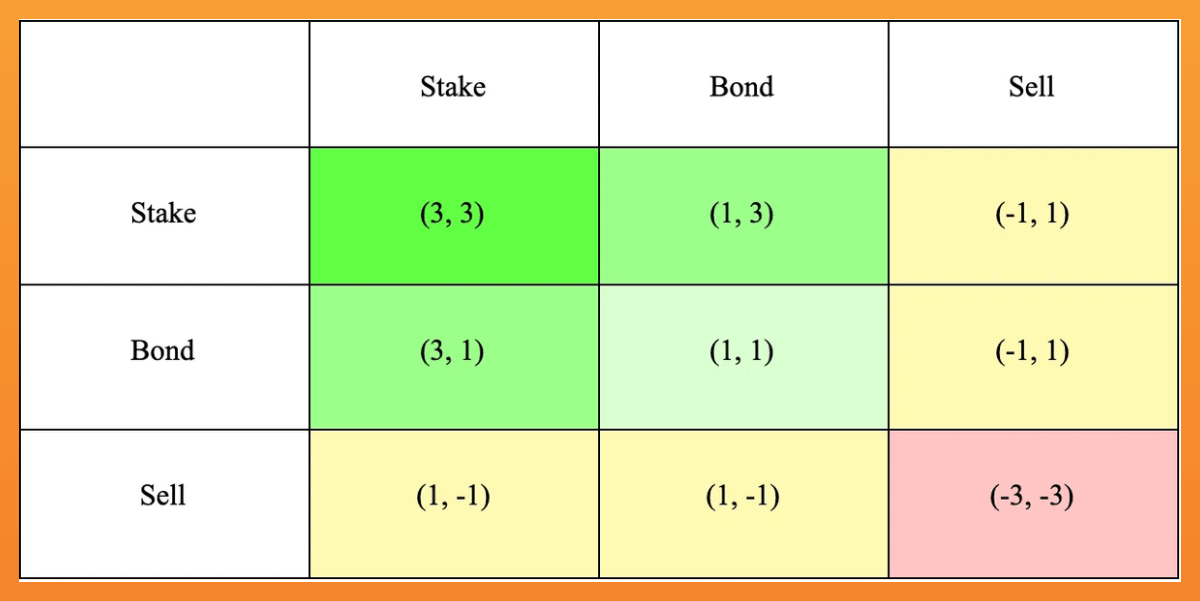

The classic ve(3,3) model is designed to ensure that everyone is willing to pledge (STAKE) tokens.

@AndreCronjeTech launched the ve(3,3) token economics model in the previous cycle through Solidly Exchange on the Fantom network.

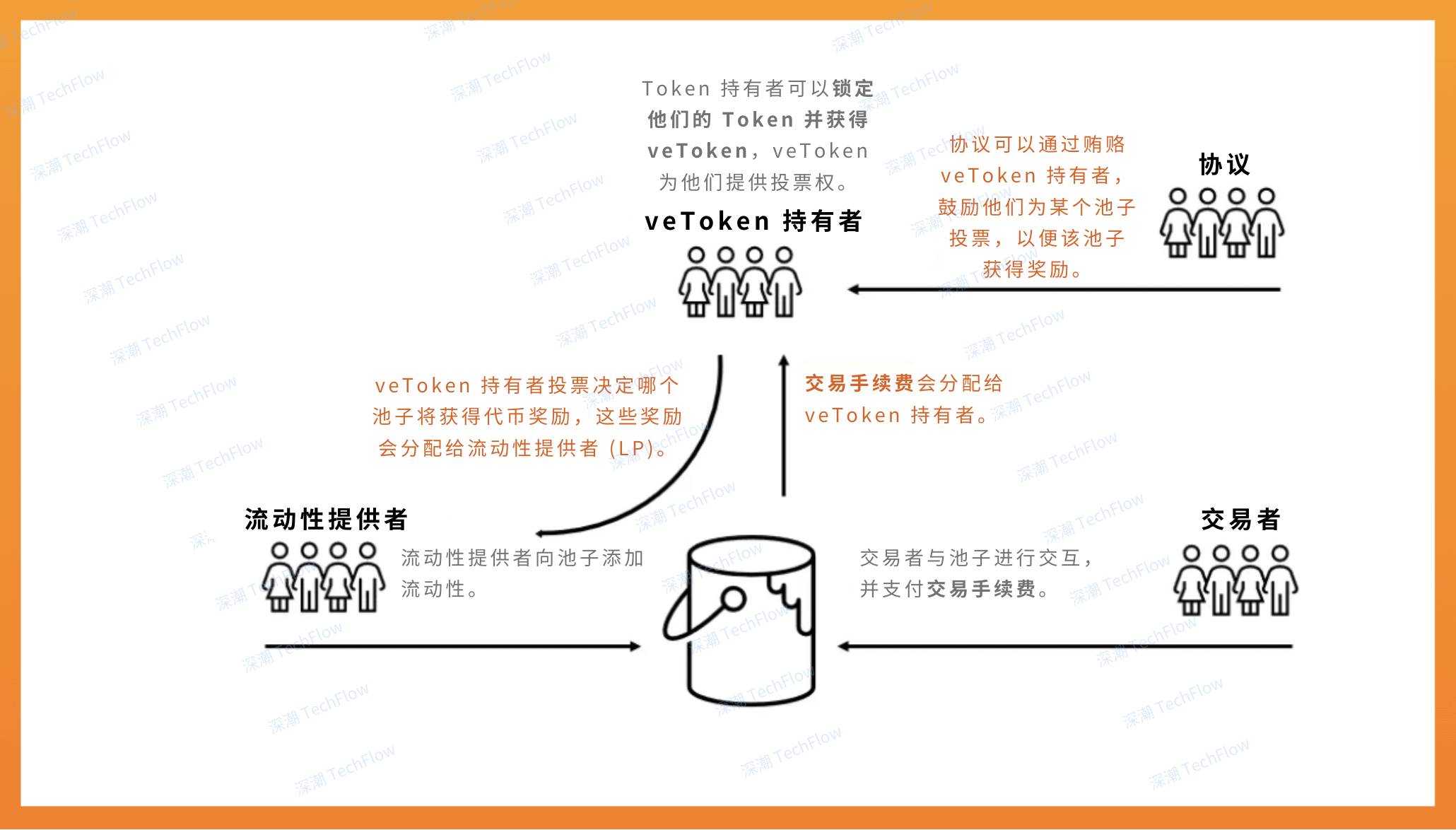

This model combines Curve Finance’s vote lock mechanism (ve) and Olympus DAO’s (3,3) game theory to reduce selling pressure and enhance the sustainability of the system by designing incentives for token holders and liquidity providers.

The core of the ve(3,3) model is to reward those users who lock up positions through transaction fees, thereby aligning the incentive mechanisms within the system. It aims to solve the high inflation problem caused by liquidity mining, with the focus shifting to creating value through transaction fees rather than relying solely on passive issuance of tokens.

As Fantom rebrands into Sonic,ve(3,3)(also called DeFi Flywheel) remains the core concept of Sonic DeFi.

How ve(3,3) works. Original picture from Foxi (DeFi / AI), compiled by Shenchao TechFlow

Flywheel is one of the important engines driving the DeFi craze. For example, Andre Cronje’s product @yearnfi is a typical example, where the price of its token YFI soared from $6 to more than $30,000 in less than two months. However, like many other memecoins, the craze will eventually calm down. For most crypto projects (except Bitcoin), the most important question is always:When to enter and when to exit.

As a classic summary says:“Enter before others notice and exit before everyone knows. rdquo;

II. What is Sonic? Why choose Sonic?

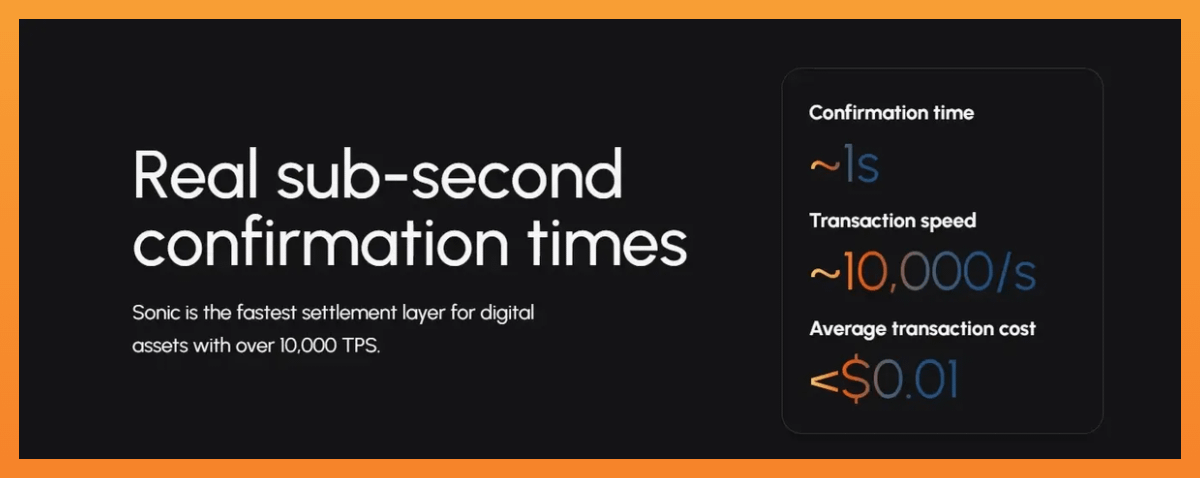

You may not have noticed, but Sonic’s predecessor was Fantom. It is a high-performance Layer-1 blockchain network that supports more than 10,000 transactions per second and has a sub-second final confirmation time. Its native token,$S, can be used to pay transaction fees, participate in pledge and governance. Existing Fantom users can upgrade $FTM to $S at a 1:1 ratio.

Although there are already many low-latency Layer-1 solutions on the market, there are three core reasons for Sonic’s rise:

-

OG Andre Cronje of DeFi is back and personally leading the project.

-

Airdrop plan: In order to attract new users, Sonic plans to distribute $190.5 million (approximately 6% of total supply, see Part 3 for details) through reward activities.

-

DeFi regression: People’s enthusiasm for memecoin has gradually subsided and they have begun to focus on the more basic value DeFi project, which can be seen from the sluggish performance of $SOL.

Recent capital inflows also show the market’s interest in Sonic:

-

Native token $S rose 113.5% in just 14 days.

-

Sonic’s total locked volume (TVL) increased by 70% in seven days, making it the best performer of any reasonably sized chain.

-

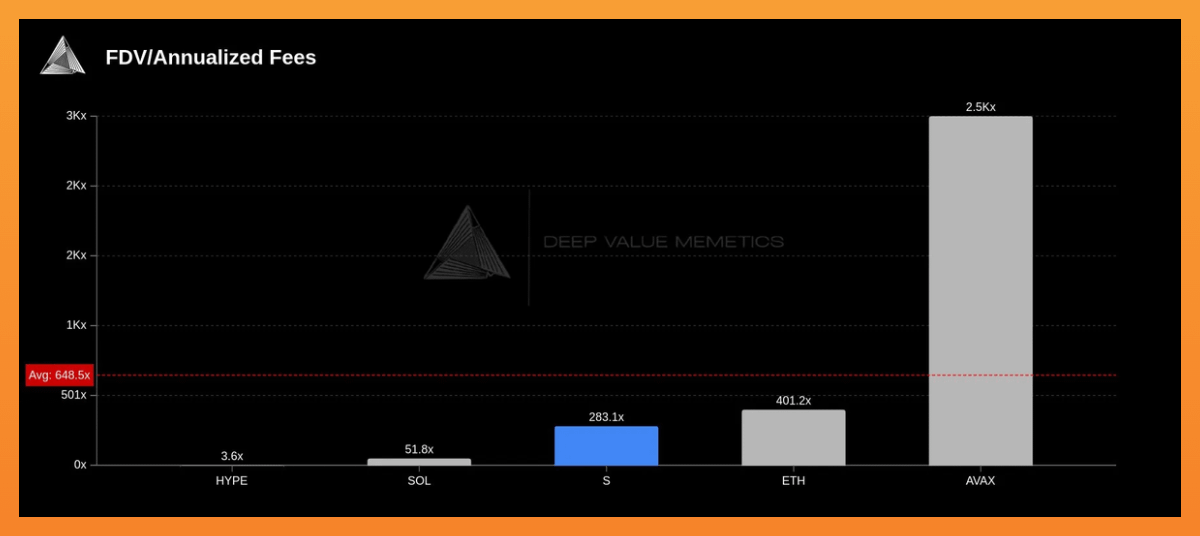

The FDV/Fee ratio is only 283 times, 57% lower than similar projects, indicating that Sonic’s valuation may be undervalued.

Source:@DV_Memetics

Sonic ranks first in the 7-day TVL growth rankings

III. New token economics (important information, worthy of attention)

Supply and inflation mechanisms

Fantom’s total supply of FTM tokens is approximately 3.175 billion (almost fully diluted). Sonic’s initial supply is the same, ensuring that existing FTM users can redeem for $S 1:1. However,$S is not a fixed supply of token, but rather supports continued growth of the ecosystem through a controlled inflation mechanism.

About 6% of the total supply of $S (approximately $190.5 million) is minted for user and developer incentives, and these tokens will be distributed via airdrop approximately six months after the project is launched. Therefore, there will be no new token supply (unlocking) before June 2025, which may be a good time for short-term transactions.

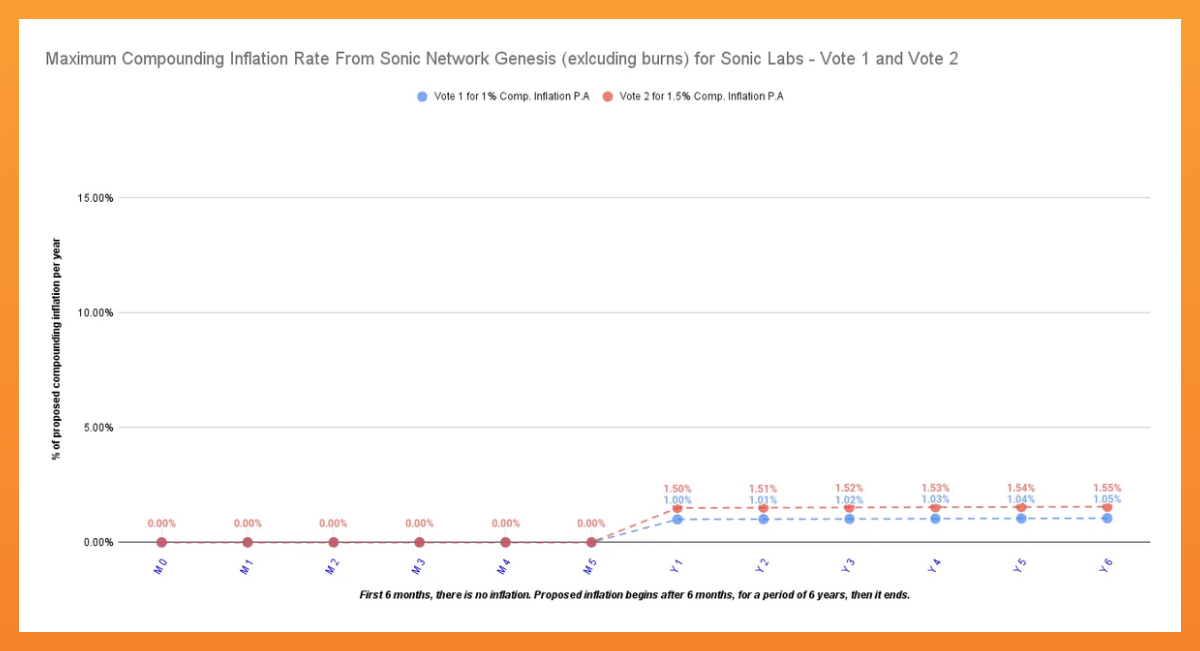

inflation plan

In order to support the continued development of the ecosystem,$S will be inflated at a rate of 1.5% per year in the first six years (approximately $S will be added in the first year). If all these tokens are used, the total supply of $S could reach approximately 3.66 billion in six years. In contrast, FTM’s token issuance is almost complete and there is no new token allocation plan (except for the remaining pledge rewards). Sonic, on the other hand, adopted a different strategy, moderately introducing inflation to support ecological growth, while setting a strict restriction mechanism that any unused ecological capital tokens would be destroyed to avoid the risk of excessive inflation.

Cost destruction and deflation mechanism

FTM’s economic model does not introduce a large-scale cost destruction mechanism. In Fantom’s Opera network, Gas fees are mainly allocated to verifiers (after 2022, 15% of them will be allocated to developers), so FTM is actually inflationary (additional issuance of pledge rewards exceeds token destruction).

Sonic’s $S introduces multiple deflation mechanisms to balance the issuance of new tokens. For example, 50% of transaction fees on Sonic will be destroyed by default (transactions that do not participate in the Gas Rewards Program). If network usage is high enough,$S may even become a net deflation token.

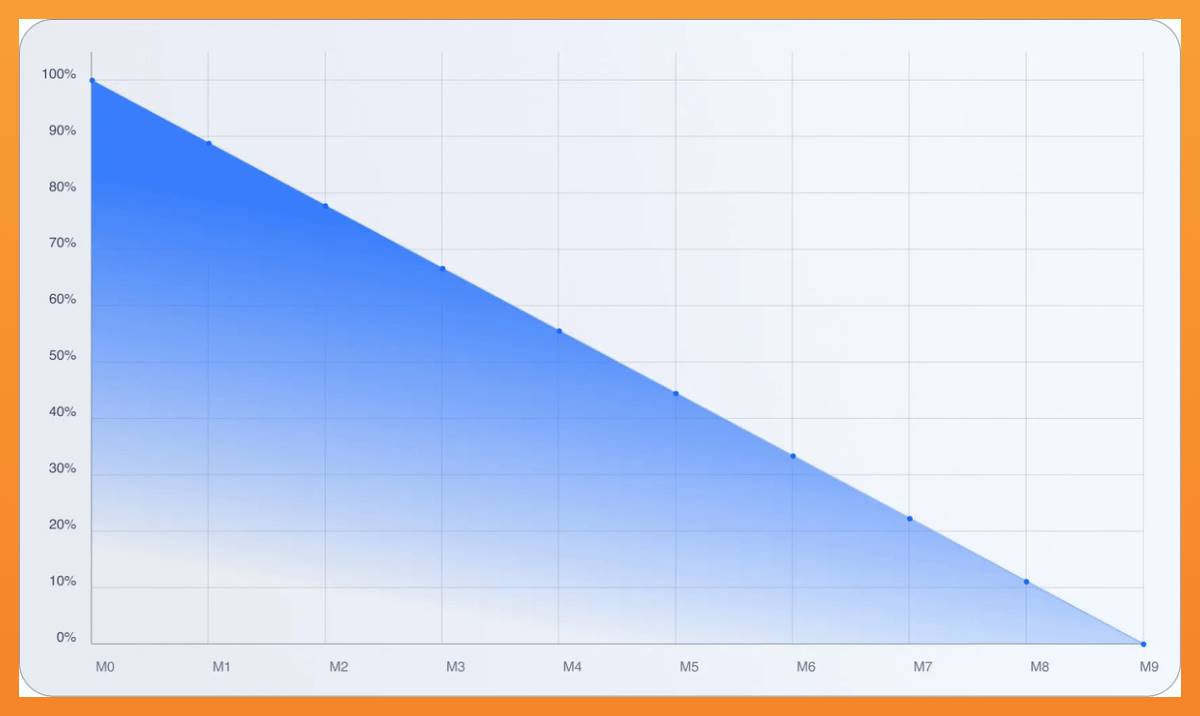

In addition, Sonic’s airdrop design also uses an unlocking and destruction mechanism: users can immediately receive 25% of the airdrop tokens, but the rest needs to be received in stages. If users choose to unlock faster, they will need to give up some tokens as a penalty to reduce short-term selling.

Destruction mechanism for airdrop distribution

Finally, any unused 1.5% of annual ecological funds will be destroyed. These destruction mechanisms, combined with a controlled token release program, are expected to significantly reduce the circulation pressure on tokens during a six-year inflation period, thereby helping the $S gradually turn towards a deflationary trend after the initial growth phase ends.

User Incentive Plan! (Airdrop benefits)

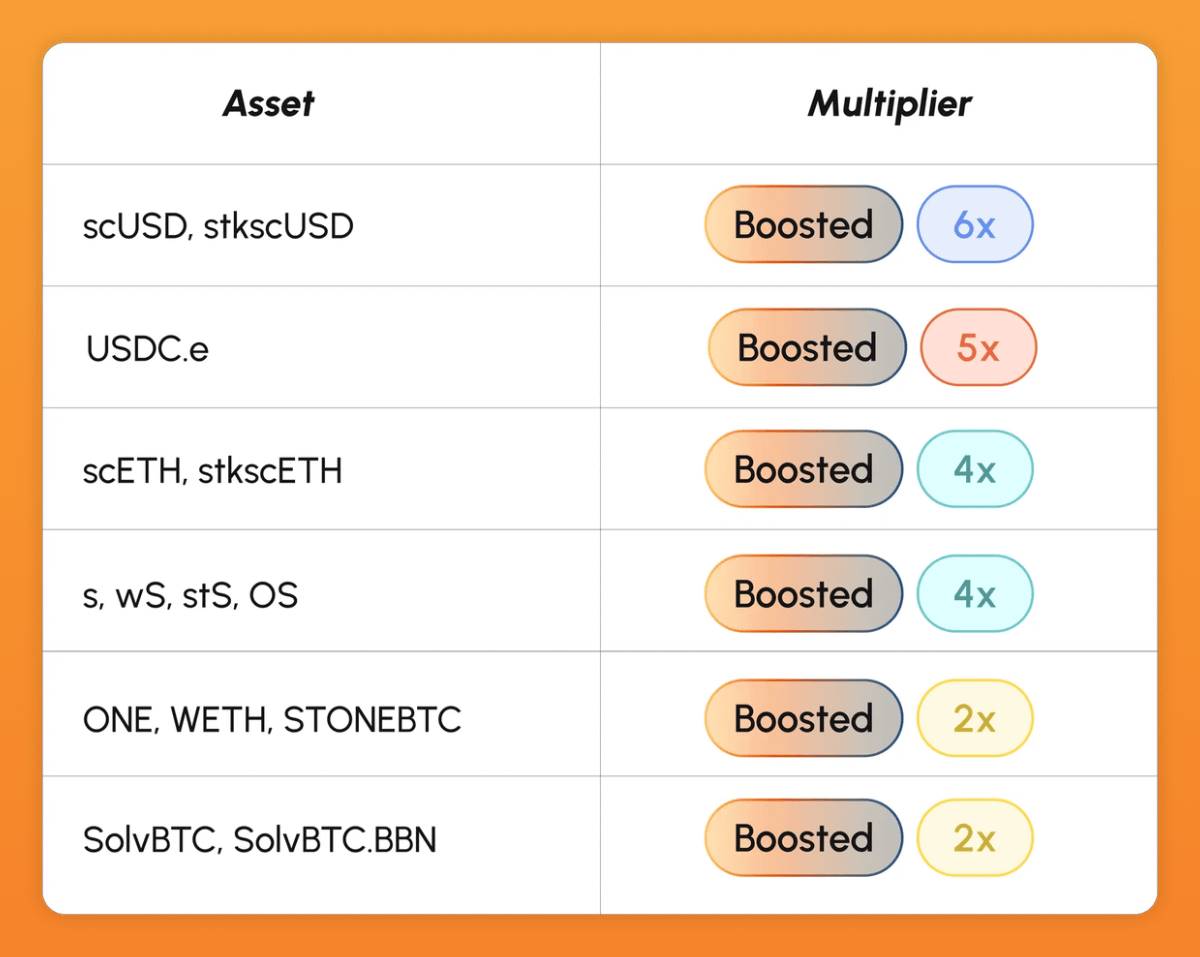

As mentioned earlier, Sonic will distribute $190.5 million in S tokens as user rewards. You can participate in receiving airdrops through the following methods:

-

Holding whitelisted assets: Keep eligible assets in your wallet (Note: Do not keep assets in the wallet of a centralized exchange).

-

Participate in Sonic’s DeFi protocol: For example, pledge $S, provide liquidity (LP) on DEX, participate in yield farming, etc. It should be noted that the point weight of DeFi activities is twice that of just holding assets, which means that users who actively participate in DeFi activities can receive more rewards. (For more information, please visit: Sonic Labs Platform)

Make sure you store your tokens in a decentralized wallet to avoid missing airdrop opportunities!

IV. Ecosystem opportunities

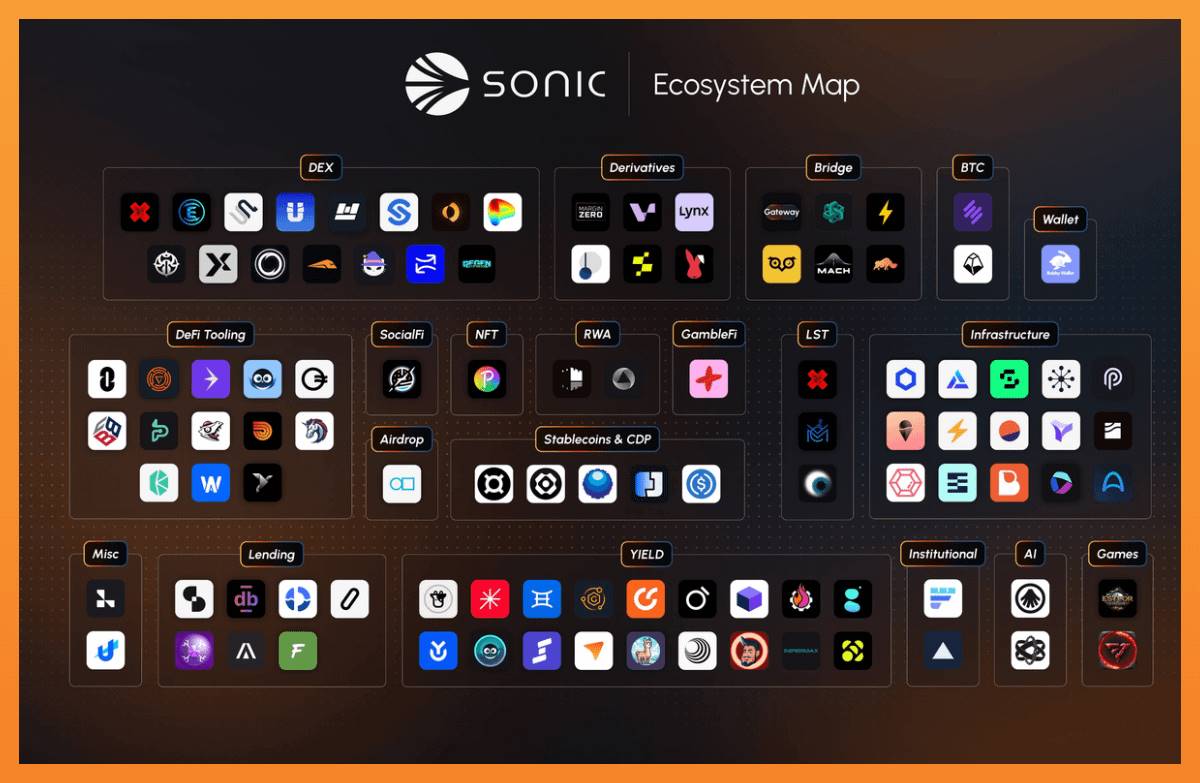

You can earn $S airdrops by holding eligible assets or participating in Sonic’s ecosystem activities. As a brand new ecosystem, many new projects in Sonic may come with higher founder risks, but they may also bring you 10 times or even 100 times high returns. Here are a few of my carefully selected potential opportunities, covering four areas: decentralized exchanges (DEX), lending agreements, derivatives, and Meme projects (these recommendations are non-paid and for personal reference only).

It should be noted that although there are many projects on Sonic, most of them are not real investment opportunities. They are either not native to Sonic projects or have been online for some time. Here are a few potential projects that deserve special attention:

DEX

@ShadowOnSonic

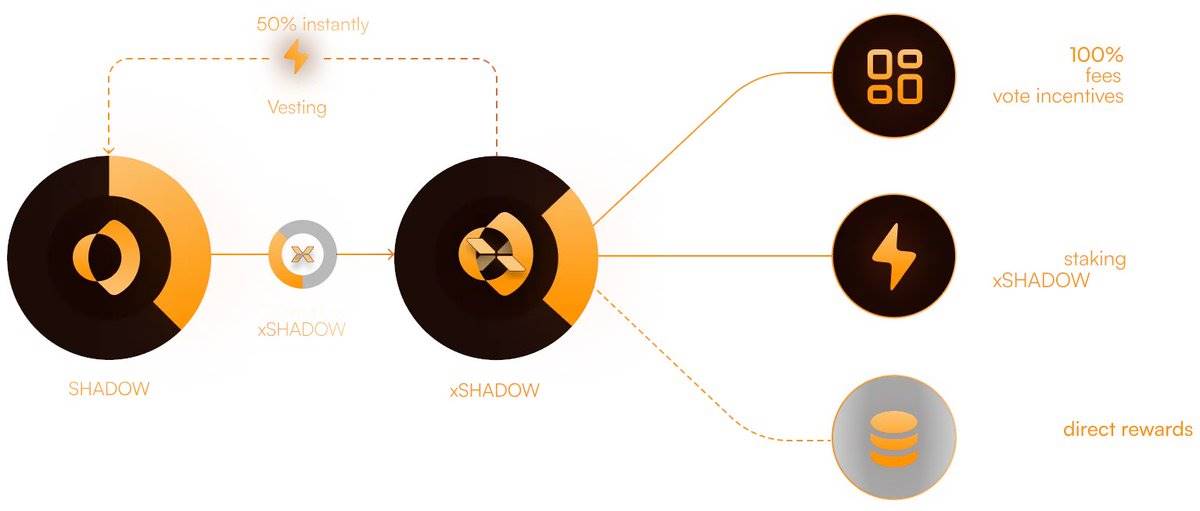

This is the main native DEX on Sonic, with a current total locked volume (TVL) of more than $150 million and offers incentives of up to $13.73 million per week. Its innovative x(3,3) token model provides users with greater flexibility: users can choose to opt out immediately or gain more revenue by unlocking in stages, rather than long-term lockups like the ve(3,3) model. In addition, the agreement also uses a PVP heavy base mechanism that imposes a 50% voting penalty on users who choose to opt out early to reduce token dilution and encourage long-term holding.

The highlight of this mechanism is the penalty design: users can choose to exit early by giving up part of their profits, thereby achieving a balance between flexibility and stability.

@MetropolisDEX

MetropolisDEX is a decentralized exchange on Sonic that uses the Dynamic Liquidity Market Market Maker (DLMM) protocol, combining the advantages of automated market makers (AMM) with the functions of order books. This design provides users with a more efficient trading experience, especially for those familiar with the Solana ecosystem and investors who have participated in the Meteora project.

@vertex_protocol

Vertex Protocol is a comprehensive DEX that provides spot trading, perpetual contracts and money market services, while supporting cross-margin trading. Its main advantages include extremely low transaction fees (0% Maker rate and 0.02% Taker rate), fast order execution speed and cross-chain liquidity support. The development team behind it is experienced and is a veteran player in the DeFi field and is trustworthy.

@wagmicom

This is a native DEX on Sonic, and it performs very well. In less than two months, the platform processed up to $1.2 billion in transactions. Users earned a total of more than $3.6 million in fee revenue by providing liquidity (LP) strategies. The protocol leverages Sonic’s high speed and high scalability to provide users with a higher-yield strategy. With these advantages,@wagmicom has the potential to become a strong competitor to Shadow.

lending

@SiloFinance

This is a permission-free and risk-isolated loan agreement that allows users to quickly create new trading markets without additional integration. Its peak daily trading volume reached US$125 million, demonstrating strong market activity.

@eggsonsonic

A smart contract-based lending platform that supports mortgage lending functions. The agreement also has characteristics such as buying and selling fees and clearing events, providing users with diversified lending options.

@eulerfinance

This is a modular lending protocol that supports permission-free lending operations. It functions similar to the Morpho protocol on Ethereum and is suitable for advanced users and developers.

@VicunaFinance

Lending agreements that focus on leveraged income agriculture, while supporting low-mortgage loans, provide users with more flexible financial instruments.

derivatives

@Rings_Protocol

This is a yuan asset agreement focusing on income-based stablecoins. It provides deep liquidity to Sonic’s DeFi ecosystem and provides financial support for ecological projects through a lockdown mechanism.

@spectra_finance

An interest rate derivatives agreement that allows users to trade earnings and supports fixed interest rates. It not only helps users hedge against earnings fluctuations, but also provides additional interest incentives to liquidity providers.

@vfat_io

A revenue aggregator that helps users simplify the operations of revenue farming while achieving automatic rebalancing of assets.

@GammaSwapLabs

This is a platform focused on volatility trading that is completely decentralized and does not rely on oracle machines. Through the AMM model, it provides users with commission-free token trading and liquidity services, which is an innovative option.

@NaviExSonic

This is a derivatives trading platform that supports perpetual contracts (Preps) and focuses on providing users with efficient trading tools.

Meme

@derpedewdz

This is one of the most important NFT projects in the Sonic ecosystem and has attracted much community attention.

@LazyBearSonic

Sonic’s native launch platform has also launched its own NFT series to provide users with more diverse ways to participate.

@TinHat_Cat

A Meme project based on Sonic Ecology, with an active and loyal community, is an important part of ecological culture.

last

Remember what we said at the beginning?“Enter before others notice and exit before everyone knows. rdquo;

As more and more people discover and participate in Sonic’s growing ecosystem, this ecological virtuous cycle will become stronger and more lasting. For every participant, this means deeper liquidity, stronger consensus and more opportunities, rather than getting caught up in memecoin scams and short-term hype.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern